Free Stock Transfer Ledger Template

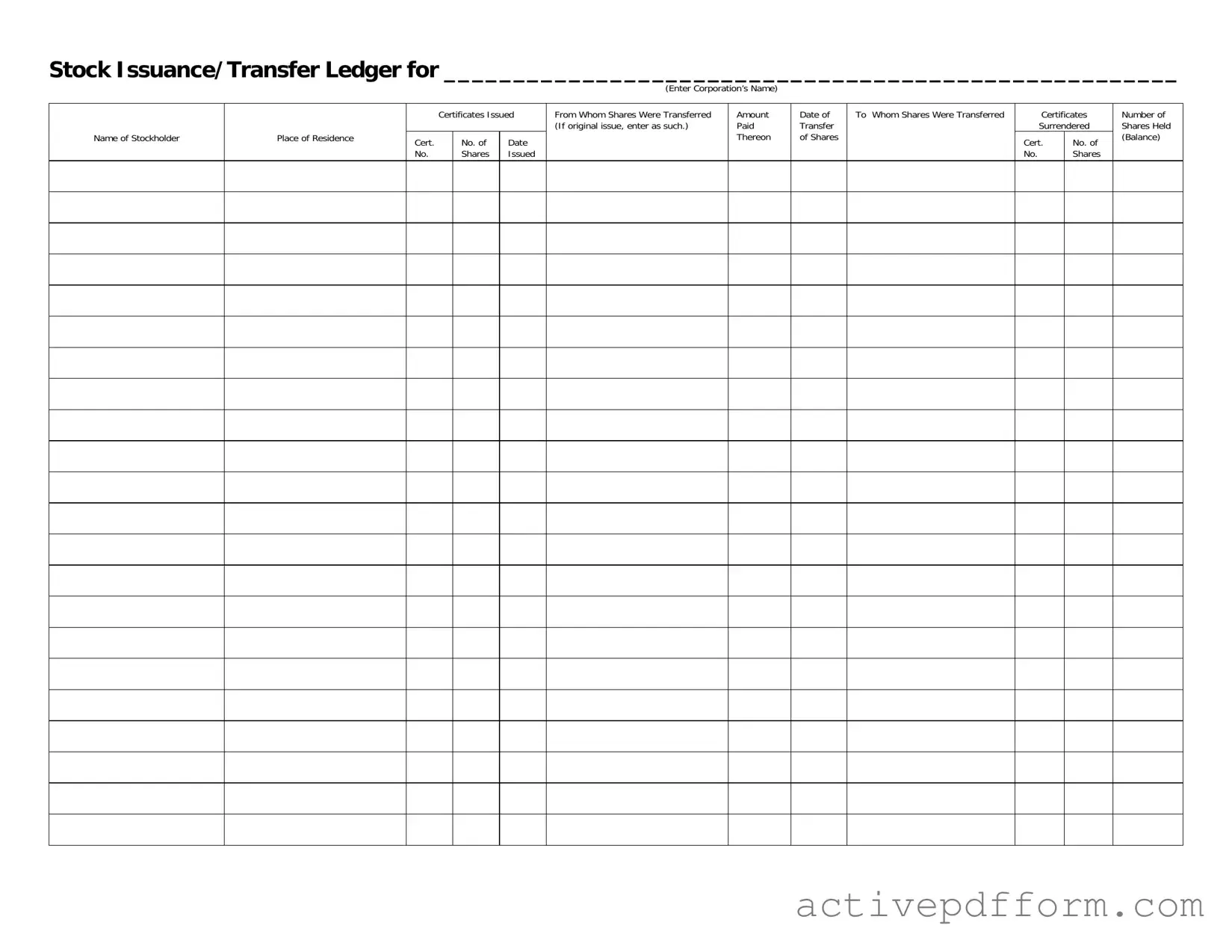

The Stock Transfer Ledger form serves as a crucial document for corporations, facilitating the accurate tracking of stock issuance and transfers among shareholders. This form includes essential details such as the name of the corporation, the stockholder’s name, and their place of residence. It records the certificates issued, providing a certificate number and the date of issuance, which is vital for maintaining clear ownership records. Additionally, it captures information about the shares transferred, specifying the amount paid for those shares and the date of transfer. If the shares were originally issued, this is noted accordingly. The form also requires details about the party to whom the shares were transferred, ensuring transparency in ownership changes. Lastly, it includes the surrendering of certificates and the balance of shares held by the stockholder, which aids in maintaining an accurate account of stock ownership within the corporation. Overall, this document plays a significant role in corporate governance and shareholder relations, promoting clarity and accountability in stock transactions.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to document the issuance and transfer of shares within a corporation. |

| Information Required | Key details include the corporation's name, stockholder's name and residence, certificates issued, and amounts paid. |

| Transfer Details | The form captures essential transfer information, such as the date of transfer and the parties involved in the transaction. |

| State-Specific Regulations | In many states, the use of a Stock Transfer Ledger is governed by corporate laws, such as the Delaware General Corporation Law. |

| Record Keeping | Maintaining an accurate Stock Transfer Ledger is crucial for compliance and can aid in resolving disputes regarding ownership. |

Similar forms

The Stock Transfer Ledger form is an essential document for tracking the issuance and transfer of shares within a corporation. Several other documents share similar functions or structures. Here’s a list of nine documents that are comparable to the Stock Transfer Ledger form:

- Stock Certificate: This document represents ownership of shares in a corporation. Like the Stock Transfer Ledger, it includes details about the stockholder and the number of shares owned.

- Shareholder Register: This record lists all shareholders of a corporation along with their contact information and the number of shares they hold, similar to the Stock Transfer Ledger’s focus on share ownership.

- Dividend Distribution Record: This document tracks dividends paid to shareholders. It parallels the Stock Transfer Ledger by maintaining records related to shareholder transactions.

- RV Bill of Sale: This document is essential for recording the sale and transfer of ownership for a recreational vehicle. It provides crucial information about both the seller and buyer while ensuring clarity in the transaction. To obtain the necessary form, visit Arizona PDF Forms.

- Corporate Bylaws: These rules govern the management of a corporation. They often include provisions about stock transfers, which relate to the information captured in the Stock Transfer Ledger.

- Stock Option Agreement: This document outlines the terms under which stock options are granted. It shares similarities in tracking stockholder rights and obligations.

- Transfer Agent Records: Transfer agents maintain records of stock ownership and transfers. Their records align with the Stock Transfer Ledger in tracking who owns shares at any given time.

- Form 10-K: This annual report filed with the SEC includes information about a company’s financial performance and stockholder equity, providing context similar to that found in the Stock Transfer Ledger.

- Annual Meeting Minutes: These records document the proceedings of shareholder meetings, including stockholder votes, which can reflect changes in share ownership similar to those recorded in the Stock Transfer Ledger.

- Proxy Statements: These documents are sent to shareholders before meetings and include details on stock ownership and voting rights, paralleling the Stock Transfer Ledger's emphasis on shareholder information.

Stock Transfer Ledger Example

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Understanding Stock Transfer Ledger

What is a Stock Transfer Ledger form?

The Stock Transfer Ledger form is a document used by corporations to track the issuance and transfer of stock shares. It records essential details about stockholders, shares issued, and the transactions related to stock transfers.

Why is the Stock Transfer Ledger important?

This ledger is crucial for maintaining accurate records of stock ownership. It helps ensure compliance with legal requirements and provides transparency for shareholders and potential investors regarding ownership changes.

What information is required on the Stock Transfer Ledger form?

You need to provide the corporation’s name, stockholder's name, place of residence, certificate numbers, dates of issuance, amounts paid, and details about transfers, including the names of the parties involved and the number of shares transferred.

How do I fill out the Stock Transfer Ledger form?

Start by entering the corporation's name at the top. Then, list each stockholder's information in the designated fields, including the number of shares issued and transferred. Make sure to include all relevant dates and certificate numbers to ensure accuracy.

Who should maintain the Stock Transfer Ledger?

The corporation's secretary or a designated officer typically maintains the Stock Transfer Ledger. This person is responsible for ensuring that all entries are accurate and up-to-date.

How often should the Stock Transfer Ledger be updated?

Updates should occur whenever stock is issued or transferred. This ensures that the ledger reflects the most current ownership information and complies with legal obligations.

What happens if there is an error in the Stock Transfer Ledger?

If an error is discovered, it should be corrected immediately. Document the correction clearly, noting the original entry and the change made. This maintains the integrity of the records.

Can electronic records be used instead of a physical Stock Transfer Ledger?

Yes, electronic records are acceptable as long as they meet legal standards for accuracy and security. Ensure that electronic systems are reliable and that backups are regularly maintained.

What are the consequences of not maintaining a Stock Transfer Ledger?

Failure to maintain a proper Stock Transfer Ledger can lead to legal issues, including challenges to stock ownership and potential penalties from regulatory bodies. It is essential to keep accurate and comprehensive records.

Where can I obtain a Stock Transfer Ledger form?

Stock Transfer Ledger forms can typically be obtained from legal stationery suppliers, corporate service providers, or online legal document resources. Ensure that the form complies with your state’s requirements.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what you should and shouldn’t do:

- Do enter the corporation’s name clearly at the top of the form.

- Do provide accurate information for each stockholder, including their place of residence.

- Don't leave any fields blank; all sections must be completed for the form to be valid.

- Don't forget to include the date of transfer and the amount paid for the shares.

Check out Common Templates

Dd 5960 - This form allows servicemembers to manage financial commitments responsibly.

2b Mindset Tracker App - Note how often you eat out to manage meal choices.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping specific details confidential, ensuring that proprietary information remains secure. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets, and you can find a helpful template at https://nytemplates.com/blank-non-disclosure-agreement-template/.

Dvla Form - Ensure your signature is clear and entirely within the designated white box.