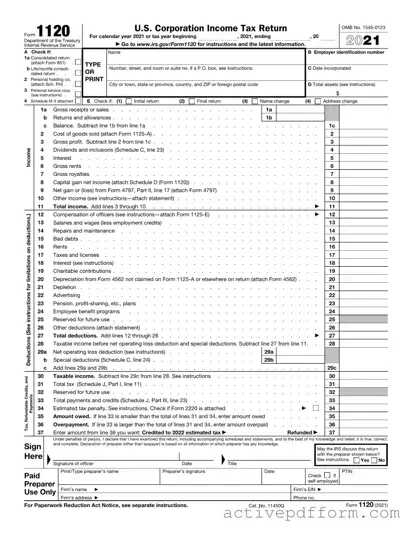

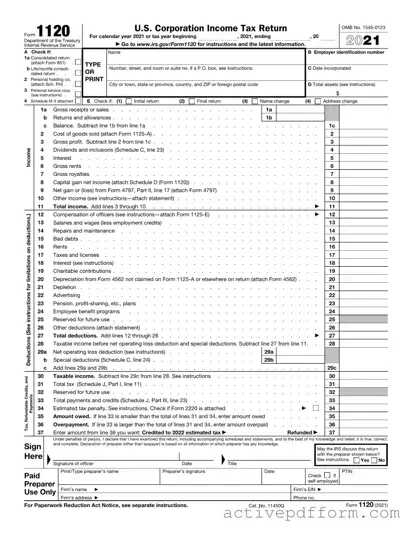

The IRS 1120 form is the U.S. Corporation Income Tax Return that corporations use to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their tax liability and ensure compliance with federal tax...

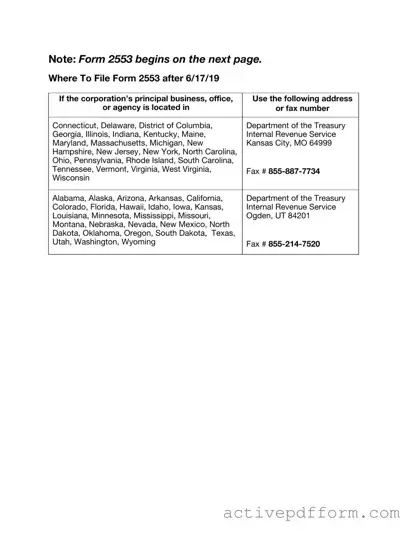

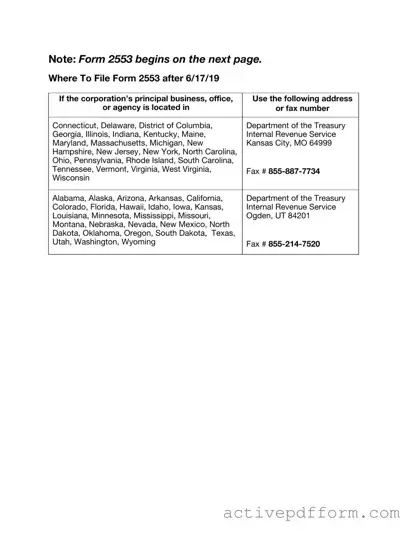

The IRS Form 2553 is a document used by small businesses to elect to be taxed as an S corporation, which can provide certain tax advantages. By filing this form, eligible corporations can avoid double taxation on their income. Understanding...

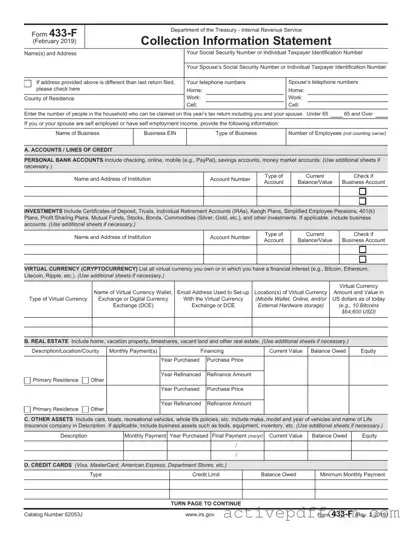

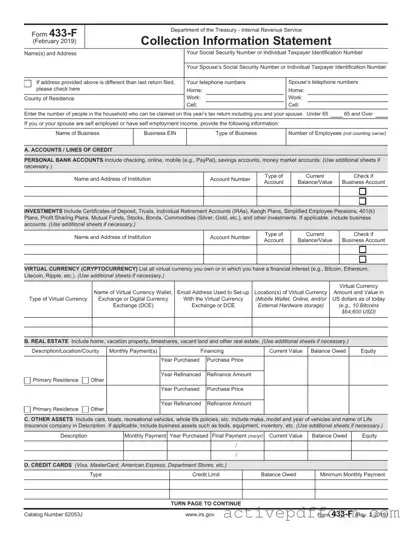

The IRS 433-F form is a financial statement used by taxpayers to provide the Internal Revenue Service with a comprehensive overview of their income, expenses, and assets. This form is often required when negotiating payment plans or settling tax debts....

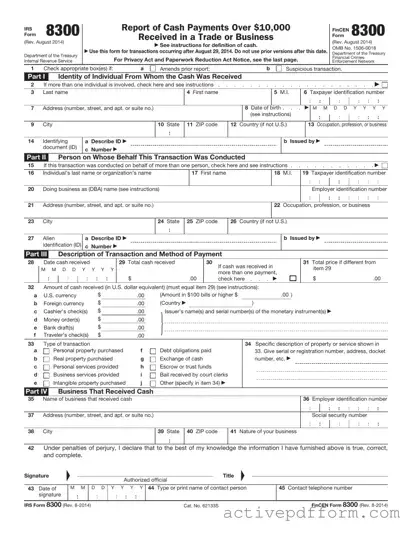

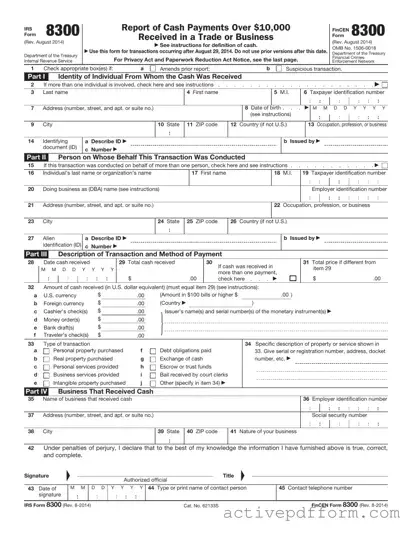

The IRS Form 8300 is a document that businesses must file to report cash payments exceeding $10,000 received in a single transaction or in related transactions. This form helps the IRS track large cash transactions and prevent money laundering and...

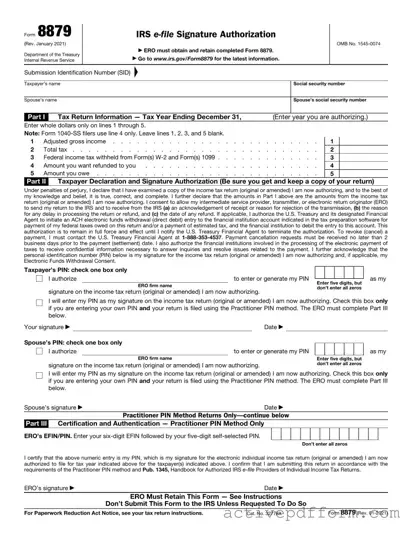

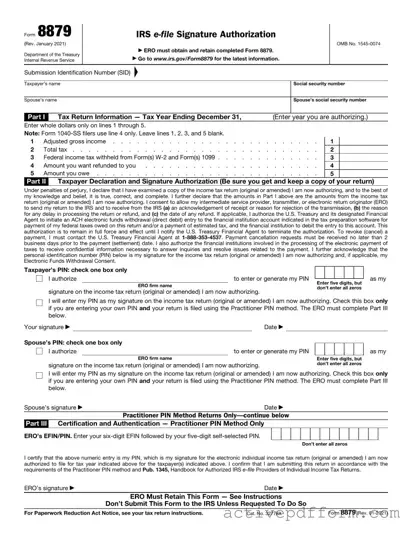

The IRS 8879 form is a crucial document that allows taxpayers to electronically sign their income tax returns. By using this form, you can ensure that your return is submitted securely and efficiently. To get started on filling out the...

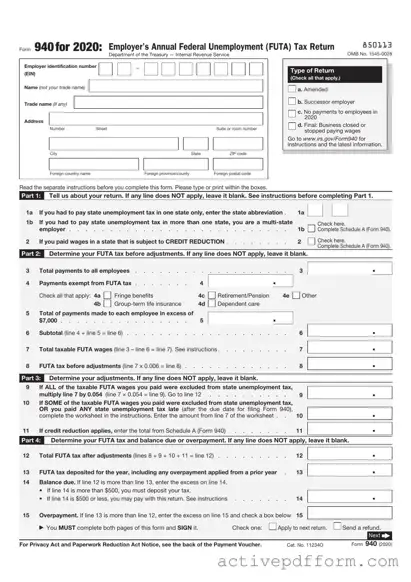

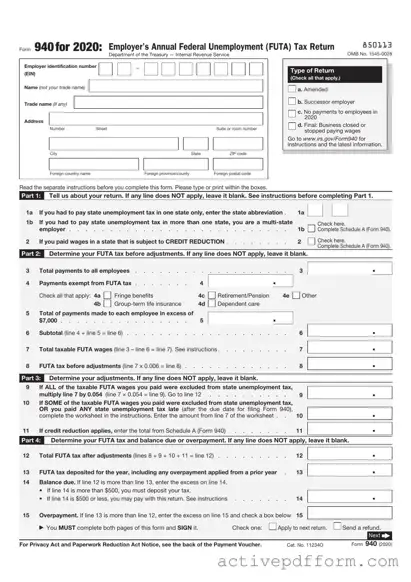

The IRS 940 form is an annual report that employers use to report their Federal Unemployment Tax Act (FUTA) liability. This form helps the IRS track unemployment taxes owed by businesses and ensures compliance with federal regulations. To learn more...

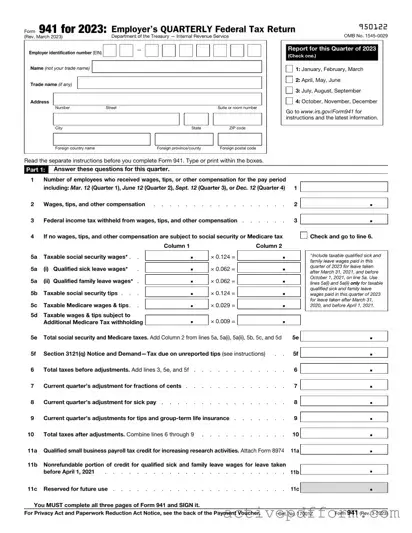

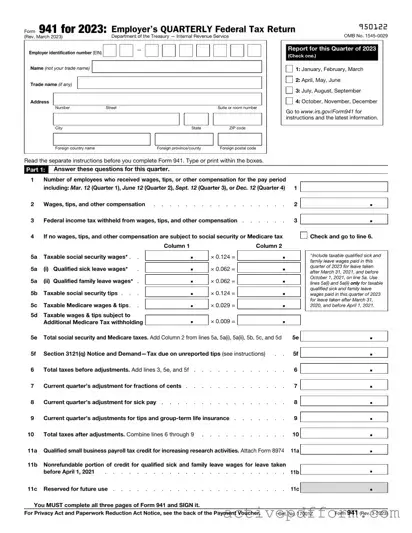

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This essential document helps the Internal Revenue Service track payroll tax liabilities and ensures...

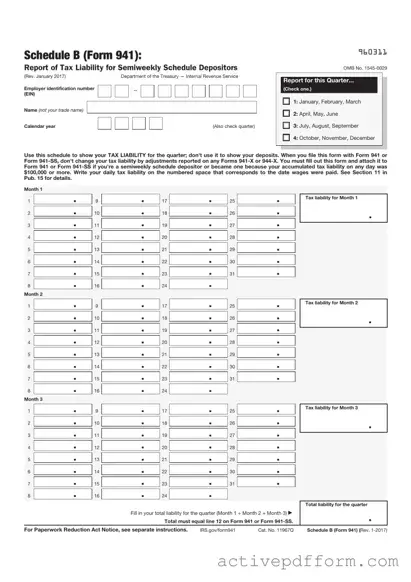

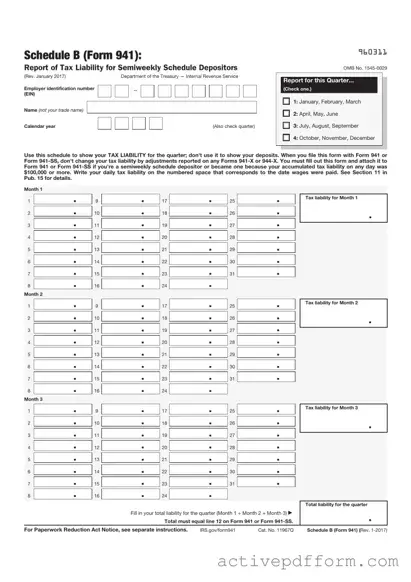

The IRS Schedule B (Form 941) is a crucial document used by employers to report their federal tax liabilities related to Social Security, Medicare, and withheld income taxes. This form provides detailed information about an employer's payroll tax obligations and...

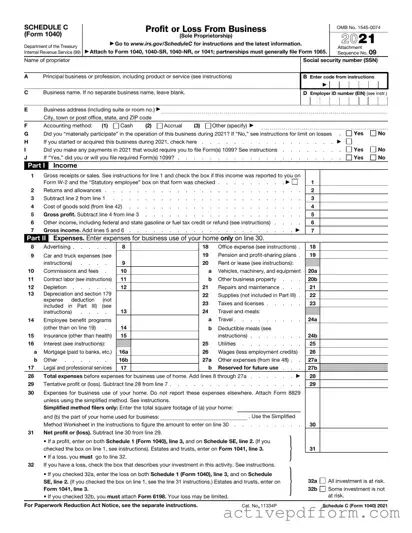

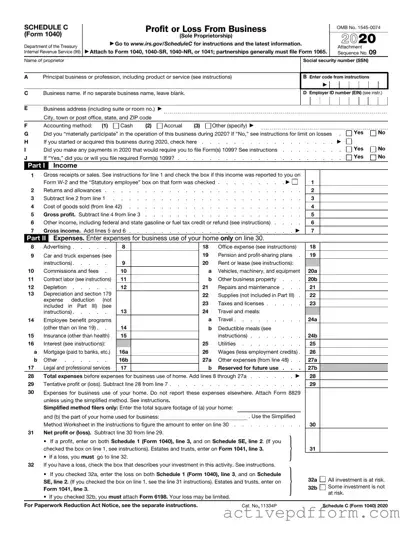

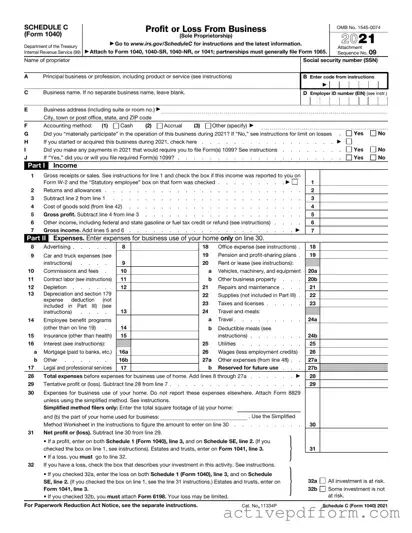

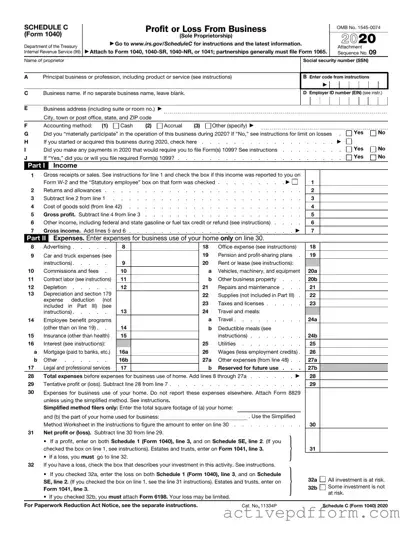

The IRS Schedule C 1040 form is a document used by sole proprietors to report income and expenses from their business activities. This form allows individuals to detail their earnings and claim deductions, ultimately determining their taxable income. Understanding how...

The IRS Schedule C 1040 form is a crucial document for self-employed individuals and sole proprietors, allowing them to report income or loss from their business activities. This form helps determine the net profit or loss that will be included...

The IRS W-2 form is a crucial document that employers use to report an employee's annual wages and the taxes withheld from their paycheck. This form provides essential information for employees when filing their income tax returns. Understanding the W-2...

The IRS W-3 form is a crucial document that serves as a summary of all W-2 forms submitted by an employer for a given tax year. It provides the Social Security Administration with essential information about employee wages and taxes...