Blank Texas Last Will and Testament Document

The Texas Last Will and Testament form is a crucial legal document that allows individuals to express their wishes regarding the distribution of their assets after death. This form serves several important functions, including appointing an executor to manage the estate, designating guardians for minor children, and outlining specific bequests to beneficiaries. It is essential for ensuring that a person's intentions are honored and can help prevent disputes among heirs. In Texas, the will must be signed by the testator and witnessed by at least two individuals, both of whom must be present at the same time. Additionally, the form can be tailored to reflect unique circumstances, allowing individuals to include personal messages or specific instructions. Understanding the components of the Texas Last Will and Testament form is vital for anyone looking to secure their legacy and provide clarity for their loved ones during a difficult time.

Document Attributes

| Fact Name | Description |

|---|---|

| Legal Requirement | In Texas, a valid Last Will and Testament must be in writing and signed by the testator or by another person in the testator's presence and at their direction. |

| Witnesses | Texas law requires that a will be signed by at least two credible witnesses who are at least 14 years old and who are not beneficiaries of the will. |

| Holographic Wills | Texas recognizes holographic wills, which are handwritten and signed by the testator. They do not require witnesses, but the testator's handwriting must be clear and identifiable. |

| Self-Proving Wills | A self-proving will in Texas includes an affidavit signed by the testator and witnesses, which can expedite the probate process by eliminating the need for witness testimony. |

| Governing Law | The Texas Estates Code governs the creation and execution of wills in Texas, specifically Title 2, Chapter 251. |

Similar forms

- Living Will: A living will outlines your preferences for medical treatment in case you become unable to communicate your wishes. Like a Last Will and Testament, it provides clear instructions regarding your desires, but it focuses on health care rather than the distribution of assets.

- Power of Attorney: This document allows you to designate someone to make decisions on your behalf if you become incapacitated. Similar to a will, it ensures that your wishes are honored, but it typically covers financial and legal matters rather than the distribution of your estate after death.

- California Judicial Council Form: The California PDF Forms provides a vital resource to ensure that individuals involved in legal processes have access to standardized documents that streamline court proceedings.

- Trust Agreement: A trust agreement allows you to place assets in a trust for the benefit of specific individuals. Like a will, it can dictate how your assets are managed and distributed, but it often avoids probate and can provide more control over when and how beneficiaries receive their inheritance.

- Advance Healthcare Directive: This document combines a living will and a medical power of attorney. It specifies your healthcare preferences and designates someone to make decisions on your behalf. Both documents aim to ensure that your medical wishes are respected when you cannot voice them.

- Letter of Instruction: A letter of instruction is an informal document that provides guidance on how to handle your affairs after your death. While not legally binding like a will, it can complement a Last Will and Testament by offering personal insights and preferences regarding your estate and funeral arrangements.

- Codicil: A codicil is a legal document that modifies an existing will. It allows you to make changes without drafting a new will entirely. Both serve to communicate your final wishes, but a codicil specifically amends the original document rather than creating a new directive.

- Beneficiary Designation Forms: These forms allow you to name individuals who will receive specific assets, such as life insurance or retirement accounts, upon your death. Similar to a will, they dictate the distribution of your assets but typically bypass the probate process.

- Joint Tenancy Agreements: When property is owned in joint tenancy, it automatically passes to the surviving owner upon death. This arrangement is similar to a will in that it determines asset distribution, but it operates outside of the probate process.

- Guardian Designation: If you have minor children, you can use a guardian designation to specify who should care for them in the event of your passing. Like a will, it addresses important decisions about your family's future, ensuring that your children are cared for by someone you trust.

- Family Trust: A family trust allows you to manage and protect family assets while providing for your beneficiaries. Similar to a will, it outlines how your assets should be distributed, but it often offers additional benefits, such as tax advantages and privacy in asset management.

Texas Last Will and Testament Example

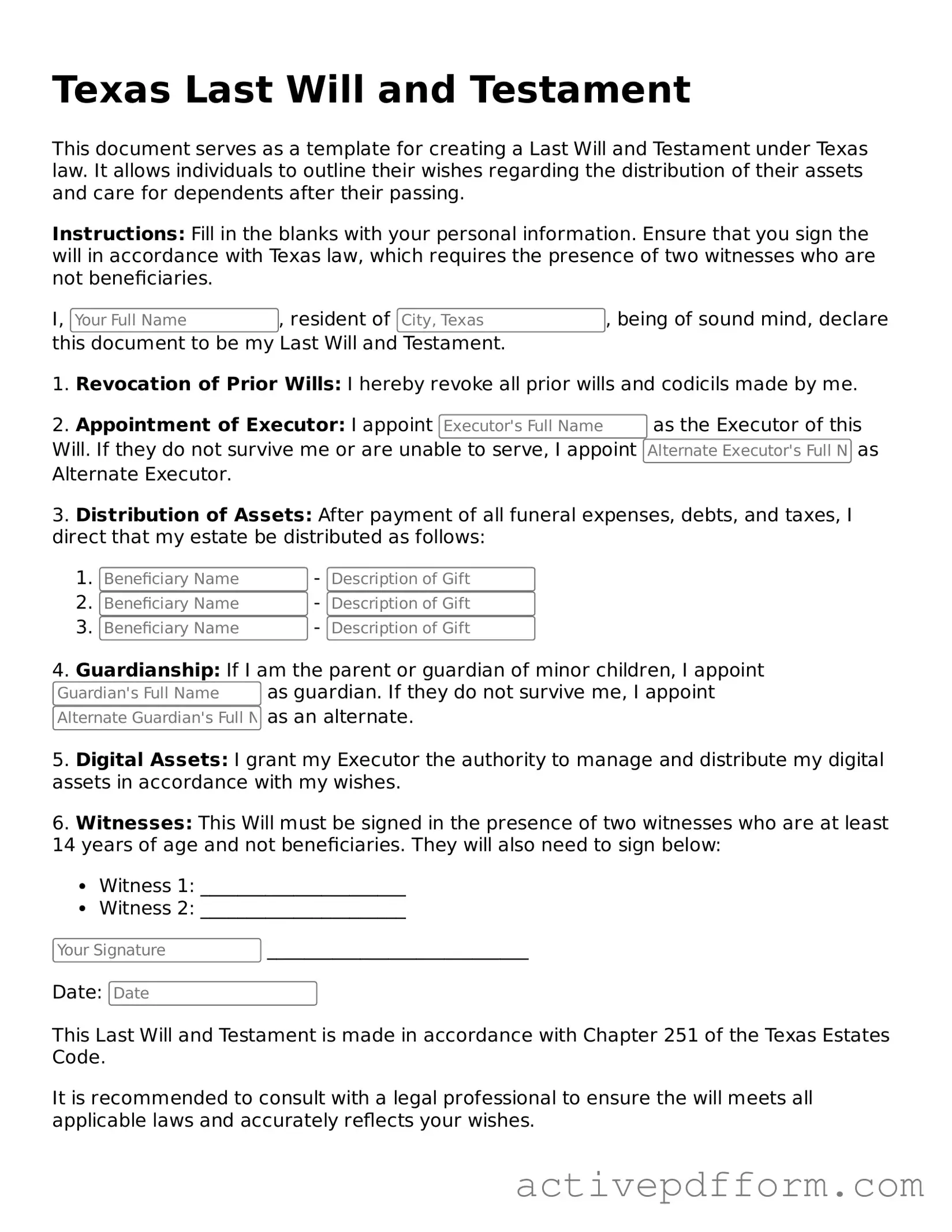

Texas Last Will and Testament

This document serves as a template for creating a Last Will and Testament under Texas law. It allows individuals to outline their wishes regarding the distribution of their assets and care for dependents after their passing.

Instructions: Fill in the blanks with your personal information. Ensure that you sign the will in accordance with Texas law, which requires the presence of two witnesses who are not beneficiaries.

I, , resident of , being of sound mind, declare this document to be my Last Will and Testament.

1. Revocation of Prior Wills: I hereby revoke all prior wills and codicils made by me.

2. Appointment of Executor: I appoint as the Executor of this Will. If they do not survive me or are unable to serve, I appoint as Alternate Executor.

3. Distribution of Assets: After payment of all funeral expenses, debts, and taxes, I direct that my estate be distributed as follows:

- -

- -

- -

4. Guardianship: If I am the parent or guardian of minor children, I appoint as guardian. If they do not survive me, I appoint as an alternate.

5. Digital Assets: I grant my Executor the authority to manage and distribute my digital assets in accordance with my wishes.

6. Witnesses: This Will must be signed in the presence of two witnesses who are at least 14 years of age and not beneficiaries. They will also need to sign below:

- Witness 1: ______________________

- Witness 2: ______________________

____________________________

Date:

This Last Will and Testament is made in accordance with Chapter 251 of the Texas Estates Code.

It is recommended to consult with a legal professional to ensure the will meets all applicable laws and accurately reflects your wishes.

Understanding Texas Last Will and Testament

What is a Texas Last Will and Testament?

A Texas Last Will and Testament is a legal document that outlines how an individual's assets and property will be distributed after their death. It allows a person to specify beneficiaries, appoint an executor, and make arrangements for any dependents. This document is essential for ensuring that one's wishes are honored and can help avoid potential disputes among heirs.

Who can create a Last Will and Testament in Texas?

In Texas, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. It is important that the individual understands the nature of their decisions and the implications of their will. Additionally, the person must not be under any undue influence or coercion when creating the document.

Do I need a lawyer to create a Last Will and Testament in Texas?

While it is not legally required to have a lawyer to create a Last Will and Testament in Texas, seeking legal advice can be beneficial. A lawyer can help ensure that the will complies with state laws and accurately reflects the individual's wishes. For those with complex estates or specific concerns, professional guidance may be particularly valuable.

What are the requirements for a valid Last Will and Testament in Texas?

For a Last Will and Testament to be valid in Texas, it must be in writing and signed by the testator (the person making the will). Additionally, the will should be witnessed by at least two individuals who are at least 14 years old and are not beneficiaries. These witnesses must sign the will in the presence of the testator.

Can I change my Last Will and Testament after it has been created?

Yes, individuals can change their Last Will and Testament at any time while they are of sound mind. This can be done by creating a new will or by drafting a codicil, which is an amendment to the existing will. It is important to follow the same legal requirements for signing and witnessing as with the original will to ensure the changes are valid.

What happens if I die without a Last Will and Testament in Texas?

If a person dies without a Last Will and Testament in Texas, they are considered to have died "intestate." In this case, the state's intestacy laws will determine how the person's assets are distributed. This may not align with the deceased's wishes and can lead to complications or disputes among surviving family members.

How can I ensure my Last Will and Testament is carried out as intended?

To ensure that a Last Will and Testament is carried out as intended, it is important to communicate your wishes clearly to your executor and beneficiaries. Choosing a trustworthy executor who understands your intentions is crucial. Additionally, keeping the will in a safe but accessible location and reviewing it periodically can help maintain its relevance and effectiveness.

Can I include specific instructions for my funeral in my Last Will and Testament?

Yes, individuals can include specific instructions for their funeral in their Last Will and Testament. However, it is advisable to communicate these wishes to family members or a designated person, as the will may not be reviewed until after the funeral. Clear communication can help ensure that your preferences are honored during this time.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it's important to ensure that the document accurately reflects your wishes. Here are some essential dos and don’ts to consider:

- Do clearly identify yourself at the beginning of the document.

- Do designate an executor who will manage your estate after your passing.

- Do specify how you want your assets distributed among your beneficiaries.

- Do sign the document in the presence of two witnesses who are not beneficiaries.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to date the will to establish its validity.

- Don't neglect to review and update your will regularly, especially after major life events.

Browse Other Popular Last Will and Testament Templates for Specific States

Simple Will in Florida - Having a will is an expression of care; it ensures that your property goes to the people you choose rather than the state.

For those looking to navigate the complexities of vehicle ownership transfers, our guide on the necessary Motor Vehicle Bill of Sale documentation is invaluable. This resource ensures that you have all the required information to facilitate a smooth transaction. Learn more about the process in our detailed overview of how to complete the Motor Vehicle Bill of Sale form effectively. For additional information, visit this helpful page on Motor Vehicle Bill of Sale requirements.

California Last Will and Testament - Reduces uncertainty for survivors regarding the deceased’s desires.