Blank Mortgage Lien Release Document

When a mortgage is paid off, it is crucial to formally release the lien that the lender held on the property. The Mortgage Lien Release form serves as the official document that signifies the lender’s relinquishment of their claim. This form is essential for homeowners who wish to clear their title and ensure that their property is free from any encumbrances. Typically, the document includes vital information such as the names of the borrower and lender, the property address, and details about the original mortgage. Once executed, the form must be recorded with the appropriate local government office to provide public notice that the mortgage has been satisfied. Understanding the importance of this form is vital for homeowners, as it not only protects their ownership rights but also facilitates the process of selling or refinancing the property in the future. Failing to file this release can lead to complications down the road, making it imperative to address this matter promptly and correctly.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a document that officially removes a mortgage lien from a property once the debt has been paid in full. |

| Purpose | The primary purpose is to provide clear evidence that the borrower has fulfilled their obligations, allowing them to sell or refinance the property without encumbrances. |

| Governing Law | In the United States, the laws governing mortgage lien releases vary by state, often outlined in state-specific real estate or property laws. |

| Signature Requirement | The form typically requires the signatures of the lender and the borrower, affirming that the mortgage has been satisfied. |

| Filing Process | Once completed, the form must be filed with the appropriate county recorder's office to ensure public record reflects the release. |

| Timeframe | The timeframe for processing a lien release can vary, but it is generally completed within a few weeks after submission. |

| Importance of Record Keeping | It is crucial for homeowners to keep a copy of the lien release for their records, as it serves as proof of the mortgage satisfaction. |

| Potential Fees | Some jurisdictions may impose a fee for filing the lien release, which can vary based on local regulations. |

Similar forms

Deed of Reconveyance: This document is similar to a Mortgage Lien Release as it serves to transfer the title back to the borrower once the loan is paid off. It effectively clears the lender's claim on the property, just like a lien release.

Quitclaim Deed: A Quitclaim Deed is often used to transfer ownership of property without warranties. While it does not specifically release a lien, it can eliminate claims by transferring interest in the property, similar to how a lien release clears encumbrances.

Certificate of Satisfaction: This document confirms that a mortgage has been fully paid and satisfied. Like a Mortgage Lien Release, it serves to notify public records that the borrower has fulfilled their obligation, thus removing the lender's interest.

Release of Judgment Lien: When a judgment is satisfied, a Release of Judgment Lien is filed to remove the lien from public records. This document parallels a Mortgage Lien Release in that both serve to eliminate encumbrances on a property.

- Release of Liability: This legally binding document ensures that one party cannot hold another liable for risks associated with an activity. It is essential for events with inherent risks, allowing participants to acknowledge and accept those risks; more information can be found at UsaLawDocs.com.

Affidavit of Release: This document is used to confirm that a debt has been settled. Similar to a Mortgage Lien Release, it provides evidence that the lender has relinquished their claim, ensuring that the property is free from liens.

Mortgage Lien Release Example

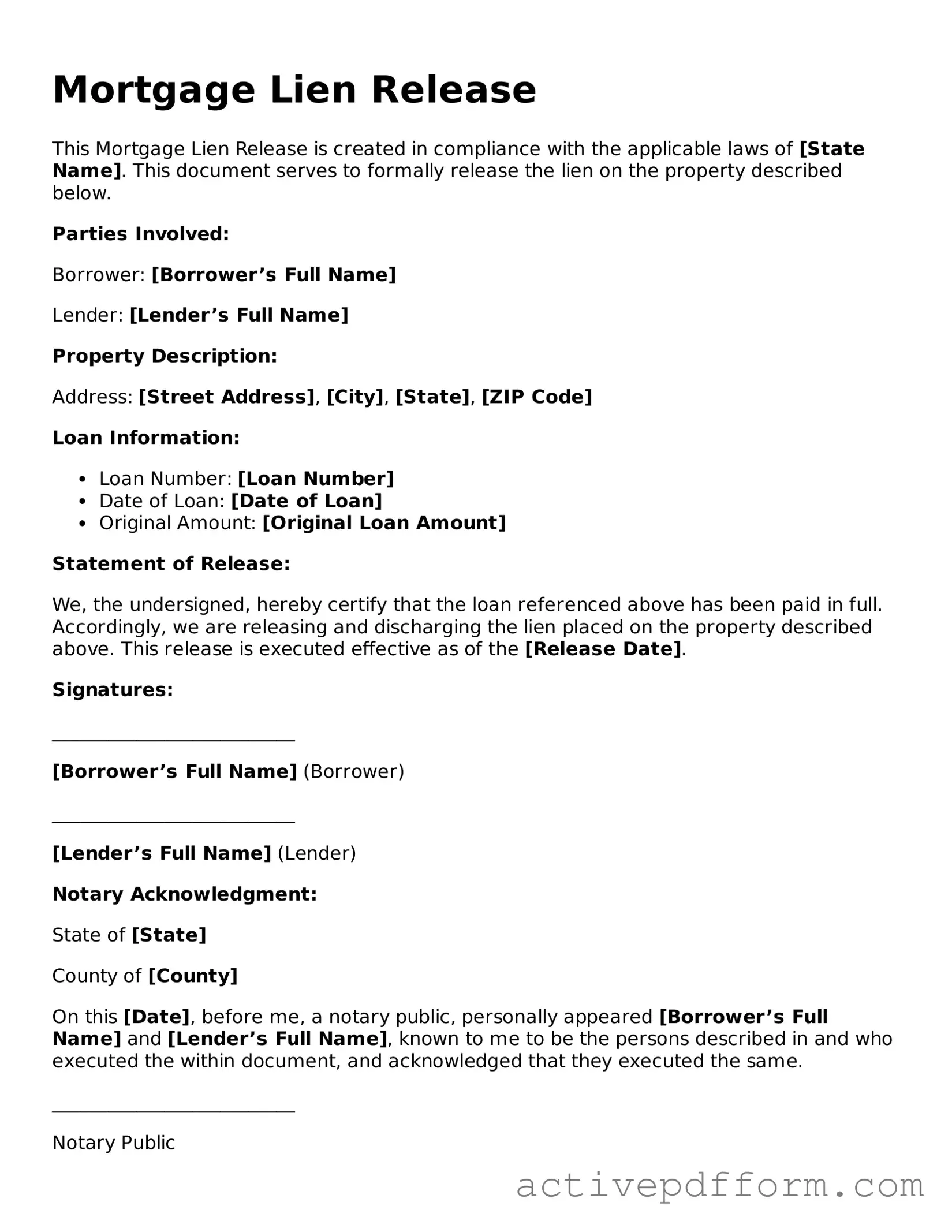

Mortgage Lien Release

This Mortgage Lien Release is created in compliance with the applicable laws of [State Name]. This document serves to formally release the lien on the property described below.

Parties Involved:

Borrower: [Borrower’s Full Name]

Lender: [Lender’s Full Name]

Property Description:

Address: [Street Address], [City], [State], [ZIP Code]

Loan Information:

- Loan Number: [Loan Number]

- Date of Loan: [Date of Loan]

- Original Amount: [Original Loan Amount]

Statement of Release:

We, the undersigned, hereby certify that the loan referenced above has been paid in full. Accordingly, we are releasing and discharging the lien placed on the property described above. This release is executed effective as of the [Release Date].

Signatures:

__________________________

[Borrower’s Full Name] (Borrower)

__________________________

[Lender’s Full Name] (Lender)

Notary Acknowledgment:

State of [State]

County of [County]

On this [Date], before me, a notary public, personally appeared [Borrower’s Full Name] and [Lender’s Full Name], known to me to be the persons described in and who executed the within document, and acknowledged that they executed the same.

__________________________

Notary Public

My Commission Expires: [Expiration Date]

Understanding Mortgage Lien Release

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a legal document that signifies the removal of a lien from a property. When a borrower pays off their mortgage, this form is filed to officially release the lender's claim to the property. This is crucial for homeowners, as it clears the title and allows them to sell or refinance the property without any encumbrances from the previous mortgage.

Why is it important to obtain a Mortgage Lien Release?

Obtaining a Mortgage Lien Release is essential for several reasons. First, it protects your ownership rights. Without this release, the lender may still have a claim on your property, which can complicate future transactions. Second, it ensures that your property title is clear, making it easier to sell or refinance. Lastly, it provides peace of mind, confirming that you have fulfilled your financial obligations to the lender.

How do I obtain a Mortgage Lien Release?

To obtain a Mortgage Lien Release, you typically need to follow a few steps. First, ensure that your mortgage is fully paid off. After payment, request the release from your lender. Most lenders will provide this document automatically, but it’s wise to follow up. Once you receive it, review the document for accuracy and then file it with your local county recorder’s office to make it part of the public record.

What happens if my lender does not provide a Mortgage Lien Release?

If your lender fails to provide a Mortgage Lien Release after you have paid off your mortgage, you should take action. Start by contacting them to inquire about the status of your release. If they are unresponsive or deny your request, consider sending a formal written request. If that still doesn’t resolve the issue, you may need to consult a legal professional to explore your options, which might include filing a complaint with a regulatory agency or pursuing legal action.

Can I sell my home without a Mortgage Lien Release?

Selling a home without a Mortgage Lien Release can be challenging. If there is still a lien on the property, the lender retains a claim, which can hinder the sale. Buyers typically want a clear title, so it’s advisable to obtain the release before attempting to sell. If you find yourself in this situation, consult with a real estate professional to navigate the process effectively.

Is there a fee associated with filing a Mortgage Lien Release?

Yes, there may be a fee associated with filing a Mortgage Lien Release, but it varies by location. Some counties charge a nominal fee for recording the document, while others might not. It’s a good idea to check with your local recorder’s office for specific fees and requirements. Remember, this small cost can save you from potential complications in the future.

Dos and Don'ts

When filling out a Mortgage Lien Release form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn’t do:

- Do double-check the accuracy of all information provided.

- Don't rush through the form; take your time to avoid mistakes.

- Do sign and date the form in the appropriate sections.

- Don't forget to include any required supporting documents.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill in all necessary fields.

- Do consult a legal advisor if you have questions about the form.

- Don't submit the form without reviewing it one last time.

Consider More Types of Mortgage Lien Release Templates

Music Release Form - Captures critical information about the music being released.

Before participating in any event or activity, it's essential to understand the importance of a legal agreement, such as the California Release of Liability form, which ensures that both participants and organizers are protected from potential legal issues. By signing the form, individuals acknowledge the inherent risks and agree not to pursue claims for injuries or damages, thereby fostering a safer environment. To learn more about this critical document, visit https://californiapdfforms.com/release-of-liability-form and secure your interests today.