Free Profit And Loss Template

The Profit and Loss form is an essential financial document that provides a clear snapshot of a business's financial performance over a specific period. It highlights the revenues generated and the expenses incurred, ultimately revealing whether the business is operating at a profit or a loss. By breaking down income sources and categorizing expenses, this form enables business owners to assess their operational efficiency and make informed decisions. Key components include total revenue, cost of goods sold, gross profit, operating expenses, and net income. Understanding these elements is crucial for anyone looking to manage their finances effectively. This form not only serves as a tool for internal analysis but is also vital for stakeholders, such as investors and lenders, who require transparency regarding a company's financial health. With a well-prepared Profit and Loss statement, businesses can track their progress, identify trends, and strategize for future growth.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | A Profit and Loss form summarizes a business's revenues and expenses over a specific period, showing the net profit or loss. |

| Purpose | This form helps business owners track financial performance and make informed decisions based on profitability. |

| Components | Typically includes sections for revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| Frequency | Businesses often prepare these forms monthly, quarterly, or annually, depending on their reporting needs. |

| Tax Implications | The net income reported on the form is used to calculate taxable income, affecting the business's tax obligations. |

| State-Specific Forms | Some states may require specific formats or additional disclosures on the Profit and Loss form, governed by state tax laws. |

| Financial Analysis | Investors and creditors often review this form to assess a company's financial health and viability. |

| Software Usage | Many businesses use accounting software to generate Profit and Loss statements, which can simplify the process. |

| Comparative Analysis | Comparing Profit and Loss forms over different periods can reveal trends in revenue and expenses, guiding strategic decisions. |

| Legal Requirements | While not always legally required, maintaining accurate Profit and Loss statements is crucial for compliance and financial transparency. |

Similar forms

The Profit and Loss form serves as a crucial financial document for businesses, providing insights into revenues and expenses over a specific period. Several other documents share similarities with the Profit and Loss form, each offering unique perspectives on a company's financial health. Here are four such documents:

- Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a particular moment in time. While the Profit and Loss form summarizes performance over a period, the Balance Sheet shows what the company owns and owes at a specific date.

- Cash Flow Statement: This statement tracks the flow of cash in and out of a business during a given timeframe. Like the Profit and Loss form, it highlights operational performance but focuses specifically on liquidity and cash management rather than profitability alone.

- California LLC 1 Form: Essential for the formation of a Limited Liability Company in California, completing this form accurately is crucial. For more information on this process, visit California PDF Forms.

- Statement of Changes in Equity: This document outlines the changes in a company’s equity over a period, detailing factors such as retained earnings and additional investments. It complements the Profit and Loss form by explaining how profits or losses affect overall equity.

- Budget vs. Actual Report: This report compares the budgeted financial performance against actual results. Similar to the Profit and Loss form, it evaluates revenue and expenses but emphasizes variances from planned financial outcomes, helping businesses manage their financial strategies more effectively.

Profit And Loss Example

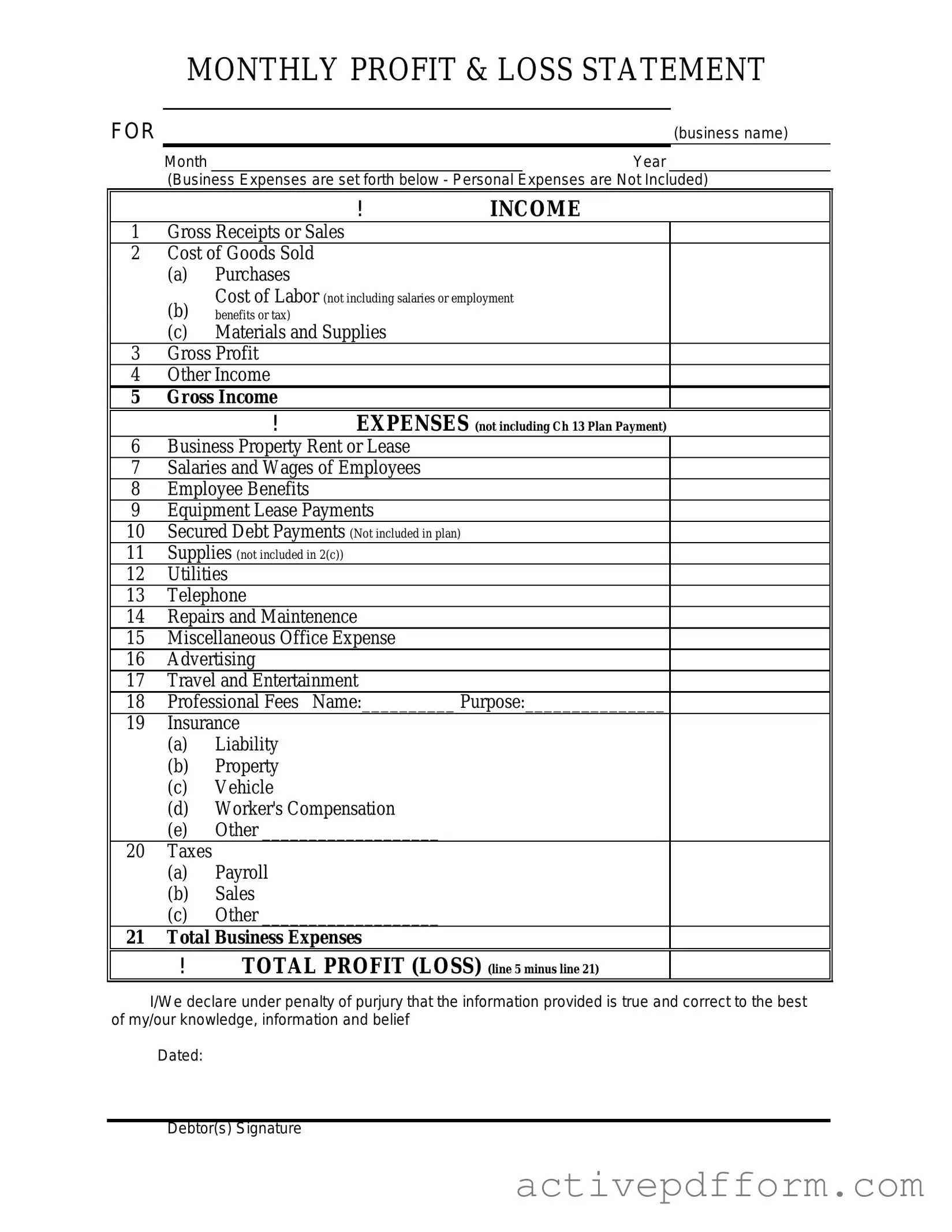

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Understanding Profit And Loss

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, summarizes a company's revenues, costs, and expenses over a specific period. This document helps businesses understand their financial performance by showing whether they made a profit or incurred a loss during that time frame.

Why is the Profit and Loss form important?

The Profit and Loss form is crucial for several reasons. It provides a clear picture of a company's financial health, helps in making informed business decisions, and is often required for tax purposes. Investors and creditors also rely on this document to assess a company's profitability and sustainability.

How often should a Profit and Loss form be prepared?

Typically, businesses prepare a Profit and Loss form on a monthly, quarterly, or annual basis. The frequency depends on the size of the business and its specific needs. Regularly updating this form allows for timely insights into financial performance and helps in adjusting strategies as necessary.

What key components are included in a Profit and Loss form?

A standard Profit and Loss form includes several key components: total revenue, cost of goods sold (COGS), gross profit, operating expenses, and net profit or loss. Each section provides essential insights into different aspects of financial performance, helping stakeholders understand where money is being made or lost.

How can I use the Profit and Loss form to improve my business?

You can use the Profit and Loss form to identify trends in revenue and expenses. By analyzing this data, you can pinpoint areas where costs can be reduced or where sales can be increased. This insight can lead to more strategic planning and better resource allocation.

Is the Profit and Loss form the same as a balance sheet?

No, the Profit and Loss form and balance sheet serve different purposes. While the P&L statement shows a company's financial performance over a specific period, the balance sheet provides a snapshot of a company's assets, liabilities, and equity at a particular point in time. Both documents are essential for a comprehensive understanding of a business's financial status.

Dos and Don'ts

When filling out the Profit and Loss form, it is essential to approach the task with care. Here are four important dos and don'ts to keep in mind:

- Do ensure all figures are accurate and reflect actual income and expenses.

- Do categorize each item correctly to provide a clear financial picture.

- Don't omit any significant sources of income or major expenses.

- Don't use vague descriptions; clarity is key to understanding your financial situation.

Check out Common Templates

What Is Auto Consignment - Commission rates for the Consignee are predetermined and detailed in the agreement.

The Ohio Horse Bill of Sale form is a legal document that records the sale and transfer of ownership of a horse in the state of Ohio. This form serves as proof of the transaction, outlining essential details such as the buyer, seller, and horse description. For a complete understanding of this important document, you can refer to the Horse Bill of Sale form, which is crucial for both buyers and sellers to ensure a smooth transfer of ownership.

Family Information Form (imm5707) - This form must be filled out by individuals 18 years or older applying for temporary residency in Canada.