Blank Owner Financing Contract Document

In the realm of real estate transactions, owner financing has emerged as an appealing alternative for buyers and sellers alike, especially in situations where traditional financing may not be readily available. The Owner Financing Contract form serves as a vital tool in facilitating this unique arrangement, allowing property owners to sell their homes while providing financing directly to the buyer. This form outlines essential components such as the purchase price, down payment, interest rate, and repayment schedule, ensuring that both parties have a clear understanding of their obligations. Additionally, it addresses important terms regarding default and remedies, which can protect the seller's interests while providing the buyer with a pathway to homeownership. By clearly delineating the rights and responsibilities of each party, the Owner Financing Contract not only simplifies the transaction but also fosters a sense of trust and transparency. Understanding the intricacies of this form can empower individuals to make informed decisions, paving the way for successful real estate transactions that benefit everyone involved.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller provides financing to the buyer, allowing them to purchase property without traditional bank loans. |

| Benefits | This type of financing can make it easier for buyers with poor credit to acquire property, while sellers may receive a steady income stream from interest payments. |

| Governing Laws | Each state has specific laws governing owner financing contracts. For example, in California, the California Civil Code regulates these agreements. |

| Down Payment | Typically, a down payment is required, which can vary widely based on the agreement between the buyer and seller. |

| Interest Rates | Interest rates in owner financing contracts can be negotiated, often higher than traditional mortgage rates, reflecting the risk taken by the seller. |

| Legal Considerations | It's crucial for both parties to understand their rights and obligations under the contract. Seeking legal advice can help avoid potential disputes. |

Similar forms

- Lease Purchase Agreement: This document allows a tenant to rent a property with the option to buy it later. Like owner financing, it involves a commitment to purchase the property.

- Land Contract: Also known as a contract for deed, this agreement allows the buyer to make payments directly to the seller while the seller retains the title until the full payment is made.

- Seller Financing Agreement: Similar to owner financing, this document outlines the terms under which the seller provides financing to the buyer, often including interest rates and payment schedules.

- Mortgage Agreement: This is a loan secured by real estate. The borrower agrees to repay the lender, similar to how a buyer repays the seller in owner financing.

- Promissory Note: A written promise to pay a specified amount of money to the lender. It is often used in conjunction with owner financing to outline payment terms.

- Installment Sale Agreement: This agreement allows the buyer to pay for the property in installments over time, similar to owner financing where payments are made over a period.

- Real Estate Purchase Agreement: This document outlines the terms of a sale, including price and financing, which can include owner financing as an option.

- Option to Purchase Agreement: This gives a buyer the right to purchase a property at a later date, often with specific terms, similar to owner financing arrangements.

-

Real Estate Purchase Agreement: This essential document clarifies the terms of a real estate transaction and protects the interests of both buyer and seller. For more details, you can visit PDF Forms Minnesota.

- Equity Sharing Agreement: This involves sharing the equity in a property between the owner and the buyer, similar to how owner financing can involve shared financial interests.

Owner Financing Contract Example

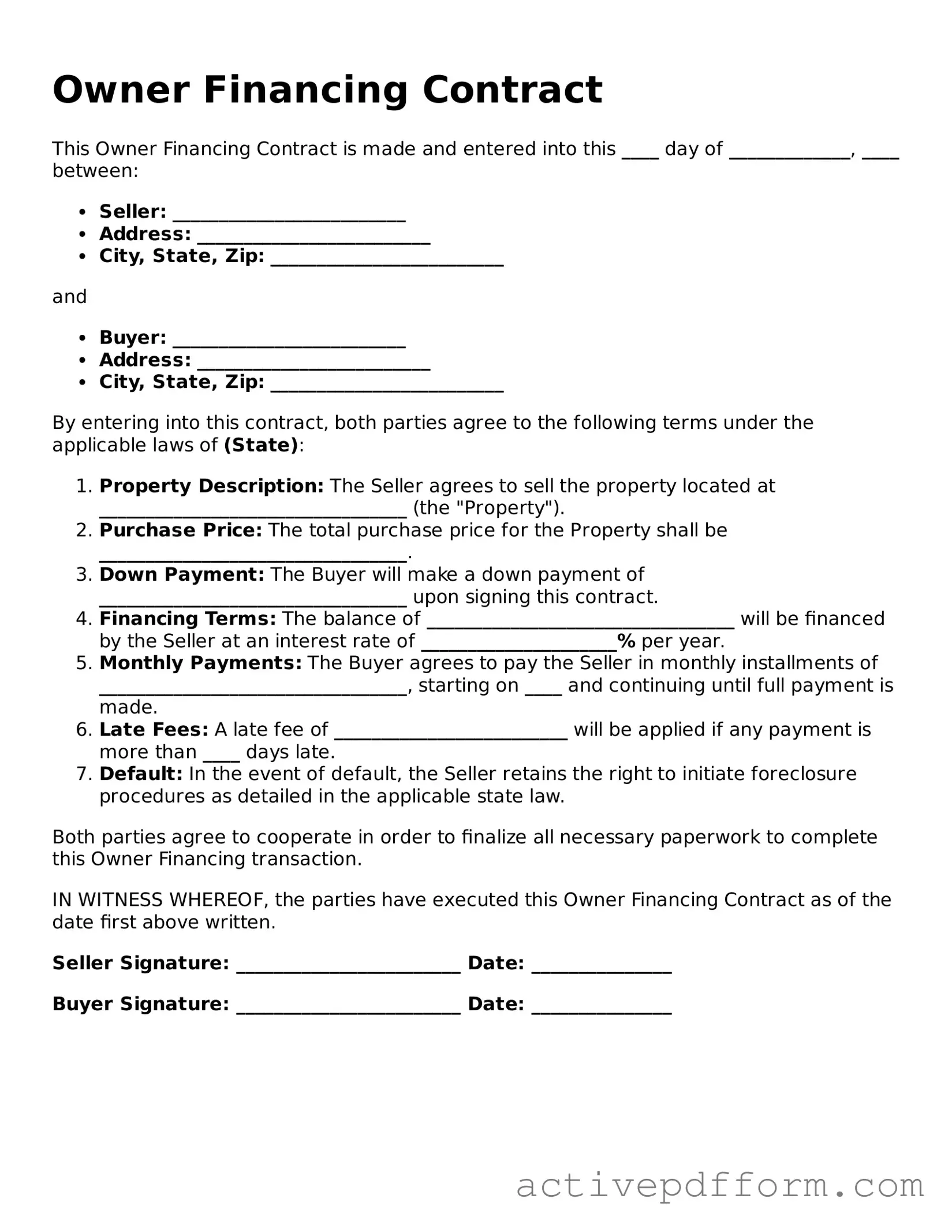

Owner Financing Contract

This Owner Financing Contract is made and entered into this ____ day of _____________, ____ between:

- Seller: _________________________

- Address: _________________________

- City, State, Zip: _________________________

and

- Buyer: _________________________

- Address: _________________________

- City, State, Zip: _________________________

By entering into this contract, both parties agree to the following terms under the applicable laws of (State):

- Property Description: The Seller agrees to sell the property located at _________________________________ (the "Property").

- Purchase Price: The total purchase price for the Property shall be _________________________________.

- Down Payment: The Buyer will make a down payment of _________________________________ upon signing this contract.

- Financing Terms: The balance of _________________________________ will be financed by the Seller at an interest rate of _____________________% per year.

- Monthly Payments: The Buyer agrees to pay the Seller in monthly installments of _________________________________, starting on ____ and continuing until full payment is made.

- Late Fees: A late fee of _________________________ will be applied if any payment is more than ____ days late.

- Default: In the event of default, the Seller retains the right to initiate foreclosure procedures as detailed in the applicable state law.

Both parties agree to cooperate in order to finalize all necessary paperwork to complete this Owner Financing transaction.

IN WITNESS WHEREOF, the parties have executed this Owner Financing Contract as of the date first above written.

Seller Signature: ________________________ Date: _______________

Buyer Signature: ________________________ Date: _______________

Understanding Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a seller and a buyer where the seller provides financing to the buyer to purchase the property. Instead of the buyer obtaining a mortgage from a bank or financial institution, the seller allows the buyer to make payments directly to them over time. This arrangement can benefit both parties by simplifying the buying process and potentially allowing for more flexible terms.

What are the advantages of using an Owner Financing Contract?

One major advantage is that it can make purchasing a home easier for buyers who may not qualify for traditional financing. Sellers can also benefit by attracting more buyers and potentially selling their property faster. Additionally, sellers may receive a steady income stream from the monthly payments, and they can negotiate terms that work best for both parties, such as interest rates and payment schedules.

Are there any risks involved with Owner Financing Contracts?

Yes, there are risks for both buyers and sellers. For buyers, if they fail to make payments, they could lose the property and any equity they have built. Sellers face the risk of the buyer defaulting on payments, which could lead to costly legal actions to reclaim the property. It is crucial for both parties to thoroughly understand the terms of the contract and consider consulting a professional before entering into an agreement.

How should an Owner Financing Contract be structured?

The contract should clearly outline the terms of the agreement, including the purchase price, down payment, interest rate, repayment schedule, and any other conditions. Both parties should agree on what happens in case of default, such as the process for foreclosure or eviction. It is essential to ensure that all terms are fair and legally enforceable. Having a real estate attorney review the contract can help protect both parties' interests.

Dos and Don'ts

When filling out the Owner Financing Contract form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do:

- Do read the entire form thoroughly before starting.

- Do ensure all parties involved are present during the signing process.

- Do provide accurate and complete information.

- Do clarify any terms or conditions you don’t understand.

- Do consult with a real estate professional if needed.

- Don’t rush through the form; take your time to ensure accuracy.

- Don’t leave any blank spaces unless instructed.

- Don’t sign the document without reading it in full.

- Don’t ignore any local laws or regulations related to owner financing.

- Don’t forget to keep a copy of the completed form for your records.

Consider More Types of Owner Financing Contract Templates

Purchase Agreement Addendum - A document used to modify terms of a purchase agreement.

Contract Cancellation Letter Pdf - It can also be used to document timelines and conditions related to the termination of the agreement.

The Colorado Real Estate Purchase Agreement can be an invaluable asset for buyers and sellers. For those looking to understand this essential document, a thorough examination of the critical components of the Real Estate Purchase Agreement is recommended to ensure all parties are well-informed throughout the transaction process.

What Is a Personal Guarantee - A personal guarantee can facilitate faster approval of business loans.