Free IRS 2553 Template

The IRS 2553 form plays a crucial role for small business owners looking to elect S corporation status for their companies. This form allows eligible corporations to avoid double taxation, meaning that the income is only taxed at the shareholder level instead of at both the corporate and individual levels. To qualify, the business must meet specific requirements, including having no more than 100 shareholders and only one class of stock. The form must be filed within a certain timeframe, typically within 75 days of the corporation's formation or the beginning of the tax year in which the election is to take effect. Completing the form accurately is essential, as errors can lead to delays or rejection of the election. Additionally, shareholders must consent to the election, which requires their signatures on the form. Understanding these key aspects can help business owners make informed decisions about their tax structure and ensure compliance with IRS regulations.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect S corporation status for tax purposes. |

| Eligibility | Only domestic corporations with 100 or fewer shareholders can file this form. |

| Filing Deadline | The form must be filed within 75 days of the corporation's formation or by March 15 for existing corporations. |

| Shareholder Requirements | All shareholders must be individuals, certain trusts, or estates. Corporations and partnerships cannot be shareholders. |

| State Forms | Some states require separate forms for S corporation election. For example, California uses Form 100S. |

| Governing Law | Federal tax law governs the IRS Form 2553, while state-specific laws apply for state elections. |

| Revocation | Once elected, S corporation status can be revoked. This process may vary by state and requires careful consideration. |

| Importance of Compliance | Filing Form 2553 correctly is crucial for maintaining S corporation status and avoiding penalties. |

Similar forms

- Form 1065: This form is used by partnerships to report income, deductions, gains, and losses. Like the IRS 2553, it is essential for tax purposes and helps determine how income is distributed among partners.

-

The Aaa International Driving Permit Application form is a document that allows individuals to apply for an international driving permit, enabling travelers to drive legally in various countries. For more information, you can visit PDF Templates Online, which offers insights on how to properly fill out this form to help ease your travel experience.

- Form 1120: Corporations use this form to report their income, gains, losses, and deductions. Similar to the IRS 2553, it plays a crucial role in defining the tax obligations of the business entity.

- Form 1040: This is the individual income tax return form. While it serves individuals, it shares a common purpose with the IRS 2553 in that both are used to report income and determine tax liabilities.

- Form 8832: This form is for entities electing to be classified as a corporation or partnership. Like the IRS 2553, it allows businesses to choose their tax classification, impacting how they are taxed.

IRS 2553 Example

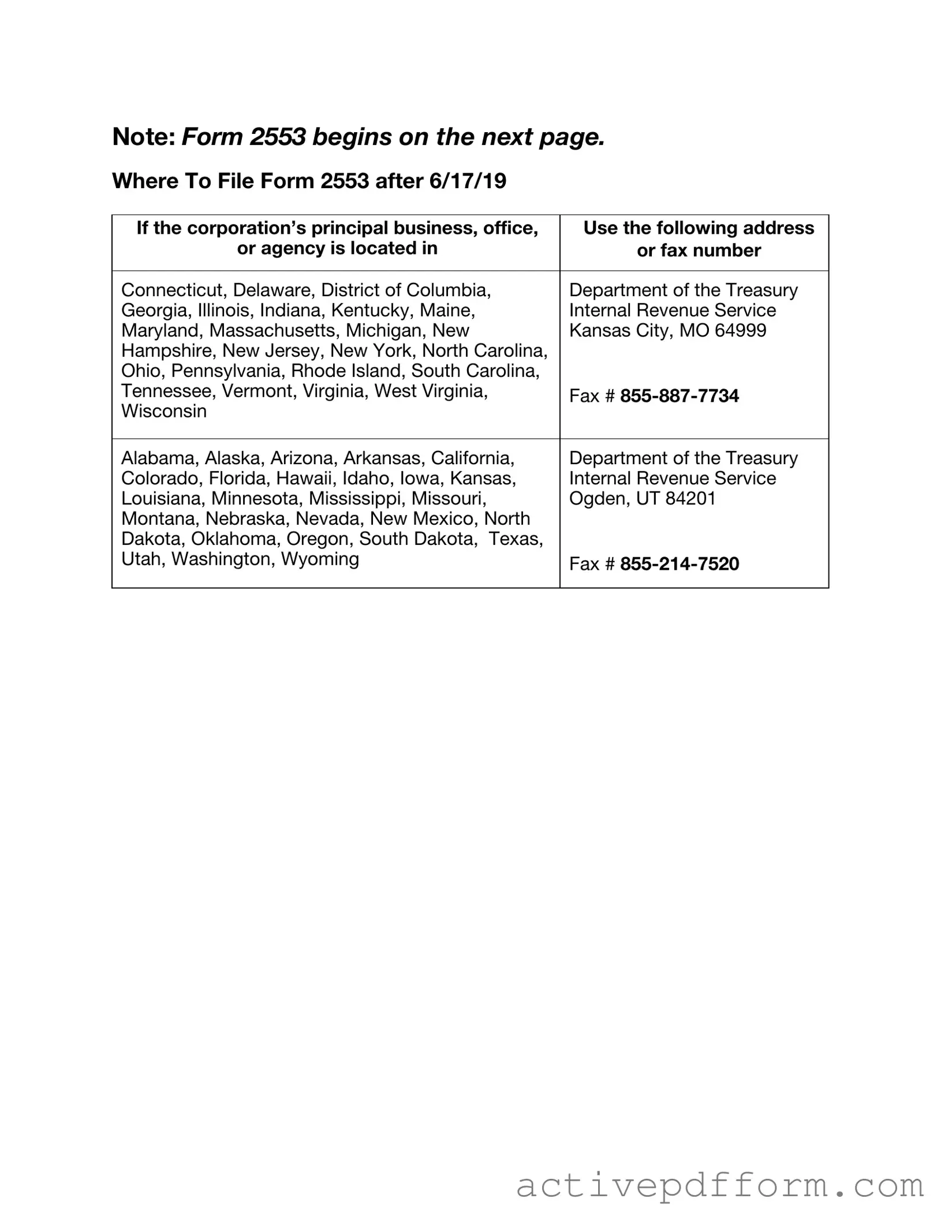

Note: Form 2553 begins on the next page.

Where To File Form 2553 after 6/17/19

If the corporation’s principal business, office, |

Use the following address |

or agency is located in |

or fax number |

|

|

Connecticut, Delaware, District of Columbia, |

Department of the Treasury |

Georgia, Illinois, Indiana, Kentucky, Maine, |

Internal Revenue Service |

Maryland, Massachusetts, Michigan, New |

Kansas City, MO 64999 |

Hampshire, New Jersey, New York, North Carolina, |

|

Ohio, Pennsylvania, Rhode Island, South Carolina, |

|

Tennessee, Vermont, Virginia, West Virginia, |

Fax # |

Wisconsin |

|

|

|

Alabama, Alaska, Arizona, Arkansas, California, |

Department of the Treasury |

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, |

Internal Revenue Service |

Louisiana, Minnesota, Mississippi, Missouri, |

Ogden, UT 84201 |

Montana, Nebraska, Nevada, New Mexico, North |

|

Dakota, Oklahoma, Oregon, South Dakota, Texas, |

|

Utah, Washington, Wyoming |

Fax # |

|

|

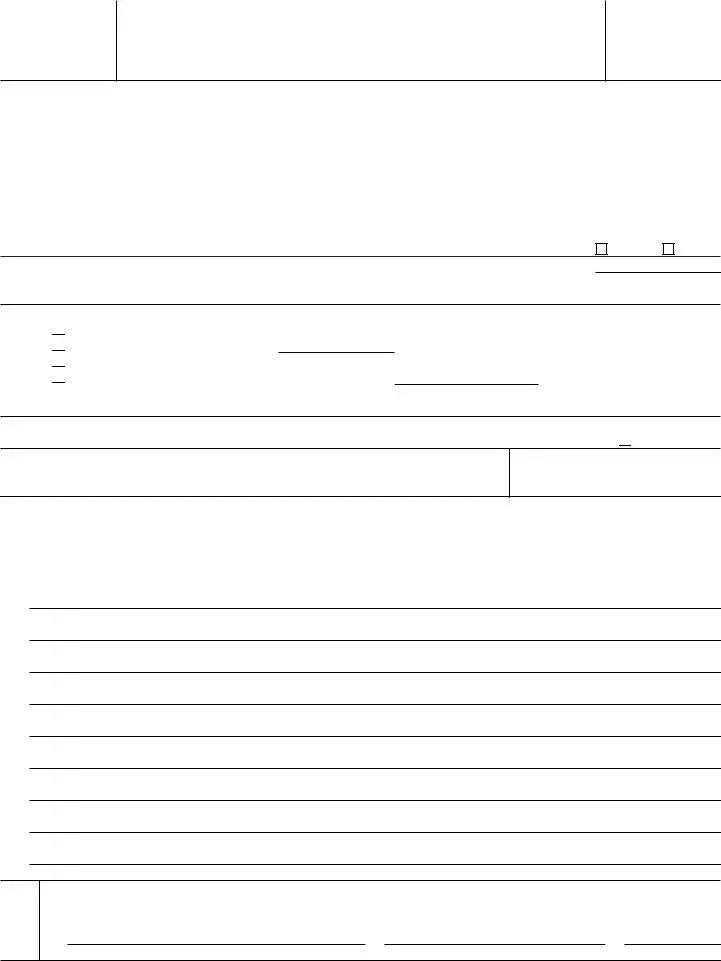

Form 2553

(Rev. December 2017)

Department of the Treasury Internal Revenue Service

Election by a Small Business Corporation

(Under section 1362 of the Internal Revenue Code)

(Including a late election filed pursuant to Rev. Proc.

▶You can fax this form to the IRS. See separate instructions.

▶Go to www.irs.gov/Form2553 for instructions and the latest information.

OMB No.

Note: This election to be an S corporation can be accepted only if all the tests are met under Who May Elect in the instructions, all shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information have been provided.

Part I |

|

Election Information |

|

|

|

|

|

|

|

Name (see instructions) |

A Employer identification number |

||

Type |

|

|

|

|

|

|

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

B Date incorporated |

|

|||

or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City or town, state or province, country, and ZIP or foreign postal code |

C State of incorporation |

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

D |

Check |

the applicable box(es) if the corporation (entity), after applying for the EIN shown in A above, changed its |

name or |

address |

||

EElection is to be effective for tax year beginning (month, day, year) (see instructions) . . . . . . ▶

Caution: A corporation (entity) making the election for its first tax year in existence will usually enter the beginning date of a short tax year that begins on a date other than January 1.

FSelected tax year:

(1) Calendar year

Calendar year

(2) Fiscal year ending (month and day) ▶

Fiscal year ending (month and day) ▶

(3)

(4)

If box (2) or (4) is checked, complete Part II.

GIf more than 100 shareholders are listed for item J (see page 2), check this box if treating members of a family as one shareholder results in no more than 100 shareholders (see test 2 under Who May Elect in the instructions) ▶

HName and title of officer or legal representative whom the IRS may call for more information

Telephone number of officer or legal representative

IIf this S corporation election is being filed late, I declare I had reasonable cause for not filing Form 2553 timely. If this late election is being made by an entity eligible to elect to be treated as a corporation, I declare I also had reasonable cause for not filing an entity classification election timely and the representations listed in Part IV are true. See below for my explanation of the reasons the election or elections were not made on time and a description of my diligent actions to correct the mistake upon its discovery. See instructions.

|

Under penalties of perjury, I declare that I have examined this election, including accompanying documents, and, to the best of my |

||

Sign knowledge and belief, the election contains all the relevant facts relating to the election, and such facts are true, correct, and complete. |

|||

Here |

▲Signature of officer |

|

|

|

Title |

Date |

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 18629R |

Form 2553 (Rev. |

|

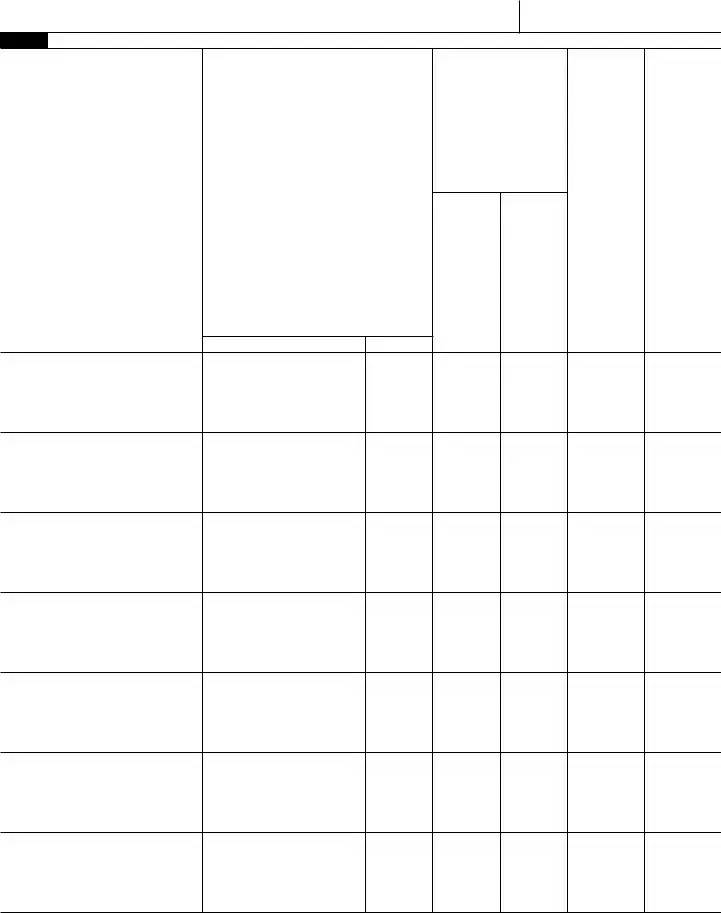

Form 2553 (Rev. |

Page 2 |

Name |

Employer identification number |

Part I Election Information (continued) Note: If you need more rows, use additional copies of page 2.

J

Name and address of each

shareholder or former shareholder required to consent to the election.

(see instructions)

K

Shareholder’s Consent Statement

Under penalties of perjury, I declare that I consent to the election of the

Signature |

Date |

L

Stock owned or

percentage of ownership

(see instructions)

Number of |

|

shares or |

|

percentage |

Date(s) |

of ownership |

acquired |

M |

|

Social security |

|

number or |

N |

employer |

Shareholder’s |

identification |

tax year ends |

number (see |

(month and |

instructions) |

day) |

Form 2553 (Rev.

Form 2553 (Rev. |

Page 3 |

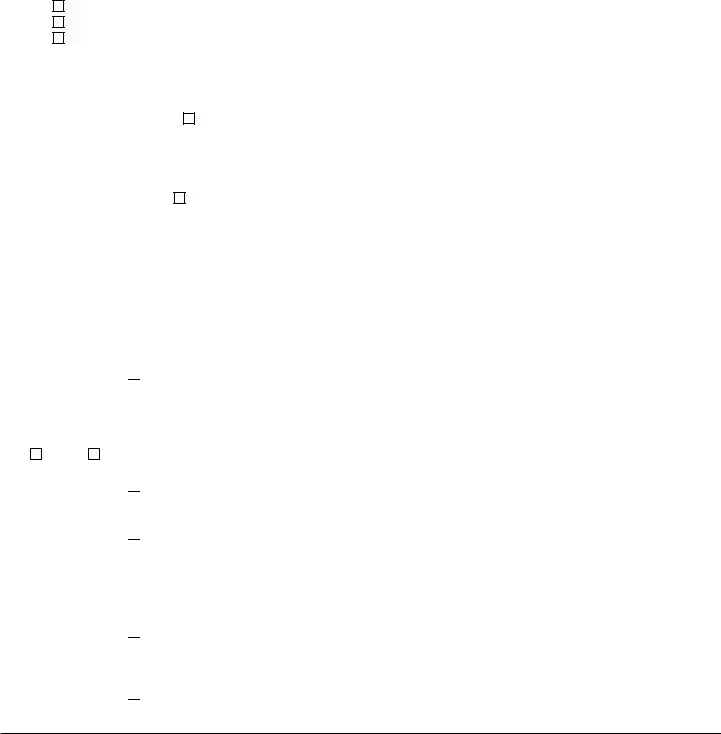

|

Name |

|

Employer identification number |

|

|

|

Part II |

Selection of Fiscal Tax Year (see instructions) |

|

Note: All corporations using this part must complete item O and item P, Q, or R. |

|

|

O Check the applicable box to indicate whether the corporation is: |

|

|

1. |

A new corporation adopting the tax year entered in item F, Part I. |

|

2. |

An existing corporation retaining the tax year entered in item F, Part I. |

|

3. |

An existing corporation changing to the tax year entered in item F, Part I. |

|

PComplete item P if the corporation is using the automatic approval provisions of Rev. Proc.

1. Natural Business Year ▶ |

I represent that the corporation is adopting, retaining, or changing to a tax year that qualifies |

as its natural business year (as defined in section 5.07 of Rev. Proc.

2. Ownership Tax Year ▶ |

I represent that shareholders (as described in section 5.08 of Rev. Proc. |

than half of the shares of the stock (as of the first day of the tax year to which the request relates) of the corporation have the same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item F, Part I, and that such tax year satisfies the requirement of section 4.01(3) of Rev. Proc.

Note: If you do not use item P and the corporation wants a fiscal tax year, complete either item Q or R below. Item Q is used to request a fiscal tax year based on a business purpose and to make a

QBusiness

1. Check here ▶  if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

Yes |

No |

2.Check here ▶

to show that the corporation intends to make a

to show that the corporation intends to make a

3.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

RSection 444

1.Check here ▶

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

2.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

Form 2553 (Rev.

Form 2553 (Rev. |

Page 4 |

Name |

Employer identification number |

Part III Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)* Note: If you are making more than

one QSST election, use additional copies of page 4.

Income beneficiary’s name and address

Social security number

Trust’s name and address

Employer identification number

Date on which stock of the corporation was transferred to the trust (month, day, year) . . . . . . . . ▶

In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is filed, I hereby make the election under section 1361(d)(2). Under penalties of perjury, I certify that the trust meets the definitional requirements of section 1361(d)(3) and that all other information provided in Part III is true, correct, and complete.

Signature of income beneficiary or signature and title of legal representative or other qualified person making the election |

|

Date |

*Use Part III to make the QSST election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation makes its election to be an S corporation. The QSST election must be made and filed separately if stock of the corporation is transferred to the trust after the date on which the corporation makes the S election.

Part IV Late Corporate Classification Election Representations (see instructions)

If a late entity classification election was intended to be effective on the same date that the S corporation election was intended to be effective, relief for a late S corporation election must also include the following representations.

1The requesting entity is an eligible entity as defined in Regulations section

2The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status;

3The requesting entity fails to qualify as a corporation solely because Form 8832, Entity Classification Election, was not timely filed under Regulations section

4The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the S corporation election was not timely filed pursuant to section 1362(b); and

5a The requesting entity timely filed all required federal tax returns and information returns consistent with its requested classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years, or

bThe requesting entity has not filed a federal tax or information return for the first year in which the election was intended to be effective because the due date has not passed for that year’s federal tax or information return.

Form 2553 (Rev.

Understanding IRS 2553

What is IRS Form 2553?

IRS Form 2553 is used by small businesses to elect to be taxed as an S corporation. This designation allows income, losses, and deductions to pass through to shareholders, avoiding double taxation at the corporate level.

Who can file Form 2553?

To file Form 2553, your business must meet specific criteria. Generally, it must be a domestic corporation with no more than 100 shareholders, all of whom must be individuals, certain trusts, or estates. Additionally, the corporation can only have one class of stock.

When should I file Form 2553?

Form 2553 should be filed within 75 days of the beginning of the tax year in which you want the S corporation status to take effect. If you miss this deadline, you may have to wait until the next tax year to make the election.

What information do I need to provide on Form 2553?

The form requires basic information about your corporation, including the name, address, and Employer Identification Number (EIN). You will also need to provide details about each shareholder and their consent to the S corporation election.

What happens if my Form 2553 is rejected?

If the IRS rejects your Form 2553, your business will not be treated as an S corporation. You may receive a notice explaining the reason for the rejection, and you can take steps to correct the issue and refile.

Can I revoke my S corporation status after filing Form 2553?

Yes, you can revoke your S corporation status. This requires a formal process, including a written statement to the IRS. All shareholders must agree to the revocation, and it can take effect at the beginning of the next tax year.

Are there any ongoing requirements for S corporations?

Yes, S corporations must adhere to specific requirements to maintain their status. These include limitations on the number and type of shareholders, as well as the necessity to file annual tax returns using Form 1120-S. Compliance with these rules is essential to avoid losing S corporation status.

Where can I find Form 2553 and instructions for filing?

You can find Form 2553 and its instructions on the IRS website. It is advisable to review the instructions carefully to ensure that you complete the form accurately and meet all filing requirements.

Dos and Don'ts

When filling out the IRS Form 2553, which is used to elect S corporation status, there are some important do's and don'ts to keep in mind. Here’s a helpful list to guide you through the process:

- Do ensure that all shareholders sign the form. Their consent is crucial for the election to be valid.

- Do double-check all information for accuracy. Mistakes can lead to delays or rejection of your application.

- Do file the form on time. Make sure to submit it within 75 days of the start of your tax year.

- Do keep a copy of the completed form for your records. This can be helpful for future reference.

- Don't forget to include all necessary attachments. Missing documents can cause complications.

- Don't use the form if your corporation does not meet the eligibility requirements. Ensure that you qualify before applying.

- Don't submit the form without reviewing the instructions. Familiarize yourself with the requirements to avoid errors.

- Don't ignore deadlines. Late submissions can result in the loss of S corporation status for that tax year.

Check out Common Templates

Printable:5s6uydlipco= Living Will Template - Five Wishes emphasizes the importance of personal relationships in health care decision-making, ensuring trust and understanding.

The ADP Pay Stub form is a crucial document that provides employees with detailed information about their earnings, deductions, and taxes for each pay period. This form serves as a transparent record of compensation, ensuring you understand how your salary is calculated. For those seeking a convenient way to access this information, the ADP Pay Statement can serve as a valuable resource. Keeping track of your pay stubs can empower you to manage your finances effectively and spot any discrepancies in your earnings.

Temporary Custody Order Mn - Parents can communicate their wishes regarding their child’s education and health care using this form.