Blank Release of Promissory Note Document

The Release of Promissory Note form serves as a crucial document in the realm of financial transactions, particularly when it comes to the repayment of loans. This form signifies the formal conclusion of a borrowing agreement, indicating that the borrower has fulfilled their obligations to repay the loan in full. By executing this document, lenders acknowledge that they no longer hold any claim over the borrower’s financial responsibility, thus releasing them from the terms of the original promissory note. The form typically includes essential details such as the names of the parties involved, the amount of the loan, and the date of repayment. Additionally, it may outline any conditions or stipulations that were part of the original agreement, ensuring that both parties have a clear understanding of the transaction's closure. This release not only protects the borrower from future claims but also provides the lender with a formal record that the debt has been satisfied. Consequently, understanding the nuances of this form is vital for anyone engaged in lending or borrowing, as it encapsulates the finality of a financial obligation.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note is a legal document that signifies the cancellation of a promissory note. |

| Purpose | This document releases the borrower from the obligation to repay the loan specified in the promissory note. |

| Signatories | Typically, both the lender and borrower must sign the release for it to be valid. |

| Governing Law | Each state has its own laws governing promissory notes and their releases. For example, in California, the relevant law is the California Commercial Code. |

| Filing Requirements | In some states, the release must be filed with the appropriate county recorder's office to be effective. |

| Impact on Credit | Releasing a promissory note can positively impact the borrower's credit score by showing that the debt has been satisfied. |

| Form Variations | Different states may have specific forms or requirements for releasing a promissory note. |

| Notarization | Some states may require the release to be notarized to ensure authenticity. |

| Record Keeping | Both parties should keep a copy of the signed release for their records. |

| Legal Advice | It is advisable to seek legal counsel when preparing or signing a Release of Promissory Note. |

Similar forms

- Release of Liability Agreement: This document releases one party from any future claims or liabilities related to a specific situation. Like the Release of Promissory Note, it ensures that the party being released cannot pursue legal action for issues that may arise after the agreement is signed.

- Settlement Agreement: In the context of disputes, a settlement agreement resolves a conflict between parties. Similar to the Release of Promissory Note, it often involves the payment of a sum of money in exchange for relinquishing further claims.

- Waiver: A waiver is a document where one party voluntarily gives up a known right. This is akin to the Release of Promissory Note, as both involve relinquishing claims or rights, often to avoid future legal complications.

- Quitclaim Deed: This real estate document transfers interest in property without guaranteeing clear title. It parallels the Release of Promissory Note in that both documents transfer rights or claims while minimizing future liabilities.

- Promissory Note Template - For those looking to create their own legal promises, utilizing a structured format can be beneficial. A useful resource for this is the https://nytemplates.com/blank-promissory-note-template/, which provides a customizable template for drafting a New York Promissory Note.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. Like the Release of Promissory Note, it aims to limit future claims by establishing clear boundaries regarding what can and cannot be disclosed.

- Indemnity Agreement: This document protects one party from loss or damage incurred by another party's actions. It shares similarities with the Release of Promissory Note, as both agreements aim to shield one party from potential future claims or liabilities.

Release of Promissory Note Example

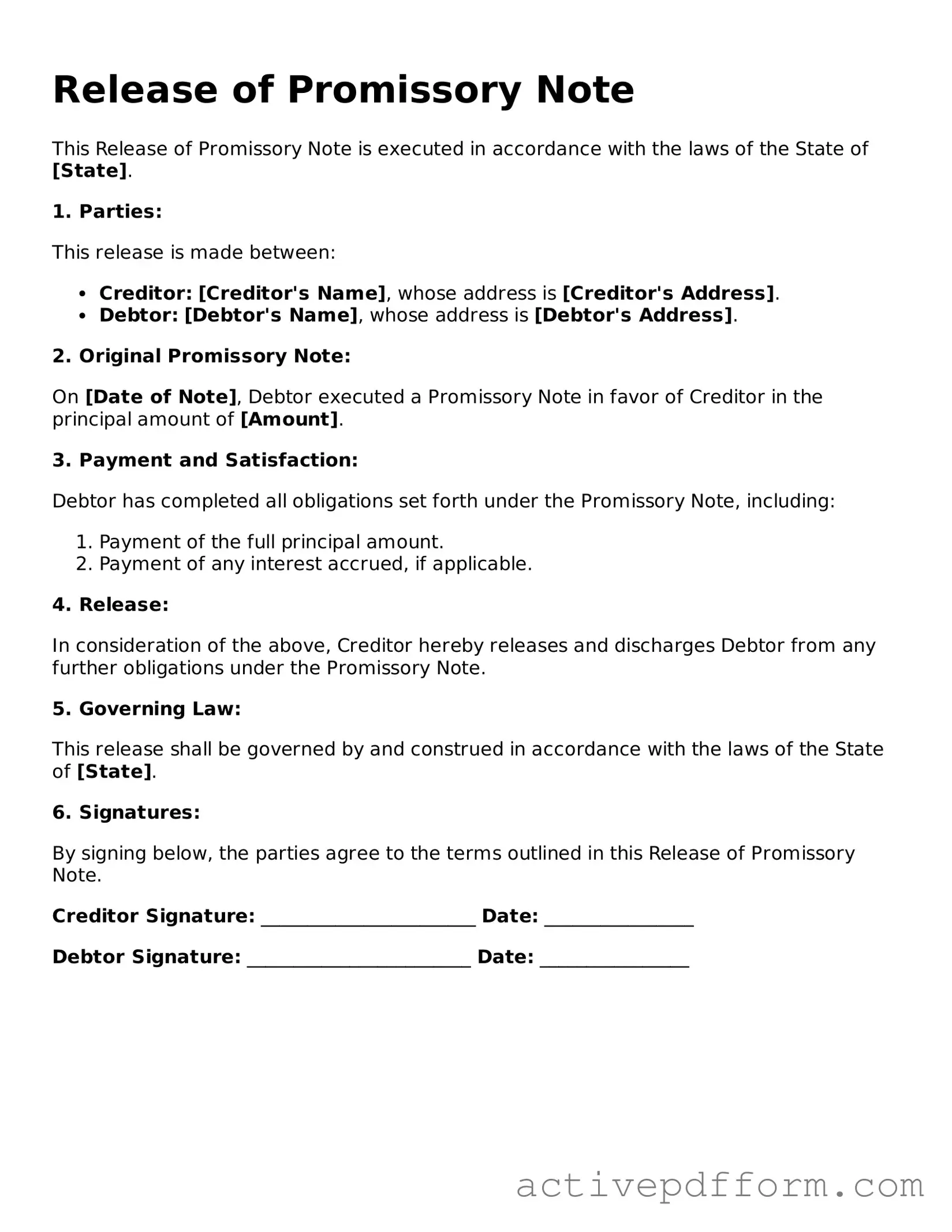

Release of Promissory Note

This Release of Promissory Note is executed in accordance with the laws of the State of [State].

1. Parties:

This release is made between:

- Creditor: [Creditor's Name], whose address is [Creditor's Address].

- Debtor: [Debtor's Name], whose address is [Debtor's Address].

2. Original Promissory Note:

On [Date of Note], Debtor executed a Promissory Note in favor of Creditor in the principal amount of [Amount].

3. Payment and Satisfaction:

Debtor has completed all obligations set forth under the Promissory Note, including:

- Payment of the full principal amount.

- Payment of any interest accrued, if applicable.

4. Release:

In consideration of the above, Creditor hereby releases and discharges Debtor from any further obligations under the Promissory Note.

5. Governing Law:

This release shall be governed by and construed in accordance with the laws of the State of [State].

6. Signatures:

By signing below, the parties agree to the terms outlined in this Release of Promissory Note.

Creditor Signature: _______________________ Date: ________________

Debtor Signature: ________________________ Date: ________________

Understanding Release of Promissory Note

What is a Release of Promissory Note form?

A Release of Promissory Note form is a document that officially states that a borrower has paid off their debt, and the lender releases their claim to the promissory note. This form serves as proof that the borrower has fulfilled their obligation and that the lender no longer has any rights to the note or the debt associated with it.

When should I use a Release of Promissory Note form?

You should use this form when a borrower has completely paid off the debt specified in the promissory note. It’s important to document this release to avoid any future claims or misunderstandings regarding the debt.

Who needs to sign the Release of Promissory Note form?

Typically, both the borrower and the lender must sign the Release of Promissory Note form. The borrower needs to confirm that they have paid off the debt, while the lender acknowledges the release of their claim to the note.

Is the Release of Promissory Note form legally binding?

Yes, once signed by both parties, the Release of Promissory Note form is legally binding. It protects both the borrower and lender by clearly stating that the debt has been settled and that the lender has relinquished their rights to the promissory note.

How do I obtain a Release of Promissory Note form?

You can typically find a Release of Promissory Note form through legal stationery stores, online legal document services, or by consulting with an attorney. Ensure that the form you use complies with your state’s laws.

What information is required on the form?

The form generally requires the names of the borrower and lender, the date of the original promissory note, details of the payment (including the amount paid), and signatures of both parties. Additional identifying information may also be necessary, such as addresses or contact information.

Can I use a Release of Promissory Note form for multiple notes?

If a borrower has multiple promissory notes, a separate Release of Promissory Note form should be completed for each note. This ensures clarity and proper documentation for each individual debt.

What happens if I don’t use a Release of Promissory Note form?

If you fail to use a Release of Promissory Note form, the lender may still have a claim to the debt, even after the borrower believes it has been paid off. This can lead to disputes and potential legal issues in the future.

Where should I keep the Release of Promissory Note form after it’s signed?

After signing, both the borrower and lender should keep a copy of the Release of Promissory Note form in a safe place. It’s advisable to store it with other important financial documents to ensure easy access if needed in the future.

Dos and Don'ts

When filling out the Release of Promissory Note form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are nine things to keep in mind:

- Do: Carefully read all instructions provided with the form.

- Do: Fill in all required fields completely and accurately.

- Do: Sign and date the form where indicated.

- Do: Keep a copy of the completed form for your records.

- Do: Double-check for any spelling or numerical errors before submission.

- Don't: Leave any mandatory fields blank.

- Don't: Use correction fluid or tape on the form.

- Don't: Submit the form without verifying that all information is current.

- Don't: Ignore any additional documentation that may be required.

Consider More Types of Release of Promissory Note Templates

Promissory Note Friendly Loan Agreement Format - A note that helps regulate repayment of loans for vehicle acquisitions.

Understanding the intricacies of a New Jersey Promissory Note is essential for anyone involved in lending or borrowing money, as it not only details the specific terms of the loan but also provides legal protection for both parties. To further enhance your knowledge and ensure compliance with local regulations, you can explore All New Jersey Forms which offer templates and guidelines for creating these important documents.