Blank Promissory Note Document

The Promissory Note is a crucial financial document that serves as a written promise to pay a specified sum of money to a designated individual or entity at a predetermined time or on demand. This form outlines key details, including the amount borrowed, interest rate, repayment schedule, and the parties involved. It often includes terms regarding late payments, default, and any applicable penalties. By clearly stating the obligations of the borrower and the rights of the lender, the Promissory Note establishes a legally binding agreement that can be enforced in a court of law. Additionally, the document may require signatures from both parties, ensuring mutual consent and acknowledgment of the terms laid out. Understanding the components and implications of a Promissory Note is essential for anyone engaged in lending or borrowing money, as it provides a clear framework for financial transactions and helps prevent disputes. Whether used in personal loans, business financing, or real estate transactions, this form plays a vital role in facilitating trust and accountability between the involved parties.

Promissory Note - Designed for Individual States

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or bearer at a specified time. |

| Parties Involved | The two main parties are the maker (the person who promises to pay) and the payee (the person to whom the payment is promised). |

| Governing Law | In the United States, the Uniform Commercial Code (UCC) governs promissory notes, with specific provisions varying by state. |

| Types | Promissory notes can be secured (backed by collateral) or unsecured (not backed by collateral). |

| Interest Rates | The note may specify an interest rate, which can be fixed or variable, affecting the total amount to be repaid. |

| Transferability | Promissory notes are generally transferable, allowing the payee to sell or assign the note to another party. |

| Enforceability | For a promissory note to be enforceable, it must meet certain requirements, including clear terms and signatures from the parties. |

| State-Specific Forms | Some states may have specific forms or requirements for promissory notes. Check local laws for details. |

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. However, it often includes more detailed provisions about the obligations of both parties.

- Mortgage: A mortgage is a specific type of loan used to purchase real estate. Like a promissory note, it involves borrowing money and promises to repay, but it also secures the loan with the property itself.

- Installment Agreement: This document allows a borrower to repay a debt in installments over time. It shares similarities with a promissory note in that it specifies the repayment terms and amounts due.

- Credit Agreement: A credit agreement outlines the terms under which a lender extends credit to a borrower. It is similar to a promissory note in that it establishes the borrower's promise to repay the borrowed amount.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the business defaults. It resembles a promissory note as it involves a commitment to pay back borrowed funds.

- Lease Agreement: While primarily used for renting property, a lease agreement can include payment terms similar to those in a promissory note, particularly if it involves a purchase option.

- Bond: A bond is a debt security that represents a loan made by an investor to a borrower. Like a promissory note, it involves a promise to repay the borrowed amount, usually with interest.

Nyc Apartment Registration Form: The Nyc Apartment Registration Form is vital for landlords and property managers to collect essential details about the apartment and its owner for regulatory compliance. It plays a crucial role in the rental process, ensuring transparency and adherence to housing laws. For more information, you can visit https://nytemplates.com/blank-nyc-apartment-registration-template.

- IOU: An IOU is a simple acknowledgment of a debt. It is less formal than a promissory note but serves a similar purpose by recognizing that one party owes money to another.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay back a portion of their debt. It is similar to a promissory note as it involves a repayment commitment.

- Repayment Plan: A repayment plan details how a borrower will pay back a debt over time. It shares key features with a promissory note, such as the payment schedule and amounts owed.

Promissory Note Categories

Promissory Note Example

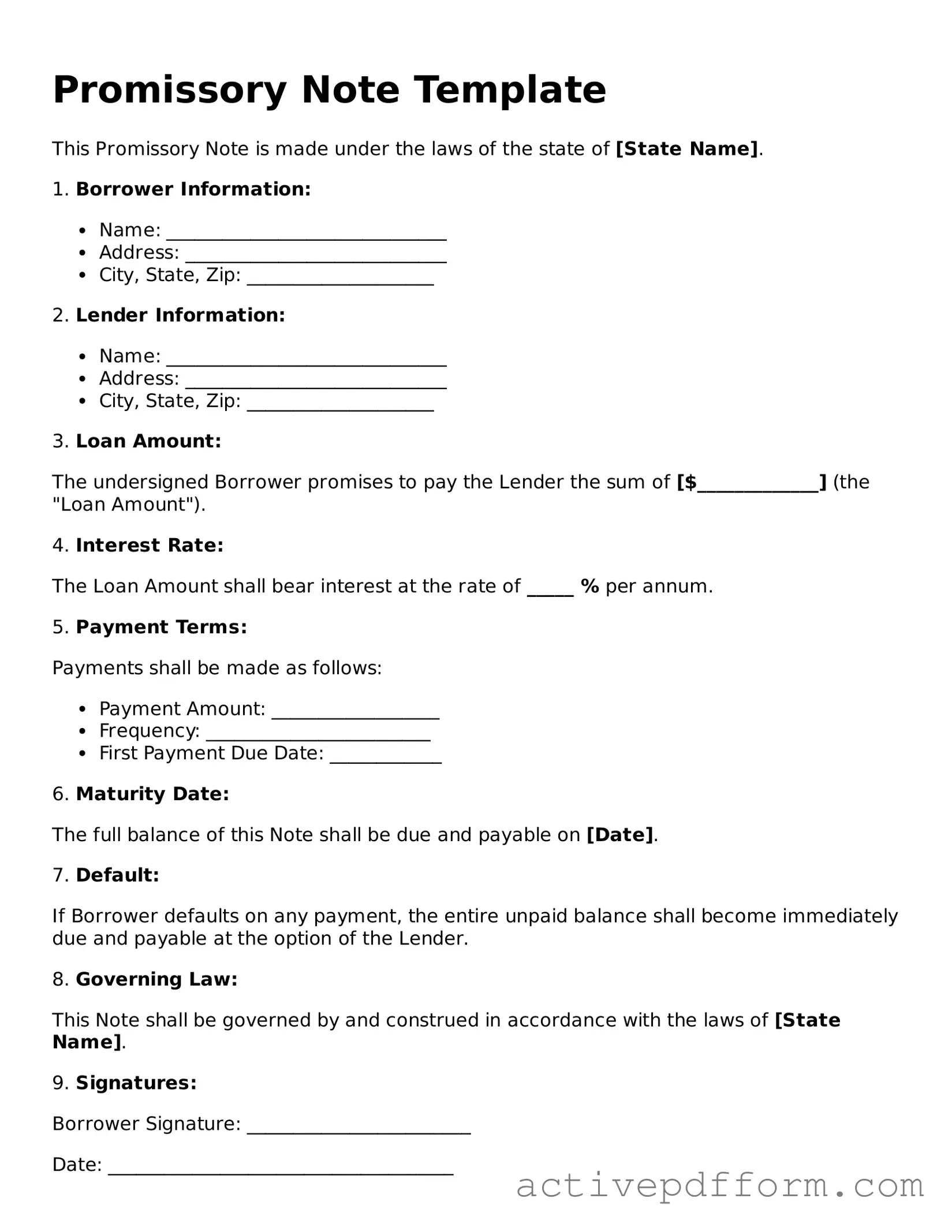

Promissory Note Template

This Promissory Note is made under the laws of the state of [State Name].

1. Borrower Information:

- Name: ______________________________

- Address: ____________________________

- City, State, Zip: ____________________

2. Lender Information:

- Name: ______________________________

- Address: ____________________________

- City, State, Zip: ____________________

3. Loan Amount:

The undersigned Borrower promises to pay the Lender the sum of [$_____________] (the "Loan Amount").

4. Interest Rate:

The Loan Amount shall bear interest at the rate of _____ % per annum.

5. Payment Terms:

Payments shall be made as follows:

- Payment Amount: __________________

- Frequency: ________________________

- First Payment Due Date: ____________

6. Maturity Date:

The full balance of this Note shall be due and payable on [Date].

7. Default:

If Borrower defaults on any payment, the entire unpaid balance shall become immediately due and payable at the option of the Lender.

8. Governing Law:

This Note shall be governed by and construed in accordance with the laws of [State Name].

9. Signatures:

Borrower Signature: ________________________

Date: _____________________________________

Lender Signature: __________________________

Date: _____________________________________

Understanding Promissory Note

What is a Promissory Note?

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a particular time or on demand. It serves as a legal document that outlines the terms of the loan, including the principal amount, interest rate, payment schedule, and any penalties for late payments. This document is crucial for both the borrower and lender, as it provides a clear record of the financial agreement.

Who typically uses a Promissory Note?

Promissory Notes are commonly used in various financial transactions. Individuals may use them for personal loans between friends or family members. Businesses often issue Promissory Notes when borrowing funds from banks or investors. Additionally, they can be utilized in real estate transactions, where buyers may sign a note to secure financing for property purchases. The versatility of this document makes it a popular choice in many lending situations.

What are the key components of a Promissory Note?

A well-drafted Promissory Note should include several essential components. These include the names and addresses of both the borrower and lender, the principal amount being borrowed, the interest rate, and the payment schedule. It should also specify the due date for repayment, any late fees that may apply, and the circumstances under which the lender may demand full repayment. Clear terms help to prevent misunderstandings and disputes between the parties involved.

Is a Promissory Note legally binding?

Yes, a Promissory Note is generally considered a legally binding contract, provided it meets certain criteria. For it to be enforceable, both parties must agree to the terms, and the document must be signed by the borrower. While it is not always necessary to have the note notarized, doing so can add an extra layer of protection and authenticity. If a borrower fails to repay the loan as agreed, the lender may take legal action based on the terms outlined in the note.

Dos and Don'ts

When filling out a Promissory Note form, it’s important to be careful and thorough. Here are some guidelines to follow:

- Do: Provide accurate information. Ensure that all names, dates, and amounts are correct.

- Do: Clearly state the terms of repayment. Include the payment schedule, interest rates, and any other relevant details.

- Do: Sign and date the document. Your signature is essential for the note to be valid.

- Do: Keep a copy for your records. This will help you track payments and maintain a record of the agreement.

- Don't: Leave any fields blank. Incomplete information can lead to misunderstandings or disputes later.

- Don't: Use vague language. Be specific about the terms to avoid confusion.

- Don't: Forget to review the document before signing. Double-checking can prevent mistakes.

- Don't: Ignore legal requirements. Make sure the note complies with local laws to ensure enforceability.

Create Popular Documents

Company Policy Handbook - Find details about health and wellness programs offered.

When engaging in the sale or purchase of an ATV, it's important to have the right documentation to ensure a hassle-free transaction. The California ATV Bill of Sale form is a fundamental part of this process, providing a clear record of ownership transfer. To make things easier, you can access and fill out this form through California PDF Forms, ensuring that all necessary details are properly recorded and understood by both parties involved.

Texas Odometer Disclosure - The Odometer Statement must be filled out during any transfer of vehicle ownership in Texas.

Flying Internationally With Dog - It must be signed by a licensed veterinarian within 10 days of your pet's travel date.