Free Generic Direct Deposit Template

The Generic Direct Deposit form is a crucial document for individuals looking to streamline their payment processes. It allows employees or beneficiaries to authorize direct deposits into their bank accounts, ensuring timely and secure transactions. This form requires essential personal information, including the individual's name, Social Security number, and contact details. Additionally, it necessitates the identification of the financial institution, the account number, and the routing transit number, all of which must be filled out accurately to avoid any processing delays. Users can select whether the deposit is for a new account, a change to an existing account, or a cancellation of previous authorizations. By signing the form, individuals grant permission to their employer or the relevant agency to deposit funds directly into their specified account. If the account is joint or held by another person, that individual must also provide their consent by signing the form. Clear instructions are provided to guide users through the completion process, emphasizing the importance of verifying account details with the financial institution to ensure successful direct deposits.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Generic Direct Deposit form is used to authorize a financial institution to deposit funds directly into a bank account. |

| Account Information | Users must provide their account number, routing transit number, and specify whether the account is a checking or savings account. |

| Signature Requirement | The form requires the signature of the account holder to authorize the direct deposit, and a joint account holder must also sign if applicable. |

| State-Specific Laws | In Florida, the governing law for direct deposits is outlined in the Florida Statutes, Chapter 655, which regulates banking practices. |

Similar forms

- W-4 Form: Like the Generic Direct Deposit form, the W-4 form is essential for payroll processing. It allows employees to indicate their tax withholding preferences, ensuring accurate deductions from their paychecks.

- Bank Account Application: This document is similar because it requires personal information and account details. Both forms involve establishing a financial relationship with a bank, focusing on account ownership and type.

- Paycheck Authorization Form: This form is used to authorize the direct deposit of paychecks. Similar to the Generic Direct Deposit form, it ensures that funds are deposited into the specified bank account.

- Tax Refund Direct Deposit Form: This document allows taxpayers to request that their tax refunds be deposited directly into their bank accounts. It shares similarities in purpose and structure, focusing on account information and authorization.

- Loan Payment Authorization Form: This form permits a lender to withdraw loan payments directly from a borrower’s bank account. It parallels the Generic Direct Deposit form by requiring account details and signatures for authorization.

- California LLC 1 Form: Essential for establishing a Limited Liability Company in the state, ensure to fill out the form accurately. More information can be found in the California PDF Forms.

- Automatic Bill Payment Authorization: This document allows individuals to set up automatic payments for recurring bills. Like the Generic Direct Deposit form, it requires bank account information and consent to withdraw funds.

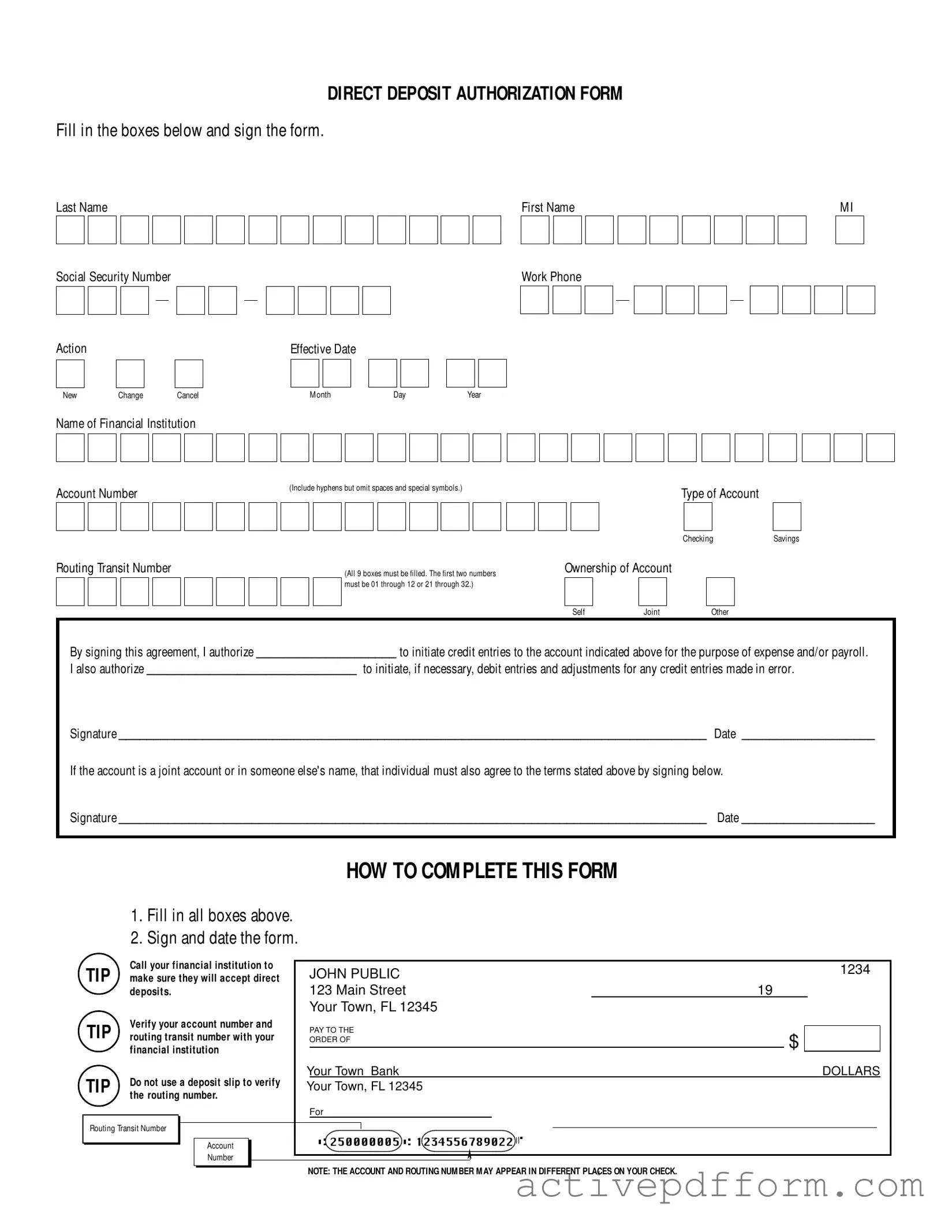

Generic Direct Deposit Example

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

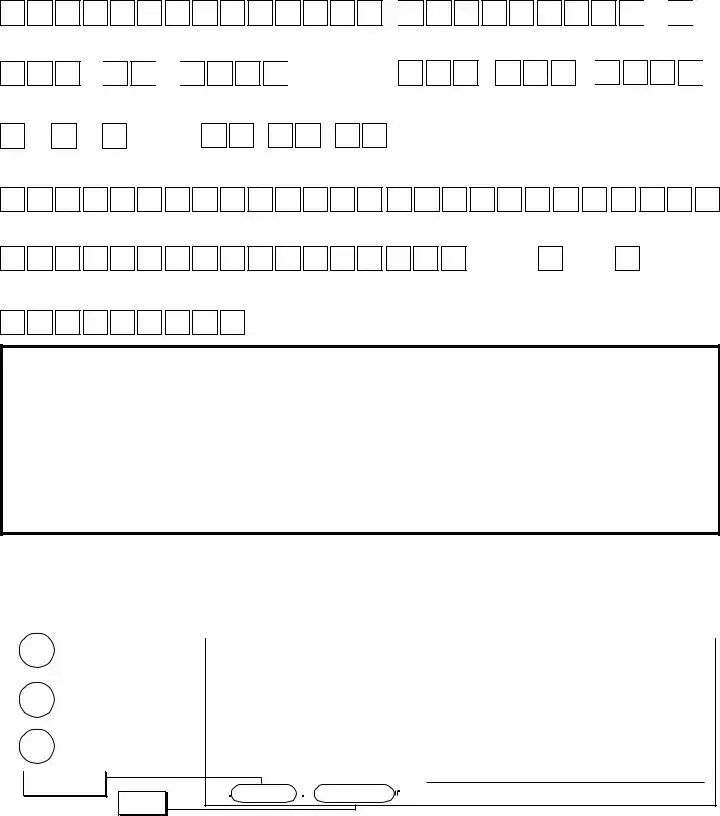

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Understanding Generic Direct Deposit

What is a Generic Direct Deposit form?

The Generic Direct Deposit form is a document that allows individuals to authorize their employer or another organization to deposit funds directly into their bank account. This form typically requires personal information, including the individual's name, social security number, and bank account details.

How do I fill out the Generic Direct Deposit form?

To complete the form, you need to fill in all the requested information accurately. This includes your last name, first name, middle initial, social security number, and contact information. You will also need to provide details about your financial institution, including the account number and routing transit number. Finally, you must sign and date the form to authorize the direct deposit.

What information do I need to provide about my bank account?

You will need to include the name of your financial institution, your account number, and the routing transit number. The account number should be written without spaces or special symbols, and the routing number must be a nine-digit number that identifies your bank. Ensure that the first two digits of the routing number are within the range of 01 to 12 or 21 to 32.

What types of accounts can I use for direct deposit?

The form allows you to select either a checking or savings account for direct deposit. Make sure to choose the correct type, as this determines where the funds will be deposited.

What should I do if my account is a joint account?

If your account is joint or held in someone else's name, that individual must also sign the form to agree to the terms. Both signatures are necessary for authorization to process the direct deposit.

How can I verify my account and routing numbers?

It is important to verify your account number and routing transit number with your financial institution. You can do this by contacting your bank directly. Avoid using a deposit slip, as the numbers may appear in different locations on it.

What happens if I make a mistake on the form?

If you make an error while filling out the form, it is advisable to correct it before submitting. If you realize a mistake after submission, contact your employer or the organization that requested the form as soon as possible to rectify the issue. They may need to initiate a correction process.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time by filling out a new Generic Direct Deposit form. Indicate that you are making a change and provide the updated account details. Ensure that you submit the new form to your employer or the relevant organization promptly.

What is the effective date for the direct deposit?

The effective date is the date on which the direct deposit will begin. You can specify this date on the form. If you are a new employee, it is often set to coincide with your first payday. For changes, the effective date should be discussed with your employer to ensure timely processing.

What should I do if I want to cancel my direct deposit?

If you wish to cancel your direct deposit, you must indicate this on the form by selecting the cancel option. It is also recommended to inform your employer or the organization managing your payroll to ensure that no further deposits are made to your account.

Dos and Don'ts

When filling out the Generic Direct Deposit form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure that your direct deposit is set up correctly and without issues.

- Do fill in all boxes completely.

- Do sign and date the form.

- Do verify your account number and routing transit number with your financial institution.

- Do contact your financial institution to confirm they accept direct deposits.

- Do ensure the routing number consists of exactly nine digits.

- Don't use a deposit slip to verify the routing number.

- Don't leave any boxes blank.

- Don't forget to include hyphens in your account number.

- Don't submit the form without the necessary signatures if it’s a joint account.

Check out Common Templates

Semi Truck Pre Trip Inspection Diagram - Make inspections a habit to foster long-term vehicle reliability.

The Missouri Tractor Bill of Sale form serves as a critical legal document that solidifies the ownership transfer of a tractor, ensuring both parties are well-informed about the transaction specifics. For added convenience, you can access the necessary paperwork through the Tractor Bill of Sale form, which streamlines the completion process.

Aia A305 Form Pdf - Contractors can demonstrate their understanding of industry standards with the A305.