Blank Gift Deed Document

When it comes to transferring property or assets without any financial exchange, the Gift Deed form plays a crucial role. This legal document allows one party, known as the donor, to voluntarily give a gift to another party, referred to as the donee. The Gift Deed not only outlines the specifics of the gift, including its description and value, but it also establishes the intentions of the donor. Essential components of this form include the names and addresses of both parties, a clear declaration of the gift, and any conditions that may apply. In many cases, witnesses are required to sign the document, adding an extra layer of authenticity. Additionally, depending on the jurisdiction, there may be specific requirements regarding notarization or registration. Understanding these elements can empower individuals to navigate the process confidently, ensuring that their intentions are honored and legally recognized.

Gift Deed - Designed for Individual States

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Voluntary Transfer | The transfer of property through a Gift Deed must be voluntary, meaning the giver must intend to make a gift without any coercion. |

| Consideration | Unlike a sale, a Gift Deed does not involve consideration, which is the legal term for something of value exchanged between parties. |

| State-Specific Laws | The rules governing Gift Deeds can vary by state. For instance, in California, the California Civil Code governs the creation and execution of Gift Deeds. |

| Tax Implications | Gifts may have tax implications. The IRS allows a certain amount to be gifted annually without incurring gift tax. In 2023, this amount is $17,000 per recipient. |

| Written Requirement | Most states require that a Gift Deed be in writing to be legally enforceable. Oral gifts are generally not recognized. |

| Signature Requirement | The giver must sign the Gift Deed for it to be valid. In some states, witnesses or notarization may also be required. |

| Revocation | Once executed, a Gift Deed is generally irrevocable unless specific conditions are met, such as the death of the recipient or mutual agreement. |

Similar forms

Will: A will is a legal document that outlines how a person's assets will be distributed after their death. Like a gift deed, it transfers ownership but does so upon the death of the individual rather than immediately.

Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Similar to a gift deed, it involves the transfer of property but can include conditions and management by a third party.

Quitclaim Deed: A quitclaim deed transfers whatever interest a person has in a property without guaranteeing that interest is valid. It is similar to a gift deed in that it conveys property without a sale, often used among family members.

Residential Lease Agreement: Understanding the Arizona PDF Forms is essential for landlords and tenants, as it outlines the legal responsibilities and terms related to renting a property in Arizona.

Warranty Deed: A warranty deed provides a guarantee that the property title is clear. While it differs in offering warranties, it also serves to transfer ownership, akin to a gift deed.

Sale Deed: A sale deed is a document that transfers ownership of property in exchange for payment. Although it involves a transaction, it shares similarities with a gift deed in the act of transferring property rights.

Power of Attorney: A power of attorney allows one person to act on behalf of another in legal matters. It can facilitate the transfer of property, similar to a gift deed, but does not itself transfer ownership.

Bill of Sale: A bill of sale documents the transfer of personal property from one party to another. It is similar to a gift deed in that it formalizes the transfer of ownership, albeit typically for items rather than real estate.

Deed of Gift: A deed of gift is specifically designed to transfer property as a gift. It is essentially synonymous with a gift deed, emphasizing the voluntary nature of the transfer without compensation.

Affidavit of Heirship: An affidavit of heirship is used to establish the heirs of a deceased person. While it does not directly transfer property, it can clarify ownership, similar to how a gift deed clarifies ownership transfer during life.

Gift Deed Example

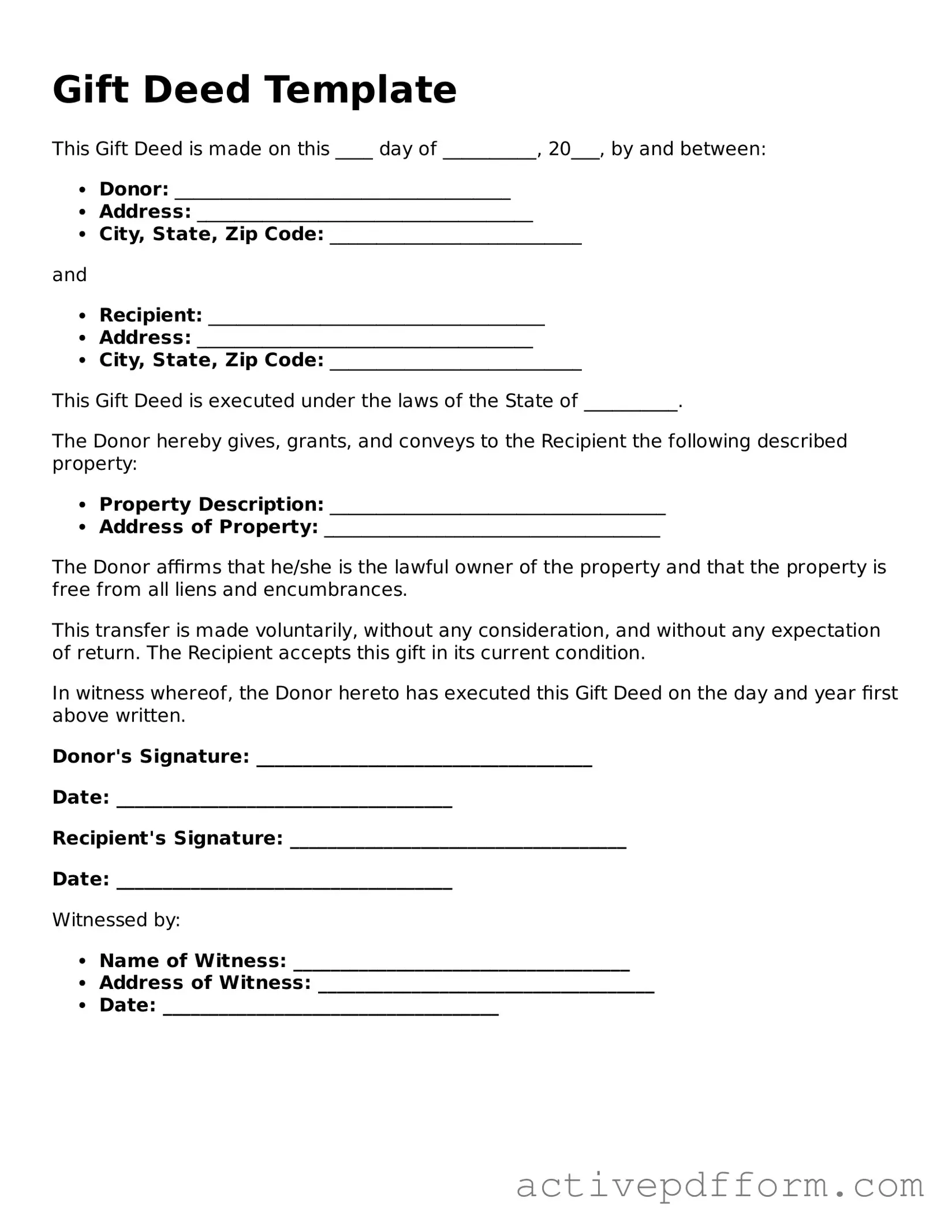

Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20___, by and between:

- Donor: ____________________________________

- Address: ____________________________________

- City, State, Zip Code: ___________________________

and

- Recipient: ____________________________________

- Address: ____________________________________

- City, State, Zip Code: ___________________________

This Gift Deed is executed under the laws of the State of __________.

The Donor hereby gives, grants, and conveys to the Recipient the following described property:

- Property Description: ____________________________________

- Address of Property: ____________________________________

The Donor affirms that he/she is the lawful owner of the property and that the property is free from all liens and encumbrances.

This transfer is made voluntarily, without any consideration, and without any expectation of return. The Recipient accepts this gift in its current condition.

In witness whereof, the Donor hereto has executed this Gift Deed on the day and year first above written.

Donor's Signature: ____________________________________

Date: ____________________________________

Recipient's Signature: ____________________________________

Date: ____________________________________

Witnessed by:

- Name of Witness: ____________________________________

- Address of Witness: ____________________________________

- Date: ____________________________________

Understanding Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. It is a way to give a gift formally and ensures that the transfer is recognized by law.

Who can create a Gift Deed?

Anyone who legally owns property can create a Gift Deed. The person giving the gift is known as the donor, while the person receiving it is called the donee. Both parties must be competent to enter into a legal agreement.

What types of property can be transferred using a Gift Deed?

A Gift Deed can be used to transfer various types of property, including real estate, vehicles, stocks, and personal belongings. However, it’s important to ensure that the property can legally be gifted and that there are no restrictions on the transfer.

Is a Gift Deed legally binding?

Yes, a Gift Deed is legally binding once it is properly executed. This means that it must be signed by the donor and the donee, and in many cases, it should be notarized and recorded with the appropriate government office to ensure its validity.

Are there any tax implications for gifting property?

Yes, there may be tax implications for both the donor and the donee. The donor may need to file a gift tax return if the value of the gift exceeds a certain amount set by the IRS. The donee may also have tax responsibilities in the future when they sell the property. Consulting a tax professional is advisable.

Can a Gift Deed be revoked?

Generally, a Gift Deed cannot be revoked once it has been executed and delivered, unless specific conditions are included in the deed itself. If the donor wishes to retain some control over the property, they should consider other options, such as a trust.

What should be included in a Gift Deed?

A Gift Deed should include the names of the donor and donee, a clear description of the property being gifted, the date of the gift, and any conditions or restrictions. It’s also wise to include a statement confirming that the gift is made voluntarily and without coercion.

How do I create a Gift Deed?

Creating a Gift Deed typically involves drafting the document, ensuring it includes all necessary information, and having it signed by both parties. Depending on your location, you may need to have it notarized and filed with local authorities. It’s often helpful to consult a legal professional to ensure everything is done correctly.

Dos and Don'ts

When filling out a Gift Deed form, attention to detail is crucial. Here are some important dos and don’ts to consider:

- Do provide accurate information about the donor and the recipient.

- Do clearly describe the property being gifted.

- Do include the date of the gift.

- Do have the document notarized to ensure its validity.

- Do keep a copy of the completed Gift Deed for your records.

- Don't leave any fields blank; all sections must be filled out.

- Don't use vague language; be specific in your descriptions.

- Don't forget to sign the document; both parties should sign.

- Don't rush through the process; take your time to review everything.

Consider More Types of Gift Deed Templates

What Is a Deed in Lieu - This form allows borrowers to avoid the foreclosure filings that become public record through judicial proceedings.

The California Articles of Incorporation form is a legal document used to establish a corporation in California. This form outlines essential details about your business, such as its name, purpose, and structure. Completing this form is the first step toward officially launching your corporation, so be sure to fill it out accurately by clicking the button below. For a convenient option, you may also explore California PDF Forms to assist you with the process.