Free Release Of Lien Texas Template

The Release of Lien Texas form is a crucial document that plays a significant role in real estate transactions. It serves to formally acknowledge that a lien, which is a legal claim against a property, has been satisfied and released. This form is typically prepared by legal professionals and is essential for ensuring that the property is free from any encumbrances associated with the lien. Key components of the form include details such as the date, the name and mailing address of the lien holder, and information about the original loan, including the principal amount and maturity date. The form also specifies the property involved, which may include any improvements made to it. By signing this document, the lien holder confirms that they have received full payment and relinquishes their rights to enforce the lien for any future debts. Additionally, the form includes sections for notarization, ensuring its validity and compliance with Texas law. Understanding the importance of this document can help property owners navigate the complexities of real estate transactions with greater confidence.

Document Specifics

| Fact Name | Fact Details |

|---|---|

| Purpose | The Release of Lien form is used to formally acknowledge the payment of a debt and to release a property from a lien held by the lender. |

| Governing Laws | This form is governed by Texas Property Code, specifically Section 51.003, which outlines the requirements for lien releases in Texas. |

| Prepared By | The form is prepared by the State Bar of Texas and is intended for use by attorneys only. |

| Notary Requirement | A notary public must acknowledge the execution of the Release of Lien to ensure its validity and enforceability. |

Similar forms

- Release of Mortgage: This document is similar to the Release of Lien Texas form as it also signifies the satisfaction of a debt secured by a mortgage. Once the mortgage is paid off, the lender releases their claim on the property, similar to how a lien is released.

- Deed of Reconveyance: A Deed of Reconveyance is used when a borrower pays off their loan. This document transfers the title back to the borrower, effectively releasing the lender's interest in the property, much like the Release of Lien.

- Non-disclosure Agreement: A Non-disclosure Agreement is crucial for protecting sensitive information shared between parties, akin to how a Release of Lien secures property interests. For more details, visit https://nytemplates.com/blank-non-disclosure-agreement-template.

- Subordination Agreement: This document allows a new loan to take priority over an existing lien. While it does not release the lien, it alters the order of claims against the property, which can be related to how a lien is managed or released.

- Affidavit of Release: An Affidavit of Release serves to confirm that a lien has been satisfied and provides public notice of the release. It is similar in purpose to the Release of Lien Texas form, ensuring that all parties are aware of the lien's status.

- Quitclaim Deed: A Quitclaim Deed transfers any interest in a property from one party to another without guaranteeing that the title is clear. It can be used to release claims on a property, similar to how a lien is released.

Release Of Lien Texas Example

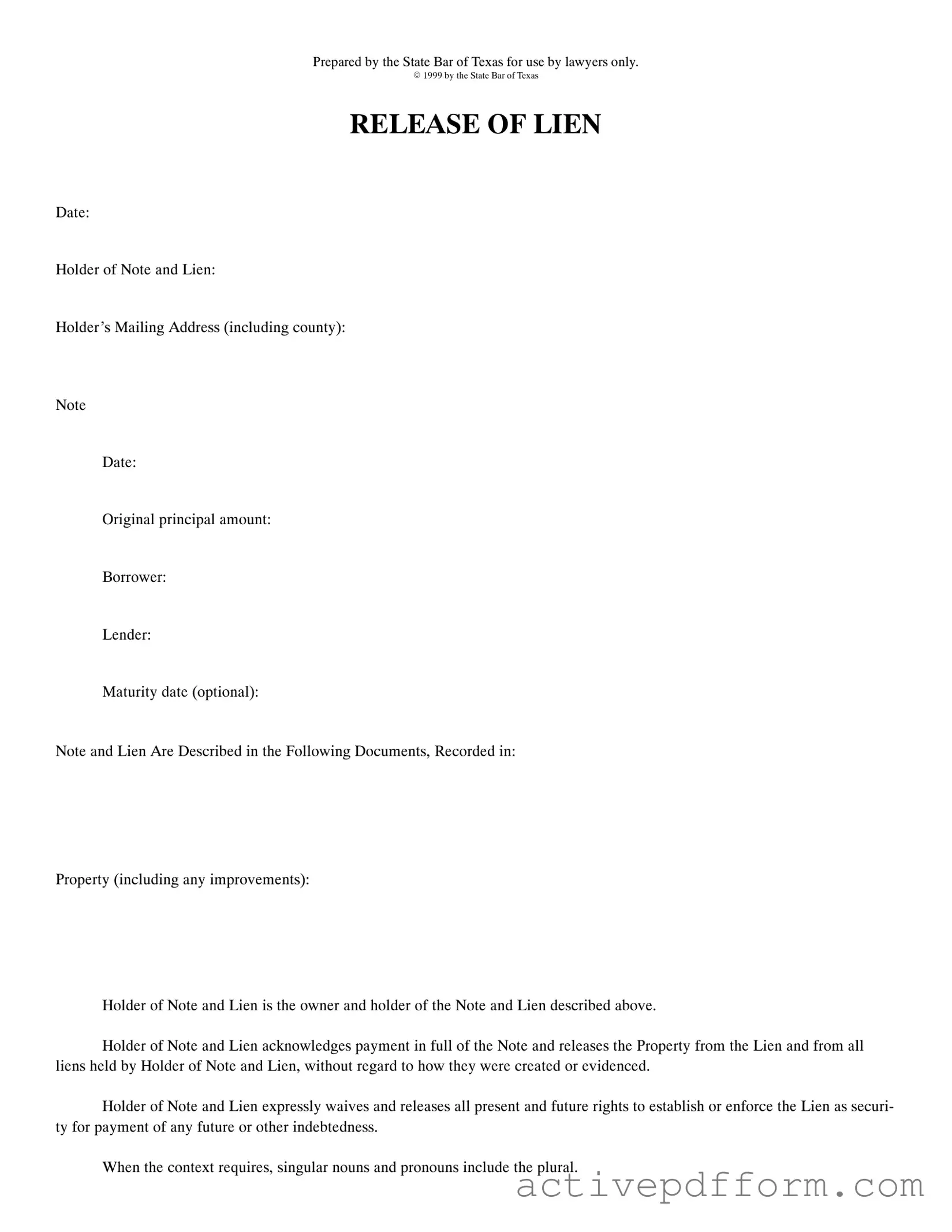

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

Understanding Release Of Lien Texas

What is a Release of Lien Texas form?

The Release of Lien Texas form is a legal document used to officially release a lien on a property. When a borrower pays off a loan, the lender must acknowledge that the debt has been satisfied. This form serves as proof that the lender relinquishes their claim to the property, allowing the borrower to own it free of any liens associated with that loan.

Who typically uses the Release of Lien Texas form?

This form is primarily used by lenders, such as banks or financial institutions, and borrowers who have paid off their loans. Once the debt is settled, the lender completes the form to confirm that they no longer hold a lien against the property. It is crucial for both parties to have a clear understanding of the lien's release to avoid any future disputes.

What information is required to complete the form?

To fill out the Release of Lien Texas form, you will need several key pieces of information. This includes the date of the release, the names of the holder of the note and lien, the borrower's name, the original principal amount of the loan, and details about the property. Additionally, the form requires acknowledgment from a notary public to validate the signatures and ensure the document's legality.

What happens if I don’t file a Release of Lien after paying off my loan?

If you fail to file a Release of Lien after paying off your loan, the lien may still appear on public records. This can lead to complications when trying to sell or refinance the property, as potential buyers or lenders may see the lien as an outstanding debt. It is important to file the release promptly to avoid any issues down the line.

How do I file the Release of Lien Texas form?

Filing the Release of Lien Texas form involves a few straightforward steps. First, complete the form with all necessary information. Next, have the form notarized to ensure it is legally binding. Finally, file the completed document with the county clerk’s office where the original lien was recorded. This step is crucial for making the release official and removing the lien from public records.

Can I create my own Release of Lien form?

Dos and Don'ts

When filling out the Release Of Lien Texas form, it is crucial to adhere to certain guidelines to ensure accuracy and compliance. Here’s a list of dos and don’ts:

- Do fill in all required fields completely and accurately.

- Do double-check the spelling of names and addresses.

- Do ensure that the date of acknowledgment is correctly filled out.

- Do have the form signed in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank unless specified as optional.

- Don't use white-out or other correction methods on the form.

- Don't forget to include the county where the acknowledgment is made.

- Don't submit the form without verifying all information is correct.

- Don't assume that the notary will fill in any missing information for you.

Check out Common Templates

I 589 Form - The I-589 outline provides a guideline for documenting fears and experiences accurately.

Before finalizing your sale, it's important to have all necessary documentation ready, including the Arizona RV Bill of Sale form, which legitimizes the transaction. You can find and download this essential paperwork through Arizona PDF Forms to ensure your sale is processed smoothly.

Can You Change Your Address at Any Post Office - This form is important for enhancing overall service efficiency.

Profits or Loss From Business - This form accommodates various types of businesses, from consulting services to retail operations.