Blank Texas Rental Application Document

The Texas Rental Application form is an essential document for both landlords and prospective tenants in the state of Texas. This form serves as a tool for landlords to gather important information about potential renters, helping them make informed decisions regarding lease agreements. Key aspects of the application include personal details such as the applicant's name, contact information, and Social Security number. Additionally, the form typically requests employment history, income verification, and rental history, allowing landlords to assess the applicant's financial stability and reliability as a tenant. Many applications also incorporate sections for references, both personal and professional, which can provide further insights into the applicant's character. Furthermore, the form may outline any application fees or deposits required, as well as the landlord's policies on background checks and credit reports. Understanding these components is crucial for both parties, as they set the stage for a successful rental relationship.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Rental Application form is used by landlords to collect information from potential tenants. |

| Governing Law | This form is governed by the Texas Property Code, specifically Chapter 92, which relates to residential leases. |

| Information Required | Applicants typically provide personal information, rental history, employment details, and references. |

| Application Fee | Landlords may charge an application fee, which cannot exceed $75 unless the applicant is notified otherwise. |

| Background Check | Landlords often conduct background checks, including credit history and criminal records, with the applicant's consent. |

| Equal Housing Opportunity | Landlords must comply with federal and state fair housing laws, ensuring no discrimination occurs in the application process. |

| Approval Process | Once submitted, landlords review applications and may approve or deny based on the provided information. |

| Security Deposit | Upon approval, landlords may require a security deposit, which is typically refundable at the end of the lease. |

| Application Expiration | Applications may have an expiration date, after which landlords can require a new application if the rental is still available. |

Similar forms

- Lease Agreement: Both documents outline the terms of occupancy. The rental application serves as a precursor, while the lease agreement formalizes the relationship between landlord and tenant.

- Credit Application: Similar to a rental application, a credit application assesses an individual's financial reliability. Both require personal and financial information to evaluate risk.

- Employment Application: This document collects information about a person’s job history and income. Like a rental application, it helps verify a candidate's stability and reliability.

- Background Check Authorization: This document allows landlords to conduct background checks. It shares the purpose of ensuring the safety and security of the rental environment.

- Tenant Screening Report: A tenant screening report compiles information from a rental application and background checks. It helps landlords make informed decisions about potential tenants.

- Financial Statement: This document provides an overview of an individual's financial situation. Similar to a rental application, it helps landlords assess the applicant's ability to pay rent.

- NYC Housing Application Form: This essential document is critical for individuals seeking public housing in New York City, allowing applicants to show their interest in available units. To learn more about it, visit https://nytemplates.com/blank-nyc-housing-application-template/.

- Rental History Verification: This document confirms a tenant's previous rental experiences. It complements the rental application by providing insights into the applicant's past behavior as a tenant.

- Guarantor Application: A guarantor application is used when a tenant needs a co-signer. Like a rental application, it collects personal information to evaluate the guarantor’s financial stability.

- Move-In Checklist: While primarily used after approval, it documents the condition of the property at move-in. It relates to the rental application by ensuring both parties understand the property’s state before occupancy.

Texas Rental Application Example

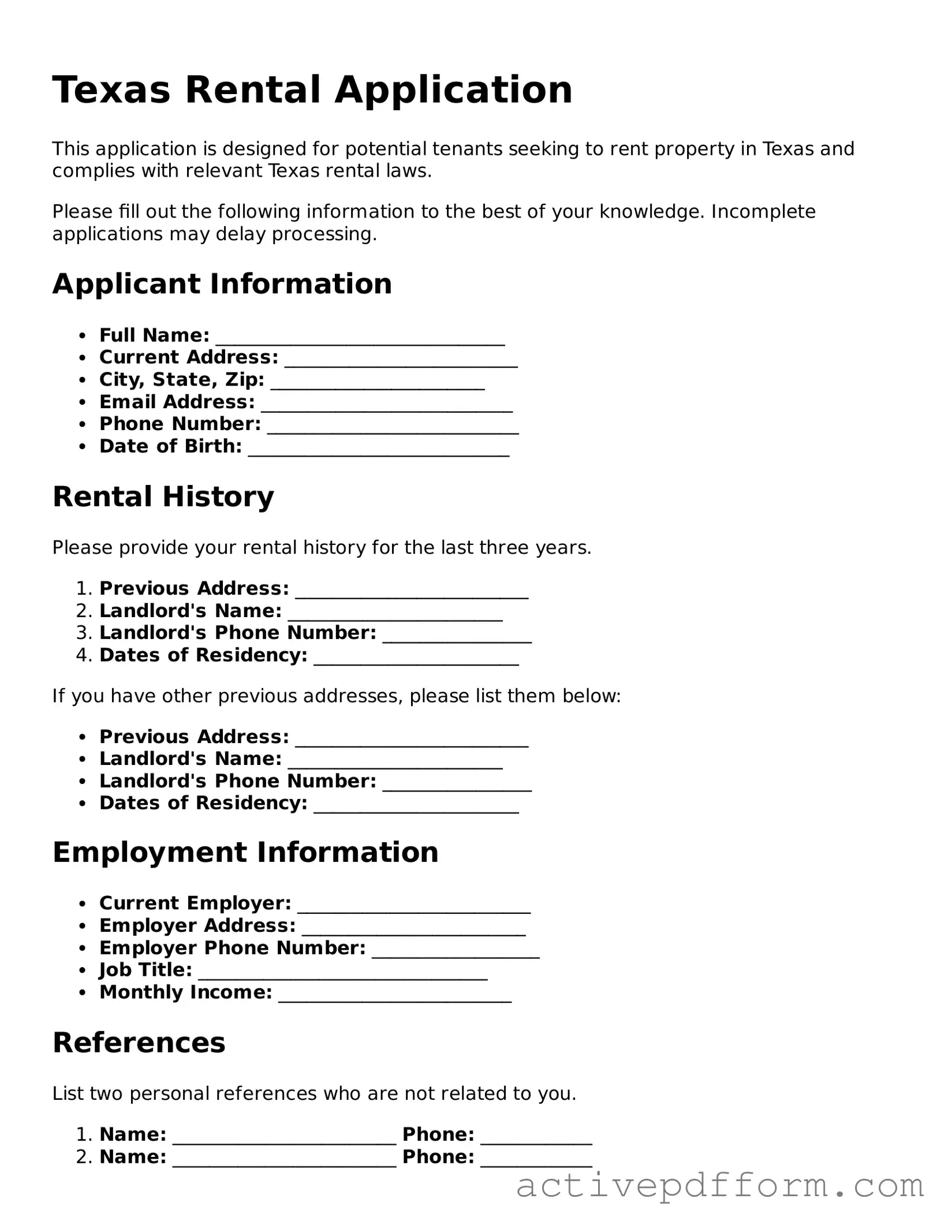

Texas Rental Application

This application is designed for potential tenants seeking to rent property in Texas and complies with relevant Texas rental laws.

Please fill out the following information to the best of your knowledge. Incomplete applications may delay processing.

Applicant Information

- Full Name: _______________________________

- Current Address: _________________________

- City, State, Zip: _______________________

- Email Address: ___________________________

- Phone Number: ___________________________

- Date of Birth: ____________________________

Rental History

Please provide your rental history for the last three years.

- Previous Address: _________________________

- Landlord's Name: _______________________

- Landlord's Phone Number: ________________

- Dates of Residency: ______________________

If you have other previous addresses, please list them below:

- Previous Address: _________________________

- Landlord's Name: _______________________

- Landlord's Phone Number: ________________

- Dates of Residency: ______________________

Employment Information

- Current Employer: _________________________

- Employer Address: ________________________

- Employer Phone Number: __________________

- Job Title: _______________________________

- Monthly Income: _________________________

References

List two personal references who are not related to you.

- Name: ________________________ Phone: ____________

- Name: ________________________ Phone: ____________

Consent

By signing this application, you give consent for the landlord to verify the information provided and conduct background checks where permissible by Texas law.

Signature: ______________________ Date: ___________________

Please submit this completed application along with any required fees to the landlord or property management.

Understanding Texas Rental Application

What is a Texas Rental Application form?

The Texas Rental Application form is a document that potential tenants fill out when applying to rent a property in Texas. It collects essential information about the applicant, including personal details, rental history, employment information, and references. This form helps landlords evaluate prospective tenants and make informed decisions about leasing their properties.

What information is typically required on the application?

Applicants will usually need to provide their full name, contact information, social security number, and date of birth. Additionally, the form may ask for details about current and previous residences, employment history, income, and references. Some applications also require information about pets or other occupants who will live in the rental unit.

Is there a fee to submit a rental application?

Many landlords charge an application fee to cover the cost of processing the application, which may include background checks and credit reports. This fee can vary widely depending on the property and the landlord's policies. It is important for applicants to inquire about any fees before submitting their application.

How long does it take to process a rental application?

The processing time for a rental application can vary. Typically, landlords may take anywhere from a few hours to several days to review applications. Factors that can affect this timeline include the number of applications received, the thoroughness of background checks, and the responsiveness of references. Applicants should follow up with the landlord if they have not received a response within a reasonable timeframe.

Can an applicant be denied based on their rental history?

Yes, landlords often consider an applicant's rental history when making their decision. A history of late payments, evictions, or lease violations can negatively impact an applicant's chances of being approved. However, each landlord has their own criteria, and some may be willing to overlook certain issues depending on the overall context of the application.

What should an applicant do if they have a poor credit score?

If an applicant has a poor credit score, it is advisable to be upfront about it. They can provide explanations for any negative marks, such as medical bills or temporary financial hardship. Additionally, offering to pay a higher security deposit or providing a co-signer may improve their chances of approval. Open communication with the landlord can help clarify concerns.

Are there any protections for applicants during the application process?

Yes, applicants have certain rights during the rental application process. The Fair Housing Act prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. Landlords must apply their criteria consistently to all applicants. If an applicant believes they have been discriminated against, they can file a complaint with the Department of Housing and Urban Development (HUD).

What happens after the application is approved?

Once the application is approved, the landlord will typically reach out to discuss lease terms and conditions. This includes the rental amount, security deposit, and move-in date. The applicant will need to sign a lease agreement, which is a legally binding document that outlines the rights and responsibilities of both parties. It is crucial for the applicant to read and understand the lease before signing.

Dos and Don'ts

When filling out a Texas Rental Application form, it’s important to approach the process carefully. Here are some essential dos and don’ts to keep in mind:

- Do read the entire application thoroughly before filling it out.

- Do provide accurate and complete information to avoid delays.

- Do include all required documents, such as proof of income or identification.

- Do check your application for errors before submitting it.

- Don’t leave any sections blank; if something doesn’t apply, write “N/A.”

- Don’t lie or provide misleading information; this can lead to disqualification.

By following these guidelines, you can enhance your chances of securing the rental you desire.

Browse Other Popular Rental Application Templates for Specific States

Residential Application Form - Disclose any past disputes with landlords to evaluate rental history.

In addition to safeguarding the interests of both parties, the California Boat Bill of Sale form is easily accessible for those looking to complete their transaction efficiently; for more convenience, you can find the necessary resources at California PDF Forms.