Blank Texas Transfer-on-Death Deed Document

The Texas Transfer-on-Death Deed form offers a straightforward method for property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the often lengthy and costly probate process. This legal instrument allows individuals to maintain full control over their property during their lifetime, ensuring that their wishes are honored after they pass away. By completing this form, property owners can specify who will inherit their property, which can include family members, friends, or organizations. Importantly, the deed must be executed and recorded properly to be valid, and it can be revoked or altered at any time before the owner's death. Understanding the nuances of this form is crucial for anyone considering estate planning in Texas, as it provides a clear pathway for transferring property while minimizing potential disputes among heirs. Additionally, the use of a Transfer-on-Death Deed can simplify the transfer process, making it easier for beneficiaries to take ownership without the complications that often accompany traditional inheritance methods.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Texas Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Texas Estates Code, Title 2, Chapter 114. |

| Eligibility | Any individual who owns real property in Texas can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. |

| Revocation | A Transfer-on-Death Deed can be revoked or modified at any time before the owner's death. |

| Filing Requirement | The deed must be recorded in the county where the property is located to be effective. |

| No Immediate Transfer | The transfer of property does not occur until the death of the property owner. |

| Tax Implications | Beneficiaries may inherit property at its fair market value at the time of the owner's death, potentially reducing capital gains taxes. |

| Legal Assistance | While legal assistance is not required, consulting a professional can help ensure the deed is completed correctly. |

Similar forms

- Will: A will allows a person to dictate how their assets will be distributed after death. Like a Transfer-on-Death Deed, it can help avoid probate, but it only takes effect after death.

- Texas Resale Certificate 01 339: The Texas Resale Certificate 01 339 form is essential for businesses purchasing goods for resale in Texas. It facilitates tax-free purchases, provided the goods are intended for resale, leasing, or rental. To ensure compliance with Texas tax laws, it's important to understand this form thoroughly and fill it out correctly. For more details, you can access the editable document download.

- Living Trust: A living trust is a legal entity that holds assets during a person's lifetime and specifies how they should be distributed after death. It functions similarly to a Transfer-on-Death Deed in that it allows for direct transfer of property without probate.

- Beneficiary Designation: This document is often used for financial accounts and insurance policies. It designates who will receive the assets upon the account holder's death, similar to how a Transfer-on-Death Deed designates property transfer.

- Joint Tenancy with Right of Survivorship: This ownership arrangement allows co-owners to inherit the entire property automatically upon the death of one owner. It parallels the Transfer-on-Death Deed in its ability to bypass probate.

- Payable-on-Death Account: This type of bank account allows the owner to name a beneficiary who will receive the funds upon the owner's death. It shares the same goal as a Transfer-on-Death Deed: to simplify asset transfer.

- Life Estate Deed: A life estate deed allows a person to live in a property for their lifetime, with the property passing to a designated beneficiary upon their death. This is similar to a Transfer-on-Death Deed in that it facilitates a smooth transfer of ownership.

- Transfer-on-Death Registration: This is commonly used for vehicles. It allows the registered owner to name a beneficiary who will receive the vehicle after death, much like a Transfer-on-Death Deed for real estate.

- Durable Power of Attorney: While primarily focused on decision-making during a person’s lifetime, a durable power of attorney can facilitate asset management, similar to how a Transfer-on-Death Deed manages asset transfer post-death.

- Community Property with Right of Survivorship: In some states, this form of property ownership allows spouses to automatically inherit property upon the death of the other. It aligns with the Transfer-on-Death Deed in its intent to ensure smooth transfer without probate.

- Revocable Trust: A revocable trust allows individuals to maintain control over their assets during their lifetime while specifying how those assets should be distributed after death. This is akin to a Transfer-on-Death Deed in its effectiveness in avoiding probate.

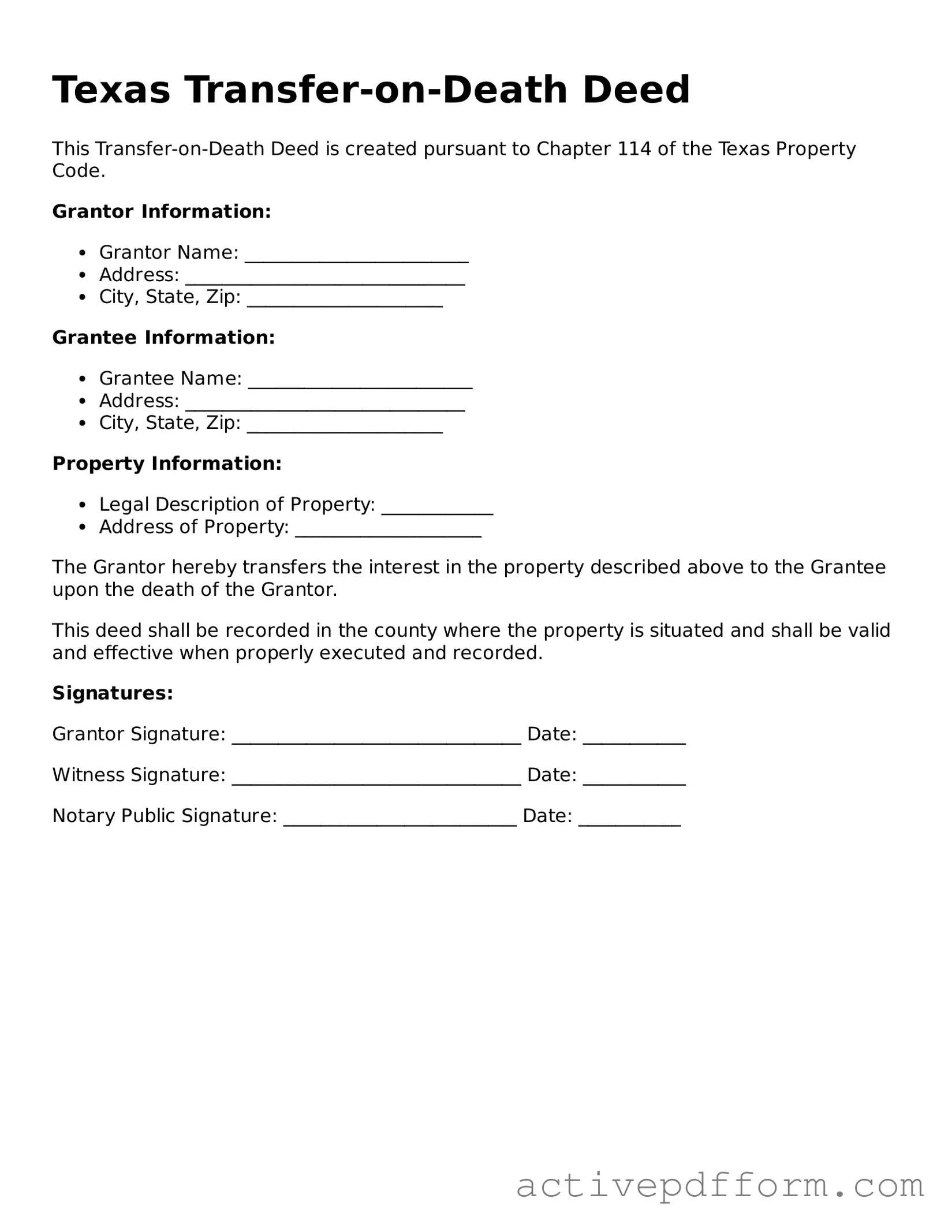

Texas Transfer-on-Death Deed Example

Texas Transfer-on-Death Deed

This Transfer-on-Death Deed is created pursuant to Chapter 114 of the Texas Property Code.

Grantor Information:

- Grantor Name: ________________________

- Address: ______________________________

- City, State, Zip: _____________________

Grantee Information:

- Grantee Name: ________________________

- Address: ______________________________

- City, State, Zip: _____________________

Property Information:

- Legal Description of Property: ____________

- Address of Property: ____________________

The Grantor hereby transfers the interest in the property described above to the Grantee upon the death of the Grantor.

This deed shall be recorded in the county where the property is situated and shall be valid and effective when properly executed and recorded.

Signatures:

Grantor Signature: _______________________________ Date: ___________

Witness Signature: _______________________________ Date: ___________

Notary Public Signature: _________________________ Date: ___________

Understanding Texas Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Texas to designate a beneficiary who will receive their property upon their death. This deed ensures that the property bypasses the probate process, allowing for a smoother and quicker transfer of ownership to the designated beneficiary without the need for court intervention.

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in Texas can create a Transfer-on-Death Deed. The property owner must be of sound mind and at least 18 years old. It’s important to ensure that the deed is properly executed and recorded to be legally effective.

How do I execute a Transfer-on-Death Deed?

To execute a Transfer-on-Death Deed, the property owner must fill out the form with accurate details about the property and the designated beneficiary. After signing the deed in the presence of a notary public, the owner must then file the deed with the county clerk’s office in the county where the property is located. This filing is crucial for the deed to take effect.

Can I change or revoke a Transfer-on-Death Deed after it has been executed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the owner’s death. The property owner can create a new deed or file a revocation form with the county clerk. It’s essential to ensure that any changes are properly documented and recorded to avoid confusion later on.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed will not automatically transfer the property to the beneficiary's heirs. In this case, the property owner may want to update the deed to name a new beneficiary to ensure a smooth transfer of ownership.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. The property remains part of the owner’s estate until death, and the beneficiary typically receives the property at its fair market value at that time. However, it is advisable to consult a tax professional to understand any potential tax consequences for both the property owner and the beneficiary.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be a great option for many property owners who want to simplify the transfer process for their loved ones. However, it may not be suitable for everyone. Individuals with complex estates, multiple properties, or specific wishes regarding how their property should be distributed may want to explore other estate planning tools, such as wills or trusts. Consulting with an estate planning attorney can provide personalized guidance based on individual circumstances.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure the document is valid and meets your intentions. Here are five important things to do and avoid.

- Do ensure you are eligible: Only certain individuals can create a Transfer-on-Death Deed. Make sure you meet the eligibility requirements.

- Do provide accurate property information: Clearly describe the property you are transferring. This includes the legal description and address.

- Do sign the deed in front of a notary: Your signature must be notarized to make the deed legally binding.

- Do keep a copy for your records: After filing the deed, retain a copy for your personal records and future reference.

- Do inform your beneficiaries: Let those who will benefit from the deed know about it. This helps avoid confusion later.

- Don't leave out essential details: Omitting critical information can lead to disputes or invalidation of the deed.

- Don't use vague language: Be specific in your descriptions to avoid misunderstandings regarding the property.

- Don't forget to file the deed: A Transfer-on-Death Deed must be filed with the county clerk to be effective.

- Don't assume the deed is permanent: Understand that you can revoke or change the deed if your circumstances change.

- Don't neglect to check state laws: Familiarize yourself with Texas laws regarding Transfer-on-Death Deeds to ensure compliance.

Browse Other Popular Transfer-on-Death Deed Templates for Specific States

Avoiding Probate in California - Probate can be a lengthy and expensive process; this deed offers a quicker alternative for property transfer.

When engaging in the sale of a vehicle, it is vital for both the buyer and seller to be well-informed about the terms outlined in the Texas Vehicle Purchase Agreement. This form not only details vehicle specifications, purchase price, and payment terms, but it also establishes a clear understanding of the transaction to prevent any conflicts. For those interested in drafting this agreement, more information can be found at https://fillable-forms.com.