Blank Vehicle Repayment Agreement Document

The Vehicle Repayment Agreement form serves as a crucial document for individuals and businesses engaged in vehicle financing. This form outlines the terms and conditions under which a borrower agrees to repay the loan amount for the vehicle acquired. Key elements include the total loan amount, the interest rate, the repayment schedule, and the consequences of default. It ensures that both parties understand their obligations and rights, fostering transparency in the financial transaction. Additionally, the form may specify the vehicle's identification details, including make, model, and VIN, which helps in clearly defining the asset involved. By documenting these essential aspects, the Vehicle Repayment Agreement aims to protect the interests of both the lender and the borrower, establishing a foundation for a responsible lending relationship.

Document Attributes

| Fact Name | Details |

|---|---|

| Definition | A Vehicle Repayment Agreement form outlines the terms under which a borrower agrees to repay a loan secured by a vehicle. |

| Purpose | This form is used to formalize the repayment terms between the lender and the borrower, ensuring both parties understand their obligations. |

| Common Use | It is commonly used in auto loans, where the vehicle serves as collateral for the loan. |

| Governing Laws | The specific laws governing these agreements can vary by state, often falling under state contract law and the Uniform Commercial Code (UCC). |

| Key Components | Essential elements typically include the loan amount, interest rate, repayment schedule, and consequences of default. |

| Signatures Required | Both the borrower and lender must sign the agreement for it to be legally binding. |

| State-Specific Forms | Some states may have specific forms or requirements. For example, California has its own Vehicle Financing Disclosure form. |

| Enforcement | If the borrower defaults, the lender may have the right to repossess the vehicle as outlined in the agreement. |

| Consumer Protections | Many states provide consumer protections, ensuring that the terms of the agreement are fair and transparent. |

| Modification | Any changes to the repayment terms must be documented in writing and agreed upon by both parties. |

Similar forms

The Vehicle Repayment Agreement form serves a specific purpose in the realm of vehicle financing and repayment. However, several other documents share similarities with it in terms of structure and function. Below are four such documents:

- Loan Agreement: Like the Vehicle Repayment Agreement, a loan agreement outlines the terms and conditions under which a borrower agrees to repay borrowed funds. Both documents specify the payment schedule, interest rates, and consequences of default.

- Investment Letter of Intent: To initiate funding discussions, utilize the preliminary Investment Letter of Intent format that establishes key terms for potential investments.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money at a future date. Similar to the Vehicle Repayment Agreement, it includes details about repayment terms and can be enforced legally if the borrower fails to pay.

- Lease Agreement: A lease agreement governs the rental of a vehicle, detailing the terms of use and payment obligations. While it differs in purpose, both documents outline the responsibilities of the parties involved and the consequences of non-compliance.

- Sales Contract: A sales contract formalizes the sale of a vehicle, including payment terms and conditions. It shares similarities with the Vehicle Repayment Agreement in that both documents protect the interests of the seller and the buyer while detailing the obligations each party must fulfill.

Understanding these documents can empower individuals to navigate their financial responsibilities more effectively. Each serves a unique purpose but ultimately aims to ensure clarity and accountability in financial transactions.

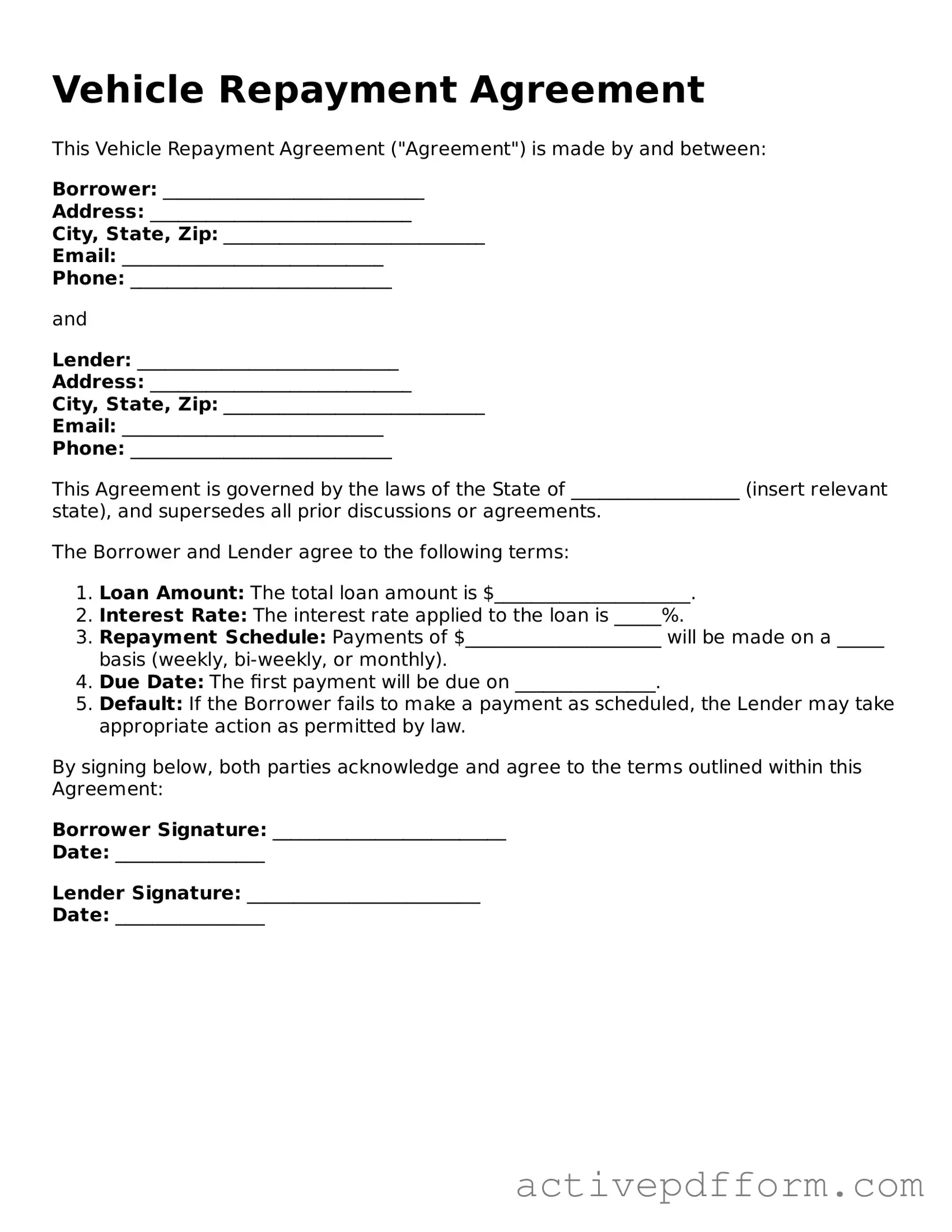

Vehicle Repayment Agreement Example

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made by and between:

Borrower: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Email: ____________________________

Phone: ____________________________

and

Lender: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Email: ____________________________

Phone: ____________________________

This Agreement is governed by the laws of the State of __________________ (insert relevant state), and supersedes all prior discussions or agreements.

The Borrower and Lender agree to the following terms:

- Loan Amount: The total loan amount is $_____________________.

- Interest Rate: The interest rate applied to the loan is _____%.

- Repayment Schedule: Payments of $_____________________ will be made on a _____ basis (weekly, bi-weekly, or monthly).

- Due Date: The first payment will be due on _______________.

- Default: If the Borrower fails to make a payment as scheduled, the Lender may take appropriate action as permitted by law.

By signing below, both parties acknowledge and agree to the terms outlined within this Agreement:

Borrower Signature: _________________________

Date: ________________

Lender Signature: _________________________

Date: ________________

Understanding Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document that outlines the terms and conditions under which a borrower agrees to repay a loan for a vehicle. It includes details such as payment amounts, due dates, and any applicable interest rates.

Who needs to complete the Vehicle Repayment Agreement form?

This form is typically completed by individuals who have taken out a loan to purchase a vehicle. It may also be used by lenders to formalize the repayment terms with the borrower.

What information is required on the form?

The form generally requires personal information about the borrower, details about the vehicle, the loan amount, payment schedule, and any terms related to default or late payments.

How do I submit the Vehicle Repayment Agreement form?

After filling out the form, it should be submitted to the lender or financial institution that issued the loan. This can often be done in person, by mail, or electronically, depending on the lender's procedures.

What happens if I miss a payment?

If a payment is missed, the lender may charge a late fee or initiate a series of actions as outlined in the agreement. It is important to communicate with the lender to discuss any potential issues as soon as possible.

Can the terms of the Vehicle Repayment Agreement be changed?

Yes, the terms can be modified, but both parties must agree to the changes. Any amendments should be documented in writing to ensure clarity and avoid misunderstandings.

Is there a penalty for paying off the loan early?

Some lenders may impose a prepayment penalty, while others do not. It is essential to review the terms of the agreement or consult with the lender to understand any potential fees associated with early repayment.

What should I do if I cannot make a payment?

If you anticipate difficulty in making a payment, contact your lender immediately. They may offer options such as a payment plan, deferment, or restructuring of the loan.

Where can I find a copy of the Vehicle Repayment Agreement form?

The form can typically be obtained from the lender's website, financial institutions, or legal offices. It is advisable to ensure that you are using the most current version of the form.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is essential to approach the task with care and attention to detail. Below is a list of things to consider:

- Do: Read the entire form thoroughly before starting to fill it out.

- Do: Provide accurate and complete information to avoid delays.

- Do: Double-check all figures and calculations for accuracy.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank; this may cause processing issues.

- Don't: Use correction fluid or tape on the form; it may lead to confusion.

- Don't: Rush through the process; take your time to ensure everything is correct.

- Don't: Ignore instructions provided on the form; they are there to help you.

Create Popular Documents

Patron List for Church Fundraiser - Be a part of our fundraising effort with just one dollar!

The California Form REG 262 is essential for anyone involved in the transfer of ownership for vehicles and vessels, as it must accompany the title or application for a duplicate title. To facilitate this process and ensure compliance with the necessary guidelines, it is advisable to utilize the proper resources, such as California PDF Forms, for completing the form accurately.

Welder Qualification Record - Qualified positions for welders are also indicated here.