Blank Texas Durable Power of Attorney Document

In Texas, the Durable Power of Attorney (DPOA) form serves as a vital tool for individuals seeking to ensure their financial and legal matters are managed according to their wishes, even in the event of incapacitation. This form allows a person, known as the principal, to designate another individual, referred to as the agent or attorney-in-fact, to make decisions on their behalf. The DPOA remains effective even if the principal becomes unable to make decisions due to illness or injury. Key aspects of this form include the ability to specify the powers granted to the agent, such as managing bank accounts, handling real estate transactions, and making healthcare decisions. Furthermore, the DPOA can be tailored to fit the principal’s unique needs, allowing for both broad and limited authority. It is important to understand that the DPOA must be signed while the principal is still mentally competent, and it typically requires witnesses or notarization to be legally valid. By taking the time to create a Durable Power of Attorney, individuals can gain peace of mind knowing that their affairs will be handled by someone they trust, ensuring their wishes are honored even when they cannot speak for themselves.

Document Attributes

| Fact Name | Details |

|---|---|

| Definition | A Texas Durable Power of Attorney allows an individual to designate someone else to make decisions on their behalf if they become incapacitated. |

| Governing Law | The Texas Durable Power of Attorney is governed by Texas Estates Code, Title 2, Chapter 751. |

| Durability | This form remains effective even if the principal becomes incapacitated, which is a key feature distinguishing it from a standard power of attorney. |

| Principal | The person granting authority is known as the principal. They must be at least 18 years old and of sound mind. |

| Agent | The agent, also known as the attorney-in-fact, is the individual designated to act on behalf of the principal. |

| Scope of Authority | The agent can be given broad or limited powers, depending on what the principal specifies in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Witness Requirements | In Texas, the document must be signed by the principal and witnessed by at least one person, or it can be notarized. |

| Healthcare Decisions | This form does not cover healthcare decisions. A separate medical power of attorney is required for that purpose. |

| Legal Effect | The Durable Power of Attorney has the same legal effect as if the principal were making the decisions themselves. |

Similar forms

The Durable Power of Attorney (DPOA) form is an important legal document, but it shares similarities with other key documents. Here are four documents that are comparable to the DPOA:

- General Power of Attorney: Like the DPOA, this document allows one person to act on behalf of another. However, it typically becomes invalid if the person who created it becomes incapacitated.

- California Judicial Council Form: The California PDF Forms provide essential structure and consistency for various pleadings and court filings, making it vital for anyone involved in legal processes in California.

- Healthcare Power of Attorney: This document specifically grants someone the authority to make medical decisions for another person. It is similar to the DPOA but focuses solely on health-related matters.

- Living Will: While a Living Will outlines a person's wishes regarding medical treatment in end-of-life situations, it often works alongside a Healthcare Power of Attorney. Both documents ensure that a person's healthcare preferences are honored.

- Trust Agreement: A Trust Agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Like the DPOA, it provides a way to manage someone’s affairs but is often used for estate planning rather than decision-making during incapacity.

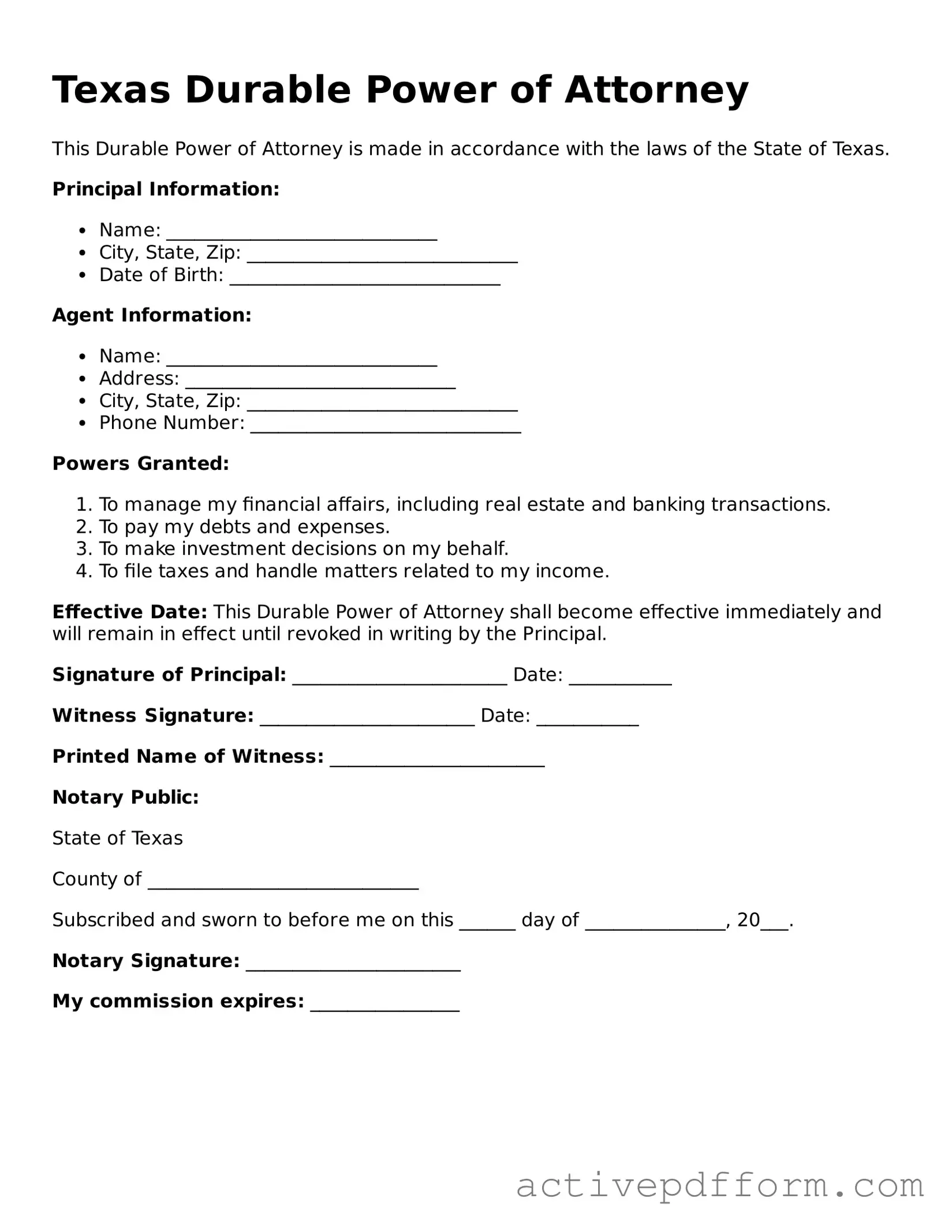

Texas Durable Power of Attorney Example

Texas Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the laws of the State of Texas.

Principal Information:

- Name: _____________________________

- City, State, Zip: _____________________________

- Date of Birth: _____________________________

Agent Information:

- Name: _____________________________

- Address: _____________________________

- City, State, Zip: _____________________________

- Phone Number: _____________________________

Powers Granted:

- To manage my financial affairs, including real estate and banking transactions.

- To pay my debts and expenses.

- To make investment decisions on my behalf.

- To file taxes and handle matters related to my income.

Effective Date: This Durable Power of Attorney shall become effective immediately and will remain in effect until revoked in writing by the Principal.

Signature of Principal: _______________________ Date: ___________

Witness Signature: _______________________ Date: ___________

Printed Name of Witness: _______________________

Notary Public:

State of Texas

County of _____________________________

Subscribed and sworn to before me on this ______ day of _______________, 20___.

Notary Signature: _______________________

My commission expires: ________________

Understanding Texas Durable Power of Attorney

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you become incapacitated. This document remains effective even if you are unable to make decisions for yourself, ensuring that your financial and medical affairs can be managed according to your wishes.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney is crucial for planning your future. It ensures that someone you trust can step in and handle your affairs without the need for court intervention. This can save time, reduce stress for your loved ones, and ensure that your preferences are respected during difficult times.

Who can I appoint as my agent?

You can appoint any competent adult as your agent, including a family member, friend, or trusted advisor. It’s important to choose someone who understands your values and can act in your best interest. Consider their ability to handle financial matters and make decisions under pressure.

How do I create a Durable Power of Attorney in Texas?

To create a Durable Power of Attorney in Texas, you must complete the appropriate form, which can be found online or through legal resources. Ensure that the document is signed in the presence of a notary public. It’s wise to discuss your intentions with your chosen agent before finalizing the document.

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. To revoke it, simply create a new document stating your intention to do so and inform your agent and any relevant institutions of the change. Keeping your documents updated is essential for ensuring your wishes are followed.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including managing your finances, paying bills, and making healthcare decisions. However, you can also limit their authority if there are specific areas where you want to retain control. Clearly outline the powers you wish to grant in the document to avoid confusion later.

Is a Durable Power of Attorney the same as a Medical Power of Attorney?

No, a Durable Power of Attorney primarily covers financial and legal matters, while a Medical Power of Attorney specifically deals with healthcare decisions. It’s advisable to have both documents to ensure comprehensive coverage of your wishes in various aspects of your life.

Dos and Don'ts

When filling out the Texas Durable Power of Attorney form, it's important to follow certain guidelines to ensure that the document is valid and meets your needs. Here are six things to consider:

- Do: Clearly identify the principal, the person granting the power, and the agent, the person receiving the power.

- Do: Specify the powers you are granting to your agent. Be as detailed as possible.

- Do: Sign the document in front of a notary public to ensure it is legally binding.

- Do: Keep a copy of the signed document in a safe place and provide copies to your agent and any relevant institutions.

- Don't: Leave blank spaces on the form. Fill in all required information to avoid ambiguity.

- Don't: Forget to review the document periodically. Changes in circumstances may require updates to the powers granted.

Browse Other Popular Durable Power of Attorney Templates for Specific States

Is Power of Attorney Public Record - A Durable Power of Attorney is often a critical part of estate planning.

For those looking to facilitate the buying or selling of a vehicle, it's vital to be aware of the key components entailed in the important Motor Vehicle Bill of Sale document. This document not only reflects the agreement between parties but also serves to legally transfer vehicle ownership in Ohio, ensuring a smooth transaction experience.

Poa Form California - Regular updates ensure the document reflects current life circumstances.