Free Goodwill donation receipt Template

The Goodwill donation receipt form serves as an essential document for individuals and organizations that contribute goods to Goodwill Industries. This form not only provides a record of the items donated but also establishes the value of those items for tax deduction purposes. When a donor makes a contribution, they receive a receipt that typically includes details such as the date of the donation, a description of the items given, and an estimated value of those items. It is important for donors to understand that this receipt is crucial for their records, especially during tax season, as it may be required to substantiate claims for charitable contributions. Additionally, the form helps Goodwill maintain accurate inventory records and track donations for their operational needs. By documenting these transactions, both the donor and Goodwill benefit from a transparent and organized process that supports the mission of providing job training and employment services to individuals in need.

Document Specifics

| Fact Name | Description |

|---|---|

| Tax Deductibility | Donations made to Goodwill are generally tax-deductible, provided you have a valid receipt. |

| Receipt Requirements | The receipt must include the name of the donor, the date of the donation, and a description of the items donated. |

| State-Specific Forms | Some states may have specific requirements for donation receipts. For example, California requires a detailed description of donated items under the California Revenue and Taxation Code. |

| Fair Market Value | Donors are responsible for determining the fair market value of their donated items for tax purposes. |

| Record Keeping | It is advisable to keep the receipt for at least three years, as the IRS may request documentation for tax returns. |

Similar forms

- Charitable Donation Receipt: This document serves as proof of a donation made to a qualified charity. Like the Goodwill donation receipt, it details the donor's information, the date of the donation, and a description of the items donated.

- Tax Deduction Form: Similar to the Goodwill receipt, this form helps donors claim deductions on their taxes. It outlines the value of the donation and requires the donor's signature to validate the claim.

- Nonprofit Donation Acknowledgment Letter: This letter is sent by nonprofits to acknowledge donations. It includes similar information as the Goodwill receipt, such as donor details and a description of the donated items.

Hold Harmless Agreement: To understand liability protection better, check out our important aspects of the Hold Harmless Agreement that clarify its usage in contracts.

- In-Kind Donation Form: This form records non-cash donations. It provides a description of the items and their estimated value, much like the Goodwill receipt, making it useful for tax purposes.

- Donation Agreement: A donation agreement outlines the terms of a donation. It includes details about the donor and the items being donated, similar to the Goodwill receipt.

- Gift Receipt: This document is given to individuals who make gifts to organizations. It confirms the gift and includes information about the donor and the item, akin to what is found in the Goodwill receipt.

- Record of Contributions: This is a personal record kept by donors to track their charitable contributions. It includes similar information to the Goodwill receipt, such as dates and descriptions of donations.

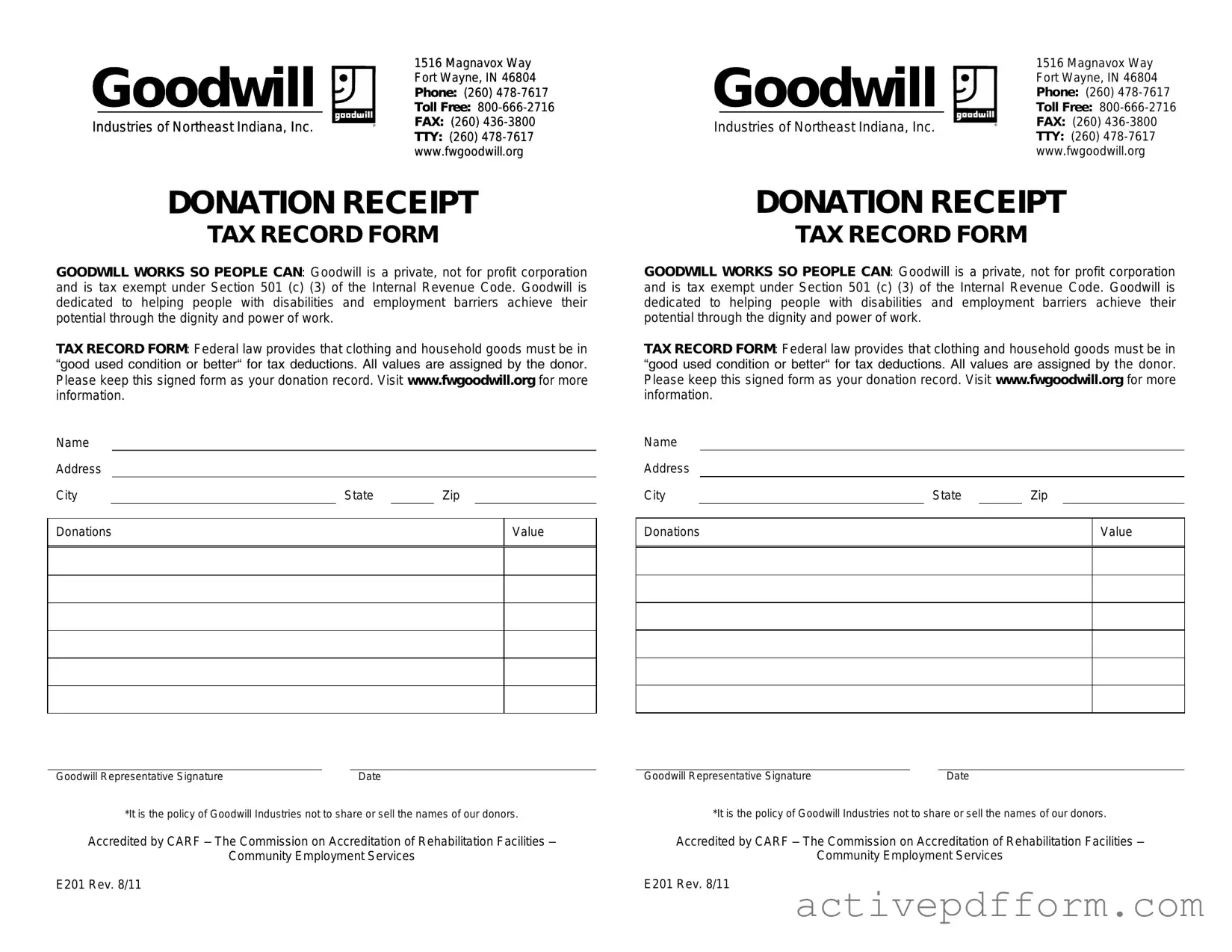

Goodwill donation receipt Example

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Understanding Goodwill donation receipt

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document that you receive when you donate items to Goodwill. This form serves as proof of your donation. It typically includes details like the date of the donation, a description of the items donated, and the estimated value of those items. You can use this receipt for tax purposes, as it may help you claim a deduction on your income tax return.

How do I obtain a Goodwill donation receipt?

When you make a donation to Goodwill, you can ask for a receipt at the time of your donation. Most Goodwill locations provide receipts on-site. If you forget to ask, you can still request one later by contacting the store where you made your donation. They may have a process in place to help you obtain a receipt after the fact.

What should I include when filling out the receipt?

When filling out the receipt, you should include a detailed list of the items you donated. Be as specific as possible. For example, instead of just writing "clothes," list items like "3 pairs of jeans" or "5 shirts." Additionally, note the condition of the items, as this can affect their value. You can also write down an estimated value for each item or group of items, which will be helpful for your tax records.

Can I use the Goodwill donation receipt for tax deductions?

Yes, you can use the Goodwill donation receipt to claim a tax deduction. The IRS allows you to deduct the fair market value of the items you donated. Keep the receipt with your tax records. It's a good idea to take a photo of your items before donating them, as this can serve as additional proof of your donation and its condition.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it’s important to ensure accuracy and clarity. Here are some key points to keep in mind:

- Do clearly write your name and address to ensure proper acknowledgment of your donation.

- Don't leave any sections blank. Every part of the form should be completed to avoid confusion.

- Do list all items donated. This helps in record-keeping and ensures you receive credit for your contributions.

- Don't overestimate the value of your items. Be honest about their condition and worth.

- Do keep a copy of the receipt for your records. This is important for tax purposes.

- Don't forget to sign and date the form. An unsigned receipt may not be valid.

- Do ask for assistance if you are unsure about any part of the form. Staff at Goodwill can help clarify any questions.

- Don't discard the receipt immediately after filling it out. Hold onto it until you confirm it is correct and complete.

Check out Common Templates

What Does It Mean to Not Be Bbb Accredited - Inadequate training of staff affected service quality.

For those looking to ensure a seamless transaction, utilizing the Arizona Trailer Bill of Sale form is vital, as it not only provides a clear record of the sale but also protects both parties involved. You can easily obtain this form by visiting Arizona PDF Forms, where you’ll find the necessary resources to complete your trailer sale accurately and efficiently.

Test Drive Agreement Pdf - Familiarize yourself with your responsibilities while using the vehicle.

Roof Warrenty - You can trust MCS Roofing to stand behind their workmanship throughout the warranty period.