Blank Florida Loan Agreement Document

When entering into a financial arrangement in Florida, a Loan Agreement form serves as a crucial document to outline the terms and conditions between the lender and the borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Both parties benefit from clearly defined expectations, which can help prevent misunderstandings and disputes down the line. Additionally, the agreement may specify late fees, default terms, and any applicable legal rights, ensuring that both the lender's investment and the borrower's obligations are protected. By having a well-structured Loan Agreement, individuals can navigate their financial commitments with confidence, knowing that they have a solid framework in place to guide their interactions.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is designed to outline the terms and conditions of a loan between a lender and a borrower, ensuring both parties understand their rights and obligations. |

| Governing Law | This agreement is governed by the laws of the State of Florida, ensuring that any disputes are resolved according to Florida's legal framework. |

| Essential Elements | Key components of the form typically include the loan amount, interest rate, repayment schedule, and any collateral involved in the agreement. |

| Signatures | Both parties must sign the agreement for it to be legally binding, demonstrating their acceptance of the terms laid out in the document. |

Similar forms

- Promissory Note: A promissory note is a written promise to pay a specific amount of money at a certain time. Like a loan agreement, it outlines the terms of repayment and the interest rate.

- Mortgage Agreement: This document secures a loan with property. Similar to a loan agreement, it details the loan amount, interest, and repayment terms, but it also includes information about the property being used as collateral.

- Credit Agreement: A credit agreement outlines the terms under which a lender provides credit to a borrower. It is similar to a loan agreement in that it specifies the amount, interest rate, and repayment schedule.

- Lease Agreement: A lease agreement allows one party to use another's property for a set period in exchange for payment. Both documents establish terms for payment and duration, though a lease typically involves rental rather than a loan.

- Service Agreement: This document outlines the terms for services rendered. Like a loan agreement, it specifies payment terms, but it focuses on services instead of borrowing money.

- ATV Bill of Sale: Similar to other loan-related documents, the California PDF Forms for an ATV Bill of Sale serves as a vital legal tool that proves the transfer of ownership for all-terrain vehicles, ensuring both parties are protected in the transaction.

- Partnership Agreement: A partnership agreement details the terms of a business partnership. It is similar to a loan agreement in that it outlines the contributions and obligations of each party, including any financial arrangements.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It shares similarities with a loan agreement in terms of payment terms and amounts owed.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the primary borrower defaults. This document is related to a loan agreement as it provides additional security for the lender.

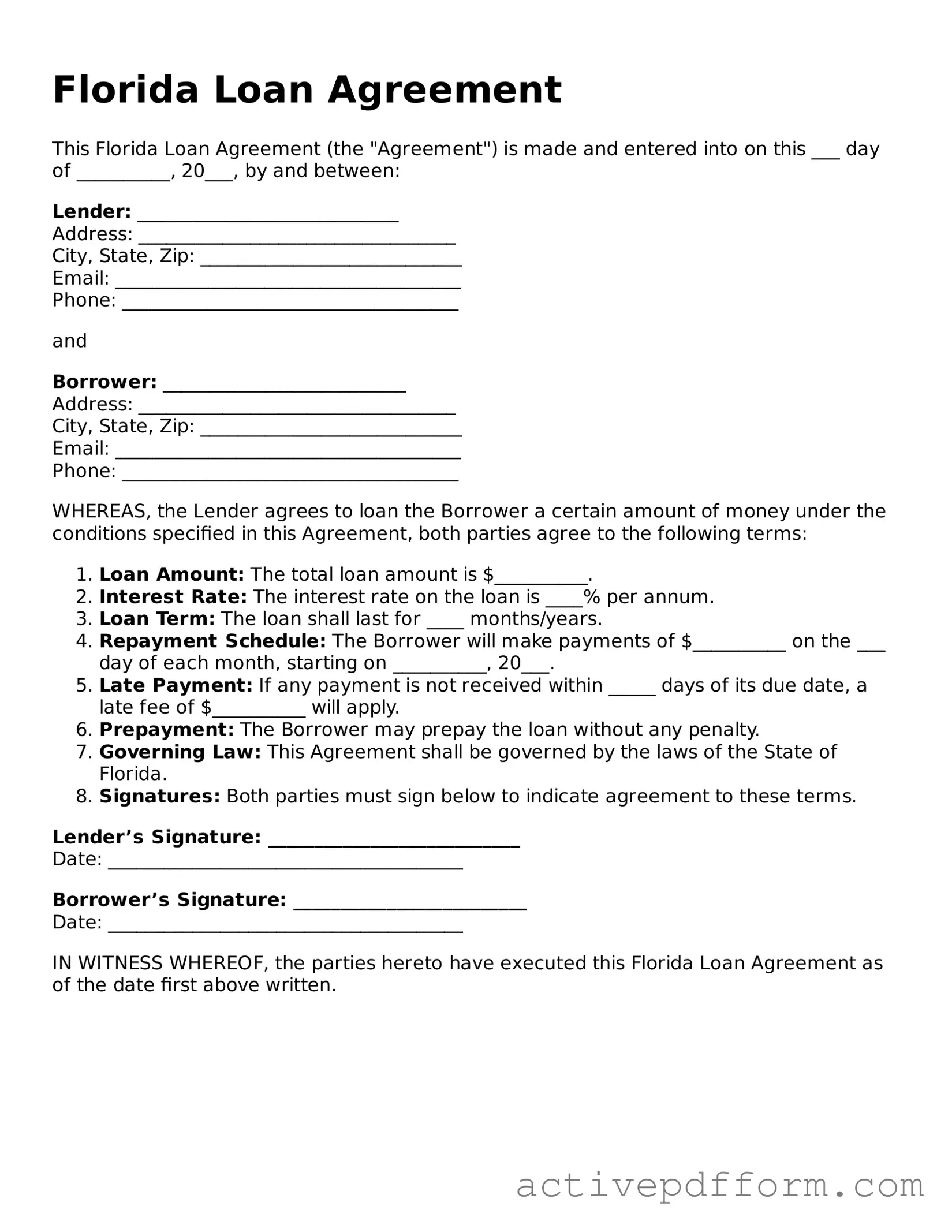

Florida Loan Agreement Example

Florida Loan Agreement

This Florida Loan Agreement (the "Agreement") is made and entered into on this ___ day of __________, 20___, by and between:

Lender: ____________________________

Address: __________________________________

City, State, Zip: ____________________________

Email: _____________________________________

Phone: ____________________________________

and

Borrower: __________________________

Address: __________________________________

City, State, Zip: ____________________________

Email: _____________________________________

Phone: ____________________________________

WHEREAS, the Lender agrees to loan the Borrower a certain amount of money under the conditions specified in this Agreement, both parties agree to the following terms:

- Loan Amount: The total loan amount is $__________.

- Interest Rate: The interest rate on the loan is ____% per annum.

- Loan Term: The loan shall last for ____ months/years.

- Repayment Schedule: The Borrower will make payments of $__________ on the ___ day of each month, starting on __________, 20___.

- Late Payment: If any payment is not received within _____ days of its due date, a late fee of $__________ will apply.

- Prepayment: The Borrower may prepay the loan without any penalty.

- Governing Law: This Agreement shall be governed by the laws of the State of Florida.

- Signatures: Both parties must sign below to indicate agreement to these terms.

Lender’s Signature: ___________________________

Date: ______________________________________

Borrower’s Signature: _________________________

Date: ______________________________________

IN WITNESS WHEREOF, the parties hereto have executed this Florida Loan Agreement as of the date first above written.

Understanding Florida Loan Agreement

What is a Florida Loan Agreement?

A Florida Loan Agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This agreement specifies the amount borrowed, the interest rate, the repayment schedule, and any collateral involved. It serves to protect the interests of both parties and ensures clarity regarding the obligations each party has under the agreement.

Who can use a Florida Loan Agreement?

Any individual or entity looking to lend or borrow money in Florida can utilize a Loan Agreement. This includes personal loans between friends or family, as well as business loans between companies. Regardless of the situation, having a written agreement is crucial to avoid misunderstandings and disputes.

What are the key components of a Florida Loan Agreement?

Essential components typically include the loan amount, interest rate, repayment terms, due dates, and any fees associated with the loan. Additionally, the agreement may outline the consequences of default, such as late fees or legal action. It is also common to include details about collateral, if applicable, to secure the loan.

Is a Florida Loan Agreement legally binding?

Yes, a Florida Loan Agreement is legally binding as long as it meets certain criteria. Both parties must agree to the terms, and the document should be signed by both the lender and the borrower. It is advisable to have witnesses or notarization to further strengthen its enforceability.

Can a Florida Loan Agreement be modified?

Yes, a Loan Agreement can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the amended agreement. This ensures that there is a clear record of the new terms and conditions.

What happens if a borrower defaults on a Florida Loan Agreement?

If a borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include pursuing a judgment in court or seizing collateral if it was part of the agreement. The specific consequences of default should be clearly outlined in the Loan Agreement itself.

Do I need a lawyer to create a Florida Loan Agreement?

While it is not legally required to have a lawyer draft a Loan Agreement, it is highly recommended. A legal professional can ensure that the agreement complies with Florida laws and adequately protects your interests. They can also help clarify any terms that may be confusing.

Can I use a template for a Florida Loan Agreement?

Yes, many templates are available online for creating a Florida Loan Agreement. However, it is important to ensure that the template is up-to-date and complies with Florida laws. Customizing the template to fit the specific details of your loan is essential to avoid potential legal issues.

Where can I find a Florida Loan Agreement form?

Florida Loan Agreement forms can be found through various online legal resources, law firms, or local government offices. Many websites offer free or paid templates that can be downloaded and customized. Always ensure that the source is reputable and that the form is relevant to your specific needs.

Dos and Don'ts

When filling out the Florida Loan Agreement form, it's important to be careful and thorough. Here are some essential dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your name and address.

- Do clearly state the loan amount you are requesting.

- Do review the terms and conditions before signing.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or slang in your responses.

- Don't rush through the form; take your time to ensure accuracy.

- Don't forget to keep a copy of the completed form for your records.

Browse Other Popular Loan Agreement Templates for Specific States

Promissory Note Texas - This document often includes a section for signatures and dates.

To further understand the requirements and ensure proper submission of the necessary paperwork, landlords can refer to the comprehensive guidelines available at https://nytemplates.com/blank-nyc-apartment-registration-template/, which offers valuable insights into the Nyc Apartment Registration Form process.

Free Promissory Note Template California - Use this form to establish the loan amount and repayment terms.