Blank Florida Promissory Note Document

The Florida Promissory Note form serves as a crucial document in the realm of personal and commercial financing, providing a written promise from a borrower to repay a specified amount of money to a lender under agreed-upon terms. This form typically outlines key details such as the principal amount borrowed, the interest rate, and the repayment schedule, which may include specific due dates or installment amounts. Additionally, it often specifies the consequences of default, ensuring that both parties understand their rights and obligations. The form can be tailored to suit various lending scenarios, whether it involves family loans, business transactions, or formal lending institutions. By detailing these essential elements, the Florida Promissory Note not only protects the interests of the lender but also clarifies the responsibilities of the borrower, fostering transparency and trust in financial agreements. Understanding this form is vital for anyone involved in lending or borrowing money in Florida, as it lays the foundation for a legally binding contract that can be enforced in court if necessary.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money at a designated time. |

| Governing Law | Florida Statutes Chapter 673 governs promissory notes in Florida. |

| Parties Involved | The note involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, as agreed upon by both parties. |

| Payment Terms | Payment terms must be clearly stated, including due dates and payment amounts. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make payments. |

| Signatures Required | Both parties must sign the note for it to be legally binding. |

| Notarization | While not required, notarizing the note can add an extra layer of security. |

| Enforceability | The note is enforceable in court if it meets all legal requirements. |

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money to a designated person or entity. Several other documents share similarities with a Promissory Note, primarily in their purpose of establishing financial obligations. Here are nine documents that resemble a Promissory Note:

- Loan Agreement: This is a formal contract between a borrower and a lender detailing the terms of the loan, including repayment schedules and interest rates, similar to a Promissory Note.

- Mortgage: A mortgage is a specific type of loan secured by real property. Like a Promissory Note, it includes a promise to repay the borrowed funds, but it also involves the property as collateral.

- Bond: A bond is a debt security issued by corporations or governments, where the issuer promises to pay back the principal along with interest. It functions similarly to a Promissory Note in that it establishes a debt obligation.

- IOU (I Owe You): An informal document acknowledging a debt, an IOU outlines the amount owed and the debtor's commitment to repay, akin to a Promissory Note but typically less formal.

- Installment Agreement: This document details a payment plan for a debt, specifying how much will be paid and when, similar to the repayment terms found in a Promissory Note.

- Credit Agreement: A credit agreement outlines the terms under which credit is extended, including repayment terms and interest rates, much like a Promissory Note.

- Bill of Sale: A Bill of Sale is crucial for recording the transfer of ownership for personal property. It ensures that the transaction is documented properly and can be obtained through resources like California PDF Forms.

- Secured Note: This is a Promissory Note backed by collateral. It shares the same fundamental promise to pay but adds a layer of security for the lender.

- Lease Agreement: While primarily for rental arrangements, a lease agreement can include payment terms and obligations similar to those in a Promissory Note.

- Personal Loan Agreement: This document specifies the terms of a personal loan between individuals, including repayment terms and interest, resembling the structure of a Promissory Note.

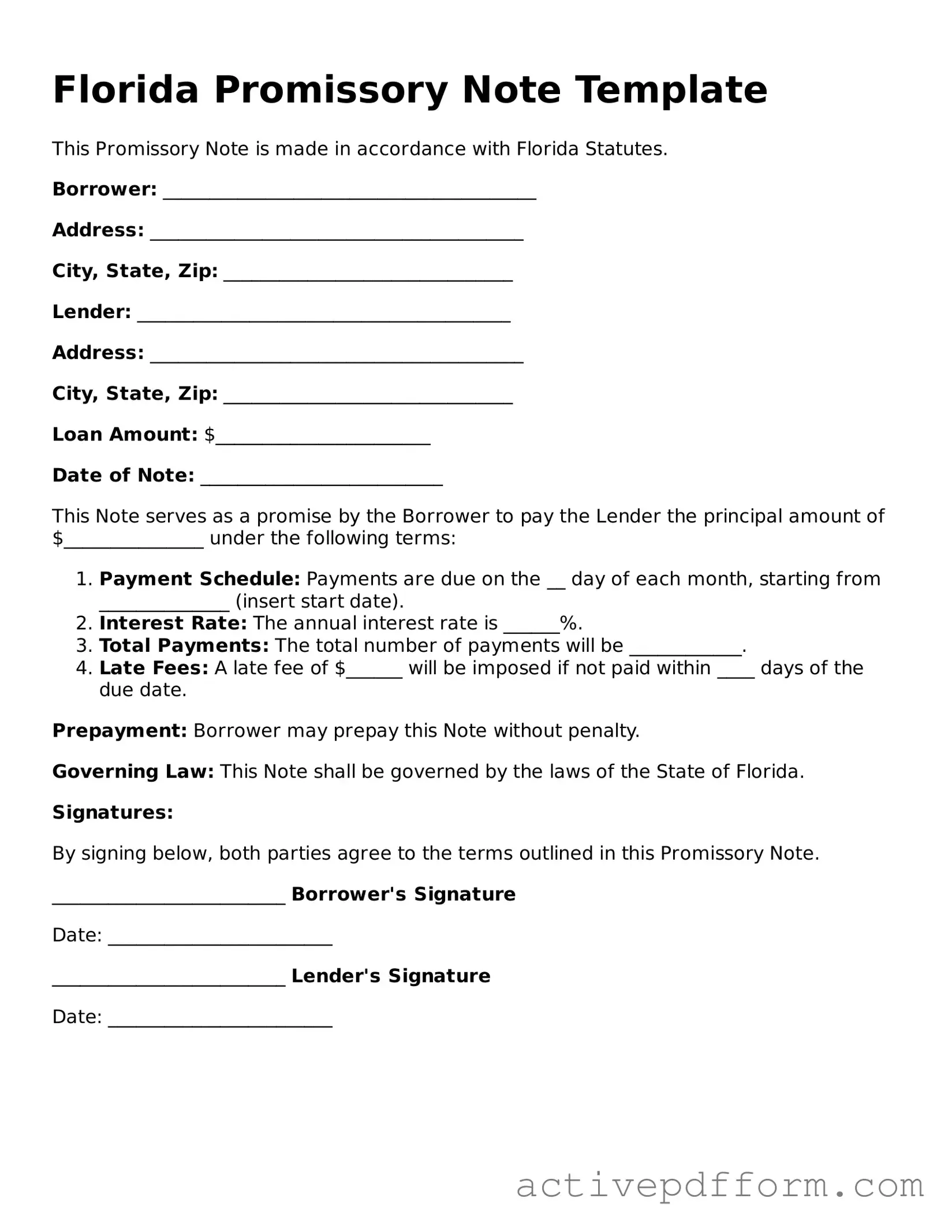

Florida Promissory Note Example

Florida Promissory Note Template

This Promissory Note is made in accordance with Florida Statutes.

Borrower: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

Lender: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

Loan Amount: $_______________________

Date of Note: __________________________

This Note serves as a promise by the Borrower to pay the Lender the principal amount of $_______________ under the following terms:

- Payment Schedule: Payments are due on the __ day of each month, starting from ______________ (insert start date).

- Interest Rate: The annual interest rate is ______%.

- Total Payments: The total number of payments will be ____________.

- Late Fees: A late fee of $______ will be imposed if not paid within ____ days of the due date.

Prepayment: Borrower may prepay this Note without penalty.

Governing Law: This Note shall be governed by the laws of the State of Florida.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

_________________________ Borrower's Signature

Date: ________________________

_________________________ Lender's Signature

Date: ________________________

Understanding Florida Promissory Note

What is a Florida Promissory Note?

A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a loan under specific terms. This note typically includes details such as the loan amount, interest rate, repayment schedule, and consequences for default. It serves as a binding agreement between the lender and borrower, ensuring that both parties understand their obligations. Having this document in place is crucial for protecting your rights and interests in any lending situation.

Who can use a Florida Promissory Note?

Any individual or business can use a Florida Promissory Note when lending or borrowing money. This includes personal loans between friends or family members, as well as formal loans from financial institutions. It is essential for both lenders and borrowers to clearly understand the terms of the loan and to document them in writing. This helps to avoid misunderstandings and provides legal protection in case of disputes.

What are the key components of a Florida Promissory Note?

A well-drafted Florida Promissory Note should include several key components: the names and addresses of both the borrower and lender, the principal amount of the loan, the interest rate (if applicable), the repayment schedule, and any penalties for late payments or default. Additionally, it may include clauses regarding prepayment, governing law, and dispute resolution. Each of these elements plays a vital role in defining the terms of the agreement and ensuring clarity for both parties.

Is a Florida Promissory Note legally binding?

Yes, a Florida Promissory Note is legally binding, provided it meets certain requirements. For the note to be enforceable, it must be in writing, signed by the borrower, and include all essential terms. If these criteria are met, the lender can take legal action to recover the owed amount if the borrower fails to repay the loan as agreed. It is advisable to consult with a legal professional to ensure that the document is properly drafted and complies with state laws.

Dos and Don'ts

When filling out the Florida Promissory Note form, it’s important to be careful and thorough. Here are some guidelines to help you.

- Do read the entire form before starting.

- Do fill in all required fields completely.

- Do use clear and legible handwriting or type the information.

- Do double-check the terms, including the interest rate and payment schedule.

- Do sign and date the form where indicated.

- Don't leave any sections blank unless instructed.

- Don't use white-out to correct mistakes; instead, cross out the error and write the correct information.

- Don't forget to keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure accuracy.

Browse Other Popular Promissory Note Templates for Specific States

Promissory Note Texas - The clear structure of a promissory note aids in loan management.

For those navigating rental agreements, a helpful resource is the comprehensive Ohio Lease Agreement documentation available online. This ensures all parties are informed about their responsibilities and rights within their leasing arrangement. More information can be found at this essential Lease Agreement guide.

California Promissory Note Requirements - Specifying a maturity date is essential for defining repayment deadlines.