Blank Texas Lady Bird Deed Document

The Texas Lady Bird Deed, also known as an enhanced life estate deed, is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This deed enables the original owner to live in and use the property without any restrictions, even after the transfer is recorded. Upon the owner’s passing, the property automatically transfers to the designated beneficiaries, avoiding the lengthy and often costly probate process. One of the key advantages of the Lady Bird Deed is that it allows the owner to retain the ability to sell, mortgage, or change the beneficiaries at any time without needing their consent. Additionally, this form can help protect the property from claims by creditors and may provide tax benefits. Understanding the intricacies of the Texas Lady Bird Deed is essential for those looking to simplify their estate planning and ensure a smoother transition of property to their loved ones.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | The Texas Lady Bird Deed is a type of transfer on death deed that allows property owners to transfer real estate to beneficiaries without going through probate. |

| Governing Law | This deed is governed by Texas Property Code, Section 114.001 through 114.008. |

| Retained Control | The property owner retains full control of the property during their lifetime, including the right to sell, mortgage, or change beneficiaries. |

| Tax Implications | Using a Lady Bird Deed can help avoid capital gains taxes for beneficiaries because the property receives a step-up in basis upon the owner's death. |

| Revocability | The deed can be revoked or modified at any time by the property owner, ensuring flexibility in estate planning. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the property can be divided among them as specified in the deed. |

| Medicaid Planning | The Lady Bird Deed can be a useful tool in Medicaid planning, as it may help protect the property from being counted as an asset for eligibility purposes. |

Similar forms

-

Transfer on Death Deed (TODD): Like the Lady Bird Deed, a Transfer on Death Deed allows property owners to transfer their real estate to beneficiaries upon their death. This document avoids probate, ensuring a smoother transition of property ownership.

-

Life Estate Deed: A Life Estate Deed grants an individual the right to live in and use a property for the duration of their life. After their passing, the property automatically transfers to designated beneficiaries, similar to the Lady Bird Deed's provisions.

-

Will: A Will outlines how a person's assets, including real estate, will be distributed after their death. While a Lady Bird Deed transfers property outside of probate, a Will typically requires probate proceedings, making the Lady Bird Deed a more efficient option for property transfer.

- Trailer Bill of Sale: The Arizona PDF Forms provide essential templates for ensuring a smooth transfer of ownership for trailers, outlining necessary details such as buyer and seller information, trailer description, and sale price.

-

Revocable Living Trust: This legal arrangement allows individuals to place their assets, including real estate, into a trust during their lifetime. Upon death, the assets can be distributed without probate. Like the Lady Bird Deed, a revocable living trust provides a way to manage property and avoid the complexities of probate.

-

Quitclaim Deed: A Quitclaim Deed transfers whatever interest a person has in a property without guaranteeing that the title is clear. While it does not provide the same protections as a Lady Bird Deed, both documents can facilitate property transfers between parties.

Texas Lady Bird Deed Example

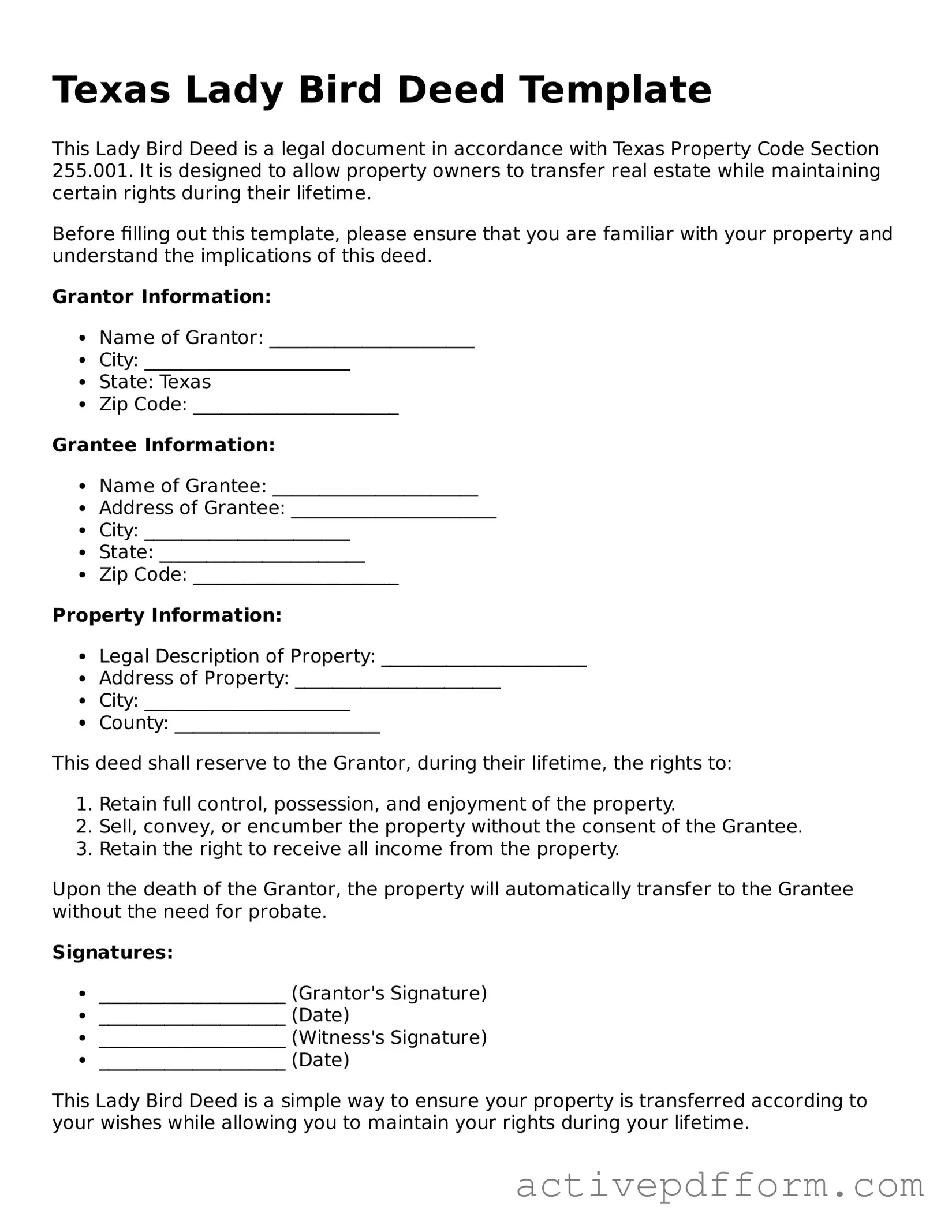

Texas Lady Bird Deed Template

This Lady Bird Deed is a legal document in accordance with Texas Property Code Section 255.001. It is designed to allow property owners to transfer real estate while maintaining certain rights during their lifetime.

Before filling out this template, please ensure that you are familiar with your property and understand the implications of this deed.

Grantor Information:

- Name of Grantor: ______________________

- City: ______________________

- State: Texas

- Zip Code: ______________________

Grantee Information:

- Name of Grantee: ______________________

- Address of Grantee: ______________________

- City: ______________________

- State: ______________________

- Zip Code: ______________________

Property Information:

- Legal Description of Property: ______________________

- Address of Property: ______________________

- City: ______________________

- County: ______________________

This deed shall reserve to the Grantor, during their lifetime, the rights to:

- Retain full control, possession, and enjoyment of the property.

- Sell, convey, or encumber the property without the consent of the Grantee.

- Retain the right to receive all income from the property.

Upon the death of the Grantor, the property will automatically transfer to the Grantee without the need for probate.

Signatures:

- ____________________ (Grantor's Signature)

- ____________________ (Date)

- ____________________ (Witness's Signature)

- ____________________ (Date)

This Lady Bird Deed is a simple way to ensure your property is transferred according to your wishes while allowing you to maintain your rights during your lifetime.

Understanding Texas Lady Bird Deed

What is a Lady Bird Deed in Texas?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to a beneficiary while retaining the right to live in and control the property during their lifetime. This type of deed is unique to Texas and offers certain benefits, such as avoiding probate and allowing the owner to change their mind about the transfer at any time before their death.

Who can use a Lady Bird Deed?

Any property owner in Texas can use a Lady Bird Deed. This includes individuals, married couples, and even some business entities. It is particularly useful for those who want to ensure their property passes directly to their chosen beneficiaries without going through the lengthy probate process.

What are the benefits of a Lady Bird Deed?

There are several benefits to using a Lady Bird Deed. First, it allows the property owner to retain full control over the property during their lifetime. Second, it avoids probate, which can save time and money for the beneficiaries. Additionally, the property may not be subject to Medicaid recovery after the owner's death, providing financial protection for the heirs.

Are there any downsides to using a Lady Bird Deed?

While there are many advantages, there are some potential downsides to consider. For instance, if the property owner needs to sell the property, they must notify the beneficiary. Furthermore, if the property owner has significant debts, creditors may still have a claim against the property. It's important to weigh these factors before proceeding.

How is a Lady Bird Deed executed?

To execute a Lady Bird Deed, the property owner must fill out the deed form accurately. This includes providing details about the property, the owner, and the beneficiary. Once completed, the deed must be signed in front of a notary public and then filed with the county clerk's office where the property is located. This ensures that the deed is legally recognized.

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked or changed at any time during the property owner's lifetime. This flexibility is one of the key features of this type of deed. The owner simply needs to create a new deed that revokes the previous one and follow the same process of signing and filing it with the county clerk.

Is legal advice needed to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without legal assistance, consulting with an attorney is often a good idea. An attorney can provide guidance tailored to your specific situation, ensuring that the deed is correctly executed and that all legal requirements are met. This can help prevent future complications for you and your beneficiaries.

Dos and Don'ts

When filling out the Texas Lady Bird Deed form, it is crucial to approach the process with care. Here are some essential dos and don'ts to keep in mind:

- Do ensure that you have the correct legal description of the property. This is vital for the deed's validity.

- Do clearly identify all parties involved, including the grantor and grantee, to avoid any confusion.

- Don't leave any sections of the form blank. Incomplete forms can lead to delays or rejections.

- Don't forget to sign and date the deed in the presence of a notary public. This step is essential for the document to be legally binding.

Taking these steps seriously can help ensure that your Lady Bird Deed is executed correctly, protecting your property interests and intentions.

Browse Other Popular Lady Bird Deed Templates for Specific States

Lady Bird Deed Texas Pros and Cons - By using a Lady Bird Deed, property owners can maintain their independence while ensuring a clear inheritance path.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping specific details confidential, ensuring that proprietary information remains secure. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets. For further details, you can refer to https://nytemplates.com/blank-non-disclosure-agreement-template.