Free Intent To Lien Florida Template

The Intent to Lien Florida form serves as a crucial communication tool for contractors and service providers seeking payment for work completed on a property. This form notifies the property owner of the contractor's intention to file a lien if payment is not received. It includes essential details such as the date of the notice, the names and addresses of both the property owner and the general contractor, if applicable, and a description of the property in question. The form also specifies the amount owed for the services rendered. Under Florida law, specifically Florida Statutes §713.06(2)(a), this notice must be sent at least 45 days prior to filing a Claim of Lien, ensuring that the property owner is adequately informed of the potential consequences of non-payment. If the property owner fails to respond or make payment within 30 days, as outlined in §713.06(2)(b), the contractor may proceed with recording the lien, which could lead to foreclosure proceedings and additional financial liabilities, including attorney fees and court costs. The form emphasizes the importance of prompt communication and resolution, aiming to encourage payment and avoid escalation into legal action.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of a contractor's intention to file a lien for unpaid services or materials. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien. |

| Notification Period | Notice must be sent at least 45 days before filing a Claim of Lien. |

| Response Time | The property owner has 30 days to respond to the notice before a lien may be recorded. |

| Consequences of Non-Payment | If payment is not made, the property may be subject to foreclosure and additional costs, such as attorney fees. |

| Required Information | The form requires the property owner's name, address, and a description of the property. |

| Service Methods | Delivery methods for the notice include certified mail, hand delivery, or publication. |

| Certificate of Service | A Certificate of Service must be completed to confirm delivery of the notice. |

| Importance of Compliance | Failure to comply with the requirements may invalidate the lien claim, impacting the contractor's rights. |

Similar forms

The Intent to Lien Florida form shares similarities with several other documents that serve to protect the rights of parties involved in property transactions. Here are ten such documents:

- Notice of Lien: This document formally declares that a lien has been placed on a property due to unpaid debts. Like the Intent to Lien, it serves as a warning to property owners about potential legal claims against their property.

- Claim of Lien: This is a legal claim filed against a property to secure payment for services rendered or materials supplied. It follows the Intent to Lien and solidifies the right to seek payment through foreclosure if necessary.

- Mechanic’s Lien: This specific type of lien is filed by contractors or suppliers when they have not been paid for work done on a property. It is closely related to the Intent to Lien, as both documents aim to secure payment for construction-related services.

- Notice of Non-Payment: Similar in purpose, this document notifies a property owner that payment has not been received. It serves as a precursor to filing a lien, just like the Intent to Lien.

- Demand Letter: This letter requests payment for outstanding debts. Like the Intent to Lien, it is a formal communication that can precede further legal action if ignored.

- Waiver of Lien Rights: This document allows a contractor or supplier to relinquish their right to file a lien. It is relevant as it can impact the validity of an Intent to Lien if executed prior to filing.

- Release of Lien: Once payment is made, this document is filed to remove the lien from the property records. It acts as a counterpart to the Intent to Lien, indicating the resolution of the payment issue.

- Notice of Commencement: This document is filed to officially begin a construction project. It informs all parties of the work being done and is often referenced in lien-related documents like the Intent to Lien.

- Hold Harmless Agreement: To safeguard against potential liabilities, consider our comprehensive Hold Harmless Agreement resources for properly mitigating risks in contracts.

- Construction Contract: This agreement outlines the terms of the work to be performed. It establishes the basis for any lien claims, making it relevant to the Intent to Lien.

- Certificate of Service: This document verifies that the Intent to Lien was properly delivered to the concerned parties. It is crucial for ensuring that the notice is legally binding and serves its intended purpose.

Intent To Lien Florida Example

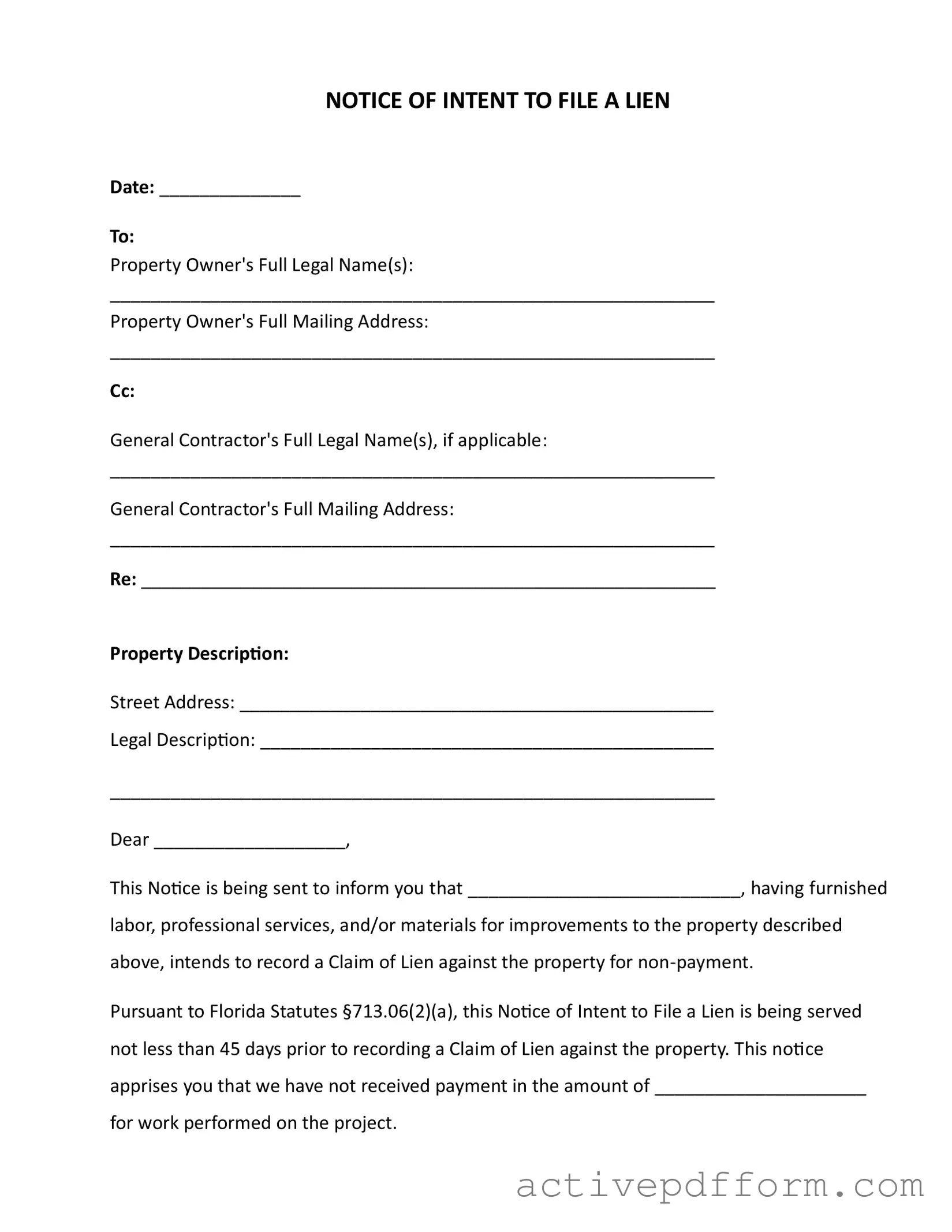

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Understanding Intent To Lien Florida

What is the purpose of the Intent To Lien Florida form?

The Intent To Lien form serves as a formal notice to property owners that a contractor or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice is a crucial step in the lien process, as it informs the property owner of the outstanding payment and the potential consequences of not addressing the issue. The form is designed to comply with Florida law, which requires that this notice be sent at least 45 days before a lien is officially recorded.

Who should receive the Intent To Lien form?

The form should be sent to the property owner, whose full legal name and mailing address must be included. If applicable, it should also be sent to the general contractor involved in the project. The inclusion of both parties ensures that all relevant stakeholders are aware of the pending lien and can take appropriate action to resolve the payment issue. Clear communication helps prevent misunderstandings and potential legal disputes.

What happens if the property owner does not respond to the Intent To Lien notice?

If the property owner fails to respond within 30 days of receiving the notice, the contractor or supplier may proceed to file a Claim of Lien against the property. This lien could lead to foreclosure proceedings, meaning the property could be sold to satisfy the debt. Additionally, the property owner may incur attorney fees, court costs, and other related expenses. Therefore, it is in the best interest of the property owner to address the notice promptly.

How does the Intent To Lien form protect the rights of contractors and suppliers?

This form acts as a safeguard for contractors and suppliers by formally notifying property owners of unpaid debts. By providing this notice, contractors can establish their intent to file a lien, which is a legal claim against the property. This claim can help secure payment for the services rendered. The law requires this notice to be sent, ensuring that contractors have a clear avenue to protect their financial interests while also providing property owners with an opportunity to resolve the matter before further legal action is taken.

What should a property owner do upon receiving an Intent To Lien notice?

Upon receiving the Intent To Lien notice, a property owner should carefully review the document and verify the details, such as the amount owed and the services provided. It is advisable to contact the contractor or supplier as soon as possible to discuss the situation and arrange for payment if applicable. Open communication can often resolve the issue before it escalates to a lien. If there are any disputes regarding the claim, seeking legal advice may also be beneficial to understand the rights and obligations involved.

Dos and Don'ts

When filling out the Intent To Lien Florida form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do provide the correct date at the top of the form.

- Do include the full legal names and mailing addresses of both the property owner and the general contractor, if applicable.

- Do clearly describe the property, including the street address and legal description.

- Do specify the amount owed for the work performed.

- Don't leave any sections blank; incomplete forms may lead to issues later.

- Don't forget to sign the form and include your contact information for follow-up.

Check out Common Templates

Med Express Mt Pleasant Pa - It’s important for all parties involved to understand their responsibilities outlined in the form.

For those looking to easily manage their trailer transactions in Arizona, utilizing the Arizona Trailer Bill of Sale form is highly recommended. This important document not only ensures a clear transfer of ownership but also provides essential details that protect both the buyer and seller. For your convenience, you can access these forms through Arizona PDF Forms, allowing for a hassle-free completion of your sale.

Profits or Loss From Business - Each line item on Schedule C has specific rules for what can be claimed as a deduction.

Roof Warrenty - Homeowners can rely on MCS Roofing for repairs caused by workmanship issues.