Blank Texas Bill of Sale Document

In Texas, the Bill of Sale form serves as a vital document for individuals engaging in the sale or transfer of personal property. This form outlines key details such as the identities of the buyer and seller, a description of the item being sold, and the agreed-upon sale price. It also provides essential information regarding the condition of the item, which helps protect both parties in the transaction. By documenting the sale, the Bill of Sale can serve as proof of ownership transfer, which is particularly important for vehicles, boats, and other high-value items. Additionally, it may include warranties or disclaimers, clarifying any guarantees about the item's condition. Understanding the intricacies of this form can help ensure a smooth transaction, making it an indispensable tool for anyone involved in buying or selling property in Texas.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Bill of Sale form serves as a legal document to transfer ownership of personal property from one party to another. |

| Governing Law | The transfer of ownership is governed by the Texas Business and Commerce Code, specifically sections related to sales and personal property. |

| Required Information | The form typically requires details such as the names and addresses of both the buyer and seller, a description of the item being sold, and the sale price. |

| Notarization | While notarization is not always required, it is recommended for added legal protection and to verify the identities of the parties involved. |

Similar forms

Purchase Agreement: This document outlines the terms of a sale, including price, description of the item, and the obligations of both the buyer and seller. Like a Bill of Sale, it serves as proof of the transaction.

- Rental Application: To assist in selecting suitable tenants, complete the essential Rental Application form that provides necessary personal and financial details to landlords.

Lease Agreement: A lease agreement details the terms under which one party rents property from another. Similar to a Bill of Sale, it provides a legal framework for the transfer of use and rights over a property.

Title Transfer Document: This document is used to officially transfer ownership of a vehicle or property. Much like a Bill of Sale, it serves to prove that ownership has changed hands.

Gift Receipt: A gift receipt records the transfer of an item without payment. It functions similarly to a Bill of Sale by providing evidence of the transfer, even though no money is involved.

Sales Invoice: An invoice lists the items sold and the amount due. It shares similarities with a Bill of Sale in that it confirms a sale has occurred and outlines the details of the transaction.

Service Agreement: This document specifies the terms under which services are provided. Like a Bill of Sale, it establishes the expectations and responsibilities of both parties involved in the transaction.

Warranty Deed: A warranty deed transfers ownership of real estate and guarantees that the seller holds clear title to the property. It is akin to a Bill of Sale in that it legally formalizes the transfer of ownership.

Contract for Deed: This is an agreement where the buyer makes payments to the seller until the purchase price is paid off. It resembles a Bill of Sale by documenting the terms of the sale and ownership transfer.

Consignment Agreement: This document allows one party to sell goods on behalf of another. It’s similar to a Bill of Sale as it outlines the terms of the sale and the responsibilities of each party involved.

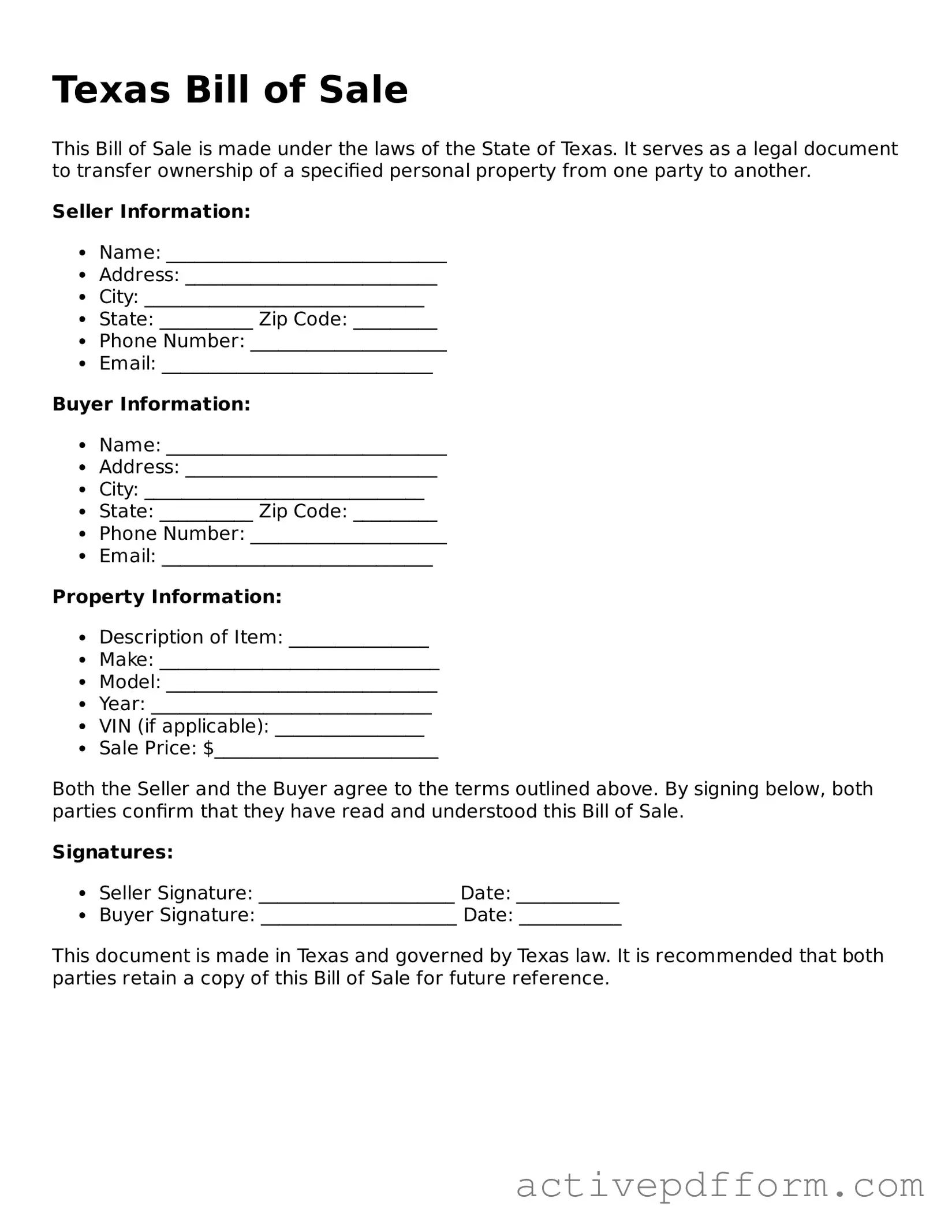

Texas Bill of Sale Example

Texas Bill of Sale

This Bill of Sale is made under the laws of the State of Texas. It serves as a legal document to transfer ownership of a specified personal property from one party to another.

Seller Information:

- Name: ______________________________

- Address: ___________________________

- City: ______________________________

- State: __________ Zip Code: _________

- Phone Number: _____________________

- Email: _____________________________

Buyer Information:

- Name: ______________________________

- Address: ___________________________

- City: ______________________________

- State: __________ Zip Code: _________

- Phone Number: _____________________

- Email: _____________________________

Property Information:

- Description of Item: _______________

- Make: ______________________________

- Model: _____________________________

- Year: ______________________________

- VIN (if applicable): ________________

- Sale Price: $________________________

Both the Seller and the Buyer agree to the terms outlined above. By signing below, both parties confirm that they have read and understood this Bill of Sale.

Signatures:

- Seller Signature: _____________________ Date: ___________

- Buyer Signature: _____________________ Date: ___________

This document is made in Texas and governed by Texas law. It is recommended that both parties retain a copy of this Bill of Sale for future reference.

Understanding Texas Bill of Sale

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This document serves as proof of the transaction and includes details such as the names of the buyer and seller, a description of the property, and the sale price. It is commonly used for vehicles, boats, and other valuable items.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for all transactions in Texas, it is highly recommended. For certain items, such as vehicles, a Bill of Sale may be necessary for registration purposes. Having a Bill of Sale can help protect both the buyer and seller by providing a clear record of the transaction.

What information should be included in a Texas Bill of Sale?

A Texas Bill of Sale should include the following information: the full names and addresses of both the buyer and seller, a detailed description of the property being sold (including make, model, and VIN for vehicles), the sale price, and the date of the transaction. Both parties should sign the document to validate it.

Can I create my own Bill of Sale in Texas?

Yes, you can create your own Bill of Sale in Texas. However, it is important to ensure that the document includes all necessary information and complies with state laws. Templates are available online, which can simplify the process. Alternatively, you may choose to use a professionally prepared form for added assurance.

Do I need a notary for a Texas Bill of Sale?

In Texas, a Bill of Sale does not need to be notarized to be legally valid. However, having the document notarized can provide an additional layer of protection and may be required by some buyers or sellers for their records. It is advisable to check the specific requirements of the transaction.

What if the item being sold has a lien?

If the item being sold has a lien, it is important to address this before completing the sale. The seller must ensure that the lien is paid off and released before transferring ownership. Buyers should verify the status of the lien to avoid future complications.

How long should I keep a Bill of Sale?

It is recommended to keep a Bill of Sale for at least three years after the transaction. This period allows for any potential disputes or issues to be resolved. Both the buyer and seller should retain a copy of the Bill of Sale for their records.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it’s important to ensure that all information is accurate and complete. Here are five things to keep in mind:

- Do: Provide accurate information about the buyer and seller. This includes full names, addresses, and contact information.

- Do: Clearly describe the item being sold. Include details such as make, model, year, and any identifying numbers.

- Do: Ensure both parties sign the document. This signifies that both the buyer and seller agree to the terms of the sale.

- Do: Keep a copy of the completed Bill of Sale for your records. This can be useful for future reference or disputes.

- Do: Check for any specific requirements in your county. Some areas may have additional rules regarding the Bill of Sale.

- Don't: Leave any sections blank. Incomplete forms can lead to confusion or disputes later on.

- Don't: Use vague descriptions. The more specific you are about the item, the better protected you will be.

- Don't: Forget to date the document. A date is essential for establishing the timeline of the sale.

- Don't: Alter the form after it has been signed. Changes can invalidate the agreement and create legal complications.

- Don't: Ignore local laws. Always be aware of any local regulations that may affect the sale of certain items.

Browse Other Popular Bill of Sale Templates for Specific States

Transfer Title of Car in Florida - If financing is involved, the Bill of Sale may reference any loans tied to the item.

When engaging in a transaction, it's essential to have the right documentation in place, and a General Bill of Sale serves this purpose effectively. By using this form, sellers and buyers can ensure a clear record of the ownership transfer, detailing the specifics of the items sold. For those looking to create or obtain a Bill of Sale, you can find various resources, including Free Business Forms, that make the process simpler and more straightforward.