Blank Texas Gift Deed Document

The Texas Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without monetary exchange. This document allows a property owner, known as the grantor, to convey their interest in real estate to another person, referred to as the grantee, as a gift. Essential elements of the form include the identification of both parties, a clear description of the property being transferred, and the grantor's intent to make a gift. Importantly, the deed must be signed by the grantor and may require notarization to ensure its validity. Additionally, the form often includes a statement affirming that the transfer is made without any expectation of compensation, which is a key aspect of gift transactions. Understanding the nuances of the Texas Gift Deed is vital for ensuring that the transfer is legally binding and properly recorded, thereby protecting the interests of both the giver and the recipient.

Document Attributes

| Fact Name | Details |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership as a gift without any payment involved. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Sections 5.021 to 5.027. |

| Requirements | The deed must be in writing, signed by the donor, and must clearly identify the property and the recipient. |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from other types of property transfers. |

| Recording | To ensure legal validity, the gift deed should be recorded in the county where the property is located. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the recipient, including potential gift tax liabilities. |

| Revocation | A gift deed can be revoked by the donor before it is delivered and accepted by the recipient. |

| Acceptance | The recipient must accept the gift for the transfer of ownership to be valid. |

| Legal Advice | It is advisable to seek legal counsel when drafting or executing a gift deed to ensure compliance with all legal requirements. |

Similar forms

-

Will: A will outlines how a person's assets will be distributed after their death. Like a gift deed, it involves the transfer of property, but a will takes effect only upon the individual's passing, while a gift deed transfers ownership immediately.

-

Trust Agreement: A trust agreement establishes a legal entity that holds assets for the benefit of others. Similar to a gift deed, it involves the transfer of property, but a trust can manage assets over time, whereas a gift deed is a straightforward transfer.

-

Sales Contract: A sales contract is an agreement between a buyer and a seller for the exchange of property. Both documents facilitate the transfer of ownership, but a sales contract typically involves a monetary exchange, while a gift deed does not.

- Residential Lease Agreement: This legal document outlines the terms between a landlord and tenant for renting a residential property in Arizona. To ensure a smooth rental experience, it’s crucial to understand this form, which you can access through Arizona PDF Forms.

-

Quitclaim Deed: A quitclaim deed transfers any ownership interest in a property without warranties. Like a gift deed, it transfers property rights, but it does not guarantee that the property is free of claims or liens.

Texas Gift Deed Example

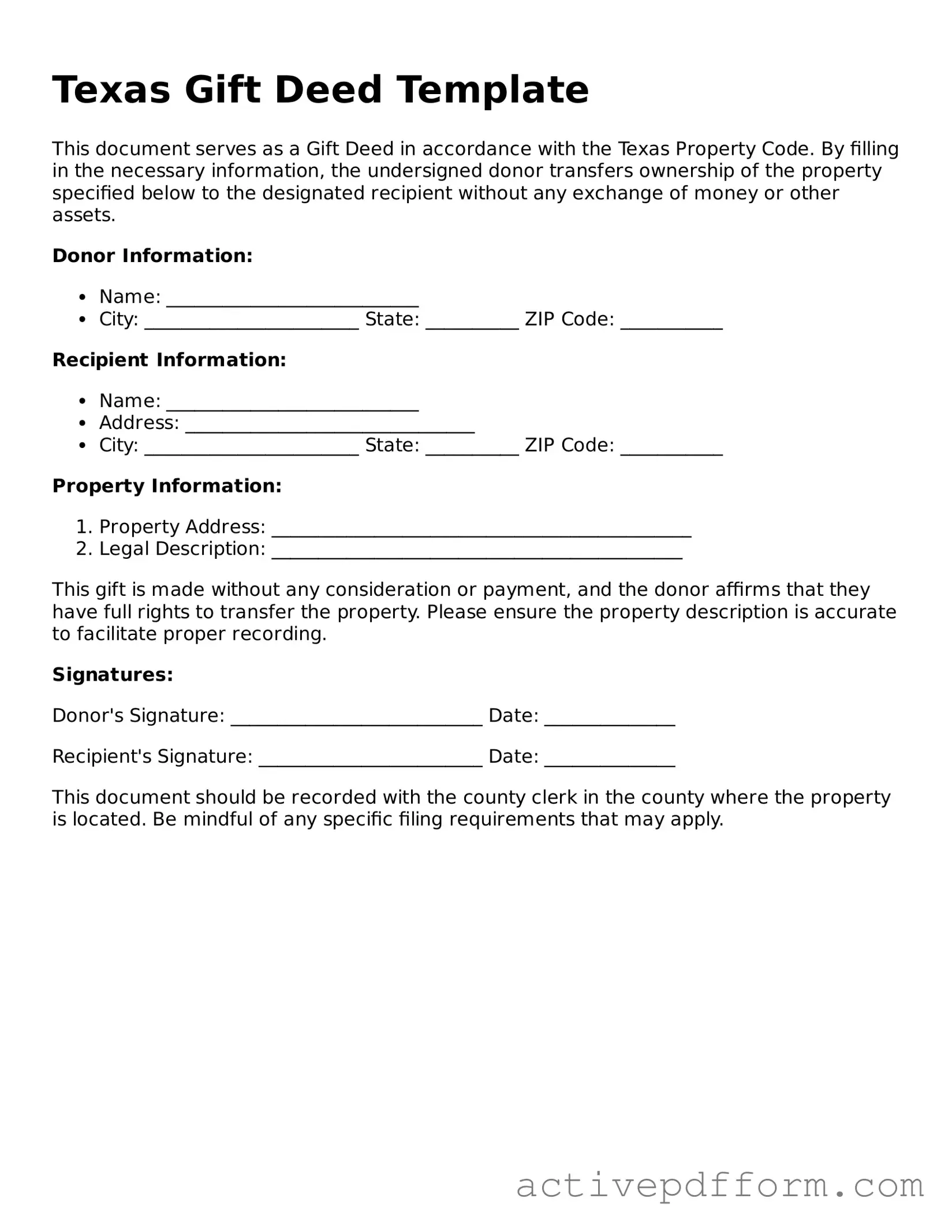

Texas Gift Deed Template

This document serves as a Gift Deed in accordance with the Texas Property Code. By filling in the necessary information, the undersigned donor transfers ownership of the property specified below to the designated recipient without any exchange of money or other assets.

Donor Information:

- Name: ___________________________

- City: _______________________ State: __________ ZIP Code: ___________

Recipient Information:

- Name: ___________________________

- Address: _______________________________

- City: _______________________ State: __________ ZIP Code: ___________

Property Information:

- Property Address: _____________________________________________

- Legal Description: ____________________________________________

This gift is made without any consideration or payment, and the donor affirms that they have full rights to transfer the property. Please ensure the property description is accurate to facilitate proper recording.

Signatures:

Donor's Signature: ___________________________ Date: ______________

Recipient's Signature: ________________________ Date: ______________

This document should be recorded with the county clerk in the county where the property is located. Be mindful of any specific filing requirements that may apply.

Understanding Texas Gift Deed

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer property from one person to another as a gift. Unlike a sale, no money changes hands. This deed allows the giver, known as the grantor, to convey ownership of real estate to the recipient, called the grantee, without any exchange of value. It is important to ensure that the deed is properly filled out and signed to make the transfer valid.

Do I need to have the Gift Deed notarized?

Yes, a Gift Deed in Texas must be notarized to be legally binding. This means that the grantor must sign the document in front of a notary public. The notary will then verify the identity of the signer and affix their seal to the document. Notarization helps prevent fraud and ensures that the transaction is legitimate.

Are there any tax implications for gifting property in Texas?

Yes, there can be tax implications when gifting property. While Texas does not have a state gift tax, the federal government does have regulations regarding gifts. If the value of the property exceeds a certain amount, the grantor may need to file a gift tax return. It’s advisable to consult with a tax professional to understand any potential tax consequences and ensure compliance with federal laws.

Can I revoke a Gift Deed after it has been executed?

Generally, once a Gift Deed is executed and recorded, it cannot be revoked. The transfer of ownership is considered complete. However, if there are specific circumstances, such as fraud or undue influence, it may be possible to challenge the deed in court. It is crucial to understand the implications before executing a Gift Deed.

What information is needed to complete a Texas Gift Deed?

To complete a Texas Gift Deed, you will need several pieces of information. This includes the full names and addresses of both the grantor and grantee, a legal description of the property being transferred, and the date of the transfer. Additionally, both parties should be aware of any existing liens or encumbrances on the property. Ensuring all information is accurate helps prevent future disputes.

Dos and Don'ts

When filling out the Texas Gift Deed form, it's important to approach the process with care. Here are nine essential do's and don'ts to keep in mind:

- Do ensure that the property description is accurate and complete.

- Don't leave any sections of the form blank; every part needs to be filled out.

- Do include the full names and addresses of both the donor and the recipient.

- Don't forget to sign the form in front of a notary public.

- Do check for any specific requirements that may apply to your situation.

- Don't use ambiguous language; clarity is key in legal documents.

- Do keep a copy of the completed form for your records.

- Don't underestimate the importance of consulting with a legal professional if needed.

- Do file the deed with the appropriate county office after completion.

Following these guidelines will help ensure that your Gift Deed is valid and effective. Taking the time to do it right can save you from potential complications in the future.

Browse Other Popular Gift Deed Templates for Specific States

Gift Deed California - The form may need to be recorded with the county clerk for real estate gifts.

For those looking to understand the requirements of the New York MV51 form, it's advisable to refer to comprehensive resources, such as https://nytemplates.com/blank-new-york-mv51-template, which provide valuable information about the documentation needed for vehicle sales and transfers.