Blank Texas Articles of Incorporation Document

Starting a business in Texas requires careful planning and adherence to legal requirements. One of the first steps in this process is completing the Texas Articles of Incorporation form. This essential document serves as the foundation for your corporation, outlining key details about your business structure. It includes important information such as the corporation's name, which must be unique and comply with state regulations. Additionally, the form requires the designation of a registered agent who will handle official correspondence. You will also need to specify the purpose of your corporation, which can be broad or specific, depending on your business goals. The Articles of Incorporation form outlines the number of shares your corporation is authorized to issue, as well as the rights and preferences of those shares. Finally, it mandates the inclusion of the names and addresses of the initial directors, ensuring transparency and accountability from the outset. Understanding these components is crucial for anyone looking to establish a corporation in Texas, as they lay the groundwork for future operations and compliance with state laws.

Document Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Texas Articles of Incorporation form is used to legally establish a corporation in Texas. |

| Governing Law | The form is governed by the Texas Business Organizations Code. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations in Texas. |

| Information Required | The form requires basic information such as the corporation's name, registered agent, and purpose. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Duration | The corporation can be established for a perpetual duration unless otherwise stated. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. |

| Online Filing | The form can be filed online through the Texas Secretary of State's website. |

| Approval Time | Approval of the Articles typically takes a few business days after submission. |

| Amendments | Changes to the Articles of Incorporation can be made through an amendment process. |

Similar forms

The Articles of Incorporation is a key document in the formation of a corporation. However, several other documents share similarities with it in terms of purpose and function. Here’s a look at seven such documents:

- Bylaws: These are the internal rules governing the management of a corporation. Like the Articles of Incorporation, they outline essential details, such as the roles of officers and procedures for meetings.

- Operating Agreement: Commonly used by LLCs, this document serves a similar purpose to the Articles of Incorporation by outlining the management structure and operational procedures of the business.

- Partnership Agreement: This document details the relationship between partners in a business. It defines roles, responsibilities, and profit-sharing, much like how the Articles of Incorporation define the structure of a corporation.

- Nyc Payroll Form: This essential document is crucial for contractors and subcontractors as it reports weekly payroll information for employees working on public projects, ensuring compliance with payroll notification requirements. For more information, visit https://nytemplates.com/blank-nyc-payroll-template.

- Certificate of Incorporation: Often used interchangeably with Articles of Incorporation, this document serves as official proof that a corporation has been formed, providing similar information about the corporation's structure.

- Business License: While not a formation document, a business license is necessary for legal operation. It can be compared to Articles of Incorporation in that both are required for a business to function legally in its jurisdiction.

- Annual Report: Corporations are often required to file annual reports that provide updates on business activities and financial status. This document maintains transparency, similar to how the Articles of Incorporation establish the corporation's foundation.

- Tax Registration Documents: These documents are essential for compliance with tax regulations. They relate to the Articles of Incorporation as both are necessary for the legal and financial operation of a business.

Texas Articles of Incorporation Example

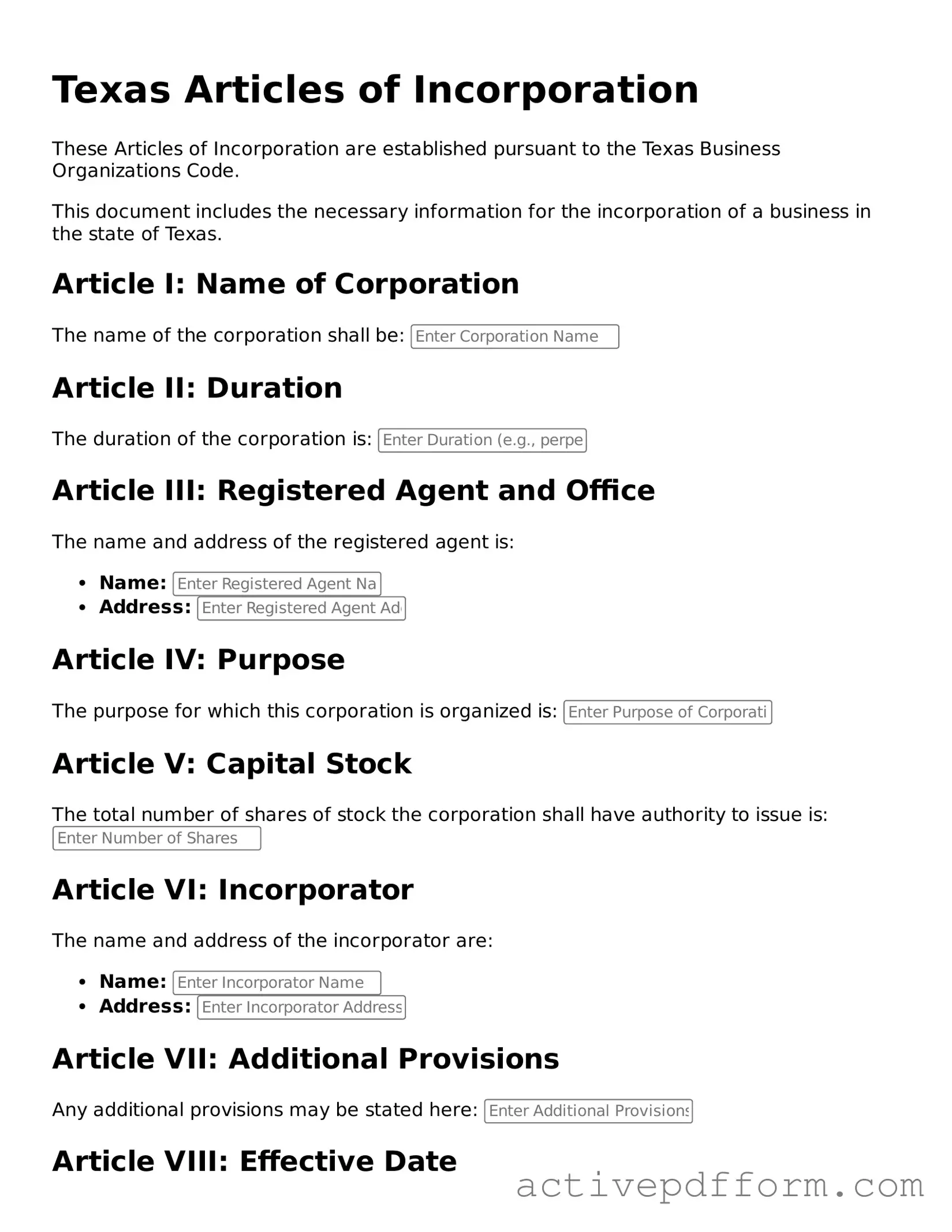

Texas Articles of Incorporation

These Articles of Incorporation are established pursuant to the Texas Business Organizations Code.

This document includes the necessary information for the incorporation of a business in the state of Texas.

Article I: Name of Corporation

The name of the corporation shall be:

Article II: Duration

The duration of the corporation is:

Article III: Registered Agent and Office

The name and address of the registered agent is:

- Name:

- Address:

Article IV: Purpose

The purpose for which this corporation is organized is:

Article V: Capital Stock

The total number of shares of stock the corporation shall have authority to issue is:

Article VI: Incorporator

The name and address of the incorporator are:

- Name:

- Address:

Article VII: Additional Provisions

Any additional provisions may be stated here:

Article VIII: Effective Date

This document shall become effective on:

IN WITNESS WHEREOF, the undersigned incorporator has executed these Articles of Incorporation on this:

Signature of Incorporator: __________________________

Understanding Texas Articles of Incorporation

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in Texas. They include important information about the corporation, such as its name, purpose, and structure. Filing these documents is a crucial step in forming a corporation.

Who needs to file Articles of Incorporation?

Anyone looking to start a corporation in Texas must file Articles of Incorporation. This includes individuals and groups who want to create a business entity that provides limited liability protection and other benefits associated with incorporation.

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require the corporation's name, the duration of the corporation, the purpose of the corporation, the registered agent's name and address, and the number of shares the corporation is authorized to issue. Ensure all information is accurate to avoid delays in processing.

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online through the Texas Secretary of State's website or by mailing a paper form. If filing online, follow the prompts carefully. For paper filings, ensure you send the completed form to the correct address along with the required filing fee.

What is the filing fee for the Articles of Incorporation?

The filing fee for Articles of Incorporation in Texas varies depending on the type of corporation you are forming. Generally, the fee ranges from $300 to $750. Check the Texas Secretary of State's website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online filings are processed faster than paper submissions. Expect a turnaround time of about 3 to 5 business days for online filings. Paper filings may take longer, sometimes up to 2 weeks or more, depending on the volume of submissions.

Can I amend my Articles of Incorporation after filing?

Yes, you can amend your Articles of Incorporation after they have been filed. To do so, you must submit an amendment form to the Texas Secretary of State, along with any required fees. Be sure to follow the specific instructions for amendments to ensure proper processing.

Do I need a lawyer to file Articles of Incorporation?

While it is not required to have a lawyer to file Articles of Incorporation, consulting one can be beneficial. A lawyer can help ensure that your documents are completed correctly and that you comply with all legal requirements. This can save time and prevent potential issues down the line.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a certificate of incorporation from the Texas Secretary of State. After that, you can begin operating your business, but remember to comply with any ongoing requirements, such as filing annual reports and maintaining your corporate records.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it is essential to approach the process with care and attention to detail. Here are some important dos and don'ts to keep in mind:

- Do provide accurate and complete information. Ensure that all required fields are filled out correctly to avoid delays in processing.

- Do choose a unique name for your corporation. The name must not be similar to any existing businesses registered in Texas.

- Do designate a registered agent. This individual or entity will be responsible for receiving legal documents on behalf of the corporation.

- Do include the purpose of your corporation. A clear statement about what your business will do helps clarify its mission.

- Do file the form with the Texas Secretary of State. Ensure that you submit it along with the required filing fee to complete the process.

- Don't rush through the form. Take your time to review each section thoroughly before submitting.

- Don't forget to check for typos or errors. Small mistakes can lead to significant issues later on.

- Don't use prohibited words in your corporation's name. Certain terms may require special approval or may not be allowed at all.

- Don't neglect to understand the implications of your chosen business structure. Each type of corporation has different legal and tax responsibilities.

- Don't assume that filing the Articles of Incorporation is the only step. Remember to comply with other local, state, and federal regulations as needed.

Browse Other Popular Articles of Incorporation Templates for Specific States

Florida Division of Corporations - Incorporators, typically founders, are required to sign the document.

The California Form REG 262, also known as the Vehicle/Vessel Transfer and Reassignment Form, is a crucial document used during the transfer of ownership for vehicles and vessels. This form must accompany the official title or an application for a duplicate title to ensure a smooth transaction. To ensure compliance with the guidelines and protect your interests, consider filling out this important form by clicking the button below, or access the necessary documents through California PDF Forms.