Blank Texas Loan Agreement Document

In Texas, a Loan Agreement form serves as a crucial document for individuals and businesses entering into a lending arrangement. This form outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It also specifies the obligations of both the lender and borrower, ensuring that each party understands their rights and responsibilities. Key components of the agreement often include collateral requirements, default provisions, and dispute resolution mechanisms. By clearly defining these elements, the Loan Agreement helps to prevent misunderstandings and provides a legal framework for the transaction. Whether for personal loans, business financing, or real estate transactions, a well-structured Loan Agreement is essential for protecting the interests of all parties involved.

Document Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Texas Loan Agreement form outlines the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Texas. |

| Loan Amount | The form specifies the principal amount being borrowed. |

| Interest Rate | The agreement includes the interest rate applicable to the loan. |

| Repayment Terms | It details the repayment schedule, including due dates and payment amounts. |

Similar forms

Promissory Note: This document outlines the borrower's promise to repay a loan. Like a Loan Agreement, it specifies the loan amount, interest rate, and repayment schedule.

Mortgage Agreement: This document secures a loan with real property. Similar to a Loan Agreement, it includes terms of repayment and consequences of default, but it specifically relates to real estate.

Credit Agreement: This is a broader document that governs the terms of credit extended to a borrower. It shares similarities with a Loan Agreement in detailing repayment terms and conditions but can cover multiple loans or credit lines.

- Non-disclosure Agreement: This legal document is essential for protecting sensitive information shared between parties. To learn more about creating a reliable NDA, visit nytemplates.com/blank-non-disclosure-agreement-template.

Loan Modification Agreement: This document changes the terms of an existing loan. It is similar to a Loan Agreement as it outlines new terms, including interest rates or payment schedules, while maintaining the original loan's framework.

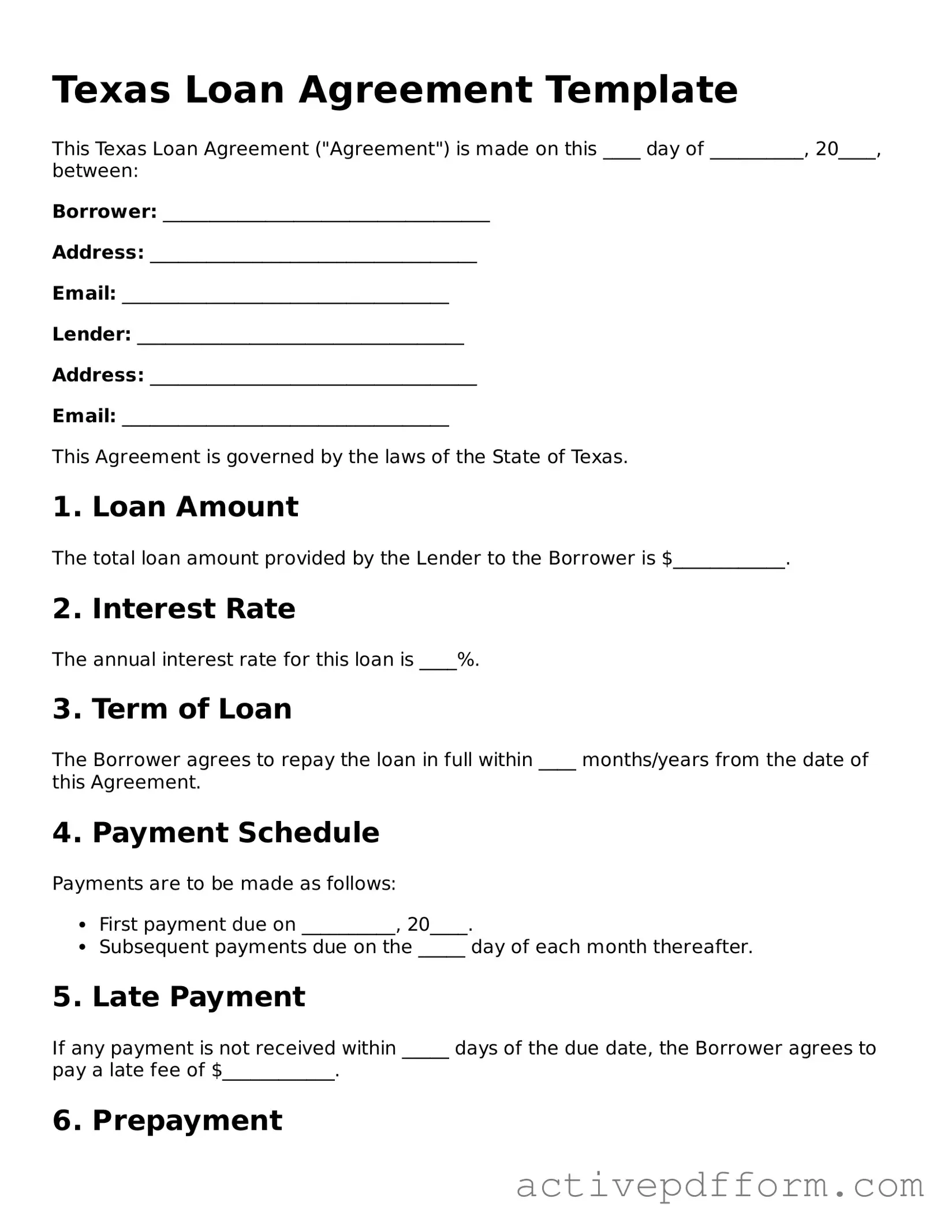

Texas Loan Agreement Example

Texas Loan Agreement Template

This Texas Loan Agreement ("Agreement") is made on this ____ day of __________, 20____, between:

Borrower: ___________________________________

Address: ___________________________________

Email: ___________________________________

Lender: ___________________________________

Address: ___________________________________

Email: ___________________________________

This Agreement is governed by the laws of the State of Texas.

1. Loan Amount

The total loan amount provided by the Lender to the Borrower is $____________.

2. Interest Rate

The annual interest rate for this loan is ____%.

3. Term of Loan

The Borrower agrees to repay the loan in full within ____ months/years from the date of this Agreement.

4. Payment Schedule

Payments are to be made as follows:

- First payment due on __________, 20____.

- Subsequent payments due on the _____ day of each month thereafter.

5. Late Payment

If any payment is not received within _____ days of the due date, the Borrower agrees to pay a late fee of $____________.

6. Prepayment

The Borrower may prepay all or part of the loan without penalty. Any partial prepayments will be applied to future payments as follows:

- _________1DS1

- _________1DS1

7. Default

If the Borrower fails to make any payment when due, the entire remaining balance of the loan shall become immediately due and payable. The Borrower will be notified in writing.

8. Governing Law

This Agreement shall be interpreted according to the laws of the State of Texas. Any disputes arising from this Agreement will be resolved in the appropriate courts located in ________ County, Texas.

9. Signatures

By signing below, both parties agree to the terms outlined in this Agreement.

Borrower Signature: ____________________________ Date: ___________

Lender Signature: _____________________________ Date: ___________

This Agreement constitutes the entire understanding between the parties and supersedes all prior negotiations or discussions.

Understanding Texas Loan Agreement

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Texas. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations throughout the loan process.

Who can use a Texas Loan Agreement form?

Any individual or entity looking to lend or borrow money in Texas can utilize this form. This includes personal loans between friends or family, business loans, and even loans secured by property. It is important for both lenders and borrowers to ensure that the agreement is tailored to their specific situation to avoid any misunderstandings in the future.

What are the key components of a Texas Loan Agreement?

A well-drafted Texas Loan Agreement should include several essential components. These typically encompass the names and addresses of both parties, the principal amount of the loan, the interest rate, the repayment terms, and any fees or penalties for late payments. Additionally, the agreement should specify whether the loan is secured or unsecured and outline any collateral involved. Finally, it is advisable to include a section on dispute resolution to address any potential conflicts that may arise.

Is it necessary to have a Texas Loan Agreement notarized?

While notarization is not a legal requirement for a Texas Loan Agreement, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes regarding the validity of the agreement. A notary public verifies the identities of the parties involved and confirms that they are signing the document willingly. This can be particularly beneficial if legal action becomes necessary in the future.

Dos and Don'ts

When filling out the Texas Loan Agreement form, careful attention to detail is essential. Here is a list of things you should and shouldn't do to ensure a smooth process.

- Do read the entire agreement thoroughly before starting to fill it out.

- Do ensure all personal information is accurate and up-to-date.

- Do provide clear and legible handwriting if filling out a paper form.

- Do double-check all numbers, including loan amounts and interest rates.

- Don't leave any required fields blank; this could delay processing.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't rush through the process; take your time to avoid mistakes.

Browse Other Popular Loan Agreement Templates for Specific States

Free Promissory Note Template Florida - The Loan Agreement helps track the borrower's financial commitments.

For those looking to streamline the sale process, utilizing the Arizona PDF Forms can greatly simplify the completion of the necessary documentation.