Free IRS 8879 Template

When it comes to filing your taxes, understanding the necessary forms is crucial for a smooth process. One such important document is the IRS Form 8879, also known as the "IRS e-file Signature Authorization." This form serves as a digital signature for taxpayers who choose to e-file their federal tax returns through a tax professional. By completing Form 8879, you authorize your preparer to submit your return electronically on your behalf, ensuring that your information is securely transmitted to the IRS. This form not only streamlines the e-filing process but also provides a layer of security, as it verifies your identity and consent. Moreover, it includes essential details such as your Social Security number, the tax year, and a declaration that the return is accurate and complete. Understanding the nuances of Form 8879 can help you navigate the e-filing landscape with confidence, making tax season less daunting and more manageable.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 8879 is used to authorize an electronic return originator (ERO) to file your tax return electronically on your behalf. |

| Eligibility | This form is primarily for individual taxpayers who are filing Form 1040 and wish to e-file their tax returns through a tax professional. |

| Signature Requirement | Taxpayers must sign Form 8879 to give their consent for the ERO to submit their tax return electronically. |

| Filing Deadline | The form must be completed and signed before the electronic submission of the tax return, typically by the tax filing deadline. |

| Record Keeping | Taxpayers should keep a copy of Form 8879 with their tax records for at least three years in case of audits or inquiries. |

| State-Specific Forms | Some states may have their own version of Form 8879 or similar forms, governed by state tax laws. Check local regulations for details. |

| Form Updates | The IRS may update Form 8879 periodically, so it’s important to use the most current version for the tax year you are filing. |

Similar forms

The IRS Form 8879 is an important document for taxpayers, especially when it comes to e-filing. It serves as an e-signature authorization for tax returns. Here are five other documents that are similar to Form 8879, along with an explanation of how they relate:

- Form 1040: This is the individual income tax return form. Like Form 8879, it is essential for filing taxes, but it focuses on reporting income, deductions, and credits. Both forms are crucial in the tax filing process.

- Form 4868: This form is used to request an extension for filing your tax return. It is similar to Form 8879 in that it requires your signature, indicating your consent for the IRS to process your request. Both forms facilitate communication with the IRS.

- Ohio ATV Bill of Sale Form: To ensure proper documentation when buying or selling all-terrain vehicles, consult our comprehensive ATV Bill of Sale form requirements for accurate and legal transactions.

- Form 8453: This is another e-signature authorization form used for electronically filed returns. Like Form 8879, it allows taxpayers to affirm the accuracy of their tax returns and provide consent for electronic submission.

- Form W-2: This document reports wages and tax withheld by employers. While it serves a different purpose, it is similar in that it is a key document needed when preparing your tax return, which is ultimately supported by Form 8879 for e-filing.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Just as Form 8879 is necessary for authorizing e-filing, Form 1099 provides essential income information that taxpayers must include when filing their returns.

Understanding these documents can help you navigate the tax filing process more smoothly. Each form plays a unique role, yet they all contribute to ensuring that your tax obligations are met accurately and efficiently.

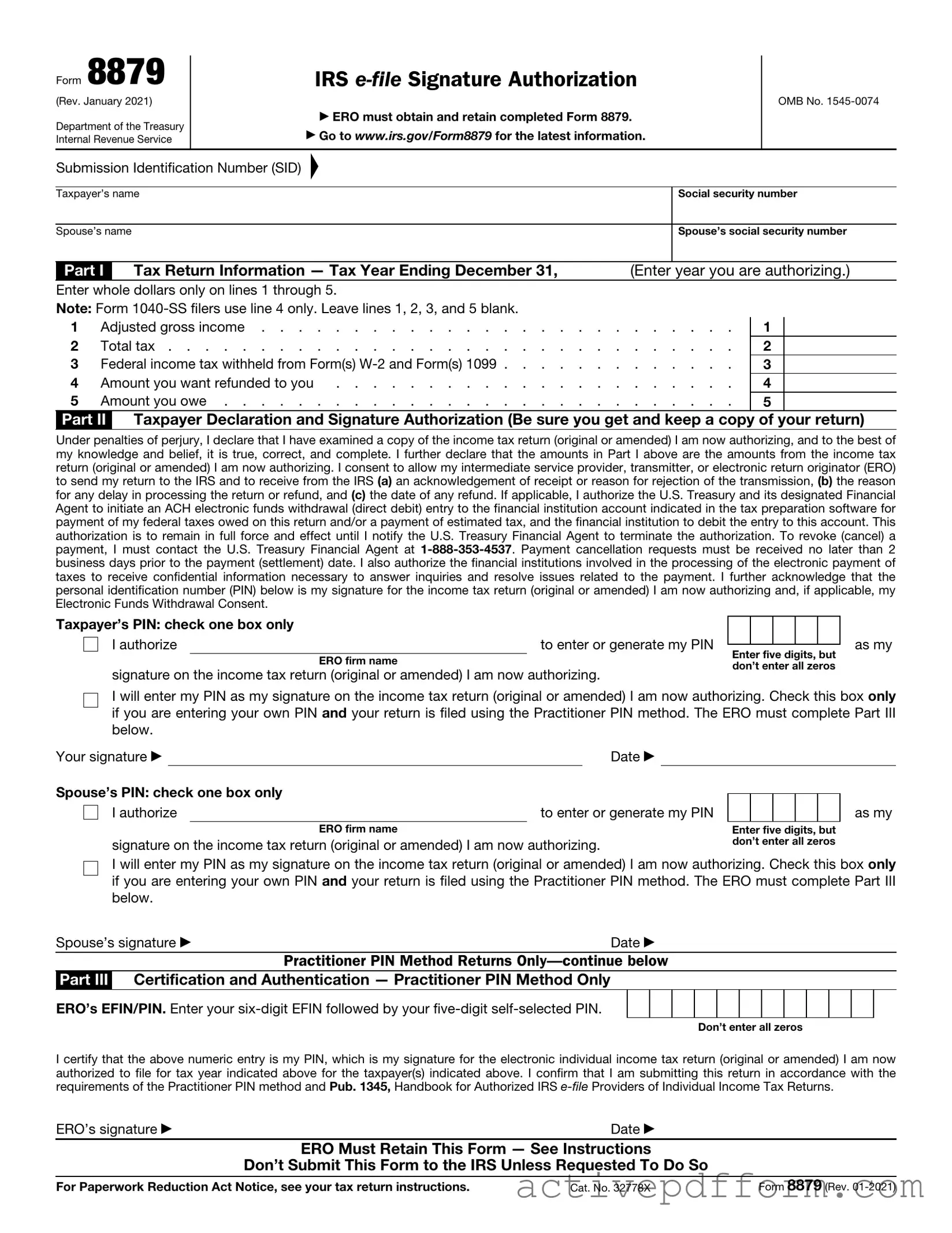

IRS 8879 Example

Form 8879

(Rev. January 2021)

Department of the Treasury Internal Revenue Service

IRS

▶ ERO must obtain and retain completed Form 8879.

▶Go to www.irs.gov/Form8879 for the latest information.

OMB No.

Submission Identification Number (SID)

▲

Taxpayer’s name |

|

|

|

Social security number |

||||

|

|

|

|

|

|

|

||

Spouse’s name |

|

|

|

|

Spouse’s social security number |

|||

|

|

|

|

|

|

|||

Part I |

|

Tax Return Information — Tax Year Ending December 31, |

|

(Enter |

year you are authorizing.) |

|||

Enter whole dollars only on lines 1 through 5. |

|

|

|

|

|

|||

Note: Form |

|

|

|

|

|

|||

1 |

Adjusted gross income |

. |

. . |

. |

. . . |

1 |

||

2 |

Total tax |

. |

. . |

. |

. . . |

2 |

||

3 |

Federal income tax withheld from Form(s) |

. |

. . |

. |

. . . |

3 |

||

4 |

Amount you want refunded to you |

. |

. . |

. |

. . . |

4 |

||

5 |

Amount you owe |

. |

. . |

. |

. . . |

5 |

||

Part II Taxpayer Declaration and Signature Authorization (Be sure you get and keep a copy of your return)

Under penalties of perjury, I declare that I have examined a copy of the income tax return (original or amended) I am now authorizing, and to the best of my knowledge and belief, it is true, correct, and complete. I further declare that the amounts in Part I above are the amounts from the income tax return (original or amended) I am now authorizing. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send my return to the IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my federal taxes owed on this return and/or a payment of estimated tax, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke (cancel) a payment, I must contact the U.S. Treasury Financial Agent at

Taxpayer’s PIN: check one box only |

|

|

|

|

|

|

|

||

I authorize |

|

|

to enter or generate my PIN |

|

|

|

|

|

|

|

Enter five digits, but |

||||||||

|

|

ERO firm name |

|||||||

|

|

don’t enter all zeros |

|||||||

signature on the income tax return (original or amended) I am now authorizing. |

|||||||||

|

|

|

|

|

|||||

as my

I will enter my PIN as my signature on the income tax return (original or amended) I am now authorizing. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Your signature ▶ |

|

|

Date ▶ |

|

|

|

|

|

|

Spouse’s PIN: check one box only |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

I authorize |

to enter or generate my PIN |

|

|

|

|

|

|||

|

|

ERO firm name |

|

|

Enter five digits, but |

||||

signature on the income tax return (original or amended) I am now authorizing. |

don’t enter all zeros |

||||||||

as my

I will enter my PIN as my signature on the income tax return (original or amended) I am now authorizing. Check this box only if you are entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Spouse’s signature ▶ |

Date ▶ |

|

Practitioner PIN Method Returns |

Part III Certification and Authentication — Practitioner PIN Method Only

ERO’s EFIN/PIN. Enter your

Don’t enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the electronic individual income tax return (original or amended) I am now authorized to file for tax year indicated above for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and Pub. 1345, Handbook for Authorized IRS

ERO’s signature ▶ |

Date ▶ |

|

ERO Must Retain This Form — See Instructions |

|

|

Don’t Submit This Form to the IRS Unless Requested To Do So |

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 32778X |

Form 8879 (Rev. |

Form 8879 (Rev. |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future developments. For the latest information about developments related to Form 8879 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8879.

What's New. Form 8879 is used to authorize the electronic filing

Purpose of Form

Form 8879 is the declaration document and signature authorization for an

|

|

▲ |

|

! |

Don’t send this form to the IRS. |

The ERO must retain Form 8879. |

|

CAUTION |

|

When and How To Complete

Use this chart to determine when and how to complete Form 8879.

IF the ERO is . . . |

THEN . . . |

|

|

|

|

Not using the Practitioner |

Don’t complete |

|

PIN method and the |

Form 8879. |

|

taxpayer enters his or her |

|

|

own PIN |

|

|

|

|

|

Not using the Practitioner |

Complete Form |

|

PIN method and is |

8879, Parts I and II. |

|

authorized to enter or |

|

|

generate the taxpayer’s |

|

|

PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

method and is authorized |

Parts I, II, and III. |

|

to enter or generate the |

|

|

taxpayer’s PIN |

|

|

|

|

|

Using the Practitioner PIN |

Complete Form 8879, |

|

Parts I, II, and III. |

||

method and the taxpayer |

||

|

||

enters his or her own PIN |

|

|

|

|

ERO Responsibilities

The ERO must:

1.Enter the name(s) and social security number(s) of the taxpayer(s) at the top of the form.

2.Complete Part I using the amounts (zeros may be entered when appropriate) from the taxpayer’s tax return. Form

3.Enter or generate, if authorized by the taxpayer, the taxpayer’s PIN and enter it in the boxes provided in Part II.

4.Enter on the authorization line in Part II the ERO firm name (not the name of the individual preparing the return) if the ERO is authorized to enter the taxpayer’s PIN.

5.Provide the taxpayer(s) Form 8879 by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

6.Enter the

You must receive the completed ▲! and signed Form 8879 from the

taxpayer before the electronic CAUTION return is transmitted (or released

for transmission).

For additional information, see Pub. 1345.

Taxpayer Responsibilities

Taxpayers must:

1.Verify the accuracy of the prepared income tax return, including direct deposit information.

2.Check the appropriate box in Part II to authorize the ERO to enter or generate your PIN or to do it yourself.

3.Indicate or verify your PIN when authorizing the ERO to enter or generate it (the PIN must be five digits other than all zeros).

4.Sign and date Form 8879. Taxpayers must sign Form 8879 by handwritten signature, or electronic signature if supported by computer software.

5.Return the completed Form 8879 to the ERO by hand delivery, U.S. mail, private delivery service, email, Internet website, or fax.

Your return won’t be transmitted to the IRS until the ERO receives your signed Form 8879.

Refund information. You can check on the status of your refund if it has been at least 72 hours since the IRS acknowledged receipt of your

•Go to www.irs.gov/Refunds.

•Call

•Call

Important Notes for EROs

•Don’t send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or IRS received date, whichever is later. Form 8879 may be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc.

•Confirm the identity of the taxpayer(s).

•Complete Part III only if you are filing the return using the Practitioner PIN method. You aren’t required to enter the taxpayer’s date of birth, prior year adjusted gross income, or PIN in the Authentication Record of the electronically filed return.

•If you aren’t using the Practitioner PIN method, enter the taxpayer(s) date of birth and either the adjusted gross income or the PIN, or both, from the taxpayer’s prior year originally filed return in the Authentication Record of the taxpayer’s electronically filed return. Don’t use an amount from an amended return or a math error correction made by the IRS.

•Enter the taxpayer’s PIN(s) on the input screen only if the taxpayer has authorized you to do so. If married filing jointly, it is acceptable for one spouse to authorize you to enter his or her PIN, and for the other spouse to enter his or her own PIN. It isn’t acceptable for a taxpayer to select or enter the PIN of an absent spouse.

•Taxpayers must use a PIN to sign their

•Provide the taxpayer with a copy of the signed Form 8879 for his or her records upon request.

•Provide the taxpayer with a corrected copy of Form 8879 if changes are made to the return (for example, based on taxpayer review).

•EROs can sign the form using a rubber stamp, mechanical device (such as a signature pen), or computer software program. See Notice

•Go to www.irs.gov/Efile for the latest information.

Understanding IRS 8879

What is IRS Form 8879?

IRS Form 8879 is known as the IRS e-file Signature Authorization. This form allows taxpayers to authorize an electronic return originator (ERO) to submit their tax return electronically. By signing this form, you confirm that you have reviewed your tax return and that it is accurate. It serves as your signature for the e-filing process.

Who needs to fill out Form 8879?

Form 8879 is required for taxpayers who choose to file their tax returns electronically through an ERO. If you are using a tax professional or tax software to e-file your return, you will likely need to complete this form. It is important to ensure that the ERO has your authorization to file on your behalf.

How do I complete Form 8879?

To complete Form 8879, you will need to provide some basic information, including your name, Social Security number, and the tax year for which you are filing. After reviewing your tax return, you will sign and date the form. Your ERO will then use this information to submit your return electronically. Make sure to double-check all the details before signing.

What happens if I do not sign Form 8879?

If you do not sign Form 8879, your tax return cannot be filed electronically. This means you will have to file your return on paper, which can delay processing and any potential refunds. Signing this form is crucial for ensuring a smooth e-filing experience.

Dos and Don'ts

When completing the IRS 8879 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are ten important dos and don'ts to consider:

- Do verify your personal information, including your name and Social Security number, for accuracy.

- Do ensure that the tax return you are authorizing is complete before signing the form.

- Do review the entire form for any errors or omissions before submission.

- Do keep a copy of the signed form for your records.

- Do sign and date the form in the appropriate sections.

- Don't leave any required fields blank; all information must be filled out completely.

- Don't sign the form if you do not agree with the information provided in the tax return.

- Don't forget to double-check the electronic filing method you are using for compatibility with the form.

- Don't submit the form without confirming that your tax preparer has completed their part.

- Don't overlook the deadline for filing your tax return, as it may affect your submission of this form.

Check out Common Templates

How to Get a Qdro Form - Maintaining accurate marital dates is essential in determining benefit division.

When completing the transfer of ownership, it's crucial to have a properly filled Arizona Motorcycle Bill of Sale to avoid any ambiguities; you can find the necessary template by visiting Arizona PDF Forms, which simplifies the process and ensures all required information is accurately documented.

Nj Real Estate Transfer Tax Calculator - The New Jersey RTF-1 form must be submitted at the time of closing.

Lyft Inspection Form 2023 - Ensure the vehicle has valid registration and insurance.