Blank Texas Operating Agreement Document

The Texas Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal workings and management structure of the LLC, detailing the rights and responsibilities of its members. It typically includes provisions related to ownership interests, profit distribution, decision-making processes, and procedures for adding or removing members. By clearly defining these aspects, the Operating Agreement helps prevent misunderstandings and disputes among members. Additionally, it can address specific issues such as the handling of financial records, voting rights, and the process for amending the agreement itself. While not required by law, having a well-drafted Operating Agreement is highly recommended, as it provides a solid foundation for the business and enhances its credibility in the eyes of banks and potential investors.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC) in Texas. |

| Governing Law | This agreement is governed by the Texas Business Organizations Code, specifically Chapter 101 for LLCs. |

| Membership Rights | It details the rights and responsibilities of the members, including voting rights, profit distribution, and management duties. |

| Customization | The agreement can be customized to fit the specific needs of the LLC, allowing flexibility in governance and operations. |

| Importance of Execution | While not required by law, having a properly executed Operating Agreement can help prevent disputes among members and provide clarity in operations. |

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the internal rules and procedures for a corporation. Both documents govern the management structure and decision-making processes within an organization.

- Partnership Agreement: This document details the relationship between partners in a business. Like an Operating Agreement, it sets forth each partner's roles, responsibilities, and profit-sharing arrangements.

- Shareholder Agreement: Shareholder agreements are used by corporations to define the rights and obligations of shareholders. They, too, establish guidelines for decision-making and the transfer of shares, similar to how an Operating Agreement governs an LLC.

- Joint Venture Agreement: A joint venture agreement outlines the terms of a partnership between two or more parties for a specific project. It shares similarities with an Operating Agreement in that it sets out the contributions, responsibilities, and profit distribution among the parties involved.

- Membership Agreement: This document is often used in LLCs to define the terms of membership. It is akin to an Operating Agreement, as both specify the rights and obligations of members within the organization.

- Franchise Agreement: A franchise agreement governs the relationship between a franchisor and a franchisee. Like an Operating Agreement, it includes details about the operational procedures and expectations for both parties.

- Nonprofit Bylaws: Nonprofit organizations use bylaws to outline their governance structure. These bylaws, similar to an Operating Agreement, detail how the organization will operate and the roles of its members and board.

- California Judicial Council Form: This standardized document is essential for ensuring clarity in legal proceedings within the California court system. For those involved in these processes, it is recommended to utilize resources such as California PDF Forms to fill out the necessary forms accurately and efficiently.

- Employment Agreement: An employment agreement sets the terms of employment between an employer and an employee. It shares similarities with an Operating Agreement in that it defines roles, responsibilities, and expectations within the organization.

- Confidentiality Agreement: Also known as a non-disclosure agreement, this document protects sensitive information. While it serves a different purpose, it can be part of the operational framework outlined in an Operating Agreement, ensuring that members keep certain information private.

Texas Operating Agreement Example

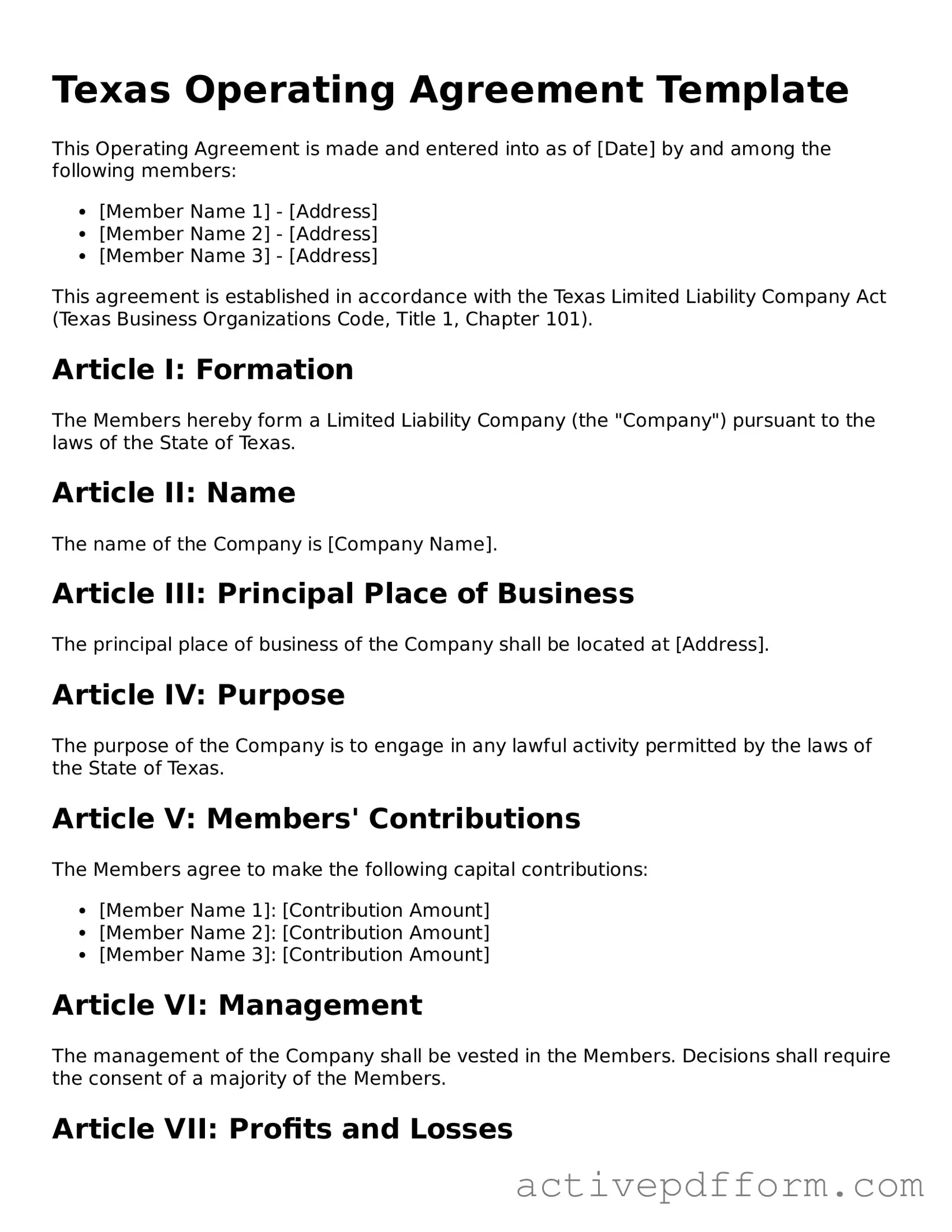

Texas Operating Agreement Template

This Operating Agreement is made and entered into as of [Date] by and among the following members:

- [Member Name 1] - [Address]

- [Member Name 2] - [Address]

- [Member Name 3] - [Address]

This agreement is established in accordance with the Texas Limited Liability Company Act (Texas Business Organizations Code, Title 1, Chapter 101).

Article I: Formation

The Members hereby form a Limited Liability Company (the "Company") pursuant to the laws of the State of Texas.

Article II: Name

The name of the Company is [Company Name].

Article III: Principal Place of Business

The principal place of business of the Company shall be located at [Address].

Article IV: Purpose

The purpose of the Company is to engage in any lawful activity permitted by the laws of the State of Texas.

Article V: Members' Contributions

The Members agree to make the following capital contributions:

- [Member Name 1]: [Contribution Amount]

- [Member Name 2]: [Contribution Amount]

- [Member Name 3]: [Contribution Amount]

Article VI: Management

The management of the Company shall be vested in the Members. Decisions shall require the consent of a majority of the Members.

Article VII: Profits and Losses

Profits and losses of the Company shall be allocated to the Members in proportion to their respective contributions as outlined in Article V.

Article VIII: Distributions

Distributions shall be made to the Members at the times and in the amounts determined by the Members, consistent with Texas law.

Article IX: Indemnification

The Company shall indemnify its Members to the fullest extent permitted by Texas law.

Article X: Amendments

This Operating Agreement may be amended only in writing and signed by all Members.

Article XI: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first above written.

Member Signatures:

- [Member Name 1] ____________

- [Member Name 2] ____________

- [Member Name 3] ____________

Understanding Texas Operating Agreement

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC) in Texas. This agreement serves as a guideline for how the business will be run, detailing the roles and responsibilities of members, management structure, and how profits and losses will be distributed. While not required by law, having an operating agreement can help prevent disputes among members and provide clarity on business operations.

Is an Operating Agreement required in Texas?

No, Texas law does not require LLCs to have an Operating Agreement. However, it is highly recommended to create one. An Operating Agreement can help establish clear rules for the business and protect members' interests. It can also provide a framework for resolving disputes and making important business decisions. Having this document can be particularly beneficial if the LLC has multiple members.

Who should draft the Operating Agreement?

Can the Operating Agreement be changed after it is created?

Yes, the Operating Agreement can be amended after it has been created. Changes may be necessary as the business evolves or as members' circumstances change. Typically, the process for making amendments is outlined within the agreement itself. It is important for all members to agree on any changes and to document them properly to maintain clarity and avoid misunderstandings.

What should be included in a Texas Operating Agreement?

A Texas Operating Agreement should include several key elements. These may consist of the LLC's name and address, the purpose of the business, the names of the members, their ownership percentages, and how profits and losses will be distributed. Additionally, it should outline the management structure, voting rights, procedures for adding or removing members, and how disputes will be resolved. Including these details can help ensure smooth operations and clear expectations among members.

Dos and Don'ts

When filling out the Texas Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information about all members and their roles.

- Do clearly outline the management structure of the LLC.

- Do include provisions for profit distribution among members.

- Don’t leave any sections blank; fill in all required fields.

- Don’t use vague language; be specific about terms and conditions.

Following these guidelines will help ensure that your Operating Agreement is complete and effective.

Browse Other Popular Operating Agreement Templates for Specific States

What Is an Operating Agreement Llc California - The agreement may include a process for changing the Operating Agreement itself.

Before participating in any potentially risky activities, it is crucial to familiarize oneself with the necessary documentation that can provide peace of mind, such as the Hold Harmless Agreement form, which outlines the responsibilities and liabilities of each party involved in the event.

Operating Agreement Llc Florida - The document can clarify the roles of any outside advisors or consultants.