Free Gift Letter Template

The Gift Letter form serves as a crucial document in various financial transactions, particularly in real estate and lending scenarios. It provides a written declaration that a monetary gift has been given, often from a family member or close friend, to assist with a home purchase or other significant expenses. This form helps clarify the nature of the funds, ensuring that they are not considered a loan that requires repayment. Typically, it includes essential details such as the donor's name, the recipient's name, the amount of the gift, and a statement affirming that the funds are indeed a gift. By documenting this information, the Gift Letter form protects both parties and satisfies lender requirements, facilitating smoother transactions. It is important for both the giver and the receiver to understand the implications of this form, as it can impact financial assessments and eligibility for loans. Properly completing and submitting the Gift Letter can significantly ease the process of securing financing for major purchases.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | A Gift Letter is a document that outlines a monetary gift given to a borrower, typically for a home purchase. |

| Purpose | It serves to clarify that the funds are a gift and do not need to be repaid, which is crucial for mortgage lenders. |

| Common Use | Gift Letters are often used in real estate transactions, especially for first-time homebuyers who may receive financial help from family. |

| Required Information | The letter should include the donor's name, the recipient's name, the amount of the gift, and a statement confirming that it is a gift. |

| State-Specific Forms | Some states may have specific requirements or forms for Gift Letters, governed by local real estate laws. |

| Tax Implications | Donors should be aware of potential gift tax implications, as gifts over a certain amount may need to be reported to the IRS. |

| Documentation | It is advisable to keep a copy of the Gift Letter for personal records and to provide it during the mortgage application process. |

Similar forms

-

Affidavit of Support: This document is often used in immigration cases to demonstrate that a sponsor can financially support an immigrant. Like a Gift Letter, it requires a clear declaration of financial support, detailing the relationship between the parties involved and the amount of support provided.

-

Loan Agreement: A Loan Agreement outlines the terms under which money is borrowed and repaid. Similar to a Gift Letter, it specifies the amount of money involved and the relationship between the lender and borrower, but it includes repayment terms, which are not present in a Gift Letter.

-

Promissory Note: This document serves as a written promise to pay a specified amount of money to a designated person. It shares similarities with a Gift Letter in that it includes details about the amount and the parties involved, but it imposes a legal obligation to repay, unlike a gift.

- California DV-260 Form: Essential for individuals seeking protection through a restraining order, the California DV-260 form ensures sensitive information remains private while enabling law enforcement to access necessary details. To begin the process of filling out the form and protecting yourself, visit California PDF Forms.

-

Financial Statement: A Financial Statement provides a snapshot of an individual's financial status, including assets, liabilities, and income. It is similar to a Gift Letter in that both documents may be used to support financial transactions and demonstrate the ability to provide financial assistance, although a Financial Statement is more comprehensive.

Gift Letter Example

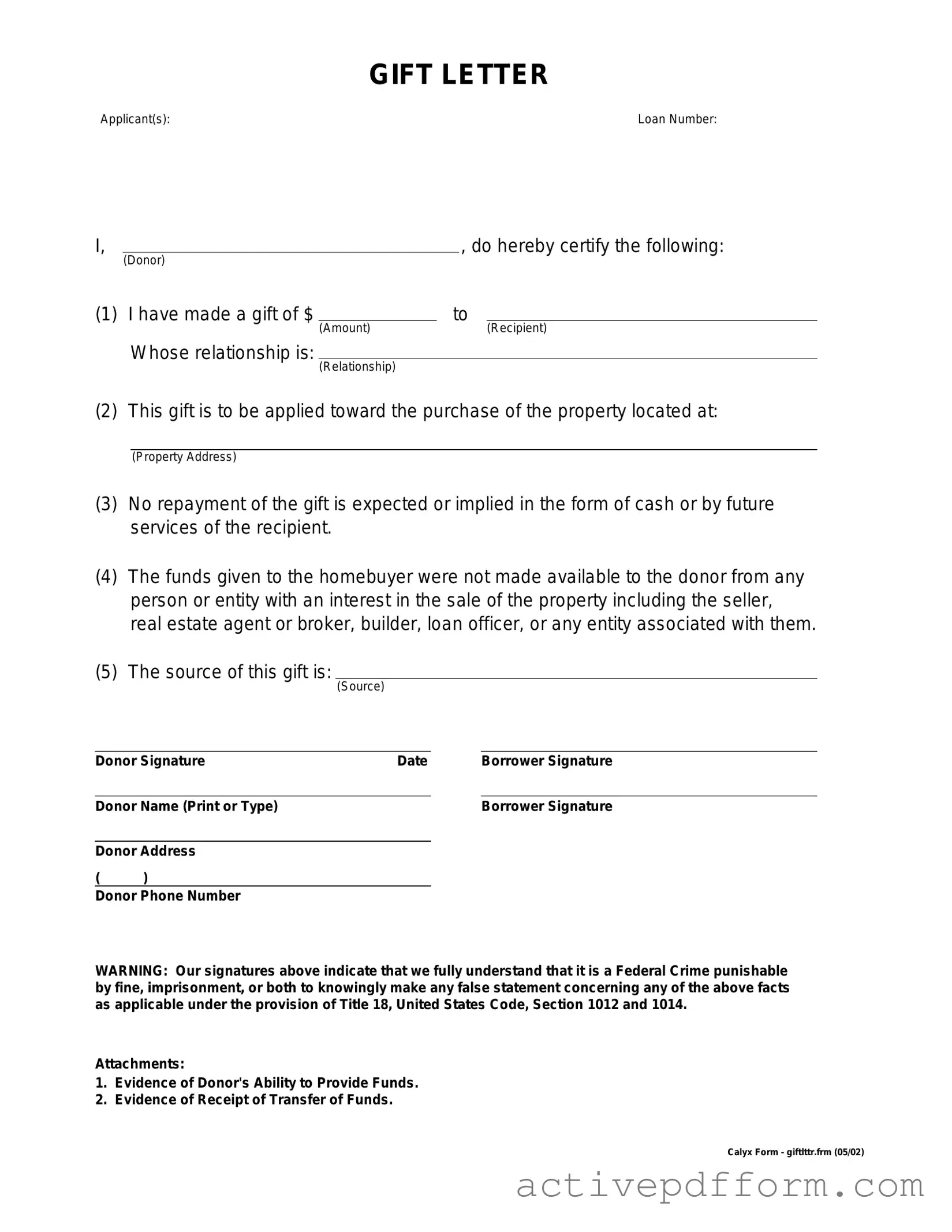

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Understanding Gift Letter

What is a Gift Letter form?

A Gift Letter form is a document that confirms a monetary gift given to an individual, often used in real estate transactions. It serves as proof that the money is a gift and not a loan, which can impact the buyer's ability to qualify for a mortgage. This form typically includes details about the donor, recipient, and the amount gifted.

Who needs to use a Gift Letter form?

Anyone receiving a significant monetary gift, especially in connection with purchasing a home, should use a Gift Letter form. Lenders often require this documentation to ensure that the funds are not expected to be repaid, which could affect the buyer's debt-to-income ratio and loan eligibility.

What information is typically included in a Gift Letter?

A standard Gift Letter includes the donor's name, address, and relationship to the recipient. It also states the amount of the gift and confirms that it is a gift, not a loan. Additionally, the letter may require the donor's signature to validate the information provided.

Is a Gift Letter form legally binding?

While a Gift Letter form is not a legally binding contract, it serves as a formal acknowledgment of the gift. It provides clarity to both the lender and the recipient. However, it’s essential to ensure that all information is accurate and truthful, as providing false information could have legal consequences.

Do I need to have my Gift Letter notarized?

Notarization is not typically required for a Gift Letter form. However, some lenders may request it to add an extra layer of verification. Always check with your lender for their specific requirements regarding documentation.

Dos and Don'ts

When filling out the Gift Letter form, it's essential to ensure accuracy and clarity. Here are ten important dos and don'ts to keep in mind:

- Do provide accurate information about the donor and recipient.

- Do include the exact amount of the gift being given.

- Do clearly state the purpose of the gift.

- Do ensure that both the donor and recipient sign the letter.

- Do keep a copy of the completed Gift Letter for your records.

- Don't leave any sections of the form blank.

- Don't use vague language that may confuse the reader.

- Don't forget to date the letter.

- Don't provide false information, as this can lead to complications.

- Don't overlook the importance of clarity in your writing.

Check out Common Templates

Proxy Form for Hoa Meeting - Completed forms after the meeting will not be accepted.

Utilizing the NYC Payroll Form is crucial for contractors and subcontractors involved in public projects, as it guarantees adherence to labor regulations and proper payment of wages. For those seeking a reliable template to assist with this process, resources like nytemplates.com/blank-nyc-payroll-template can provide valuable guidance to ensure accurate reporting.

How to Make a Rental Lease Agreement - Tenants must pay a security deposit upon signing the lease, which is held for any damages or unpaid rent.