Free Louisiana act of donation Template

The Louisiana Act of Donation form serves as a vital legal document that facilitates the transfer of property from one individual to another, often without the exchange of monetary compensation. This form is particularly significant in the context of familial relationships, allowing individuals to gift assets such as real estate or personal property to relatives or loved ones. Essential elements of the form include the identification of the donor and the recipient, a detailed description of the property being donated, and the explicit intention of the donor to make a gift. Additionally, the form may require the inclusion of witnesses or notarization to ensure its validity and enforceability under Louisiana law. Understanding the implications of this form is crucial for both donors and recipients, as it outlines the rights and responsibilities associated with the donation, thereby promoting transparency and reducing potential disputes in the future. By clearly documenting the transfer of ownership, the Act of Donation form plays an essential role in estate planning and the management of personal assets.

Document Specifics

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1469 to 1473. |

| Requirements | Both the donor and the donee must sign the form, and it should be notarized to be legally binding. |

| Types of Donations | Donations can include movable property, immovable property, or both, depending on the donor's intent. |

Similar forms

The Louisiana act of donation form is a unique legal document used to transfer ownership of property or assets without consideration, often as a gift. However, it shares similarities with several other documents. Here are four documents that are comparable to the act of donation form:

- Gift Deed: A gift deed is a legal document that facilitates the transfer of property ownership from one person to another without any exchange of money. Like the act of donation, it requires the intent to give and acceptance by the recipient.

- Durable Power of Attorney: To ensure your interests are protected, consider our helpful Durable Power of Attorney resources that guide you through the process of appointing a decision-maker during incapacity.

- Will: A will outlines how a person's assets will be distributed upon their death. Both documents involve the transfer of property, but a will takes effect after death, while the act of donation is immediate.

- Trust Agreement: A trust agreement allows a person to place assets into a trust for the benefit of another party. Similar to the act of donation, it can involve transferring property without immediate compensation, though it often includes specific terms and conditions.

- Power of Attorney: A power of attorney grants one person the authority to act on behalf of another in legal or financial matters. While it doesn't transfer ownership like the act of donation, it does empower someone to manage assets, often in a way that benefits the principal.

Understanding these documents can help individuals navigate the complexities of property transfer and ensure that their intentions are clearly expressed and legally recognized.

Louisiana act of donation Example

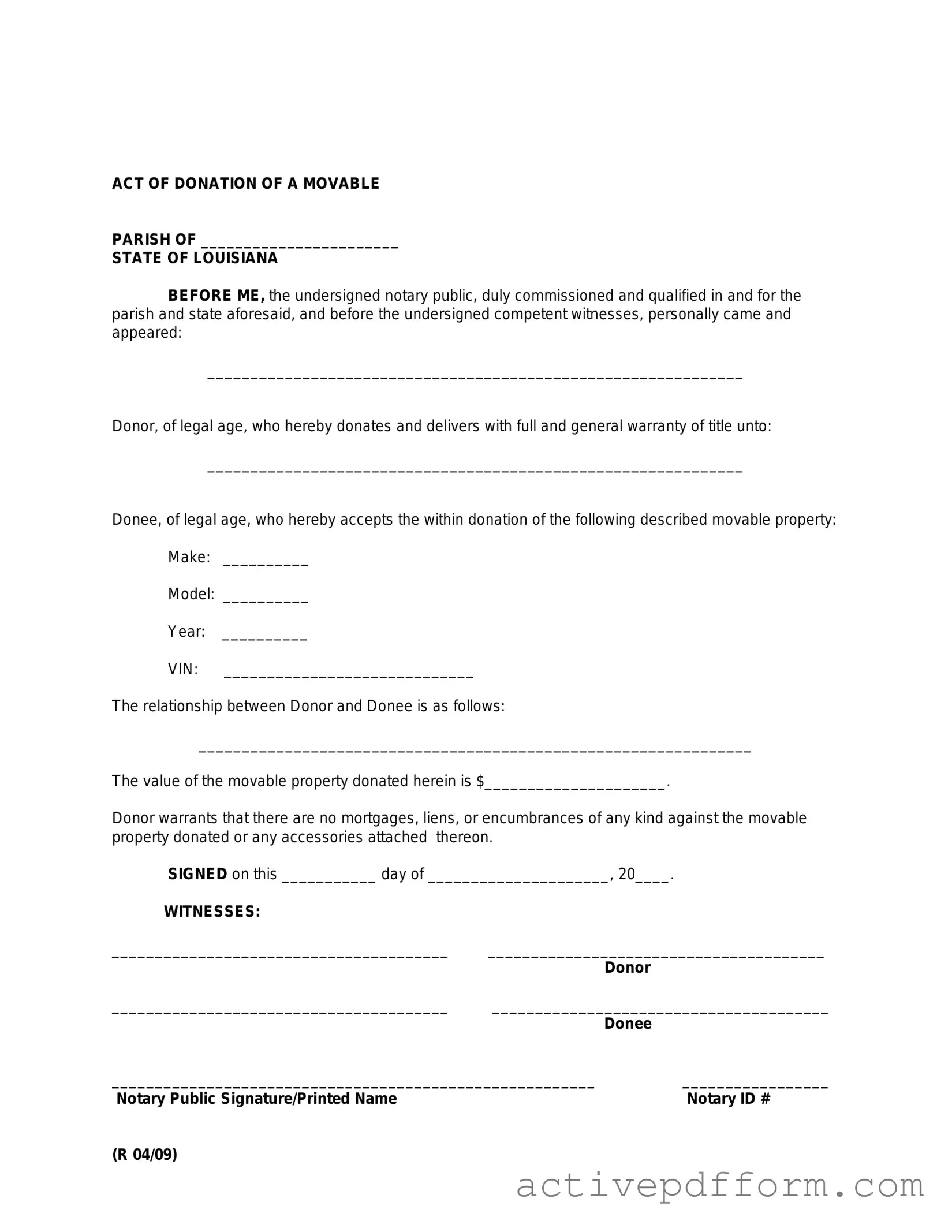

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Understanding Louisiana act of donation

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property from one individual to another without any exchange of money. This form is often used for gifts of real estate, personal property, or other assets. It serves as a formal declaration of the donor's intent to give and the recipient's acceptance of the gift. The form must be properly executed to be legally binding, ensuring that both parties understand the terms of the donation.

Who can use the Louisiana Act of Donation Form?

Any individual who wishes to donate property can use the Louisiana Act of Donation Form. This includes family members, friends, or even organizations. However, it is important to note that the donor must have legal ownership of the property being donated. Additionally, the recipient must be capable of accepting the gift, which typically means they are of legal age and have the mental capacity to understand the transaction.

Are there any requirements for completing the form?

What are the tax implications of using the Louisiana Act of Donation Form?

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below are some key dos and don'ts to consider:

- Do read the instructions carefully before starting the form.

- Do provide complete and accurate information about the donor and the recipient.

- Do sign and date the form where indicated.

- Do consult with a legal professional if you have questions about the process.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank unless instructed.

- Don't use unclear or ambiguous language when describing the donated property.

- Don't forget to check for any additional requirements specific to your situation.

- Don't submit the form without reviewing it for errors.

Check out Common Templates

2021 Tax Return - This form captures various sources of income, deductions, and credits to determine your tax liability or refund.

When engaging in a transaction involving an RV, it's crucial to utilize the appropriate documentation to ensure a smooth transfer. The Arizona RV Bill of Sale form serves this purpose well, detailing vital information about the buyer and seller while safeguarding both parties’ rights. To seamlessly facilitate your RV sale, consider obtaining your documents through resources like Arizona PDF Forms.

Roof Warrenty - This comprehensive warranty ensures homeowners feel secure about their investment.