Free Independent Contractor Pay Stub Template

The Independent Contractor Pay Stub form serves as a crucial document for freelancers and independent contractors, providing a clear record of earnings and deductions for each payment period. This form typically includes essential details such as the contractor's name, payment date, and the total amount earned for the services rendered. It also outlines any deductions, such as taxes or fees, which can help contractors understand their net income better. By documenting hours worked or projects completed, the pay stub can serve as proof of income, which is often necessary for loan applications or tax filings. Additionally, this form promotes transparency between contractors and clients, ensuring both parties have a mutual understanding of the financial transaction. Overall, the Independent Contractor Pay Stub is not just a simple receipt; it is a vital tool for managing finances and maintaining professional relationships in the gig economy.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor during a specific pay period. |

| Purpose | This pay stub serves as a record for both the contractor and the hiring entity, ensuring transparency in payments and helping with tax reporting. |

| Components | A typical pay stub includes the contractor's name, address, payment period, total earnings, deductions, and net pay. |

| State-Specific Requirements | Some states, like California, require specific information on pay stubs, including the contractor's tax identification number and the nature of the work performed (California Labor Code Section 226). |

| Tax Implications | Independent contractors are responsible for their own taxes, and a pay stub can help them track income and prepare for tax season. |

Similar forms

- W-2 Form: This document is issued to employees and summarizes their earnings and tax withholdings for the year. Like the Independent Contractor Pay Stub, it provides a clear breakdown of income, but it is specifically for employees rather than independent contractors.

- 1099-MISC Form: This form is used to report payments made to independent contractors. It shares similarities with the Pay Stub in that it details the amount earned, but it is typically issued annually rather than per pay period.

- Paycheck Stub: This document is similar in that it provides a summary of earnings and deductions for employees. Both forms show gross pay, deductions, and net pay, but the Paycheck Stub is for employees, while the Pay Stub is for independent contractors.

- Invoice: Independent contractors often submit invoices for their services. Like the Pay Stub, an invoice outlines the services provided and the amount due, but it is a request for payment rather than a record of payment already made.

- Payment Receipt: This document acknowledges the receipt of payment for services rendered. It is similar to the Pay Stub in that it confirms payment details, but it does not typically provide a breakdown of earnings and deductions.

- Civil Case Cover Sheet: This essential document, required for initiating a civil action, is crucial for proper case categorization and management in California courts. To fill out the form, you can find it at California PDF Forms.

- Contract Agreement: This document outlines the terms of the working relationship between an independent contractor and a client. While it does not detail earnings, it establishes the scope of work and payment terms, which can influence what appears on the Pay Stub.

- Expense Report: Independent contractors often submit expense reports to claim reimbursements for business-related costs. Similar to the Pay Stub, it provides a detailed account of financial transactions, but it focuses on expenses rather than income.

- Tax Return: This document summarizes an individual's income and taxes owed or refunded for the year. Both the Tax Return and the Pay Stub include financial information, but the Tax Return is a comprehensive annual summary, while the Pay Stub is a periodic record of earnings.

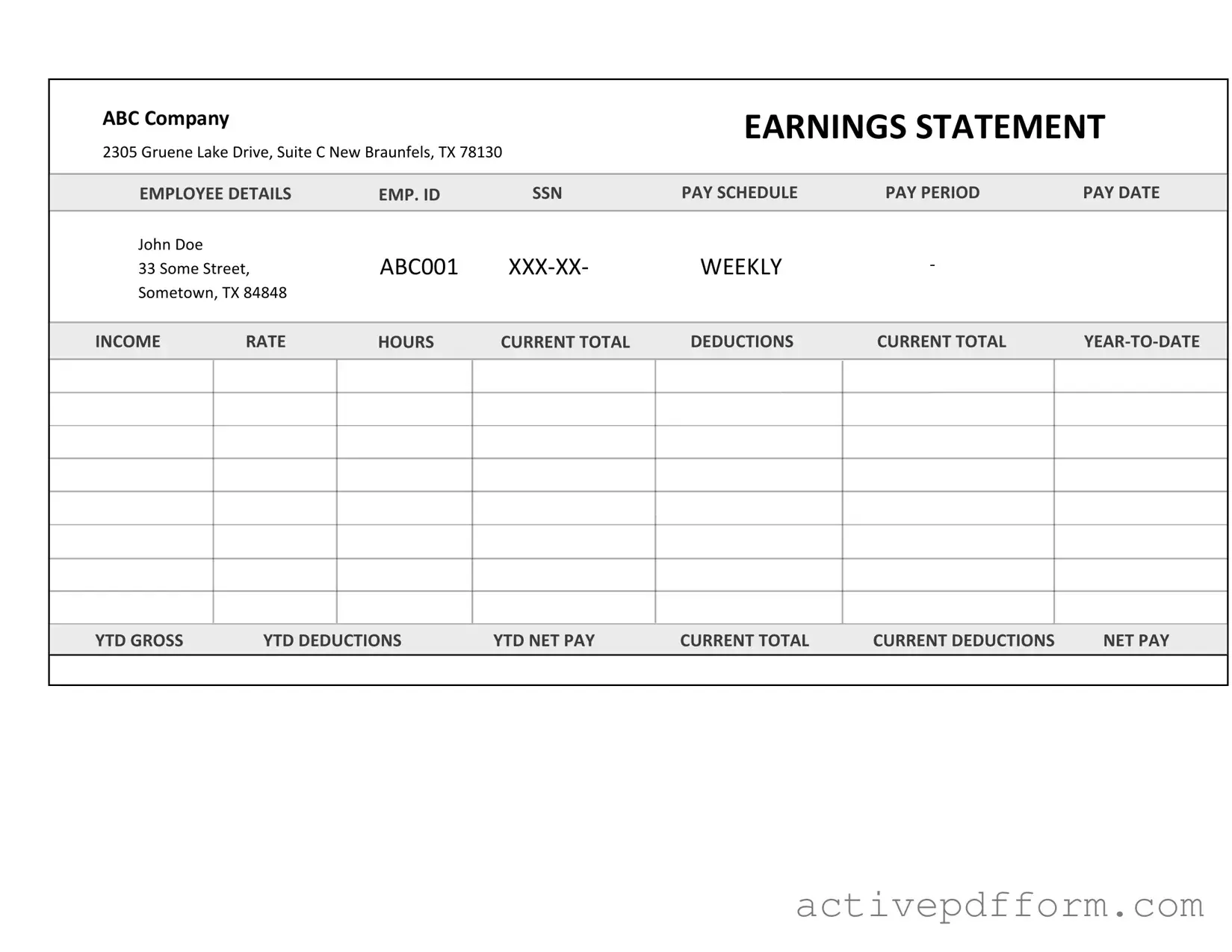

Independent Contractor Pay Stub Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Understanding Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor for a specific pay period. It provides a detailed summary of the contractor's income, including any taxes withheld, fees, and other deductions. This document serves as proof of income and can be useful for tax purposes or when applying for loans or other financial services.

Who should use an Independent Contractor Pay Stub?

Independent contractors who receive payment for their services should use a pay stub. This includes freelancers, consultants, and any individuals who are not classified as employees but provide services to clients or companies. Using a pay stub helps contractors keep track of their earnings and simplifies tax reporting.

What information is typically included in an Independent Contractor Pay Stub?

A standard Independent Contractor Pay Stub includes the contractor's name, address, and tax identification number. It also lists the client's information, the pay period, total earnings, any deductions (such as taxes or fees), and the net pay amount. Additional details may include the payment method and any relevant project descriptions.

How can I create an Independent Contractor Pay Stub?

Creating an Independent Contractor Pay Stub can be done using various online templates or software designed for invoicing and payroll. Many accounting programs offer features that allow you to generate pay stubs easily. Simply input the required information, including earnings and deductions, and the software will format it for you.

Is it necessary to provide a pay stub to clients?

While it is not legally required to provide a pay stub to clients, doing so can enhance professionalism and transparency. A pay stub can help clarify payment details and ensure both parties are on the same page regarding compensation. It may also be beneficial for record-keeping purposes.

What are the tax implications of using an Independent Contractor Pay Stub?

Independent contractors are responsible for reporting their income and paying self-employment taxes. The pay stub can help track earnings and deductions, making it easier to file taxes accurately. Contractors should keep copies of their pay stubs for their records and consult with a tax professional for specific guidance on tax obligations.

Can I modify a pay stub after it has been issued?

Once a pay stub has been issued, it is generally advisable not to modify it. Altering a pay stub can lead to discrepancies and potential legal issues. If an error is found, it is best to issue a corrected pay stub rather than changing the original document.

What should I do if I don't receive a pay stub?

If you do not receive a pay stub after completing work for a client, you should reach out to them directly. Requesting a pay stub is a reasonable expectation, as it helps you keep accurate records of your income. If the client is unresponsive or unwilling to provide one, consider documenting your communication and seeking advice from a legal professional.

Are there any state-specific requirements for pay stubs?

Yes, some states have specific requirements regarding pay stubs, including what information must be included. It's essential to familiarize yourself with the laws in your state to ensure compliance. Checking with a local labor department or legal advisor can provide clarity on these requirements.

How long should I keep my Independent Contractor Pay Stubs?

It is advisable to keep your Independent Contractor Pay Stubs for at least three years. This timeframe aligns with the IRS guidelines for retaining tax documents. Keeping records longer can be beneficial, especially if you are subject to an audit or need to reference past earnings for any reason.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do include your full legal name as it appears on your tax documents.

- Do provide the correct business name if you operate under a trade name.

- Do specify the payment period clearly to avoid confusion.

- Do accurately report the total amount earned for the period.

- Do include any deductions that apply, such as taxes or benefits.

- Don't leave any sections blank; fill in all required fields.

- Don't use nicknames or abbreviations for your name or business.

- Don't forget to double-check the numbers for accuracy.

- Don't submit the form without a signature if required.

Check out Common Templates

Profits or Loss From Business - The instructions included with the form guide taxpayers through reporting income and expenses accurately.

Final Waiver of Lien Chicago Title - Provides a clear timeline and record of transactions related to the property.

The process of applying for public housing in New York City can be daunting, but utilizing the right resources can simplify your journey. One essential tool is the https://nytemplates.com/blank-nyc-housing-application-template/, which provides a structured format to help applicants navigate the requirements and fill out their NYC Housing Application Form with precision, increasing their chances of securing a suitable living arrangement.

Availability Template - Help us create a balanced work schedule by sharing your availability.