Blank Personal Guarantee Document

When entering into a business agreement, securing financial obligations often requires additional assurances. One such assurance is the Personal Guarantee form, a crucial document that holds individuals accountable for the debts of a business entity. This form is typically used by lenders to mitigate risk, ensuring that if a business defaults on a loan or financial obligation, the personal assets of the guarantor can be pursued for repayment. The Personal Guarantee form outlines the responsibilities of the guarantor, detailing the extent of their liability and the conditions under which they will be held accountable. It serves as a protective measure for lenders while also providing clarity for those willing to back a business financially. Understanding the implications of signing this form is essential for anyone considering a personal guarantee, as it can significantly impact personal finances and credit standing. By familiarizing oneself with the key components, including the terms of liability, duration, and any specific conditions attached, individuals can make informed decisions about their involvement in business ventures.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A personal guarantee is a legal commitment made by an individual to repay a debt or obligation if the primary borrower defaults. |

| Purpose | It serves to provide additional security to lenders, ensuring that they have recourse to the guarantor's personal assets. |

| Common Use | Personal guarantees are frequently used in business loans, leases, and credit agreements. |

| Governing Law | The governing law may vary by state; for example, New York law applies to personal guarantees executed in New York. |

| Requirements | Typically, a personal guarantee must be in writing and signed by the guarantor to be enforceable. |

| Risks | Signing a personal guarantee can put the guarantor's personal assets at risk, including savings and property. |

| Revocation | Generally, a personal guarantee cannot be revoked unilaterally; it often requires consent from the lender. |

| Duration | The duration of a personal guarantee can vary; it may last until the debt is paid in full or until a specified term ends. |

Similar forms

The Personal Guarantee form is a significant document often used in business transactions. It ensures that an individual agrees to be responsible for the debt or obligations of a business. Here are ten documents that share similarities with the Personal Guarantee form, along with explanations of how they are alike:

- Loan Agreement: This document outlines the terms of a loan between a lender and a borrower. Like the Personal Guarantee, it specifies obligations and can hold individuals accountable for repayment.

- Lease Agreement: A lease agreement details the terms under which one party rents property from another. It often requires personal guarantees from individuals to secure the lease, similar to how a Personal Guarantee secures a loan.

Real Estate Purchase Agreement: This form outlines the terms and conditions of a property sale, establishing the framework for a smooth transaction. For more information, visit https://topformsonline.com/real-estate-purchase-agreement/.

- Business Partnership Agreement: This document sets the terms of a partnership between two or more individuals. It may include clauses that hold partners personally liable for business debts, akin to a Personal Guarantee.

- Indemnity Agreement: An indemnity agreement provides protection against loss or damage. It can hold individuals personally responsible for certain obligations, just like a Personal Guarantee does.

- Corporate Resolution: A corporate resolution is a formal document that records decisions made by a corporation's board. It may include personal guarantees from officers, paralleling the purpose of a Personal Guarantee.

- Personal Loan Application: This application collects information about an individual seeking a personal loan. It often requires a Personal Guarantee, linking the two documents in terms of liability.

- Credit Application: A credit application assesses an individual's creditworthiness. Similar to a Personal Guarantee, it may involve signing documents that make the applicant responsible for debts incurred.

- Security Agreement: This agreement establishes a security interest in collateral to secure a loan. It can involve personal guarantees to ensure that individuals are accountable, much like the Personal Guarantee.

- Guaranty Agreement: A guaranty agreement is a promise made by a third party to fulfill obligations if the primary party defaults. This is very similar to a Personal Guarantee, which also involves personal accountability for another's obligations.

- Surety Bond: A surety bond is a contract among three parties that guarantees the performance of a duty. It shares the concept of liability with the Personal Guarantee, ensuring that someone is responsible for fulfilling an obligation.

Personal Guarantee Example

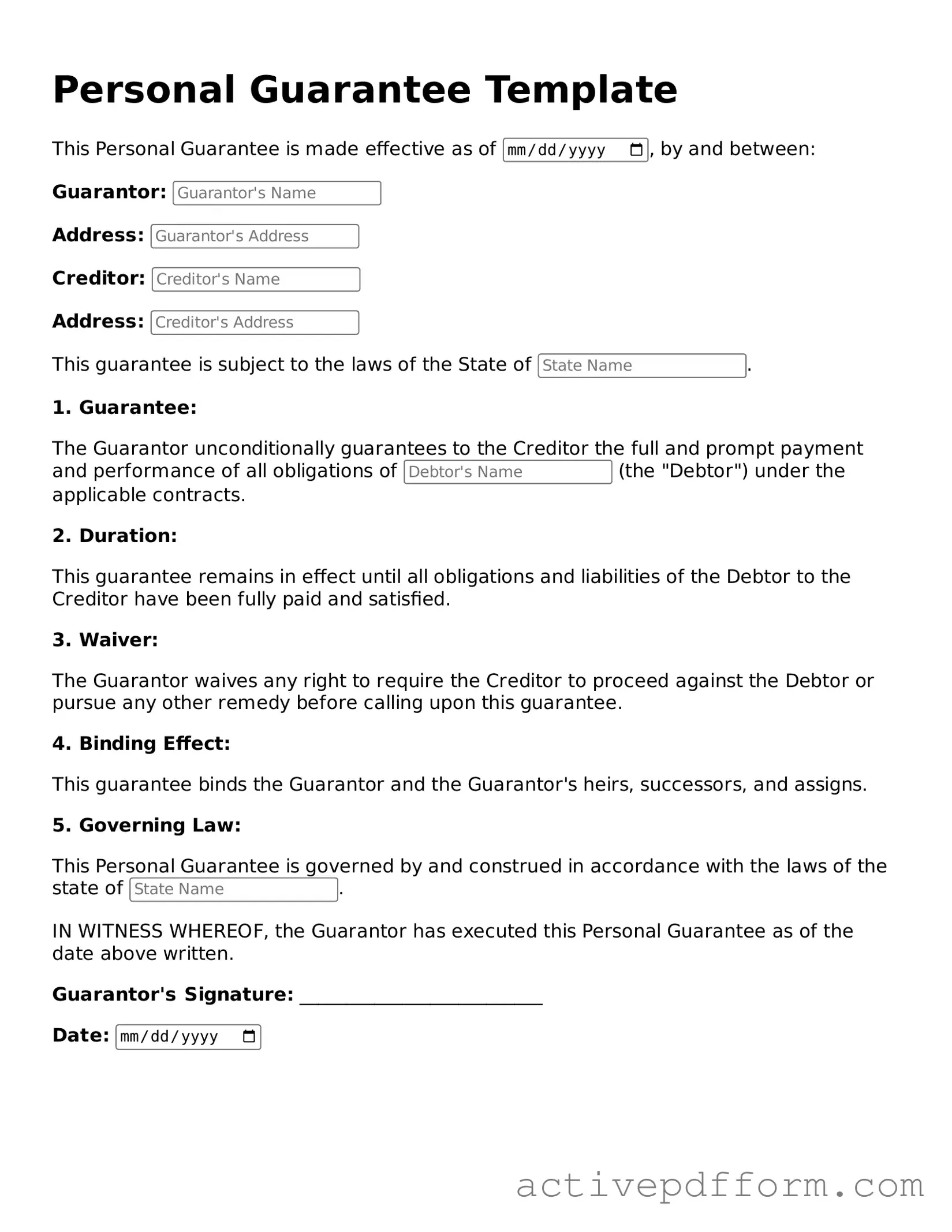

Personal Guarantee Template

This Personal Guarantee is made effective as of , by and between:

Guarantor:

Address:

Creditor:

Address:

This guarantee is subject to the laws of the State of .

1. Guarantee:

The Guarantor unconditionally guarantees to the Creditor the full and prompt payment and performance of all obligations of (the "Debtor") under the applicable contracts.

2. Duration:

This guarantee remains in effect until all obligations and liabilities of the Debtor to the Creditor have been fully paid and satisfied.

3. Waiver:

The Guarantor waives any right to require the Creditor to proceed against the Debtor or pursue any other remedy before calling upon this guarantee.

4. Binding Effect:

This guarantee binds the Guarantor and the Guarantor's heirs, successors, and assigns.

5. Governing Law:

This Personal Guarantee is governed by and construed in accordance with the laws of the state of .

IN WITNESS WHEREOF, the Guarantor has executed this Personal Guarantee as of the date above written.

Guarantor's Signature: __________________________

Date:

Understanding Personal Guarantee

What is a Personal Guarantee form?

A Personal Guarantee form is a legal document where an individual agrees to be personally responsible for a debt or obligation of a business or another individual. This means that if the business fails to meet its financial obligations, the individual who signed the guarantee can be held liable for the outstanding amount. It’s often used in business loans and leases to provide additional security to the lender or landlord.

Who typically needs to sign a Personal Guarantee?

Owners, partners, or key stakeholders of a business often sign a Personal Guarantee. Lenders may require this from individuals who are seeking loans for their business, especially if the business does not have a strong credit history or sufficient collateral. This form can also be required from anyone who has a significant stake in the business.

What are the risks of signing a Personal Guarantee?

Signing a Personal Guarantee carries significant risks. If the business defaults on its debts, the individual who signed the guarantee may have to use personal assets to cover the debt. This can include savings, property, or other personal resources. It is crucial to understand the potential financial implications before signing.

Can a Personal Guarantee be revoked?

Generally, a Personal Guarantee cannot be revoked unilaterally once it has been signed. However, some agreements may allow for a release under certain conditions, such as when the debt is paid off or if the lender agrees to terminate the guarantee. Always review the terms of the guarantee and consult with a legal professional if you seek to revoke it.

Is a Personal Guarantee the same as a co-signer?

While both a Personal Guarantee and co-signing involve taking responsibility for someone else's debt, they are not exactly the same. A co-signer is typically involved in the loan process from the beginning and shares the responsibility equally. A Personal Guarantee is often a separate document that adds an additional layer of security for the lender.

What should I consider before signing a Personal Guarantee?

Before signing, evaluate your financial situation and the business's financial health. Consider the amount of debt involved and your ability to cover it if necessary. It’s also wise to assess the business’s prospects for success. Consulting with a financial advisor or attorney can provide valuable insights.

Can a Personal Guarantee affect my personal credit score?

Yes, a Personal Guarantee can impact your personal credit score. If the business defaults on its obligations and you are required to pay, this could lead to negative marks on your credit report. Lenders may report the default to credit bureaus, affecting your ability to secure personal loans in the future.

Are there different types of Personal Guarantees?

Yes, there are generally two types of Personal Guarantees: limited and unlimited. A limited Personal Guarantee specifies a maximum amount for which the individual is responsible, while an unlimited guarantee holds the individual liable for the full amount of the debt. Understanding the type you are signing is crucial.

Where can I obtain a Personal Guarantee form?

A Personal Guarantee form can often be obtained from lenders, financial institutions, or legal service providers. Many online resources also offer templates that can be customized. However, it is advisable to have any form reviewed by a legal professional to ensure it meets your specific needs and complies with local laws.

Dos and Don'ts

When filling out a Personal Guarantee form, attention to detail is crucial. Here’s a straightforward list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't provide false information, as this can lead to serious consequences.

Consider More Types of Personal Guarantee Templates

Purchase Agreement Addendum - Serves as an official amendment to existing purchase terms.

To facilitate a smooth transaction, it is essential to utilize the appropriate documentation; for a comprehensive understanding of the process, many find it helpful to reference the PDF Forms Minnesota resource, which provides valuable guidance on the Minnesota Real Estate Purchase Agreement.