Blank Transfer-on-Death Deed Document

The Transfer-on-Death Deed (TODD) form serves as a valuable tool for individuals looking to simplify the process of transferring property upon their passing. By allowing property owners to designate beneficiaries who will automatically receive the property without the need for probate, this deed can streamline what can often be a complicated and lengthy process. The form typically requires the property owner's details, a clear description of the property, and the names of the designated beneficiaries. Importantly, the TODD can be revoked or altered at any time during the owner’s lifetime, providing flexibility as personal circumstances change. Additionally, it is essential to ensure that the form is properly executed and recorded to be legally effective, highlighting the importance of understanding the requirements and implications of this deed. For those navigating estate planning, the Transfer-on-Death Deed offers an innovative approach to managing property transfer, making it a noteworthy consideration in any estate strategy.

Transfer-on-Death Deed - Designed for Individual States

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | In the United States, Transfer-on-Death Deeds are governed by state laws. For example, in California, it is governed by California Probate Code Section 5600-5694. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time before their death, ensuring they maintain control over their property. |

| Beneficiary Designation | Owners can designate multiple beneficiaries and specify how the property will be divided among them, providing flexibility in estate planning. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the owner's lifetime, but beneficiaries may be responsible for capital gains taxes when they sell the property. |

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property, but it goes through probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust allows a person to manage their assets during their lifetime and specify how those assets are distributed after death. Both documents facilitate the transfer of property outside of probate.

- Trailer Bill of Sale: Essential for transferring ownership of trailers in Arizona, this document records vital information about the seller, buyer, and trailer. It ensures a legally binding transaction and helps prevent disputes. For easy access to the necessary form, visit Arizona PDF Forms.

- Beneficiary Designation: Commonly used for accounts like life insurance or retirement plans, this document names beneficiaries who will receive assets upon death. Similar to a Transfer-on-Death Deed, it directly transfers assets without probate.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together. Upon the death of one owner, the surviving owner(s) automatically inherit the deceased's share, similar to the transfer process in a Transfer-on-Death Deed.

- Payable-on-Death Account: This type of bank account allows the account holder to designate a beneficiary who will receive the funds upon the holder's death. Like the Transfer-on-Death Deed, it avoids probate.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime while transferring ownership to another party after death. It provides a way to manage property similar to a Transfer-on-Death Deed.

- Transfer-on-Death Registration for Securities: This document allows individuals to designate a beneficiary for their securities. Upon death, the securities transfer directly to the beneficiary, similar to the process in a Transfer-on-Death Deed.

- Community Property with Right of Survivorship: This is a form of ownership for married couples that allows property to automatically transfer to the surviving spouse upon death, akin to a Transfer-on-Death Deed.

- Declaration of Trust: This document can specify how assets are to be managed and distributed, similar to a living trust. It can also bypass probate, similar to a Transfer-on-Death Deed.

- Durable Power of Attorney: While primarily used for financial decisions during a person’s lifetime, it can also specify what happens to property after death, similar to the intentions expressed in a Transfer-on-Death Deed.

Transfer-on-Death Deed Example

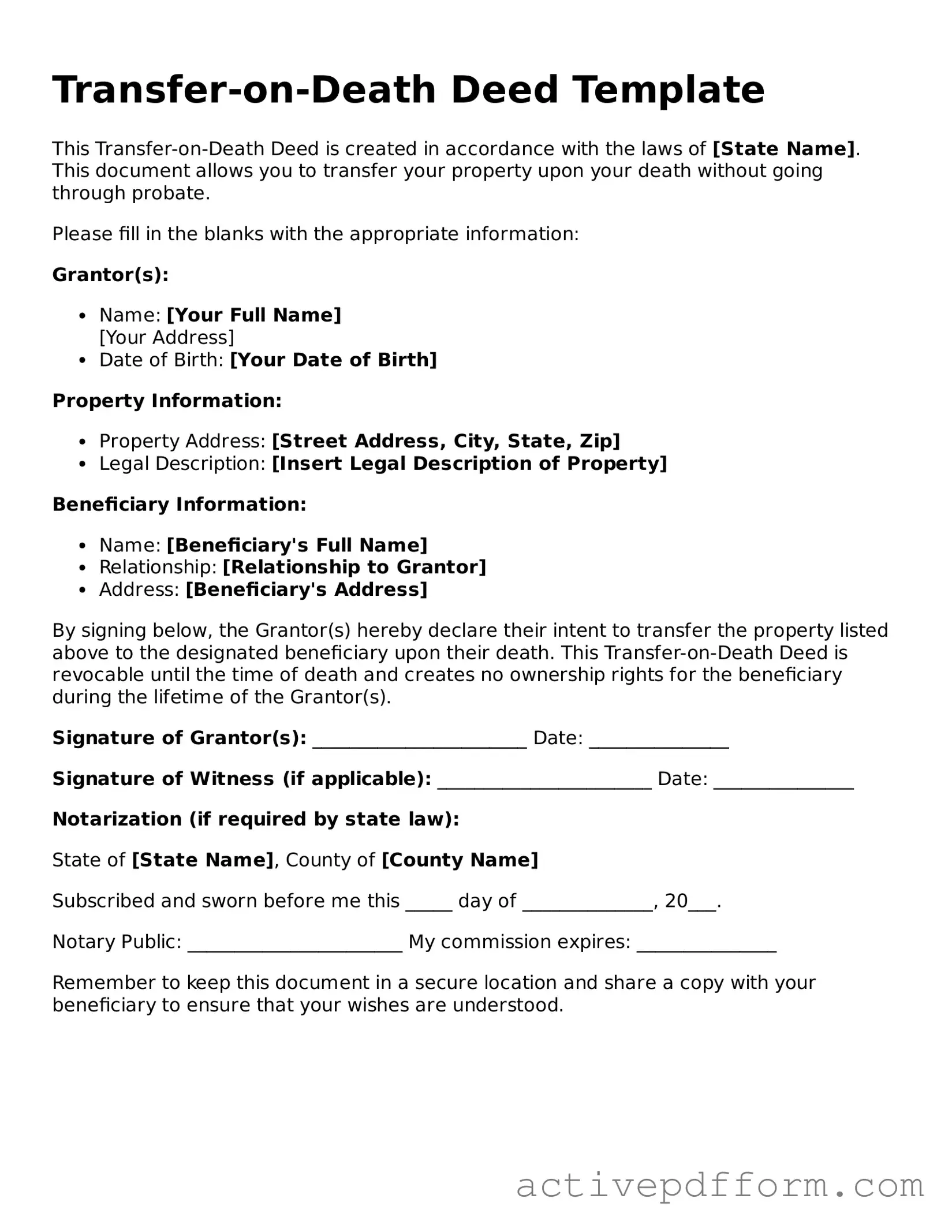

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the laws of [State Name]. This document allows you to transfer your property upon your death without going through probate.

Please fill in the blanks with the appropriate information:

Grantor(s):

- Name: [Your Full Name]

- Date of Birth: [Your Date of Birth]

Property Information:

- Property Address: [Street Address, City, State, Zip]

- Legal Description: [Insert Legal Description of Property]

Beneficiary Information:

- Name: [Beneficiary's Full Name]

- Relationship: [Relationship to Grantor]

- Address: [Beneficiary's Address]

By signing below, the Grantor(s) hereby declare their intent to transfer the property listed above to the designated beneficiary upon their death. This Transfer-on-Death Deed is revocable until the time of death and creates no ownership rights for the beneficiary during the lifetime of the Grantor(s).

Signature of Grantor(s): _______________________ Date: _______________

Signature of Witness (if applicable): _______________________ Date: _______________

Notarization (if required by state law):

State of [State Name], County of [County Name]

Subscribed and sworn before me this _____ day of ______________, 20___.

Notary Public: _______________________ My commission expires: _______________

Remember to keep this document in a secure location and share a copy with your beneficiary to ensure that your wishes are understood.

Understanding Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death. This deed bypasses the probate process, enabling a smoother and quicker transition of property ownership. It is essential for individuals looking to simplify the transfer of their assets without the complications that often arise during probate proceedings.

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must first obtain the appropriate form for your state, as requirements can vary. Fill out the form with accurate information, including your name, the property description, and the names of your chosen beneficiaries. Once completed, the deed must be signed and notarized. Finally, it should be filed with the local county recorder's office to ensure it is legally recognized. It is advisable to consult with a legal professional to ensure compliance with state laws.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. This can be done by executing a new deed that explicitly revokes the previous one or by filing a formal revocation document with the county recorder's office. It is important to follow the legal requirements in your state to ensure the revocation is valid. Keep in mind that any changes should be communicated to the beneficiaries to avoid confusion in the future.

Are there any limitations to using a Transfer-on-Death Deed?

While a TOD Deed offers many benefits, there are some limitations. For instance, it cannot be used for transferring property that is subject to a mortgage or other liens without addressing those obligations first. Additionally, the beneficiaries will not inherit the property until the owner passes away, which means they cannot access or manage the property during the owner's lifetime. Furthermore, some states may have restrictions regarding the types of property that can be transferred using this deed, so it is essential to check local laws.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's essential to be careful and precise. Here are nine important dos and don'ts to keep in mind:

- Do ensure that you are the rightful owner of the property.

- Do clearly identify the property in the deed.

- Do include the full names and addresses of the beneficiaries.

- Do sign the deed in front of a notary public.

- Do file the deed with the appropriate local government office.

- Don't leave out any required information on the form.

- Don't assume that verbal agreements are enough; everything must be in writing.

- Don't forget to check your state's specific laws regarding Transfer-on-Death Deeds.

- Don't neglect to inform your beneficiaries about the deed and its implications.

By following these guidelines, you can help ensure that your intentions are clear and legally binding. Take the time to review your form carefully before submission.

Consider More Types of Transfer-on-Death Deed Templates

How to Get a Quit Claim Deed - A quick way to pass on property without warranties.

The California Articles of Incorporation form is a legal document used to establish a corporation in California. This form outlines essential details about your business, such as its name, purpose, and structure. Completing this form is the first step toward officially launching your corporation, so be sure to fill it out accurately by clicking the button below or by visiting California PDF Forms for more information.