Free Mortgage Statement Template

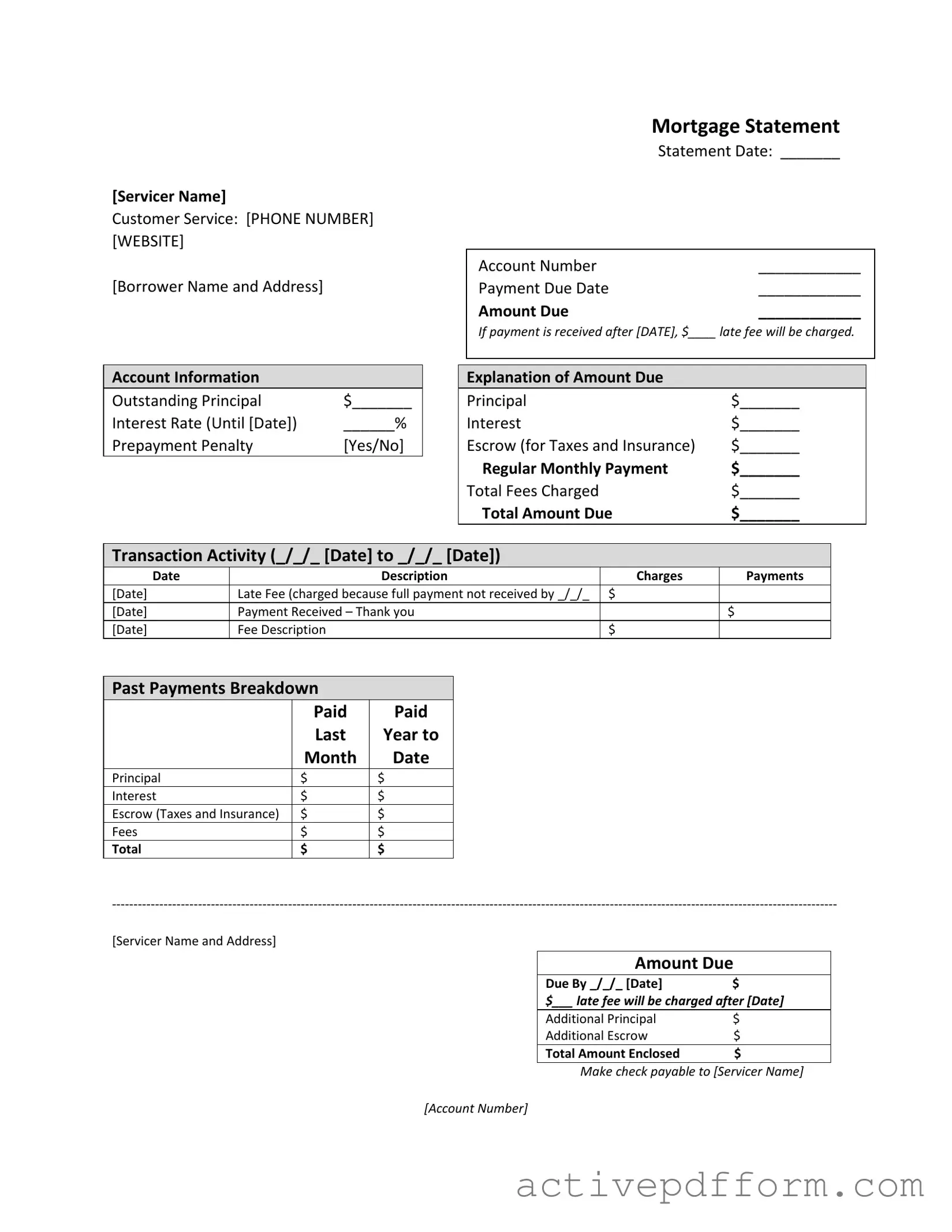

The Mortgage Statement form serves as a critical document for borrowers, providing essential information regarding their mortgage account. It includes the servicer's contact details, such as the customer service phone number and website, ensuring that borrowers can easily seek assistance. Key components of the form include the statement date, account number, payment due date, and the total amount due, which highlights the financial obligations of the borrower. Notably, the form specifies any late fees that may be incurred if payments are not made by the designated due date. Additionally, the account information section breaks down the outstanding principal, interest rate, and any applicable prepayment penalties, giving borrowers a clear view of their financial standing. The explanation of the amount due further details the principal, interest, escrow for taxes and insurance, and total fees charged, allowing borrowers to understand how their payments are allocated. Transaction activity is documented over a specified period, detailing charges, payments received, and any late fees incurred, which aids in tracking payment history. The form also includes important messages regarding partial payments and delinquency notices, emphasizing the potential consequences of late payments. For those experiencing financial difficulties, the form directs borrowers to resources for mortgage counseling or assistance, underscoring the importance of addressing any challenges promptly.

Document Specifics

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for inquiries. |

| Payment Details | It specifies the payment due date, amount due, and any late fees applicable if payment is not received on time. |

| Account Information | This section outlines the outstanding principal, interest rate, and whether a prepayment penalty applies. |

| Delinquency Notice | The statement includes a notice about delinquency, detailing the number of days late and potential consequences of non-payment. |

Similar forms

- Billing Statement: A billing statement provides a summary of charges and payments for a specific period. Similar to a mortgage statement, it outlines amounts due, payment history, and any fees incurred. Both documents inform the recipient of outstanding balances and payment deadlines.

- NYC Payroll Form: The NYC Payroll Form is essential for contractors and subcontractors to report weekly payroll information for employees working on public projects. It ensures compliance with payroll notification requirements set by the Department of Labor's Bureau of Public Work, affirming that all wages have been paid correctly and adhere to applicable labor laws. For more details, visit https://nytemplates.com/blank-nyc-payroll-template/.

- Loan Statement: A loan statement details the current status of a loan, including the principal balance, interest rate, and payment history. Like a mortgage statement, it also specifies the due date for the next payment and any applicable fees, helping borrowers track their obligations.

- Account Statement: An account statement summarizes all transactions in an account over a defined period. Similar to a mortgage statement, it provides insights into payments made, fees charged, and the remaining balance, ensuring that account holders are aware of their financial standing.

- Property Tax Statement: A property tax statement outlines the taxes owed on a property, including due dates and amounts. Like a mortgage statement, it informs property owners of their financial responsibilities and potential penalties for late payment, emphasizing the importance of timely payment to avoid additional fees.

- Credit Card Statement: A credit card statement lists all transactions made on a credit card during a billing cycle. It includes the total amount due, minimum payment required, and payment due date. Similar to a mortgage statement, it helps individuals manage their debt and avoid late fees by providing clear payment information.

Mortgage Statement Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Understanding Mortgage Statement

What is a Mortgage Statement?

A mortgage statement is a document provided by your mortgage servicer that outlines the details of your mortgage account. It includes important information such as your outstanding balance, payment due date, interest rate, and any fees that may apply. This statement helps you keep track of your mortgage payments and understand your financial obligations.

How often will I receive my Mortgage Statement?

Typically, mortgage statements are sent out monthly. However, some servicers may provide statements quarterly or annually, depending on your loan agreement. It’s important to check with your servicer for their specific schedule and to ensure you’re aware of your payment obligations.

What does the "Amount Due" section mean?

The "Amount Due" section of your mortgage statement indicates the total amount you need to pay by the due date to keep your account in good standing. This amount often includes principal, interest, escrow for taxes and insurance, and any additional fees. Paying this amount on time helps you avoid late fees and potential negative impacts on your credit score.

What are late fees and when are they charged?

Late fees are charges that may be applied if your payment is not received by the due date. Your mortgage statement will specify the amount of the late fee and the date after which it will be charged. To avoid these fees, it’s essential to make your payments on time.

What is the "Transaction Activity" section?

The "Transaction Activity" section provides a detailed history of your recent payments and charges. It includes dates, descriptions of transactions, and amounts charged or paid. This transparency helps you track your payments and understand any changes to your account.

What should I do if I can't make my mortgage payment?

If you're experiencing financial difficulty and cannot make your mortgage payment, it’s crucial to reach out to your mortgage servicer as soon as possible. They may offer options such as loan modification, repayment plans, or mortgage counseling to help you manage your situation and avoid foreclosure.

What is a prepayment penalty?

A prepayment penalty is a fee charged by some lenders if you pay off your mortgage early. Not all mortgages have this fee, so it’s important to check your mortgage statement for details. Understanding whether you have a prepayment penalty can help you make informed decisions about paying off your loan early.

How can I contact my mortgage servicer for questions?

Your mortgage statement includes contact information for your servicer, such as a customer service phone number and website. If you have questions or need assistance, don’t hesitate to reach out to them. They are there to help you understand your mortgage and address any concerns you may have.

Dos and Don'ts

When filling out the Mortgage Statement form, it’s essential to be thorough and accurate. Here’s a list of things you should and shouldn’t do:

- Do double-check your account number to ensure it matches your mortgage records.

- Do clearly write your name and address as it appears on your mortgage documents.

- Do note the payment due date and amount due to avoid late fees.

- Do include any additional payments you want to make towards principal or escrow.

- Do keep a copy of the completed form for your records.

- Don’t leave any fields blank; incomplete forms can lead to processing delays.

- Don’t ignore the delinquency notice if applicable; take action to avoid foreclosure.

- Don’t forget to sign and date the form before submitting it.

- Don’t use nicknames or abbreviations for your name or address; this can cause confusion.

By following these guidelines, you can help ensure that your mortgage statement is processed smoothly and accurately.

Check out Common Templates

Chick Fil a Workers - Learn valuable skills that will benefit you in your career.

In navigating the complexities of the legal system, familiarity with the California Judicial Council form can prove invaluable for individuals and attorneys alike. This standardized document, designed to facilitate legal proceedings, helps maintain consistency in various court filings. To ensure you have the most effective tools at your disposal, you can easily access the necessary paperwork through California PDF Forms, making your journey through the court system smoother and more efficient.

Va Form 10-2850c - The VA 10-2850c may require updates if the applicant's situation changes after submission.