Free Payroll Check Template

The Payroll Check form serves as a crucial document in the realm of employee compensation, encapsulating essential information that ensures both accuracy and compliance in payroll processing. This form typically includes vital details such as the employee's name, identification number, and the pay period for which the compensation is being issued. Additionally, it outlines the gross pay, deductions, and net pay, providing a transparent breakdown of how the final amount was calculated. Employers often use this form to not only distribute wages but also to maintain records for tax purposes and to comply with labor regulations. The form may also include information regarding overtime hours, bonuses, and any other adjustments that might affect the employee's earnings. Understanding the intricacies of the Payroll Check form is essential for both employers and employees, as it fosters trust and clarity in the often complex world of payroll management.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | A Payroll Check form is a document used by employers to issue payments to employees for work performed. |

| Components | Typically includes employee name, pay period, amount, and employer details. |

| Frequency of Use | Commonly used on a bi-weekly or monthly basis, depending on the employer's pay schedule. |

| State-Specific Forms | Some states require specific formats or additional information; for example, California mandates itemized wage statements. |

| Governing Laws | Federal and state labor laws govern payroll checks, including the Fair Labor Standards Act (FLSA) and state-specific wage laws. |

| Record Keeping | Employers must maintain payroll records for a minimum of three years as per federal law. |

| Direct Deposit Option | Many employers offer direct deposit as a convenient alternative to physical checks. |

| Tax Deductions | Payroll checks typically reflect various tax deductions, including federal, state, and Social Security taxes. |

| Employee Rights | Employees have the right to receive timely payment and accurate information regarding their wages. |

Similar forms

The Payroll Check form serves as a crucial document in the payroll process, ensuring employees receive their wages accurately and on time. Several other documents share similarities with the Payroll Check form, each playing an important role in payroll and financial management. Below is a list of eight documents that are similar to the Payroll Check form:

- Pay Stub: This document provides a detailed breakdown of an employee's earnings, deductions, and net pay for a specific pay period, similar to how a Payroll Check form indicates the amount to be paid.

Ohio Mobile Home Bill of Sale Form - For those transferring ownership of a mobile home, the official Mobile Home Bill of Sale guidelines ensure that all legal aspects are properly addressed.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their pay directly into their bank account, streamlining the payment process much like a Payroll Check.

- W-2 Form: Issued at the end of the year, this form summarizes an employee's earnings and tax withholdings, paralleling the Payroll Check form's purpose of documenting income.

- 1099 Form: For independent contractors, this form reports income received, similar to how a Payroll Check documents payment for services rendered.

- Time Sheet: This record tracks hours worked by an employee, which directly influences the information on the Payroll Check form, ensuring accurate payment.

- Payroll Register: This document compiles payroll information for all employees in a pay period, providing a comprehensive view akin to the individual details found on a Payroll Check.

- Employee Earnings Record: This record keeps track of an employee's earnings over time, reflecting similar information to what is found on the Payroll Check form.

- Expense Reimbursement Form: This form allows employees to request reimbursement for work-related expenses, which, while different in nature, also documents financial transactions similar to payroll checks.

Understanding these documents can help employees and employers alike navigate the payroll process more effectively.

Payroll Check Example

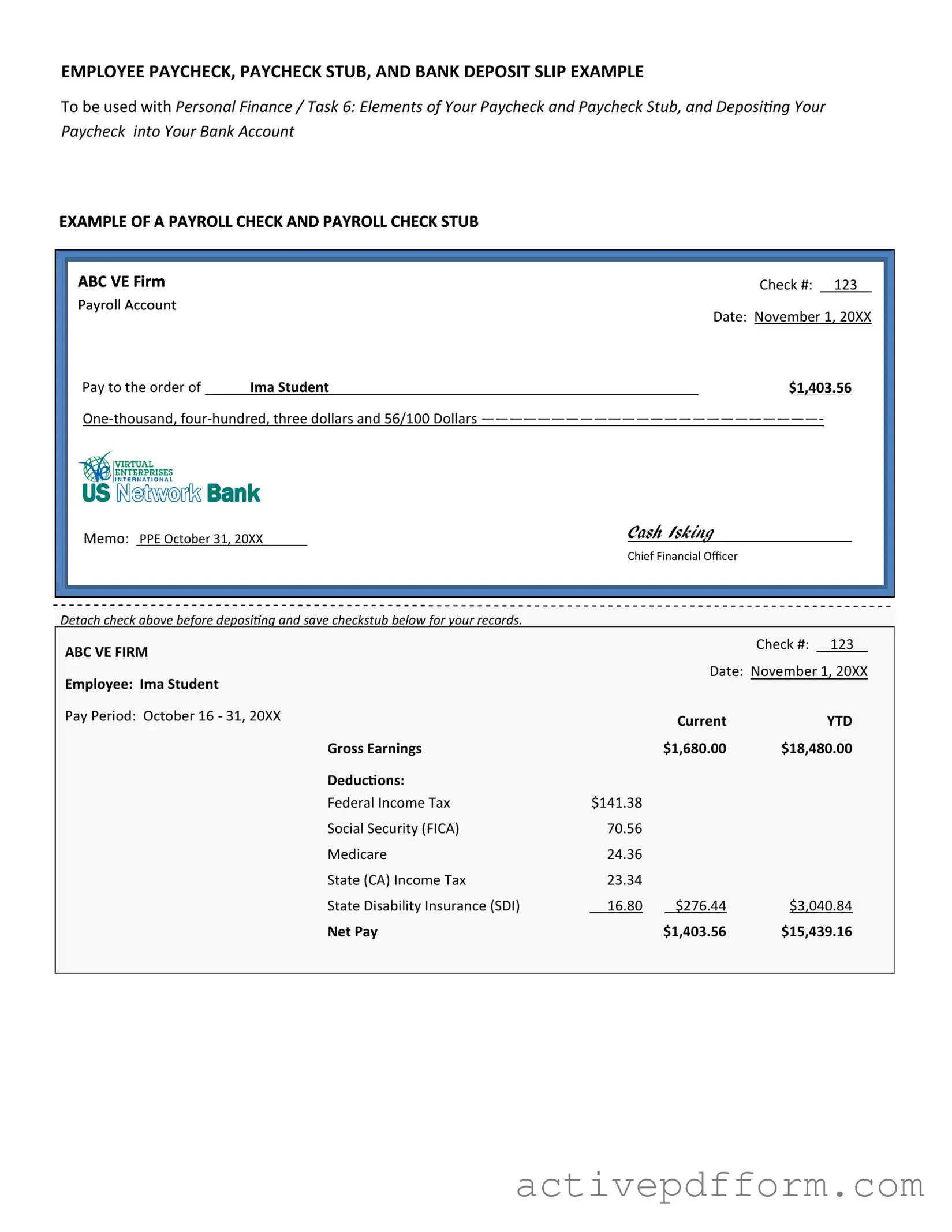

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Understanding Payroll Check

What is a Payroll Check form?

A Payroll Check form is a document used by employers to issue payments to their employees for work performed. This form typically includes essential details such as the employee's name, pay period, gross pay, deductions, and net pay. It serves as a record of payment and can be used for tax purposes as well.

How do I fill out a Payroll Check form?

To fill out a Payroll Check form, start by entering the employee's name and identification number. Next, specify the pay period for which the payment is being made. Calculate the gross pay based on hours worked or salary. Deduct any applicable taxes and other withholdings to arrive at the net pay. Finally, sign the form to authorize the payment. Ensure all information is accurate to avoid issues with payroll processing.

When should I submit the Payroll Check form?

The Payroll Check form should be submitted according to your company’s payroll schedule. Typically, this is done before the scheduled payday to ensure employees receive their payments on time. It is important to adhere to deadlines to avoid delays in processing and to maintain employee satisfaction.

What should I do if I notice an error on the Payroll Check form?

If you notice an error on the Payroll Check form, address it immediately. Contact your payroll department or the person responsible for payroll processing. They can guide you on how to correct the error. Depending on the nature of the mistake, you may need to submit a revised form or follow specific procedures to ensure the correct amount is paid.

Dos and Don'ts

When filling out the Payroll Check form, attention to detail is crucial. Here are some important guidelines to follow:

- Do double-check all personal information for accuracy, including your name, address, and Social Security number.

- Do ensure that the payment amount is correct before submitting the form.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; incomplete forms can lead to delays in processing.

- Don't use abbreviations or nicknames; always use your legal name as it appears on official documents.

Following these guidelines will help ensure a smooth payroll process and prevent potential issues. Accuracy is key when dealing with financial documents.

Check out Common Templates

Broward Animal Control - This evidence of vaccination supports community health initiatives.

The California Form REG 262, also known as the Vehicle/Vessel Transfer and Reassignment Form, is a crucial document used during the transfer of ownership for vehicles and vessels. This form must accompany the official title or an application for a duplicate title to ensure a smooth transaction. To ensure compliance with the guidelines and protect your interests, consider filling out this important form by clicking the button below or by visiting California PDF Forms.

Ppe Form - The form ultimately serves the best interests of young athletes in sports.