Blank Single-Member Operating Agreement Document

The Single-Member Operating Agreement is a crucial document for individuals who own a single-member limited liability company (LLC). This form outlines the governance structure and operational guidelines for the LLC, ensuring clarity in management and decision-making processes. It typically includes essential provisions such as the member's rights and responsibilities, the method for handling profits and losses, and the procedures for dissolving the company if necessary. Additionally, this agreement can address how the member can transfer ownership interests and the process for admitting new members in the future, should the business evolve. By establishing these foundational elements, the Single-Member Operating Agreement not only protects the owner's personal assets from business liabilities but also provides a framework for the LLC's operations, fostering a clear understanding of the business's objectives and procedures. In essence, this form serves as a vital tool for single-member LLCs, promoting both legal compliance and operational efficiency.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a legal document that outlines the management structure and operating procedures for a single-member limited liability company (LLC). |

| Purpose | This agreement serves to protect the owner's personal assets by clearly defining the separation between personal and business liabilities. |

| Governing Law | The governing law for Single-Member Operating Agreements typically depends on the state where the LLC is formed. For example, in Delaware, it follows Delaware LLC law. |

| Flexibility | The agreement allows the owner to customize the rules and procedures for the LLC, providing flexibility in operations and decision-making. |

| Member Rights | It outlines the rights and responsibilities of the single member, ensuring clarity in ownership and management roles. |

| Tax Treatment | Single-member LLCs are typically treated as disregarded entities for tax purposes, meaning the owner reports business income on their personal tax return. |

| Formalities | While not always required by law, having an operating agreement is recommended to establish credibility and protect the owner's limited liability status. |

| Dispute Resolution | The agreement can include provisions for resolving disputes, which can help avoid costly litigation in the future. |

| Amendments | It can be amended as needed, allowing the owner to adapt to changes in business operations or personal circumstances. |

Similar forms

The Single-Member Operating Agreement is an important document for business owners, especially those running a single-member LLC. It outlines the management structure and operating procedures of the business. Here are eight other documents that share similarities with the Single-Member Operating Agreement:

- Partnership Agreement: This document outlines the terms and conditions of a partnership. Like the operating agreement, it defines roles, responsibilities, and profit-sharing among partners.

- Operating Agreement for New York: This document is essential for LLCs operating in New York, ensuring clarity in the management structure and compliance with state laws. For more information, visit https://pdfdocshub.com.

- Bylaws: Bylaws govern the internal management of a corporation. Similar to an operating agreement, they set rules for meetings, voting, and the roles of officers.

- Shareholder Agreement: This document is used in corporations with multiple shareholders. It details how shares can be bought, sold, or transferred, akin to how an operating agreement addresses ownership and management in an LLC.

- Business Plan: A business plan outlines the goals and strategies of a business. While it serves a different purpose, it also provides a framework for operations and can complement an operating agreement.

- Employment Agreement: This document specifies the terms of employment for individuals within a business. Like the operating agreement, it defines roles and responsibilities but focuses on employee relationships.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. It is similar in that it establishes clear guidelines, though its focus is on information security rather than business operations.

- Asset Purchase Agreement: This document outlines the terms of buying or selling business assets. It shares similarities with the operating agreement in that it defines the rights and obligations of the parties involved.

- Joint Venture Agreement: This agreement details the terms of collaboration between two or more parties for a specific project. It resembles an operating agreement by establishing roles and responsibilities among the participants.

Single-Member Operating Agreement Example

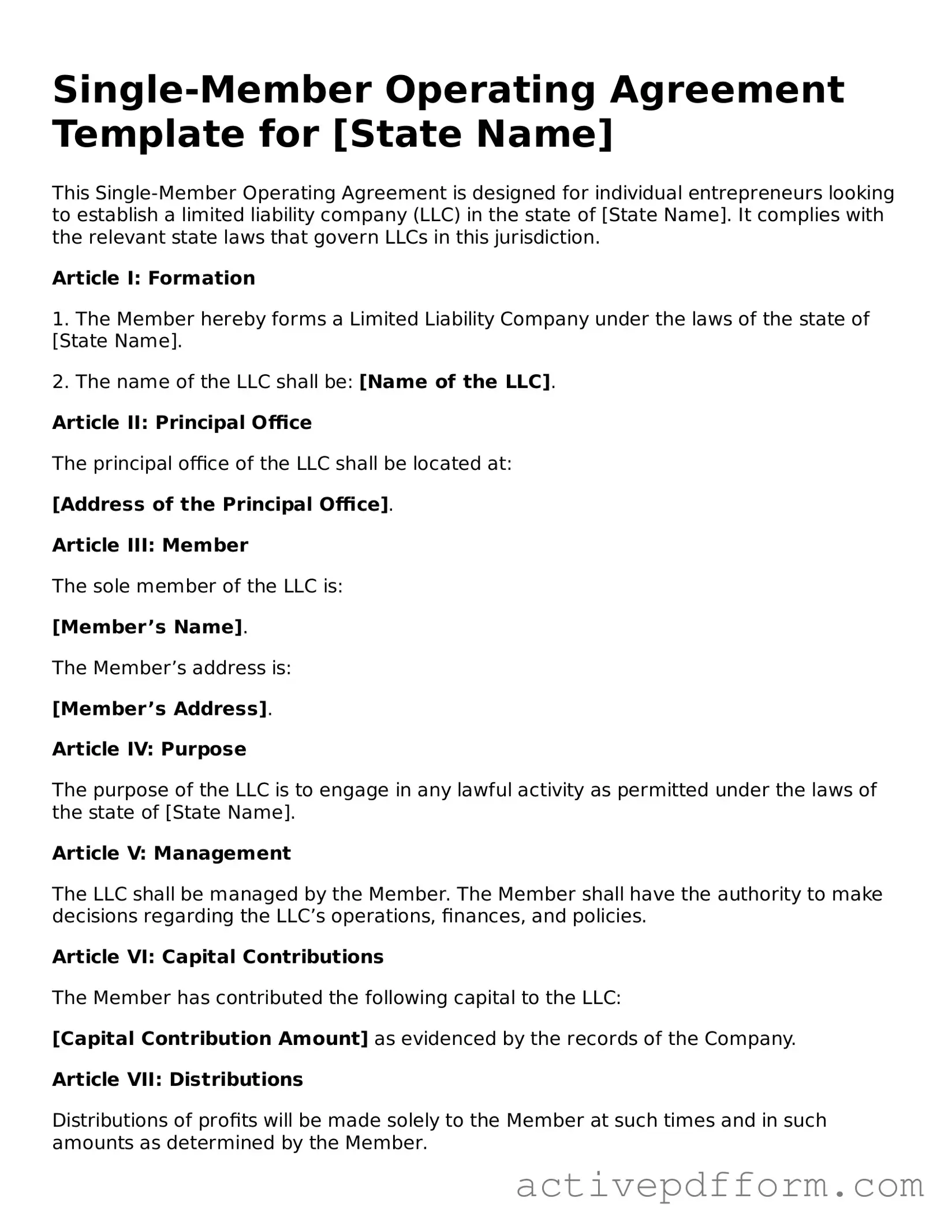

Single-Member Operating Agreement Template for [State Name]

This Single-Member Operating Agreement is designed for individual entrepreneurs looking to establish a limited liability company (LLC) in the state of [State Name]. It complies with the relevant state laws that govern LLCs in this jurisdiction.

Article I: Formation

1. The Member hereby forms a Limited Liability Company under the laws of the state of [State Name].

2. The name of the LLC shall be: [Name of the LLC].

Article II: Principal Office

The principal office of the LLC shall be located at:

[Address of the Principal Office].

Article III: Member

The sole member of the LLC is:

[Member’s Name].

The Member’s address is:

[Member’s Address].

Article IV: Purpose

The purpose of the LLC is to engage in any lawful activity as permitted under the laws of the state of [State Name].

Article V: Management

The LLC shall be managed by the Member. The Member shall have the authority to make decisions regarding the LLC’s operations, finances, and policies.

Article VI: Capital Contributions

The Member has contributed the following capital to the LLC:

[Capital Contribution Amount] as evidenced by the records of the Company.

Article VII: Distributions

Distributions of profits will be made solely to the Member at such times and in such amounts as determined by the Member.

Article VIII: Indemnification

The LLC shall indemnify the Member against any and all expenses and liabilities incurred in connection with the LLC, to the fullest extent permitted by law.

Article IX: Amendments

This Operating Agreement may be amended only in writing and signed by the Member.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of [State Name].

IN WITNESS WHEREOF, the Member has executed this Operating Agreement as of the _____ day of __________, 20____.

_____________________________

Member’s Signature

[Member’s Name]

Understanding Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operational procedures of a single-member Limited Liability Company (LLC). This agreement serves as an internal guideline for the owner, detailing how the business will be run and how decisions will be made.

Why do I need a Single-Member Operating Agreement?

This agreement is essential for several reasons. It helps establish the LLC as a separate legal entity, protecting personal assets from business liabilities. Additionally, it provides clarity on the management and operational processes, which can be beneficial for tax purposes and in the event of disputes.

Is a Single-Member Operating Agreement required by law?

While not all states require a Single-Member Operating Agreement, having one is highly recommended. It can prevent misunderstandings and provide a clear framework for the business. Some banks and financial institutions may also require this document to open a business account.

What should be included in a Single-Member Operating Agreement?

The agreement should include the LLC’s name, the owner’s name, the purpose of the business, management structure, and procedures for decision-making. It may also outline the process for adding members in the future, handling profits and losses, and dissolving the LLC if necessary.

Can I create my own Single-Member Operating Agreement?

Yes, you can draft your own Single-Member Operating Agreement. Many templates are available online to help guide you. However, it is advisable to consult with a legal professional to ensure that the document meets state requirements and adequately protects your interests.

How does a Single-Member Operating Agreement affect taxes?

The Single-Member Operating Agreement does not directly affect taxes, but it can influence how the LLC is taxed. By default, a single-member LLC is treated as a sole proprietorship for tax purposes. However, you may choose to elect corporate taxation. The agreement can outline how profits and losses are allocated, which can impact tax filings.

Can I amend my Single-Member Operating Agreement?

Yes, you can amend your Single-Member Operating Agreement. Changes may be necessary as your business evolves. It is important to document any amendments in writing and keep them with the original agreement to maintain clarity and legal standing.

What happens if I do not have a Single-Member Operating Agreement?

Without a Single-Member Operating Agreement, your LLC may face challenges in establishing its legal status. You may encounter difficulties in securing financing or resolving disputes. Additionally, the absence of an agreement can lead to confusion regarding business operations and management.

Where can I find a template for a Single-Member Operating Agreement?

Templates for a Single-Member Operating Agreement are widely available online. Many legal websites offer customizable templates that you can fill out according to your specific needs. Ensure that the template complies with your state’s regulations before using it.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it is crucial to approach the task with care. This document serves as a foundational piece for your business structure. Here are ten essential do's and don'ts to consider:

- Do read the entire form thoroughly before beginning to fill it out.

- Do provide accurate and complete information about your business.

- Do include your name and contact information as the sole member.

- Do specify the purpose of your business clearly.

- Do outline the management structure, even if it is solely you.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to date and sign the document once completed.

- Don't ignore state-specific requirements that may apply.

- Don't rush through the process; take your time to ensure accuracy.

Following these guidelines can help ensure that your Single-Member Operating Agreement is completed correctly and effectively supports your business objectives.

Consider More Types of Single-Member Operating Agreement Templates

Multi Member Operating Agreement - Sets rules for how meetings will be conducted and documented.

To facilitate the establishment of this framework for your LLC, a blank document is here which can be tailored to suit your specific needs and preferences, ensuring that all operational nuances are formally addressed and agreed upon by the members.