Blank Promissory Note for a Car Document

When purchasing a vehicle, financing options often come into play, and a Promissory Note for a Car serves as a crucial document in this process. This form outlines the borrower's promise to repay a specified amount of money, detailing the terms of the loan agreement between the buyer and the lender. Key components include the principal amount borrowed, the interest rate, and the repayment schedule, which can vary based on the lender's policies and the borrower's creditworthiness. Additionally, the note may specify consequences for missed payments, including late fees or potential repossession of the vehicle. Both parties benefit from having a clear, written record of the agreement, which helps to prevent misunderstandings and disputes down the line. Understanding the structure and significance of this document is essential for anyone entering into a car financing agreement, as it lays the foundation for the financial responsibilities involved in car ownership.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Parties Involved | The note typically involves a borrower (buyer) and a lender (seller or financial institution). |

| Payment Terms | It outlines the payment schedule, including the amount, frequency, and due dates. |

| Interest Rate | The document specifies the interest rate applied to the loan amount. |

| Governing Law | The laws of the state where the transaction occurs govern the note. For example, California law may apply if the car is purchased in California. |

| Default Terms | It includes terms that define what happens if the borrower fails to make payments. |

| Collateral | The car often serves as collateral for the loan, meaning the lender can reclaim it if the borrower defaults. |

| Signatures Required | Both parties must sign the note to make it legally binding. |

| Amendments | Any changes to the terms of the note must be documented and signed by both parties. |

Similar forms

- Loan Agreement: This document outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. Like a promissory note, it serves as a formal acknowledgment of debt.

- Lease Agreement: A lease agreement details the terms under which one party rents property from another. Similar to a promissory note, it includes payment terms and obligations of both parties.

- Mortgage Note: This document is a written promise to repay a loan used to purchase real estate. It shares similarities with a car promissory note in that both are legally binding and outline repayment terms.

- Personal Loan Agreement: This agreement specifies the terms of a personal loan, including repayment conditions. It is similar to a car promissory note in that both involve borrowing money and promise to repay it.

- Installment Agreement: This document lays out the terms for paying off a debt in installments. Like a promissory note, it establishes a clear repayment plan.

- Credit Card Agreement: This document details the terms and conditions of a credit card account. It is similar to a promissory note as it outlines the borrower's obligations to repay borrowed funds.

- Business Loan Agreement: This agreement specifies the terms for a loan taken out by a business. It shares characteristics with a car promissory note in that both require repayment under agreed terms.

- Student Loan Agreement: This document outlines the terms for loans taken out to pay for education. Like a car promissory note, it requires the borrower to repay the borrowed amount with interest.

- Promissory Note: For documenting loans, the clear Pennsylvania promissory note guidelines outline essential terms to avoid misunderstandings and legal issues.

- Promissory Note for Personal Property: This document serves as a promise to repay a loan for personal property. It is similar to a car promissory note as both involve a promise to pay for an item.

Promissory Note for a Car Example

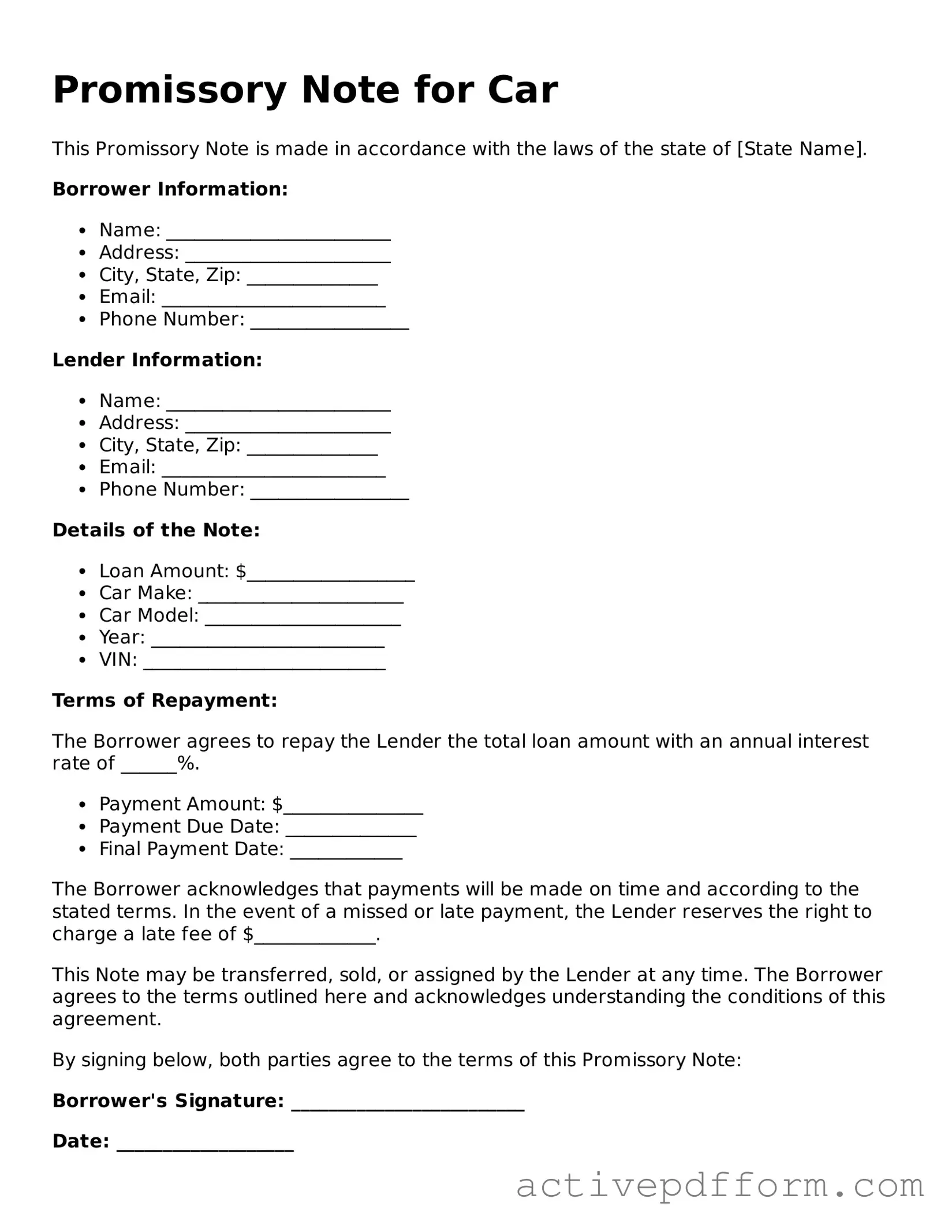

Promissory Note for Car

This Promissory Note is made in accordance with the laws of the state of [State Name].

Borrower Information:

- Name: ________________________

- Address: ______________________

- City, State, Zip: ______________

- Email: ________________________

- Phone Number: _________________

Lender Information:

- Name: ________________________

- Address: ______________________

- City, State, Zip: ______________

- Email: ________________________

- Phone Number: _________________

Details of the Note:

- Loan Amount: $__________________

- Car Make: ______________________

- Car Model: _____________________

- Year: _________________________

- VIN: __________________________

Terms of Repayment:

The Borrower agrees to repay the Lender the total loan amount with an annual interest rate of ______%.

- Payment Amount: $_______________

- Payment Due Date: ______________

- Final Payment Date: ____________

The Borrower acknowledges that payments will be made on time and according to the stated terms. In the event of a missed or late payment, the Lender reserves the right to charge a late fee of $_____________.

This Note may be transferred, sold, or assigned by the Lender at any time. The Borrower agrees to the terms outlined here and acknowledges understanding the conditions of this agreement.

By signing below, both parties agree to the terms of this Promissory Note:

Borrower's Signature: _________________________

Date: ___________________

Lender's Signature: __________________________

Date: ___________________

Understanding Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the terms of a loan used to purchase a vehicle. It serves as a written promise from the borrower to repay the lender the amount borrowed, along with any interest, by a specified date. This document protects both parties by clearly stating the obligations and rights involved in the transaction.

Why do I need a Promissory Note for a Car?

This document is essential for several reasons. First, it provides legal evidence of the loan agreement, which can be crucial in case of disputes. Second, it outlines the repayment schedule, including the amount due, interest rate, and any penalties for late payments. Having a clear record helps ensure that both parties understand their responsibilities and can prevent misunderstandings in the future.

What information should be included in a Promissory Note for a Car?

A comprehensive Promissory Note should include the names and addresses of both the borrower and lender, the amount of the loan, the interest rate, the repayment schedule, and the due date. Additionally, it may specify any collateral, such as the vehicle itself, and outline the consequences of defaulting on the loan. Including all relevant details helps protect both parties' interests.

Is a Promissory Note for a Car legally binding?

Yes, a properly executed Promissory Note is legally binding. Once both parties sign the document, it becomes enforceable in a court of law. This means that if the borrower fails to make payments as agreed, the lender can take legal action to recover the owed amount. However, it is important to ensure that the note complies with state laws to maintain its validity.

Can I modify a Promissory Note after it has been signed?

Modifying a Promissory Note is possible, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the borrower and lender to ensure clarity and enforceability. Verbal agreements are not sufficient; written documentation protects both parties and prevents future disputes.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. They may pursue legal action to recover the outstanding amount, which could involve filing a lawsuit. Additionally, if the loan is secured by the vehicle, the lender may have the right to repossess the car. The specific actions available depend on the terms outlined in the Promissory Note and state laws governing such agreements.

Do I need a lawyer to create a Promissory Note for a Car?

While it is not strictly necessary to hire a lawyer to create a Promissory Note, consulting one can be beneficial. A lawyer can help ensure that the document meets legal requirements and adequately protects your interests. If you choose to draft the note independently, it is crucial to follow best practices and include all necessary information to avoid potential issues later on.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it's important to follow certain guidelines to ensure accuracy and clarity. Here’s a list of things you should and shouldn’t do:

- Do: Read the entire form carefully before filling it out.

- Do: Provide accurate information about the car, including the make, model, and VIN.

- Do: Clearly state the loan amount and the repayment terms.

- Do: Sign and date the form in the designated areas.

- Don't: Leave any sections blank; incomplete forms can lead to delays.

- Don't: Use nicknames or abbreviations for names; always use full legal names.

- Don't: Forget to keep a copy of the completed form for your records.

- Don't: Rush through the process; take your time to ensure everything is correct.

Consider More Types of Promissory Note for a Car Templates

Satisfaction of Promissory Note - It helps prevent confusion over future borrowing transactions between the parties.

To ensure clarity in your loan agreement, it is essential to utilize a Maryland Promissory Note form that details crucial elements such as the borrowed amount, interest rate, and repayment schedule. For additional resources, you can access All Maryland Forms to help you properly document your loan.