Blank Texas Quitclaim Deed Document

The Texas Quitclaim Deed form serves as a vital tool in real estate transactions, allowing property owners to transfer their interest in a property without making any guarantees about the title's quality. This straightforward document is particularly useful in situations where the parties involved have a pre-existing relationship, such as family members or friends, and trust each other to handle the property transfer amicably. Unlike other types of deeds, the Quitclaim Deed does not provide any warranty of ownership, meaning that the grantor simply relinquishes their claim to the property without assuring the grantee of clear title. This can make the Quitclaim Deed an efficient option for transferring property, especially in cases like divorce settlements or estate settlements. However, it is essential for both parties to understand the implications of using this form, as it may not offer the same level of protection as other deed types. Ensuring that the form is filled out correctly, including all necessary details such as the names of the parties, the legal description of the property, and the date of transfer, is crucial for a smooth transaction. Once executed, the Quitclaim Deed must be filed with the county clerk to provide public notice of the change in ownership, making it an important step in the property transfer process.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties. |

| Governing Law | In Texas, quitclaim deeds are governed by the Texas Property Code. |

| Purpose | This type of deed is often used to clear up title issues or transfer property between family members. |

| Warranties | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has good title to the property. |

| Consideration | Consideration is not required, but it is common to include a nominal amount, such as $1. |

| Recording | To be effective against third parties, a quitclaim deed should be recorded in the county where the property is located. |

| Revocation | A quitclaim deed cannot be revoked once it is executed and recorded unless a new deed is created. |

| Tax Implications | Transfers via quitclaim deeds may have tax implications, so consulting a tax professional is advisable. |

| Common Uses | Commonly used in divorce settlements, estate planning, and transferring property to trusts. |

| Legal Advice | It is recommended to seek legal advice before executing a quitclaim deed to understand its implications fully. |

Similar forms

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it provides warranties to the buyer regarding the title's validity.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and includes some assurances about the title. However, it does not offer the same level of protection as a warranty deed.

- Deed of Trust: This document secures a loan by placing a lien on the property. It involves three parties: the borrower, the lender, and a trustee, unlike the quitclaim deed, which only involves the grantor and grantee.

- Lease Agreement: While not a transfer of ownership, a lease agreement allows one party to use the property owned by another for a specified period. It differs significantly from the quitclaim deed, which transfers ownership rights.

- Aaa International Driving Permit Application: For travelers seeking to drive internationally, the PDF Templates Online provides essential resources to navigate the application process correctly, ensuring compliance with varying international laws.

- Bill of Sale: This document transfers ownership of personal property, such as vehicles or equipment. Unlike a quitclaim deed, it does not apply to real estate transactions.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the absence of liens or claims against the property. It complements a quitclaim deed by providing additional assurance to the buyer.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal or financial matters. It can be used in conjunction with a quitclaim deed when someone is signing on behalf of the property owner.

- Trust Agreement: This document establishes a trust, allowing a trustee to manage property for the benefit of beneficiaries. It differs from a quitclaim deed as it involves a fiduciary relationship rather than a direct transfer of ownership.

- Partition Deed: Used to divide property among co-owners, this document formally separates interests in the property. It is similar to a quitclaim deed in that it transfers ownership but serves a specific purpose of division.

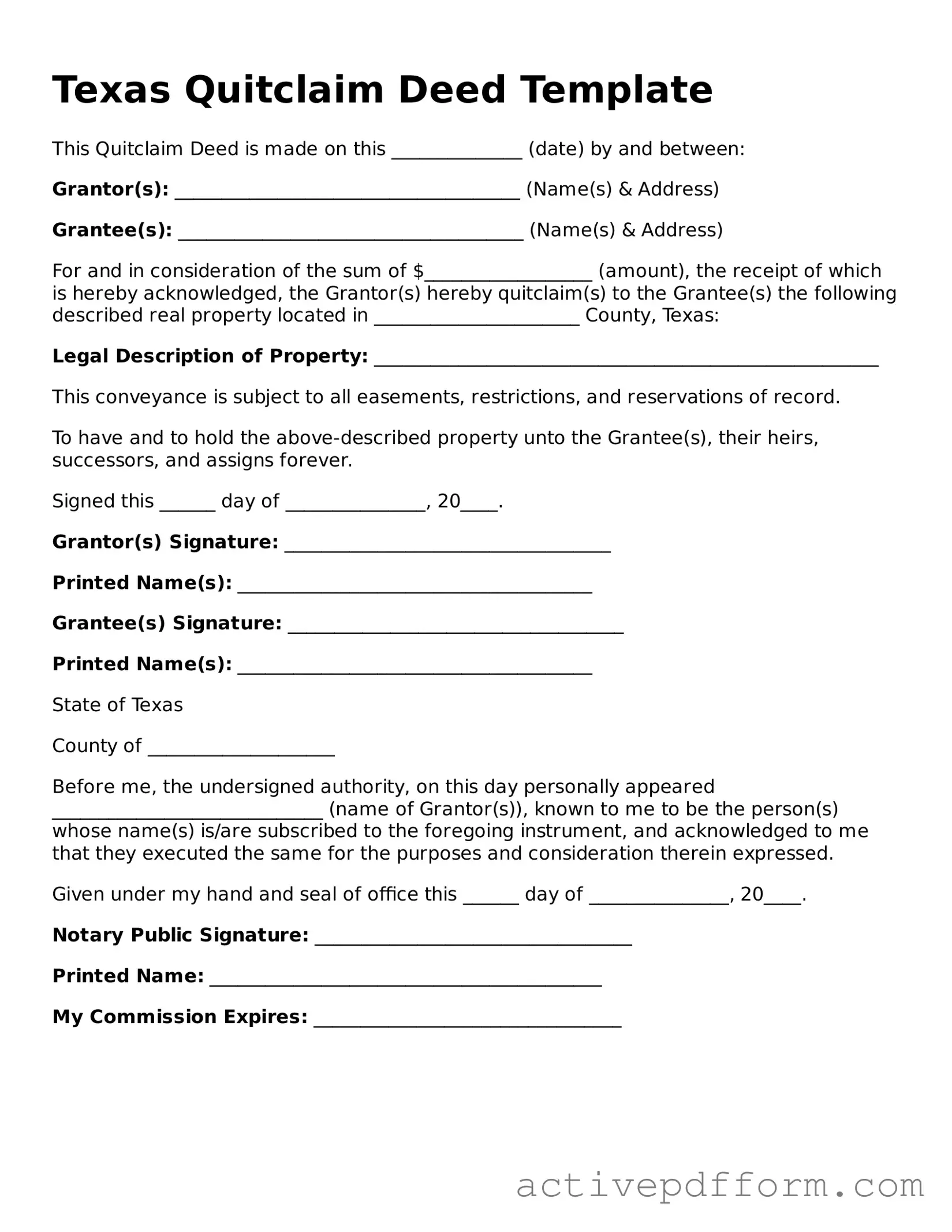

Texas Quitclaim Deed Example

Texas Quitclaim Deed Template

This Quitclaim Deed is made on this ______________ (date) by and between:

Grantor(s): _____________________________________ (Name(s) & Address)

Grantee(s): _____________________________________ (Name(s) & Address)

For and in consideration of the sum of $__________________ (amount), the receipt of which is hereby acknowledged, the Grantor(s) hereby quitclaim(s) to the Grantee(s) the following described real property located in ______________________ County, Texas:

Legal Description of Property: ______________________________________________________

This conveyance is subject to all easements, restrictions, and reservations of record.

To have and to hold the above-described property unto the Grantee(s), their heirs, successors, and assigns forever.

Signed this ______ day of _______________, 20____.

Grantor(s) Signature: ___________________________________

Printed Name(s): ______________________________________

Grantee(s) Signature: ____________________________________

Printed Name(s): ______________________________________

State of Texas

County of ____________________

Before me, the undersigned authority, on this day personally appeared _____________________________ (name of Grantor(s)), known to me to be the person(s) whose name(s) is/are subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ______ day of _______________, 20____.

Notary Public Signature: __________________________________

Printed Name: __________________________________________

My Commission Expires: _________________________________

Understanding Texas Quitclaim Deed

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike a warranty deed, it does not guarantee that the property is free from liens or other claims. The grantor (the person transferring the property) simply conveys whatever interest they may have in the property to the grantee (the person receiving the property).

When should I use a Quitclaim Deed in Texas?

This type of deed is often used in situations where property is transferred between family members, such as in divorce settlements, or when adding or removing someone from the title. It is also useful for clearing up title issues or transferring property into a trust.

What information is required on a Texas Quitclaim Deed?

The deed must include the names of the grantor and grantee, a legal description of the property, the date of the transfer, and the signature of the grantor. Some counties may also require a notary public to witness the signature for the deed to be valid.

Do I need to file a Quitclaim Deed with the county?

Are there any fees associated with filing a Quitclaim Deed in Texas?

Can a Quitclaim Deed be revoked?

Is legal advice necessary when using a Quitclaim Deed?

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it’s important to follow certain guidelines. Here’s a list of things you should and shouldn’t do:

- Do ensure all names are spelled correctly.

- Do include the legal description of the property.

- Do sign the document in front of a notary public.

- Do provide the date of the transaction.

- Don't leave any required fields blank.

- Don't use white-out or any correction fluid on the form.

- Don't forget to check local recording requirements.

Browse Other Popular Quitclaim Deed Templates for Specific States

How Much Does an Attorney Charge for a Quit Claim Deed - It can provide a hassle-free way to assign property rights.

This convenient form for a simple trailer bill of sale ensures that all necessary details are documented properly, providing clarity and security for both buyers and sellers in trailer transactions.

Quick Deed Florida - Formalizes the act of giving up interest in real estate.