Blank Loan Agreement Document

When individuals or businesses seek financial assistance, a Loan Agreement form becomes a crucial document in the lending process. This form outlines the terms and conditions under which a lender provides funds to a borrower, ensuring that both parties understand their rights and obligations. Key aspects of the Loan Agreement include the loan amount, interest rate, repayment schedule, and any collateral that may secure the loan. Additionally, the form typically addresses default scenarios, specifying what happens if the borrower fails to meet repayment obligations. It may also include provisions for prepayment, allowing borrowers to pay off the loan early without incurring penalties. By clearly delineating these elements, the Loan Agreement fosters transparency and helps prevent disputes, serving as a vital tool for both lenders and borrowers in navigating their financial relationship.

Loan Agreement - Designed for Individual States

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms and conditions under which a loan is provided, including repayment schedules and interest rates. |

| Parties Involved | The form typically identifies the lender and the borrower, ensuring both parties are clearly defined. |

| Governing Law | For state-specific forms, the governing laws may vary. For example, in California, the laws of the State of California apply. |

| Loan Amount | The form specifies the total amount of money being borrowed, which is crucial for both parties. |

| Interest Rate | The interest rate is detailed in the agreement, impacting the total repayment amount over time. |

| Default Terms | It outlines the consequences if the borrower fails to repay the loan as agreed, providing clarity on potential penalties. |

Similar forms

The Loan Agreement form is a crucial document in the lending process, outlining the terms and conditions of a loan. Several other documents serve similar purposes in various financial and legal contexts. Here’s a list of eight documents that share similarities with a Loan Agreement:

- Promissory Note: This document is a written promise from the borrower to repay a specified amount of money to the lender. Like a Loan Agreement, it outlines the loan amount, interest rate, and repayment schedule.

- Mortgage Agreement: This agreement secures a loan with real estate as collateral. It contains terms similar to a Loan Agreement but focuses specifically on property-related loans.

Articles of Incorporation: To legally establish your corporation in Washington, you must complete the Articles of Incorporation form, which outlines vital information such as the corporation's name, purpose, and registered agent.

- Credit Agreement: Often used in business financing, this document details the terms under which a lender provides credit to a borrower, similar to how a Loan Agreement outlines loan terms.

- Lease Agreement: While primarily for renting property, a lease agreement can resemble a Loan Agreement in that it specifies payment terms and obligations of both parties, particularly in commercial leases.

- Personal Guarantee: This document involves a third party agreeing to take on the debt if the borrower defaults. It parallels a Loan Agreement in its focus on financial responsibility and terms of repayment.

- Line of Credit Agreement: This document allows borrowers to access funds up to a certain limit, detailing terms and conditions similar to those found in a Loan Agreement.

- Forbearance Agreement: This is an arrangement between a lender and borrower to temporarily suspend payments. It contains terms that reflect the original Loan Agreement while addressing changes due to financial hardship.

- Debt Settlement Agreement: This document outlines the terms under which a borrower agrees to pay a reduced amount to settle their debt. It shares similarities with a Loan Agreement in terms of outlining payment obligations and conditions.

Understanding these documents can help borrowers navigate their financial obligations more effectively. Each one plays a unique role in the lending process, but they all share the common goal of clarifying the terms of financial agreements.

Loan Agreement Categories

Loan Agreement Example

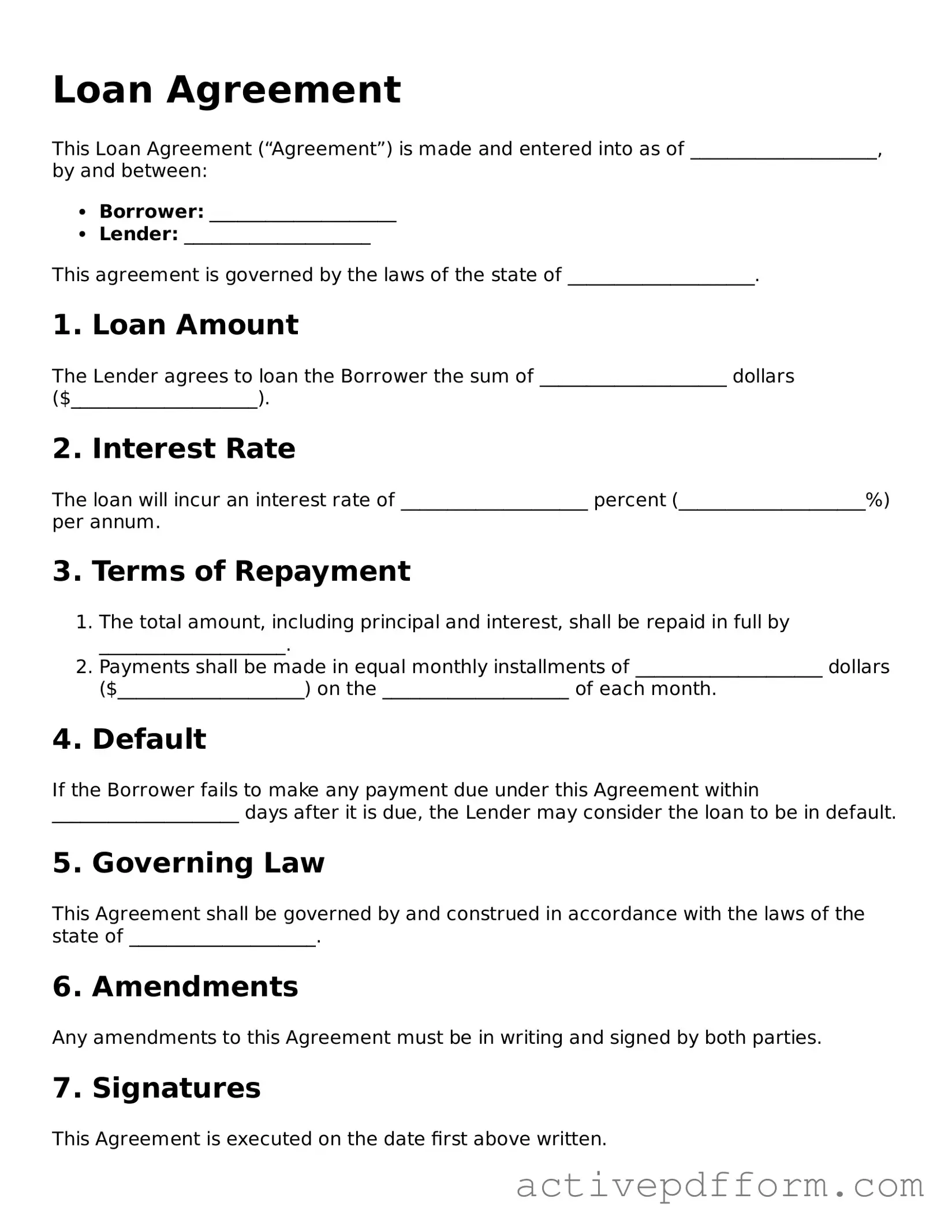

Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into as of ____________________, by and between:

- Borrower: ____________________

- Lender: ____________________

This agreement is governed by the laws of the state of ____________________.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of ____________________ dollars ($____________________).

2. Interest Rate

The loan will incur an interest rate of ____________________ percent (____________________%) per annum.

3. Terms of Repayment

- The total amount, including principal and interest, shall be repaid in full by ____________________.

- Payments shall be made in equal monthly installments of ____________________ dollars ($____________________) on the ____________________ of each month.

4. Default

If the Borrower fails to make any payment due under this Agreement within ____________________ days after it is due, the Lender may consider the loan to be in default.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of ____________________.

6. Amendments

Any amendments to this Agreement must be in writing and signed by both parties.

7. Signatures

This Agreement is executed on the date first above written.

- Borrower Signature: ____________________________ Date: ____________________________

- Lender Signature: ____________________________ Date: ____________________________

Understanding Loan Agreement

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form specifies the amount of money being borrowed, the interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities throughout the loan process.

Why is it important to have a Loan Agreement?

Having a Loan Agreement is crucial because it provides a written record of the loan terms. This documentation can help prevent misunderstandings and disputes between the lender and borrower. In the event of a disagreement, a signed Loan Agreement serves as evidence in legal proceedings, ensuring that both parties adhere to the agreed-upon terms.

What should I include in a Loan Agreement form?

A comprehensive Loan Agreement should include several key elements. First, clearly state the names and addresses of both the lender and the borrower. Next, specify the loan amount, interest rate, and repayment terms, including the payment schedule. Additionally, outline any fees, penalties for late payments, and details regarding collateral, if applicable. Finally, include the signatures of both parties to validate the agreement.

Can I modify a Loan Agreement after it has been signed?

Yes, a Loan Agreement can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This ensures clarity and maintains a record of the agreed-upon changes, helping to avoid future disputes.

Dos and Don'ts

When filling out a Loan Agreement form, it is essential to approach the task with care. Here are some important dos and don’ts to consider:

- Do: Read the entire agreement carefully before filling it out.

- Do: Provide accurate and complete information to avoid delays.

- Do: Double-check all figures and terms to ensure they are correct.

- Do: Keep a copy of the signed agreement for your records.

- Don't: Rush through the form; take your time to understand each section.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Use abbreviations or shorthand that may confuse the lender.

- Don't: Sign the agreement without fully understanding the terms and conditions.

Create Popular Documents

Form I9 - The form can expedite the job application process for candidates.

60 Day Notice to Not Renew Lease From Tenant - Landlords may use this notice for various lease types.

The proper completion of the California LLC 1 form is essential for anyone aiming to launch a Limited Liability Company (LLC) in California. To assist in this process, you can access the necessary paperwork and guidelines through California PDF Forms, ensuring that all requirements are met accurately and efficiently.

Purchase Agreement Form - Offers contingencies for financing, allowing the buyer to secure a mortgage.