Blank Texas Affidavit of Gift Document

The Texas Affidavit of Gift form is an essential document for individuals wishing to legally transfer ownership of property or assets without the exchange of money. This form serves as a declaration that a gift is being made and outlines the details of the transaction, including the names of the donor and recipient, a description of the property being gifted, and the date of the gift. It is crucial for both parties to understand that this form not only formalizes the gift but also provides legal protection in case of future disputes. By completing the affidavit, the donor affirms their intention to give the property voluntarily and without coercion, while the recipient acknowledges acceptance of the gift. Proper execution of this form may require notarization, ensuring that the document holds up in legal situations. Understanding the requirements and implications of the Texas Affidavit of Gift form can facilitate a smooth transfer of assets and help prevent misunderstandings down the line.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Affidavit of Gift form is used to formally document the transfer of property or assets as a gift. |

| Governing Law | This form is governed by Texas Property Code, specifically Sections 112.001 to 112.008. |

| Eligibility | Any individual can use this form to gift property, provided they are the legal owner of the asset. |

| Notarization Requirement | The form must be signed in the presence of a notary public to be considered valid. |

| Record Keeping | Once completed, the affidavit should be kept in a safe place and a copy may be filed with the county clerk. |

| Tax Implications | Gifts may have tax implications; it’s advisable to consult a tax professional regarding potential gift taxes. |

| Revocation | A gift can be revoked if the donor is still alive, but this may require additional legal documentation. |

Similar forms

The Affidavit of Gift form serves as a declaration of a gift, typically used in various legal and financial contexts. Several other documents share similarities with this form, each serving its own purpose in the realm of gifts, transfers, and declarations. Here’s a list of eight such documents:

- Gift Letter: This is a simple document that outlines the intent to give a gift, often used in real estate transactions to verify that a down payment is a gift and not a loan.

- ADP Pay Stub: An important document that provides a detailed account of earnings and deductions, much like the other forms listed, ensuring clarity in financial records. You can find more information about it in this ADP Check Stub.

- Bill of Sale: This document transfers ownership of personal property. Like the Affidavit of Gift, it serves as proof of the transaction and the intent to give.

- Trust Agreement: A legal document that establishes a trust. Similar to the Affidavit of Gift, it can outline how and when gifts are to be distributed to beneficiaries.

- Declaration of Trust: This document declares the existence of a trust and the intentions behind it, much like an Affidavit of Gift specifies the donor's intent.

- Gift Tax Return (Form 709): This form is filed with the IRS to report gifts exceeding a certain value. It provides a record of the gift, similar to the Affidavit of Gift.

- Transfer of Ownership Form: Used for transferring ownership of various assets, this document serves a similar purpose by documenting the change of ownership.

- Power of Attorney: While primarily used to grant authority to another person, it can include provisions for gifting assets, reflecting the donor’s intent.

- Charitable Donation Receipt: This document acknowledges a donation made to a charity. It serves a similar purpose by formalizing the act of giving.

Each of these documents plays a crucial role in the process of gifting and asset transfer, ensuring clarity and legal protection for all parties involved.

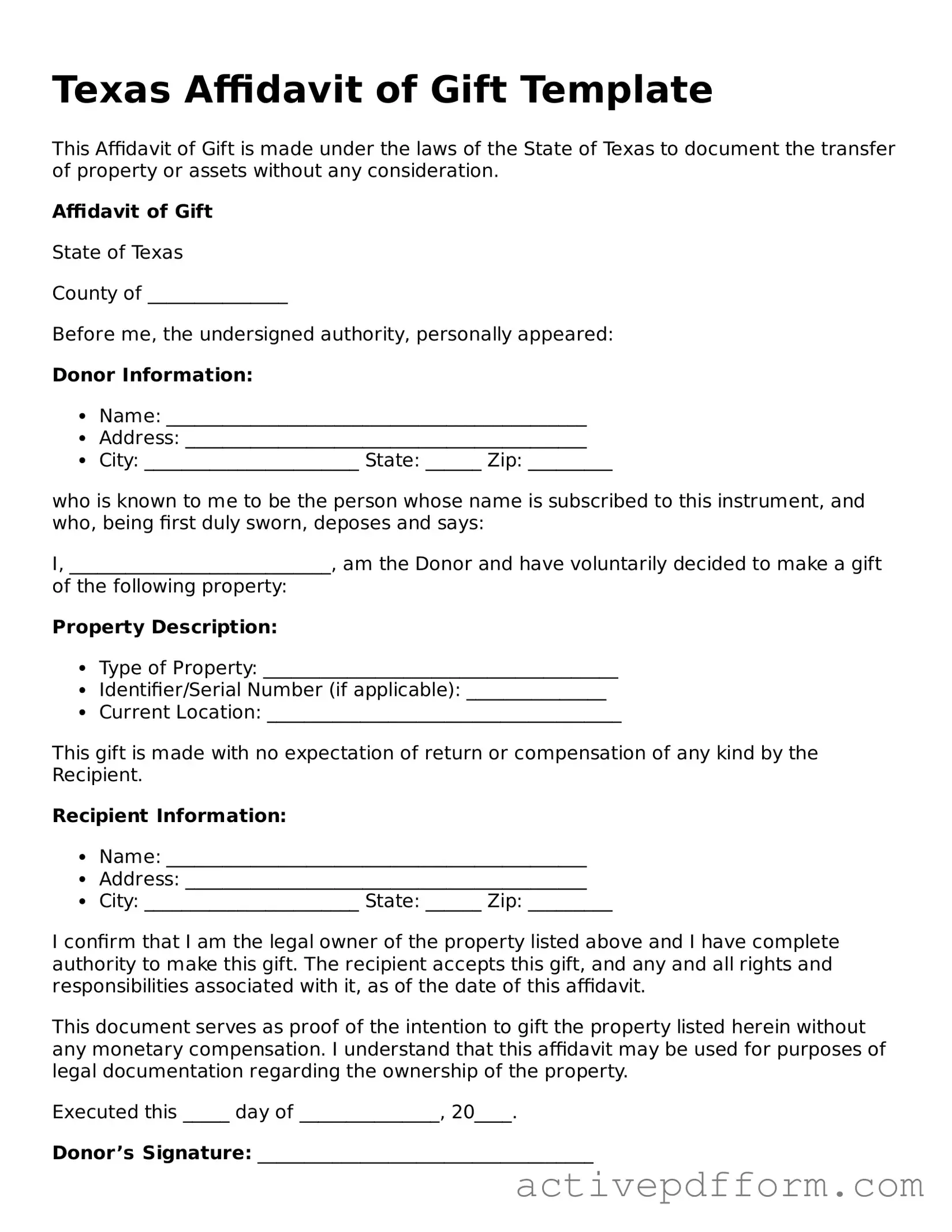

Texas Affidavit of Gift Example

Texas Affidavit of Gift Template

This Affidavit of Gift is made under the laws of the State of Texas to document the transfer of property or assets without any consideration.

Affidavit of Gift

State of Texas

County of _______________

Before me, the undersigned authority, personally appeared:

Donor Information:

- Name: _____________________________________________

- Address: ___________________________________________

- City: _______________________ State: ______ Zip: _________

who is known to me to be the person whose name is subscribed to this instrument, and who, being first duly sworn, deposes and says:

I, ____________________________, am the Donor and have voluntarily decided to make a gift of the following property:

Property Description:

- Type of Property: ______________________________________

- Identifier/Serial Number (if applicable): _______________

- Current Location: ______________________________________

This gift is made with no expectation of return or compensation of any kind by the Recipient.

Recipient Information:

- Name: _____________________________________________

- Address: ___________________________________________

- City: _______________________ State: ______ Zip: _________

I confirm that I am the legal owner of the property listed above and I have complete authority to make this gift. The recipient accepts this gift, and any and all rights and responsibilities associated with it, as of the date of this affidavit.

This document serves as proof of the intention to gift the property listed herein without any monetary compensation. I understand that this affidavit may be used for purposes of legal documentation regarding the ownership of the property.

Executed this _____ day of _______________, 20____.

Donor’s Signature: ____________________________________

Printed Name: ______________________________________

Sworn to and subscribed before me this _____ day of _______________, 20____.

Notary Public Signature: ____________________________

Notary Public in and for the State of Texas

My Commission Expires: _____________________________

Understanding Texas Affidavit of Gift

What is the Texas Affidavit of Gift form?

The Texas Affidavit of Gift form is a legal document used to declare the transfer of ownership of property or assets as a gift. This form is often utilized for vehicles but can apply to other types of property as well. It serves to provide a clear record of the gift, which can be important for tax purposes and to avoid disputes in the future.

Who needs to fill out the Affidavit of Gift?

Both the giver (donor) and the receiver (donee) of the gift must participate in completing the form. The donor must provide details about the gift and confirm that it is being given without any expectation of payment. The donee will also need to acknowledge receipt of the gift.

Is the Affidavit of Gift required for all gifts?

No, the Affidavit of Gift is not required for all gifts. However, it is recommended for significant gifts, especially those involving valuable property like vehicles or real estate. Using the form can help clarify ownership and ensure that the transaction is documented properly.

How do I obtain a Texas Affidavit of Gift form?

You can obtain the Texas Affidavit of Gift form from various sources. Many county tax offices provide the form online. Additionally, legal websites often have downloadable versions. Ensure that you are using the most current version to avoid any issues.

What should I include in the form?

The form typically requires details such as the names and addresses of both the donor and the donee, a description of the property being gifted, and any relevant identification numbers (like a vehicle identification number for cars). Both parties must sign the document to validate the transfer.

Do I need to notarize the Affidavit of Gift?

While notarization is not always required, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent future disputes regarding the gift. Check with local regulations or consult a legal professional for specific requirements.

Dos and Don'ts

When filling out the Texas Affidavit of Gift form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about the donor and recipient.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use white-out or erasers; corrections should be made by crossing out and initialing.

- Don't forget to check for any specific instructions regarding additional documentation.

- Don't submit the form without ensuring that it is properly notarized.

Browse Other Popular Affidavit of Gift Templates for Specific States

Affidavit for Gifting a Car Florida - Many individuals may need this affidavit when donating to charities or nonprofits.

The Aaa International Driving Permit Application form is a crucial document for those seeking an international driving permit, which allows travelers to drive legally across different countries. For more information on how to effectively complete this application, you can visit PDF Templates Online, ensuring that you have all the necessary details to enhance your travel experience.