Blank Texas Motor Vehicle Bill of Sale Document

The Texas Motor Vehicle Bill of Sale form is an essential document for anyone involved in the buying or selling of a vehicle in the Lone Star State. This form serves as a legal record of the transaction, providing crucial details that protect both the buyer and the seller. Key aspects of the form include the vehicle's identification number (VIN), make, model, and year, which help to uniquely identify the vehicle in question. Additionally, the bill of sale captures the names and addresses of both parties involved, ensuring transparency and accountability. It also outlines the sale price, which is vital for tax purposes and future registration. Furthermore, the form may include important disclosures about the vehicle's condition, ensuring that buyers are fully informed before making a purchase. By using this form, individuals can facilitate a smooth transfer of ownership while adhering to Texas state regulations, making it an indispensable tool for vehicle transactions.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Motor Vehicle Bill of Sale is used to document the sale or transfer of a motor vehicle between a seller and a buyer. |

| Governing Law | This form is governed by Texas state law, specifically the Texas Transportation Code. |

| Required Information | The form must include the names and addresses of both the seller and the buyer, vehicle description, and sale price. |

| Notarization | Notarization is not required for the Bill of Sale in Texas, but it can provide an additional layer of security. |

| Usage | This form is commonly used for private sales, but it can also be used in dealer transactions. |

| Transfer of Title | The Bill of Sale serves as a receipt and can be used to facilitate the transfer of the vehicle title. |

| Record Keeping | Both the seller and buyer should keep a copy of the Bill of Sale for their records. |

| Vehicle Identification Number (VIN) | It is essential to include the Vehicle Identification Number (VIN) on the form to avoid any disputes regarding the vehicle's identity. |

| Availability | The Texas Motor Vehicle Bill of Sale form can typically be found online through state resources or local DMV offices. |

Similar forms

Boat Bill of Sale: Similar to a motor vehicle bill of sale, this document transfers ownership of a boat from one party to another. It includes details about the boat, such as its make, model, and hull identification number.

Aircraft Bill of Sale: This document serves to transfer ownership of an aircraft. Like the motor vehicle bill of sale, it includes essential information about the aircraft, including its registration number and specifications.

Real Estate Bill of Sale: Used in property transactions, this document outlines the sale of personal property associated with real estate, such as appliances or furniture. It provides a clear record of what is included in the sale.

Personal Property Bill of Sale: This document is used to transfer ownership of personal items, such as electronics or collectibles. It details the items being sold and helps protect both the buyer and seller.

Motorcycle Bill of Sale: Similar to the motor vehicle bill of sale, this document specifically pertains to the sale of motorcycles. It includes information about the motorcycle, such as its VIN and condition.

Mobile Home Bill of Sale: This document transfers ownership of a mobile home. It includes details about the mobile home, such as its make, model, and serial number, ensuring a smooth transaction.

-

Purchase Agreement: This document is essential for formalizing the sale of various goods and is vital for both parties involved. It lays out the terms of sale, including payment details and item description, fostering transparency and clarity. For further details, refer to the Purchase Agreement.

Trailer Bill of Sale: This document is used when selling a trailer. It outlines the specifics of the trailer, including its identification number and condition, similar to the motor vehicle bill of sale.

ATV Bill of Sale: This form is specifically for the sale of all-terrain vehicles. It provides the necessary details about the ATV, ensuring that both parties have a clear understanding of the transaction.

Equipment Bill of Sale: Used for the sale of heavy machinery or equipment, this document includes information about the equipment being sold, similar to how a motor vehicle bill of sale operates.

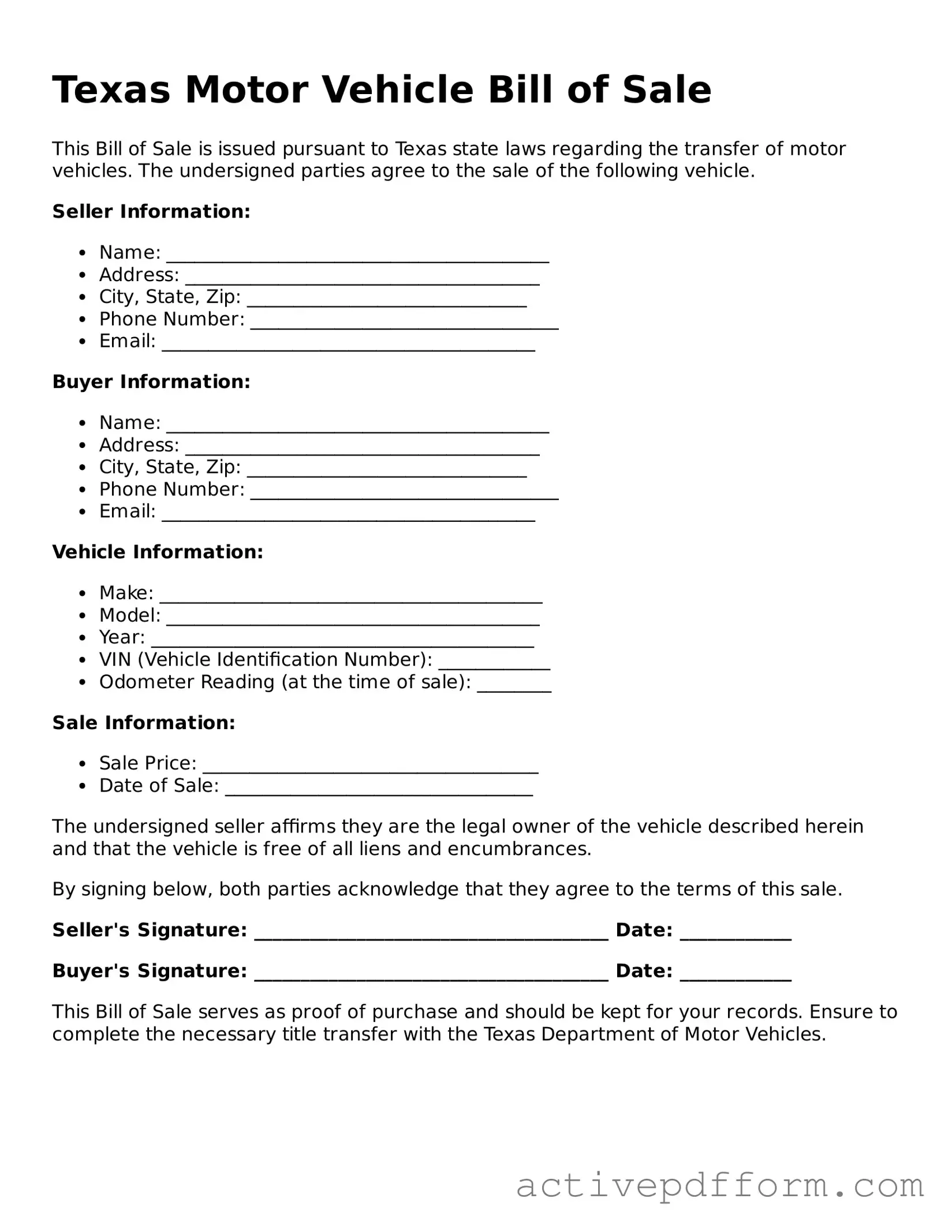

Texas Motor Vehicle Bill of Sale Example

Texas Motor Vehicle Bill of Sale

This Bill of Sale is issued pursuant to Texas state laws regarding the transfer of motor vehicles. The undersigned parties agree to the sale of the following vehicle.

Seller Information:

- Name: _________________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Phone Number: _________________________________

- Email: ________________________________________

Buyer Information:

- Name: _________________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Phone Number: _________________________________

- Email: ________________________________________

Vehicle Information:

- Make: _________________________________________

- Model: ________________________________________

- Year: _________________________________________

- VIN (Vehicle Identification Number): ____________

- Odometer Reading (at the time of sale): ________

Sale Information:

- Sale Price: ____________________________________

- Date of Sale: _________________________________

The undersigned seller affirms they are the legal owner of the vehicle described herein and that the vehicle is free of all liens and encumbrances.

By signing below, both parties acknowledge that they agree to the terms of this sale.

Seller's Signature: ______________________________________ Date: ____________

Buyer's Signature: ______________________________________ Date: ____________

This Bill of Sale serves as proof of purchase and should be kept for your records. Ensure to complete the necessary title transfer with the Texas Department of Motor Vehicles.

Understanding Texas Motor Vehicle Bill of Sale

What is a Texas Motor Vehicle Bill of Sale?

The Texas Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle between a buyer and a seller. It provides proof of the transaction and includes essential details about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN). This document is crucial for both parties to establish ownership and for the buyer to register the vehicle with the state.

Do I need a Bill of Sale to sell a vehicle in Texas?

While a Bill of Sale is not legally required to sell a vehicle in Texas, it is highly recommended. It protects both the seller and the buyer by providing a record of the transaction. In case of disputes or issues regarding the vehicle's condition, the Bill of Sale serves as evidence of the agreed terms.

What information should be included in the Bill of Sale?

A complete Texas Motor Vehicle Bill of Sale should include the following information: the names and addresses of both the buyer and seller, the vehicle's make, model, year, VIN, sale price, date of sale, and any warranties or conditions of the sale. Both parties should sign the document to validate the transaction.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it contains all necessary information. However, using a standard form can simplify the process and ensure that you don’t miss any critical details. Various templates are available online that comply with Texas requirements.

Is a Bill of Sale required for registering a vehicle in Texas?

Yes, when registering a vehicle in Texas, the buyer must present the Bill of Sale to the Texas Department of Motor Vehicles (DMV) along with other required documents. This document helps confirm the purchase and is necessary for transferring the title.

What if the vehicle has a lien on it?

If there is a lien on the vehicle, the seller must disclose this information in the Bill of Sale. The lienholder's information should be included, and the seller should ensure that the lien is satisfied before completing the sale. This protects the buyer from potential legal issues related to the outstanding debt.

Can I use a Bill of Sale for a vehicle gifted to someone?

Yes, a Bill of Sale can be used for gifting a vehicle. In this case, the sale price can be listed as "gift" or $0. However, it’s important to still document the transaction to avoid any future disputes regarding ownership.

How do I ensure the Bill of Sale is valid?

To ensure the Bill of Sale is valid, both the buyer and seller should sign it and keep copies for their records. Additionally, it’s advisable to have the document notarized, although this is not a requirement in Texas. Notarization can add an extra layer of authenticity.

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, you can create a new one, but both parties must agree to the terms and sign it again. If the original Bill of Sale was notarized, it may be more challenging to recreate. Keep a backup copy of all important documents to avoid this issue in the future.

Where can I obtain a Texas Motor Vehicle Bill of Sale form?

You can obtain a Texas Motor Vehicle Bill of Sale form from various sources, including the Texas Department of Motor Vehicles website, local DMV offices, and online legal document providers. Ensure that the form you choose is up-to-date and complies with Texas laws.

Dos and Don'ts

When filling out the Texas Motor Vehicle Bill of Sale form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the vehicle, including the VIN, make, model, and year.

- Do include the names and addresses of both the buyer and seller to establish clear ownership.

- Do specify the sale price clearly to avoid any misunderstandings later on.

- Do sign and date the form to validate the transaction.

- Don't leave any sections blank; incomplete forms can lead to delays in registration.

- Don't provide false information or misrepresent the vehicle's condition, as this can lead to legal issues.

- Don't forget to keep a copy of the completed Bill of Sale for your records.

- Don't rush through the process; take your time to ensure everything is filled out correctly.

Browse Other Popular Motor Vehicle Bill of Sale Templates for Specific States

Bill of Sale Dmv Ca - Provides a foundation for resolving any future disputes.

When managing payroll, it's crucial to have access to accurate documentation, and that's where the ADP Pay Stub form comes into play. This form not only outlines an employee's earnings and deductions for a specific pay period but also enhances transparency and trust in the employer-employee relationship. For those looking to easily create and manage such forms, you can visit Online PDF Forms for a streamlined experience.

Car Bill of Sale Florida - Having a Bill of Sale can streamline the process of transferring vehicle titles with the state.