Free Netspend Dispute Template

When you find yourself facing unauthorized transactions on your Netspend card, the Dispute Notification Form serves as an essential tool to help you resolve the issue. This form must be filled out and submitted to Netspend promptly, ideally within 60 days of the disputed transaction. By completing this form, you initiate a process that allows Netspend to review your claim and potentially credit the disputed funds back to your card within 10 business days. To strengthen your case, it is advisable to include any supporting documentation, such as receipts or correspondence with the merchant involved. If your card has been lost or stolen, it is crucial to indicate this on the form, as it may affect your liability for unauthorized transactions. Additionally, you should take immediate steps to secure your account, such as resetting your PIN and filing a police report. The form requires you to provide your personal information, details of the disputed transactions, and a narrative explaining the circumstances surrounding the issue. This comprehensive approach not only aids in the investigation but also helps protect your financial interests.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to report unauthorized credit or debit transactions on a NetSpend card. |

| Submission Deadline | The completed form must be submitted within 60 days from the date of the disputed transaction. |

| Response Time | NetSpend will make a decision regarding the disputed funds within 10 business days after receiving the form. |

| Liability Notice | If the card was lost or stolen, cardholders may be liable for unauthorized transactions unless they report it promptly. |

| Supporting Documentation | Providing additional documentation, such as receipts or police reports, can help with the dispute process. |

| State-Specific Laws | Applicable laws vary by state. For example, California's Consumer Credit Reporting Agencies Act may apply. |

Similar forms

- Fraud Report Form: Similar to the Netspend Dispute form, a Fraud Report Form is used to report unauthorized transactions. Both require details about the transaction and the cardholder’s information, ensuring a thorough investigation.

- Chargeback Request Form: This document is filed with a bank or credit card issuer to dispute a charge. Like the Netspend Dispute form, it requires information about the transaction and any supporting documentation to support the claim.

- Identity Theft Report: This form is used when someone’s personal information is stolen and misused. Both forms focus on unauthorized use of financial accounts, requiring detailed descriptions of the incidents.

- NYC Payroll Form: This essential document is necessary for contractors and subcontractors to report weekly payroll information, ensuring compliance with labor laws. For more information, visit nytemplates.com/blank-nyc-payroll-template.

- Consumer Complaint Form: This document is submitted to consumer protection agencies to address grievances. Similar to the Netspend Dispute form, it collects specific details about the issue and the consumer’s experience.

- Credit Card Dispute Form: Issued by credit card companies, this form allows users to dispute charges. Both forms share a similar structure, asking for transaction details and the cardholder’s contact information.

- Bank Statement Dispute Form: Used to challenge discrepancies in bank statements, this form resembles the Netspend Dispute form in its request for transaction specifics and supporting documents.

- Unauthorized Transaction Report: This document is specifically for reporting transactions that were not authorized by the account holder. It mirrors the Netspend Dispute form in terms of required information and the urgency of submission.

- Lost or Stolen Card Report: This form is used to notify a bank or card issuer that a card has been lost or stolen. Similar to the Netspend Dispute form, it emphasizes the need for prompt action and includes a section for detailing the circumstances.

Netspend Dispute Example

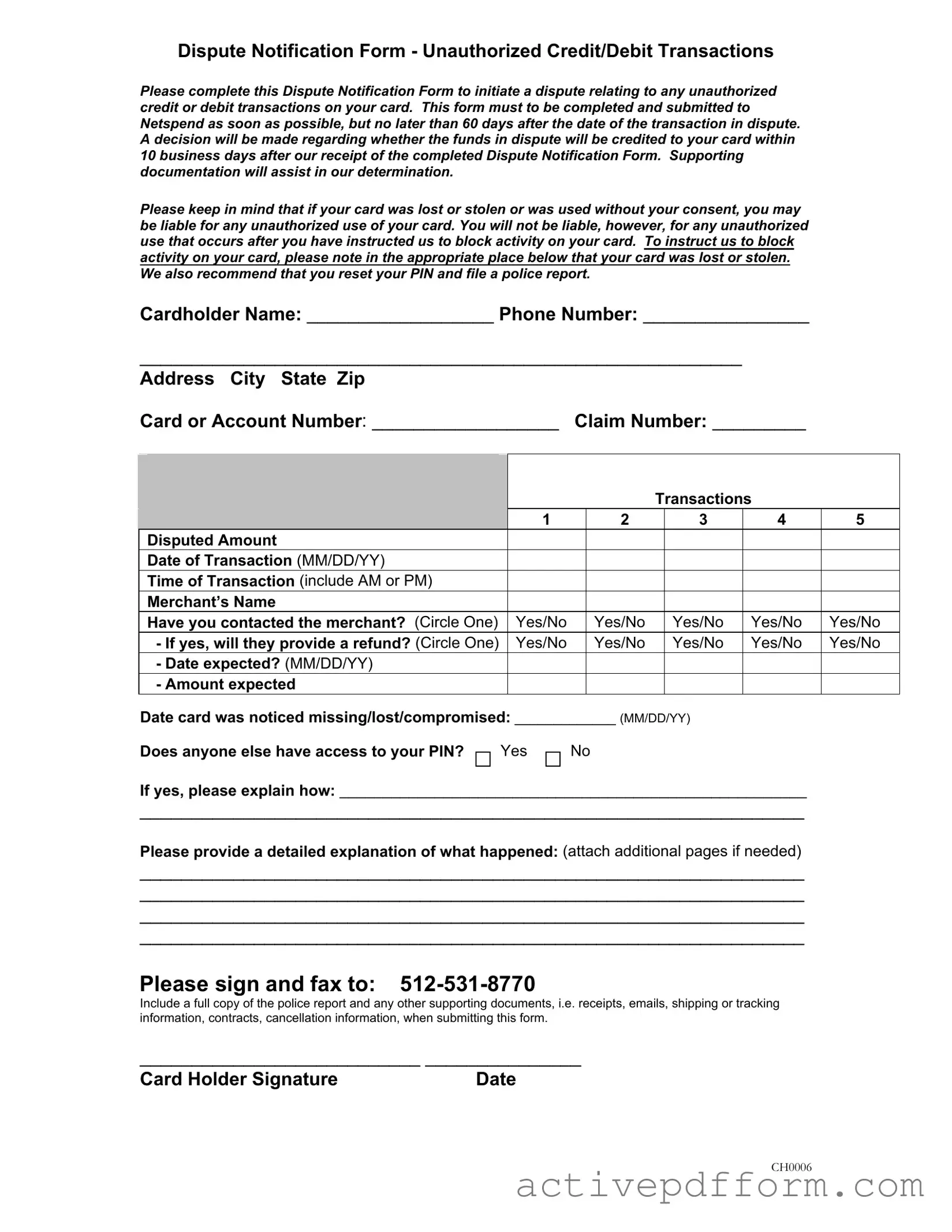

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Understanding Netspend Dispute

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form is designed to help cardholders report unauthorized credit or debit transactions on their cards. By completing this form, you initiate a formal dispute process, allowing Netspend to investigate the transactions in question and determine if you are eligible for a refund.

How soon should I submit the Dispute Notification Form?

You must submit the Dispute Notification Form as soon as possible, but it should be done no later than 60 days after the date of the transaction you are disputing. Timely submission is crucial to ensure your dispute is processed correctly and efficiently.

What happens after I submit the form?

Once you submit the completed Dispute Notification Form, Netspend will review your claim. A decision regarding whether the disputed funds will be credited back to your card will typically be made within 10 business days after they receive your form. Providing supporting documentation can help expedite this process.

What kind of documentation should I include with my form?

To strengthen your dispute, include any relevant supporting documents. This may consist of receipts, emails, shipping or tracking information, and a full copy of the police report if your card was lost or stolen. These documents can provide additional context and evidence for your claim.

Am I liable for unauthorized transactions?

Liability for unauthorized transactions can vary. If your card was lost or stolen, or if it was used without your consent, you may be liable for unauthorized use. However, you will not be held responsible for any transactions that occur after you have notified Netspend to block your card. It’s essential to report any loss or theft promptly.

What should I do if my card is lost or stolen?

If your card is lost or stolen, you should indicate this on the Dispute Notification Form. Additionally, it is advisable to reset your PIN and file a police report. Taking these steps helps protect your account and can assist in the investigation of unauthorized transactions.

Can I dispute multiple transactions on one form?

Yes, you can dispute up to five transactions on a single Dispute Notification Form. For each transaction, you will need to provide specific details, including the disputed amount, date and time of the transaction, and the merchant's name. This allows for a more streamlined process in handling your disputes.

What if I have more than five transactions to dispute?

If you have more than five transactions to dispute, you will need to submit additional Dispute Notification Forms. Each form can address up to five transactions, so simply fill out separate forms for any additional disputes you wish to report.

Dos and Don'ts

When filling out the Netspend Dispute form, it’s important to be thorough and accurate. Here are five things you should and shouldn't do to ensure your dispute is processed smoothly.

- Do submit the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do provide all required information, including your name, contact details, and transaction specifics.

- Do include supporting documentation, such as receipts or police reports, to strengthen your case.

- Do clearly explain the situation in detail, as this helps in understanding your dispute.

- Do keep a copy of the completed form and all documents for your records.

- Don't wait too long to submit your dispute; delays can affect your eligibility for a refund.

- Don't omit any details about the transactions you are disputing; incomplete information can lead to delays.

- Don't forget to indicate if your card was lost or stolen, as this is crucial for blocking unauthorized activity.

- Don't provide false information; this can jeopardize your claim and lead to further complications.

- Don't assume that your dispute will be resolved without follow-up; keep track of your claim status.

Check out Common Templates

Can You Change Your Address at Any Post Office - This form allows users to request specific delivery notifications.

To effectively navigate the complexities of the legal landscape in California, it is crucial to utilize the appropriate documentation, such as the standardized California Judicial Council form. This form not only brings structure to the process but also aligns with the state’s requirements for court filings. For those looking to fill out these necessary documents, accessing California PDF Forms can help initiate the journey toward legal clarity and compliance.

Place of Birth Passport Application - A recent passport photo is necessary and must meet specific size guidelines.

Flying Internationally With Dog - Microchip or tattoo numbers should be provided if your pet has them, enhancing traceability.