Blank Texas Promissory Note Document

The Texas Promissory Note form serves as a crucial financial instrument in various lending scenarios, facilitating clear agreements between borrowers and lenders. This document outlines the terms of repayment, including the principal amount borrowed, interest rates, and the schedule for repayment. It also specifies the consequences of default, ensuring that both parties understand their rights and obligations. Importantly, the form can be tailored to accommodate different types of loans, whether for personal use, business financing, or real estate transactions. In Texas, the enforceability of a promissory note hinges on its adherence to state laws, which require specific elements to be present for the note to be legally binding. Additionally, the note may include provisions for prepayment and late fees, adding further clarity to the financial arrangement. Understanding these components is essential for anyone involved in lending or borrowing, as it helps to mitigate risks and foster trust in financial transactions.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated party at a future date or on demand. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Chapter 3, which addresses negotiable instruments. |

| Parties Involved | The document typically involves two parties: the maker (borrower) who promises to pay and the payee (lender) who receives the payment. |

| Interest Rates | Interest rates on the note can be fixed or variable, but they must comply with Texas usury laws, which limit the amount of interest that can be charged. |

| Signatures | The note must be signed by the maker to be enforceable. An electronic signature is acceptable under Texas law. |

| Default Provisions | It is common to include default provisions, outlining the consequences if the maker fails to make timely payments. |

| Transferability | A Texas Promissory Note is generally transferable, meaning the payee can sell or assign the note to another party, subject to certain conditions. |

Similar forms

- Loan Agreement: Like a Promissory Note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. Both documents serve as evidence of the borrower’s obligation to repay the loan.

- Mortgage: A mortgage is similar in that it secures a loan with real property. While a Promissory Note details the promise to repay, the mortgage provides the lender with a legal claim to the property if the borrower defaults.

- Last Will and Testament: To ensure your assets are distributed according to your wishes, consult our essential guidance on Last Will and Testament preparation for clear instructions and requirements.

- Installment Agreement: This document sets up a repayment plan for a debt, similar to a Promissory Note. Both documents specify payment amounts and due dates, ensuring clarity in repayment expectations.

- Personal Guarantee: A personal guarantee is an assurance from an individual that they will fulfill the debt obligations of a business. Like a Promissory Note, it holds the individual accountable for repayment, reinforcing the commitment to the lender.

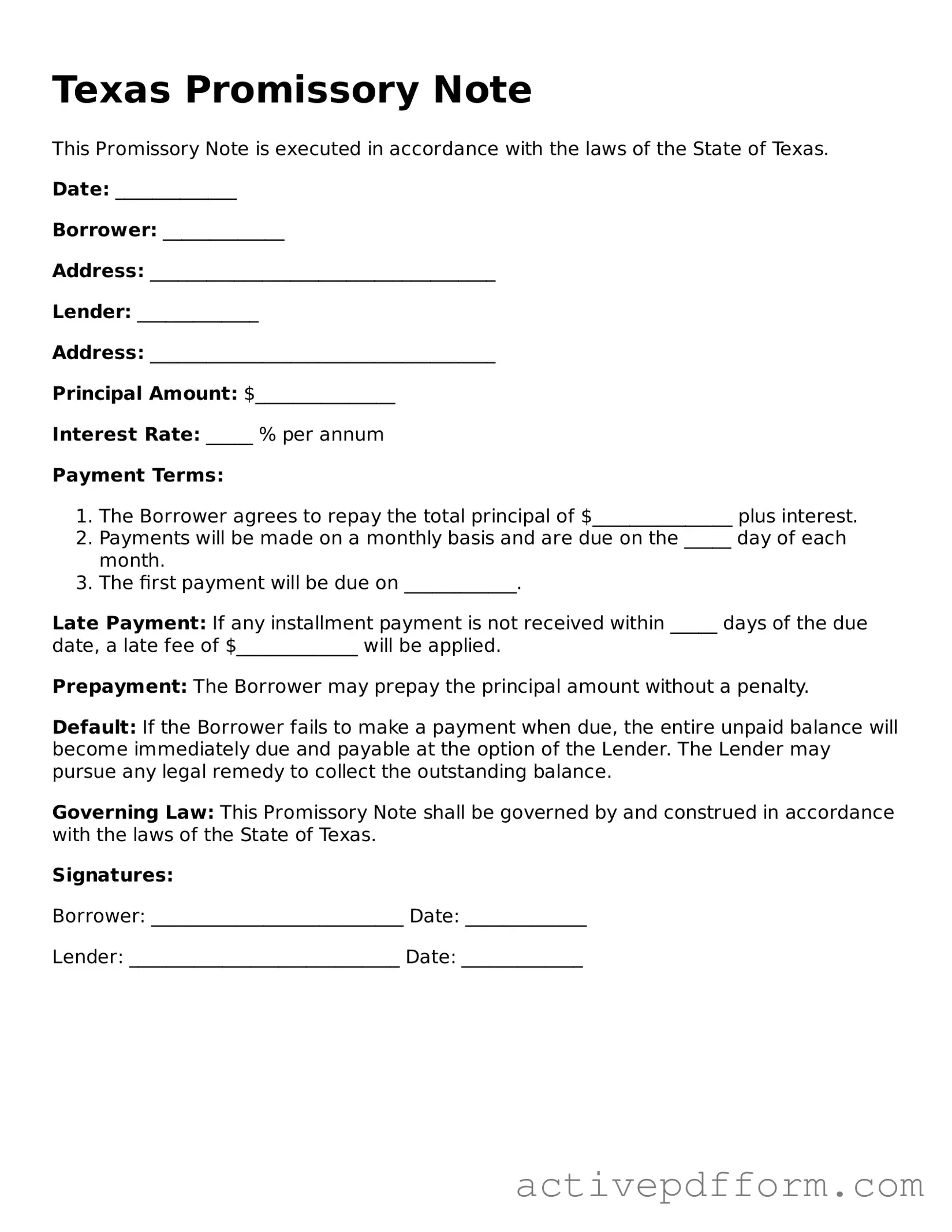

Texas Promissory Note Example

Texas Promissory Note

This Promissory Note is executed in accordance with the laws of the State of Texas.

Date: _____________

Borrower: _____________

Address: _____________________________________

Lender: _____________

Address: _____________________________________

Principal Amount: $_______________

Interest Rate: _____ % per annum

Payment Terms:

- The Borrower agrees to repay the total principal of $_______________ plus interest.

- Payments will be made on a monthly basis and are due on the _____ day of each month.

- The first payment will be due on ____________.

Late Payment: If any installment payment is not received within _____ days of the due date, a late fee of $_____________ will be applied.

Prepayment: The Borrower may prepay the principal amount without a penalty.

Default: If the Borrower fails to make a payment when due, the entire unpaid balance will become immediately due and payable at the option of the Lender. The Lender may pursue any legal remedy to collect the outstanding balance.

Governing Law: This Promissory Note shall be governed by and construed in accordance with the laws of the State of Texas.

Signatures:

Borrower: ___________________________ Date: _____________

Lender: _____________________________ Date: _____________

Understanding Texas Promissory Note

What is a Texas Promissory Note?

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This document includes details such as the loan amount, interest rate, repayment schedule, and any applicable fees. It serves as a record of the debt and provides legal protection for both parties involved in the transaction.

What are the key components of a Texas Promissory Note?

Essential components of a Texas Promissory Note include the names and addresses of both the borrower and lender, the principal amount borrowed, the interest rate, the repayment schedule, and any late fees or penalties for missed payments. Additionally, the note should specify the governing law, which in this case would be the laws of Texas.

Is a Texas Promissory Note legally binding?

Yes, a Texas Promissory Note is a legally binding agreement once both parties sign it. This means that the borrower is obligated to repay the loan according to the terms outlined in the note. If the borrower fails to make payments as agreed, the lender has the right to take legal action to recover the owed amount.

Do I need a lawyer to create a Texas Promissory Note?

While it is not mandatory to have a lawyer draft a Texas Promissory Note, consulting with a legal professional can be beneficial. A lawyer can ensure that the document complies with Texas laws and meets the specific needs of both parties. However, many templates are available online that can be used to create a basic promissory note.

Can a Texas Promissory Note be modified after it is signed?

Yes, a Texas Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This helps avoid misunderstandings and provides a clear record of the new terms.

What happens if the borrower defaults on the Texas Promissory Note?

If the borrower defaults on the Texas Promissory Note, the lender has several options. They may attempt to negotiate a new payment plan, but if that fails, the lender can pursue legal action to recover the owed amount. This may include filing a lawsuit or seeking a judgment against the borrower, which could lead to wage garnishment or other collection methods.

Are there any specific state laws governing Texas Promissory Notes?

Yes, Texas has specific laws that govern promissory notes. These laws dictate how the notes must be structured, what information must be included, and the rights of both lenders and borrowers. Understanding these regulations is crucial for ensuring that the promissory note is enforceable and compliant with state requirements.

Dos and Don'ts

When filling out the Texas Promissory Note form, it's essential to approach the task with care. Here are some important dos and don'ts to consider:

- Do read the entire form carefully before starting.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Don't leave any sections blank unless instructed.

- Don't use vague language; be precise in your terms.

Browse Other Popular Promissory Note Templates for Specific States

Loan Agreement Template Florida - Some promissory notes may include a prepayment option without penalties.

For those looking to complete a sale in California, the California Bill of Sale form can be easily accessed through California PDF Forms, ensuring a straightforward process that protects both the buyer and seller while documenting the essential details of the transaction.