Blank Texas Deed in Lieu of Foreclosure Document

In the complex landscape of real estate transactions, the Texas Deed in Lieu of Foreclosure form serves as a critical tool for homeowners facing financial distress. This legal document allows property owners to voluntarily transfer the title of their home back to the lender, effectively bypassing the lengthy and often stressful foreclosure process. By opting for a deed in lieu, homeowners can mitigate the negative impact on their credit score while providing the lender with a quicker resolution to the defaulted mortgage. The form outlines essential details, such as the property description, the parties involved, and any existing liens that may affect the transfer. Additionally, it often includes provisions that protect both the homeowner and the lender, ensuring a smoother transition of ownership. Understanding this form can empower homeowners to make informed decisions during challenging times, paving the way for a fresh start without the burden of foreclosure hanging over their heads.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The Texas Deed in Lieu of Foreclosure is governed by Texas Property Code, particularly sections related to mortgage and foreclosure processes. |

| Eligibility | Homeowners facing financial difficulties may qualify, but lenders typically require that the borrower is unable to make mortgage payments. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and may have a less damaging effect on their credit score. |

| Process | The borrower must negotiate with the lender, who will review the property’s condition and the borrower’s financial situation before accepting the deed. |

| Potential Consequences | Borrowers may still be responsible for any remaining debt after the property transfer, depending on the terms agreed upon with the lender. |

| Alternative Options | Other alternatives include loan modification, short sales, or working with housing counselors to explore different solutions to foreclosure. |

Similar forms

The Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender in exchange for the cancellation of their mortgage debt. This process can be beneficial for both parties, as it can help the borrower avoid the lengthy and costly foreclosure process. Several other documents share similarities with the Deed in Lieu of Foreclosure, each serving specific purposes in property and mortgage transactions. Below is a list of five such documents:

- Loan Modification Agreement: This document outlines changes to the original loan terms, such as interest rates or payment schedules. Like the Deed in Lieu of Foreclosure, it aims to provide relief to borrowers struggling to meet their mortgage obligations, often preventing foreclosure.

- Short Sale Agreement: A short sale occurs when a property is sold for less than the outstanding mortgage balance, with the lender's approval. This document is similar in that it allows borrowers to avoid foreclosure while still addressing their financial difficulties, although it involves selling the property rather than transferring it back to the lender.

- Forbearance Agreement: This agreement temporarily suspends or reduces mortgage payments for a specified period. It offers a solution for borrowers facing temporary financial hardships, much like the Deed in Lieu of Foreclosure, which helps borrowers manage their debt without going through foreclosure.

- New York MV51 Form: Essential for the sale or transfer of vehicles that are 1972 or older, this certification ensures proper documentation and legal ownership transfer. For more information, visit nytemplates.com/blank-new-york-mv51-template.

- Release of Mortgage: This document signifies that the lender has released its claim on the property, usually after the mortgage is paid off. While it differs in that it typically follows the completion of payments, it shares the goal of resolving the mortgage obligation, similar to the Deed in Lieu of Foreclosure.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. This document can be used in various situations, such as transferring property between family members. It is similar in that it involves the transfer of property rights but does not necessarily address mortgage obligations directly.

Texas Deed in Lieu of Foreclosure Example

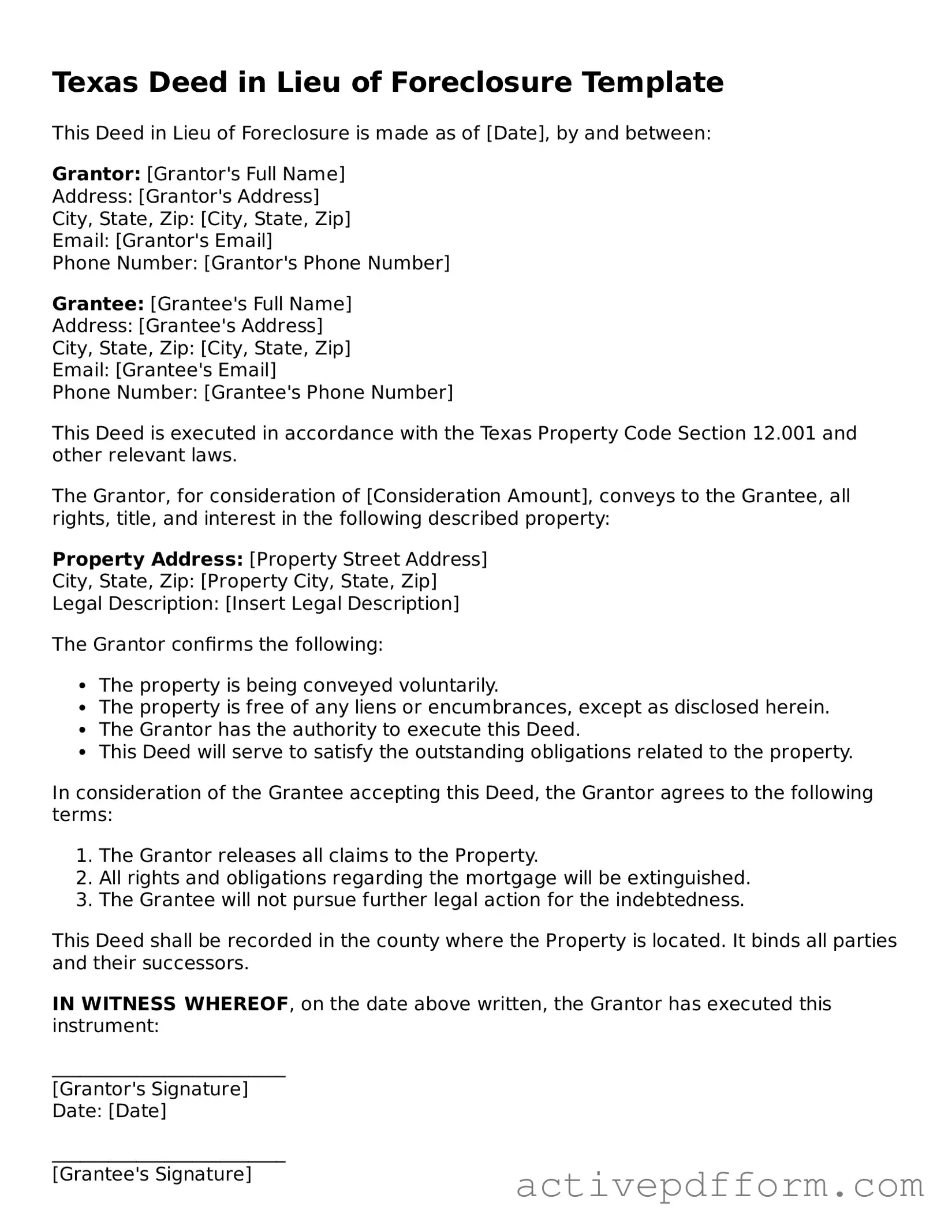

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made as of [Date], by and between:

Grantor: [Grantor's Full Name]

Address: [Grantor's Address]

City, State, Zip: [City, State, Zip]

Email: [Grantor's Email]

Phone Number: [Grantor's Phone Number]

Grantee: [Grantee's Full Name]

Address: [Grantee's Address]

City, State, Zip: [City, State, Zip]

Email: [Grantee's Email]

Phone Number: [Grantee's Phone Number]

This Deed is executed in accordance with the Texas Property Code Section 12.001 and other relevant laws.

The Grantor, for consideration of [Consideration Amount], conveys to the Grantee, all rights, title, and interest in the following described property:

Property Address: [Property Street Address]

City, State, Zip: [Property City, State, Zip]

Legal Description: [Insert Legal Description]

The Grantor confirms the following:

- The property is being conveyed voluntarily.

- The property is free of any liens or encumbrances, except as disclosed herein.

- The Grantor has the authority to execute this Deed.

- This Deed will serve to satisfy the outstanding obligations related to the property.

In consideration of the Grantee accepting this Deed, the Grantor agrees to the following terms:

- The Grantor releases all claims to the Property.

- All rights and obligations regarding the mortgage will be extinguished.

- The Grantee will not pursue further legal action for the indebtedness.

This Deed shall be recorded in the county where the Property is located. It binds all parties and their successors.

IN WITNESS WHEREOF, on the date above written, the Grantor has executed this instrument:

_________________________

[Grantor's Signature]

Date: [Date]

_________________________

[Grantee's Signature]

Date: [Date]

State of Texas

County of [County]

Before me, a Notary Public in and for said County and State, personally appeared [Grantor's Full Name], known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that he/she executed the same for the purposes therein contained.

Given under my hand and seal this [Date] day of [Month, Year].

_________________________

Notary Public Signature

My commission expires: [Date]

Understanding Texas Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Texas?

A Deed in Lieu of Foreclosure is an agreement between a homeowner and their lender. Instead of going through the lengthy and often stressful foreclosure process, the homeowner voluntarily transfers the property title to the lender. This can help both parties avoid the costs and complications associated with foreclosure.

Who can use a Deed in Lieu of Foreclosure?

Homeowners facing financial difficulties and unable to keep up with mortgage payments may consider this option. However, lenders typically require that the homeowner is in default or at risk of defaulting on their mortgage payments. It's essential to communicate with your lender to determine eligibility.

What are the benefits of a Deed in Lieu of Foreclosure?

This process can provide several advantages. It often allows homeowners to walk away from their mortgage debt without the lengthy foreclosure process. Additionally, it can help protect the homeowner's credit score from the more severe impact of a foreclosure. For lenders, it can be a quicker way to take possession of the property and reduce losses.

Are there any downsides to a Deed in Lieu of Foreclosure?

While this option can be beneficial, it may also have drawbacks. Homeowners may still face tax implications, as forgiven debt could be considered taxable income. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, and it might not be an option for everyone. Always consult with a financial advisor or attorney before proceeding.

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will review the homeowner's financial situation and property details. If both parties agree, they will draft the necessary documents, and the homeowner will sign over the property title to the lender.

Do I need an attorney to complete a Deed in Lieu of Foreclosure?

While it's not legally required to have an attorney, it is highly recommended. An attorney can help ensure that the documents are correctly prepared and that the homeowner understands their rights and obligations. This can help avoid potential pitfalls during the process.

Will I still owe money after a Deed in Lieu of Foreclosure?

This can vary based on the lender's policies and the specific terms of the agreement. In some cases, the lender may forgive the remaining mortgage balance. However, in other situations, the homeowner might still be responsible for a deficiency balance. It's crucial to clarify this with the lender before proceeding.

How does a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure will likely have a negative impact on your credit score, but it may be less severe than a foreclosure. The exact effect will depend on various factors, including your overall credit history. Generally, the sooner you address the situation, the better it can be for your credit in the long run.

Can I still buy another home after a Deed in Lieu of Foreclosure?

Yes, you can still buy another home after a Deed in Lieu of Foreclosure, but it may take some time. Lenders often have waiting periods before you can qualify for a new mortgage, usually ranging from two to four years. During this time, it’s important to rebuild your credit and improve your financial standing.

Where can I find the Texas Deed in Lieu of Foreclosure form?

You can obtain the Texas Deed in Lieu of Foreclosure form through various sources, including legal document providers, real estate websites, or directly from your lender. It's essential to ensure that the form you use complies with Texas laws and meets your specific situation's requirements.

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are five essential dos and don'ts to keep in mind:

- Do ensure that all property information is accurate and complete.

- Do consult with a legal expert if you have questions about the implications of signing the deed.

- Do provide all required signatures from all parties involved in the transaction.

- Don't rush through the form; take your time to review each section thoroughly.

- Don't forget to keep a copy of the completed form for your records.

Browse Other Popular Deed in Lieu of Foreclosure Templates for Specific States

Florida Deed in Lieu of Foreclosure - This option usually requires the property to be free of significant liens.

Before signing any documentation, it's essential for both landlords and tenants to familiarize themselves with the critical elements of the agreement. For a comprehensive overview and to ensure all terms are clearly defined, you can access the Arizona PDF Forms which provide necessary templates and guidance that facilitate a mutually beneficial rental arrangement.

California Property Surrender Deed - This option can potentially minimize the damage to a homeowner’s credit and serve as a stepping stone for future financial recovery.