Blank Investment Letter of Intent Document

The Investment Letter of Intent (LOI) is a crucial document in the world of finance and investment, serving as a preliminary agreement between parties involved in a potential transaction. It outlines the key terms and conditions that will govern the investment process, providing a framework for negotiations. Typically, an LOI includes details such as the amount of investment, the structure of the deal, and any specific conditions that must be met before moving forward. It also often addresses confidentiality, exclusivity, and timelines for due diligence and closing. By laying out these fundamental aspects, the LOI helps to align the expectations of all parties and can facilitate smoother discussions as they move toward a formal agreement. Understanding the components of an Investment Letter of Intent is essential for both investors and companies seeking funding, as it sets the stage for a successful partnership.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent serves as a preliminary agreement outlining the intent of parties to enter into a formal investment agreement. |

| Non-Binding Nature | Typically, this letter is non-binding, meaning that it does not legally obligate the parties to complete the investment. |

| Key Components | Common elements include the amount of investment, the terms of the investment, and any conditions that must be met before finalizing the agreement. |

| Confidentiality Clause | Often, these letters include a confidentiality clause to protect sensitive information shared during negotiations. |

| Governing Law | The governing law may vary by state; for example, in California, it is governed by the California Commercial Code. |

| Use in Negotiations | This document can facilitate negotiations by clearly outlining the expectations and intentions of both parties. |

Similar forms

- Term Sheet: Similar to an Investment Letter of Intent, a term sheet outlines the key terms and conditions of an investment agreement. It serves as a preliminary document that guides the negotiation process.

- Memorandum of Understanding (MOU): An MOU is a non-binding agreement that expresses the intention of the parties to work together. Like an Investment Letter of Intent, it sets forth the framework for future negotiations.

- Letter of Intent (LOI): This document indicates a party's intention to enter into a formal agreement. It shares similarities with the Investment Letter of Intent by outlining the essential details of the proposed investment.

- Confidentiality Agreement: Often used in conjunction with an Investment Letter of Intent, this document protects sensitive information shared during negotiations. It ensures that parties maintain confidentiality while discussing potential investments.

- Purchase Agreement: This formal contract outlines the terms of a sale. An Investment Letter of Intent may precede a purchase agreement, establishing the intent before finalizing the deal.

- Shareholder Agreement: This document governs the relationship between shareholders. Similar to an Investment Letter of Intent, it can outline expectations and responsibilities related to an investment.

- Non-Binding Agreement: Like an Investment Letter of Intent, a non-binding agreement expresses the intent to collaborate without creating enforceable obligations. It allows parties to explore possibilities without commitment.

- Joint Venture Agreement: This document outlines the terms of a partnership between two or more parties. An Investment Letter of Intent may initiate discussions that lead to a joint venture agreement.

- Investment Proposal: An investment proposal details the specifics of a potential investment opportunity. It shares similarities with an Investment Letter of Intent by presenting the investment's rationale and benefits.

- Business Plan: A business plan outlines a company's goals and strategies. While broader in scope, it can include elements similar to an Investment Letter of Intent by detailing the investment strategy and objectives.

Investment Letter of Intent Example

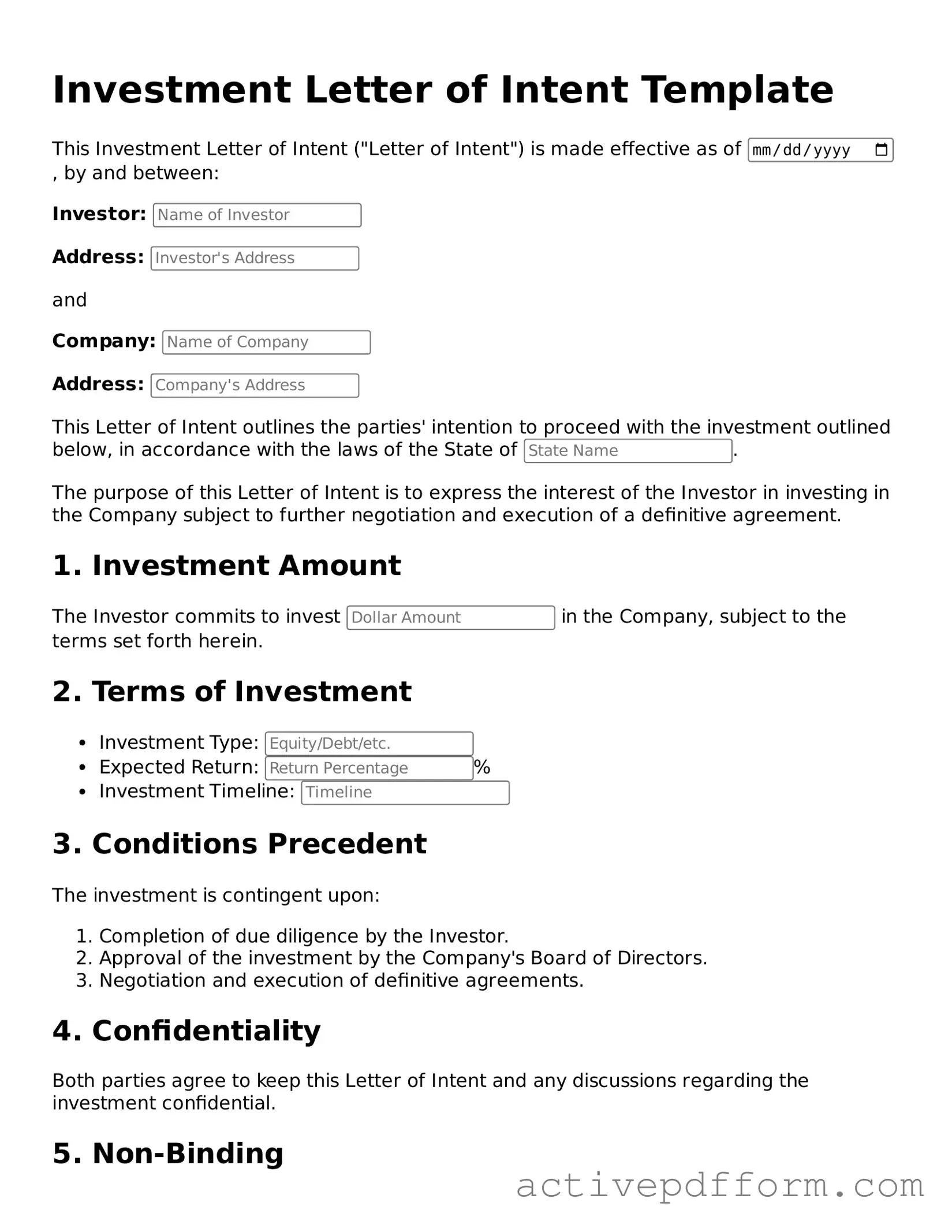

Investment Letter of Intent Template

This Investment Letter of Intent ("Letter of Intent") is made effective as of , by and between:

Investor:

Address:

and

Company:

Address:

This Letter of Intent outlines the parties' intention to proceed with the investment outlined below, in accordance with the laws of the State of .

The purpose of this Letter of Intent is to express the interest of the Investor in investing in the Company subject to further negotiation and execution of a definitive agreement.

1. Investment Amount

The Investor commits to invest in the Company, subject to the terms set forth herein.

2. Terms of Investment

- Investment Type:

- Expected Return: %

- Investment Timeline:

3. Conditions Precedent

The investment is contingent upon:

- Completion of due diligence by the Investor.

- Approval of the investment by the Company's Board of Directors.

- Negotiation and execution of definitive agreements.

4. Confidentiality

Both parties agree to keep this Letter of Intent and any discussions regarding the investment confidential.

5. Non-Binding

This Letter of Intent is non-binding, and neither party shall be obligated to proceed with the transaction until a definitive agreement is executed.

IN WITNESS WHEREOF, the parties hereto have executed this Letter of Intent on the date first above written.

Investor: Date:

Company: Date:

Understanding Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary agreement between parties interested in making an investment. It serves as a starting point for negotiations and establishes the basic terms and conditions of the investment. While it is not legally binding, it demonstrates the intent of the parties to move forward with the investment process.

Why is an Investment Letter of Intent important?

The Investment Letter of Intent is important because it helps clarify the expectations of both parties. It provides a framework for discussions and can prevent misunderstandings. By outlining key terms such as the amount of investment, ownership stakes, and timelines, the LOI lays the groundwork for a more detailed agreement later on.

What should be included in an Investment Letter of Intent?

An effective Investment Letter of Intent typically includes several key components. These may consist of the names of the parties involved, the amount of investment being proposed, the purpose of the investment, and the expected timeline for completion. Additionally, it may outline any conditions that must be met before the investment can proceed, as well as any confidentiality agreements that apply.

Is an Investment Letter of Intent legally binding?

How do I create an Investment Letter of Intent?

Creating an Investment Letter of Intent involves drafting a clear and concise document that outlines the terms of the proposed investment. It is advisable to consult with legal and financial advisors to ensure that all necessary elements are included. Once drafted, both parties should review the LOI, make any necessary adjustments, and sign it to indicate their agreement to proceed with negotiations.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it's important to be thorough and accurate. Here are some key dos and don'ts to consider:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check your contact information for accuracy.

- Do sign and date the form where required.

- Don't leave any required fields blank.

- Don't use ambiguous language or abbreviations.

- Don't submit the form without reviewing it for errors.

Following these guidelines will help ensure your submission is clear and effective.

Consider More Types of Investment Letter of Intent Templates

Letter of Intent Business Purchase - This document can help identify areas for further consideration in the transaction.