Blank Florida Transfer-on-Death Deed Document

The Florida Transfer-on-Death Deed (TOD) form serves as a crucial tool for property owners looking to streamline the transfer of real estate upon their death. This legal document allows individuals to designate beneficiaries who will automatically receive ownership of the property without the need for probate. By completing the TOD form, property owners can maintain control during their lifetime while ensuring a smooth transition of assets to their chosen heirs. The form requires specific information, including the names of the beneficiaries, a clear description of the property, and the signature of the property owner. Additionally, it must be properly recorded with the county clerk to take effect. Understanding the nuances of the Transfer-on-Death Deed can help individuals make informed decisions about their estate planning, allowing them to minimize potential disputes and complications for their loved ones in the future.

Document Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Florida Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property upon death, avoiding probate. |

| Governing Law | This deed is governed by Florida Statutes, specifically Chapter 732.4015. |

| Revocation | Property owners can revoke the deed at any time before their death by filing a new deed or a revocation form. |

| Eligibility | Only real property can be transferred using this deed. It must be signed, notarized, and recorded to be effective. |

Similar forms

A Transfer-on-Death (TOD) Deed is a unique estate planning tool that allows individuals to transfer real estate to beneficiaries upon their death without the need for probate. Several other documents serve similar purposes in the realm of estate planning and asset transfer. Below are nine documents that share similarities with the Transfer-on-Death Deed:

- Last Will and Testament: A legal document that outlines how an individual wishes to distribute their assets after death. Like a TOD Deed, it can designate beneficiaries but typically requires probate.

- Living Trust: This document holds assets during a person's lifetime and specifies how they should be distributed upon death. It avoids probate, similar to a TOD Deed.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows co-owners to automatically inherit each other’s share upon death, bypassing probate like a TOD Deed.

- Notice to Quit: Essential for landlords, this document formally requests tenants to vacate a rental property, ensuring compliance with rental laws. For more information, refer to the Arizona PDF Forms.

- Payable-on-Death (POD) Accounts: Bank accounts that transfer funds to a designated beneficiary upon the account holder's death, similar to the beneficiary designation in a TOD Deed.

- Transfer-on-Death Registration for Securities: This allows individuals to designate beneficiaries for stocks and bonds, facilitating transfer without probate, akin to a TOD Deed.

- Life Insurance Beneficiary Designation: A document that specifies who will receive the death benefit from a life insurance policy, ensuring direct transfer to beneficiaries without probate.

- Retirement Account Beneficiary Designation: This allows account holders to name beneficiaries for retirement accounts, ensuring a smooth transfer of assets upon death, similar to a TOD Deed.

- Family Limited Partnership Agreements: These agreements can facilitate the transfer of family-owned business interests or assets while providing certain tax benefits, paralleling the intent of a TOD Deed.

- Durable Power of Attorney: While primarily used for managing financial matters during one’s lifetime, it can include provisions for asset transfer upon death, reflecting some characteristics of a TOD Deed.

Understanding these documents can help individuals make informed decisions about their estate planning needs. Each document has its own advantages and considerations, and it is essential to choose the right one based on personal circumstances and goals.

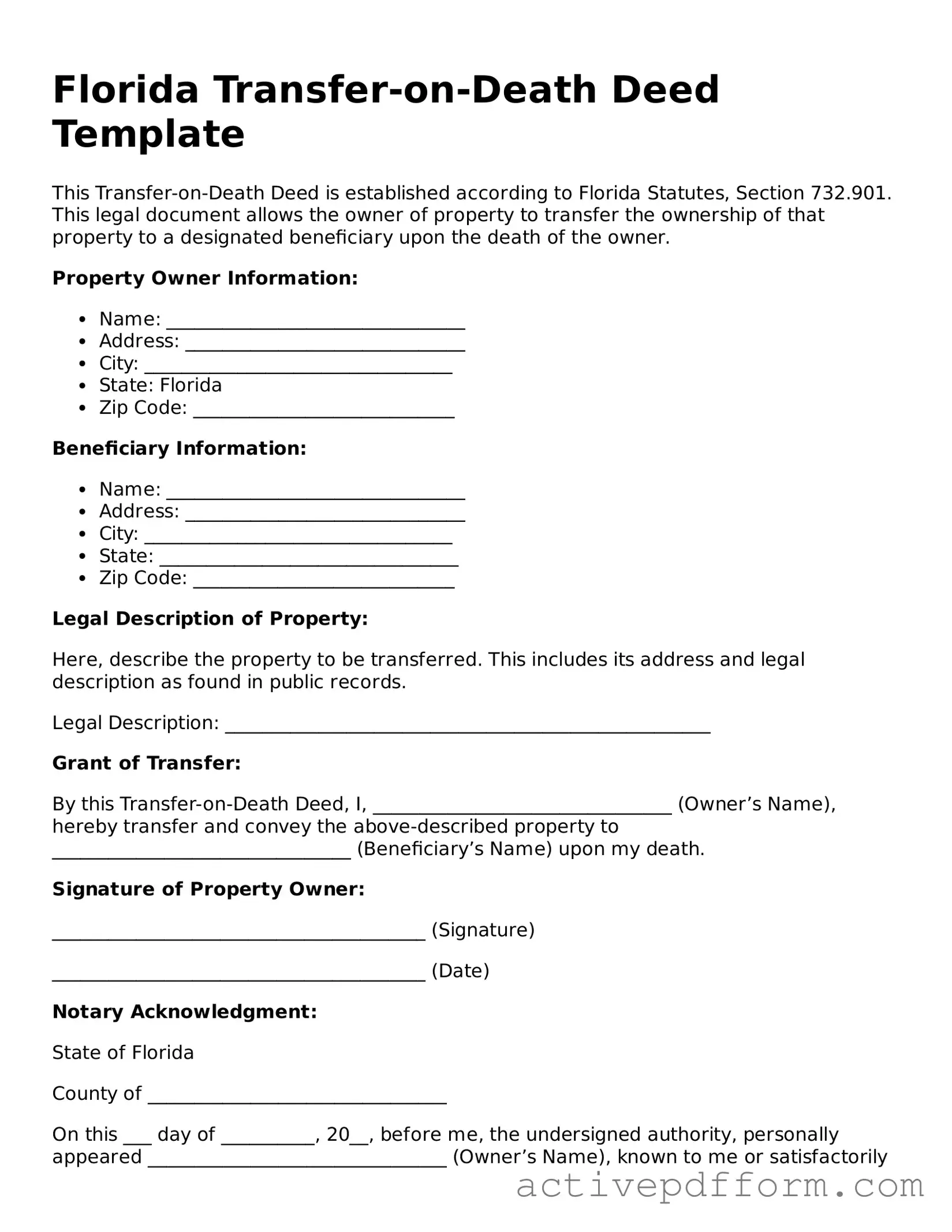

Florida Transfer-on-Death Deed Example

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is established according to Florida Statutes, Section 732.901. This legal document allows the owner of property to transfer the ownership of that property to a designated beneficiary upon the death of the owner.

Property Owner Information:

- Name: ________________________________

- Address: ______________________________

- City: _________________________________

- State: Florida

- Zip Code: ____________________________

Beneficiary Information:

- Name: ________________________________

- Address: ______________________________

- City: _________________________________

- State: ________________________________

- Zip Code: ____________________________

Legal Description of Property:

Here, describe the property to be transferred. This includes its address and legal description as found in public records.

Legal Description: ____________________________________________________

Grant of Transfer:

By this Transfer-on-Death Deed, I, ________________________________ (Owner’s Name), hereby transfer and convey the above-described property to ________________________________ (Beneficiary’s Name) upon my death.

Signature of Property Owner:

________________________________________ (Signature)

________________________________________ (Date)

Notary Acknowledgment:

State of Florida

County of ________________________________

On this ___ day of __________, 20__, before me, the undersigned authority, personally appeared ________________________________ (Owner’s Name), known to me or satisfactorily proved to be the person whose name is subscribed to this document, and acknowledged that he/she executed the same for the purposes therein expressed.

________________________________________

Notary Public signature

My Commission Expires: ________________

Understanding Florida Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Florida to transfer real estate to a designated beneficiary upon their death. This form bypasses the probate process, enabling a smoother transition of property ownership without the need for court intervention.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Florida can utilize a Transfer-on-Death Deed. This includes homeowners, co-owners, and individuals holding property in a trust. However, it is essential that the property is not subject to any liens or encumbrances that could complicate the transfer.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must fill out the appropriate form, which includes details about the property, the owner, and the beneficiary. It is advisable to have the deed signed in the presence of a notary public and recorded with the county clerk's office where the property is located. This ensures the deed is legally recognized and enforceable.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do so, you must execute a new deed or a formal revocation document. It is crucial to record any changes with the county clerk to ensure that the most current wishes are reflected in public records.

What happens if I do not designate a beneficiary?

If you do not designate a beneficiary in your Transfer-on-Death Deed, the property will not automatically transfer upon your death. Instead, it will become part of your estate and may be subject to probate, which can be a lengthy and costly process.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. The property is not considered part of the deceased's estate for estate tax purposes. However, beneficiaries may be subject to capital gains tax when they sell the property, depending on the property's value at the time of transfer and their individual tax situations.

Can a Transfer-on-Death Deed be contested?

Yes, a Transfer-on-Death Deed can be contested, just like any other estate planning document. Common grounds for contesting a TODD may include claims of undue influence, lack of mental capacity, or improper execution of the deed. If a beneficiary or interested party believes there are valid reasons to challenge the deed, they may pursue legal action.

Is legal assistance necessary when creating a Transfer-on-Death Deed?

While it is not legally required to seek assistance, consulting with a legal professional can be beneficial. An attorney can help ensure that the deed is properly executed, complies with state laws, and aligns with your overall estate planning goals.

What types of property can be transferred using a Transfer-on-Death Deed?

In Florida, a Transfer-on-Death Deed can be used to transfer various types of real estate, including residential homes, vacant land, and commercial properties. However, it cannot be used for personal property, such as vehicles or bank accounts.

When does the Transfer-on-Death Deed take effect?

The Transfer-on-Death Deed takes effect only upon the death of the property owner. Until that time, the owner retains full control over the property and can sell, mortgage, or otherwise manage it as they see fit. The beneficiary has no rights to the property until the owner's passing.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it's important to ensure accuracy and clarity. Here are some guidelines to follow:

- Do ensure that you understand the purpose of the deed. It allows property to transfer directly to a beneficiary upon your death.

- Do provide accurate information about the property. Include the legal description and address.

- Do clearly identify the beneficiary. Use full names and ensure they are spelled correctly.

- Do sign the deed in the presence of a notary public. This step is crucial for the deed's validity.

- Don't leave any sections blank. Incomplete forms can lead to complications later.

- Don't forget to record the deed with the county clerk's office. This step is necessary for the transfer to be effective.

- Don't assume the deed is permanent. Review and update it if your circumstances change, such as a change in beneficiaries.

Browse Other Popular Transfer-on-Death Deed Templates for Specific States

Deed on Death Texas - Life changes, such as marriage or divorce, might necessitate updates to the Transfer-on-Death Deed.

The California Articles of Incorporation form is a legal document used to establish a corporation in California. This form outlines essential details about your business, such as its name, purpose, and structure. Completing this form is the first step toward officially launching your corporation, so be sure to fill it out accurately by clicking the button below. For more information and to access the form, visit California PDF Forms.