Blank Florida Lady Bird Deed Document

The Florida Lady Bird Deed is a powerful estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining full control during their lifetime. This unique deed, officially known as an enhanced life estate deed, offers several advantages, including the ability to avoid probate, protect assets from creditors, and facilitate a smooth transition of property upon the owner's passing. By granting the right of survivorship to the designated beneficiaries, the Lady Bird Deed ensures that the property automatically transfers to them without the need for court intervention. Furthermore, the form allows the original owner to sell, mortgage, or otherwise manage the property without restrictions, providing flexibility and peace of mind. Understanding the nuances of this deed is essential for anyone looking to simplify their estate planning process and safeguard their assets for future generations.

Document Attributes

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed allows property owners in Florida to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, particularly Chapter 732, which covers wills and estates. |

| Retained Control | With a Lady Bird Deed, the property owner retains the right to sell, mortgage, or change the beneficiaries at any time. |

| Tax Benefits | This type of deed can help avoid probate and may provide tax advantages for the beneficiaries. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, making it a flexible estate planning tool. |

| Medicaid Protection | A Lady Bird Deed may protect the property from being counted as an asset for Medicaid eligibility purposes. |

| Revocability | The deed can be revoked or modified at any time by the original owner, offering peace of mind. |

| Immediate Transfer | Upon the death of the property owner, the property automatically transfers to the designated beneficiaries without going through probate. |

| Not for All Properties | Not all types of property are eligible for a Lady Bird Deed; for example, it cannot be used for jointly owned properties. |

| Legal Assistance Recommended | While it is possible to create a Lady Bird Deed without an attorney, seeking legal advice is strongly recommended to ensure compliance with state laws. |

Similar forms

The Lady Bird Deed is a unique estate planning tool, but it shares similarities with several other legal documents. Understanding these similarities can help you make informed decisions about your property and estate. Here are four documents that are comparable to the Lady Bird Deed:

- Transfer on Death Deed (TODD): Like the Lady Bird Deed, a Transfer on Death Deed allows property owners to designate beneficiaries who will receive the property upon their death. This avoids probate, simplifying the transfer process.

- NYC Housing Application Form: This essential document is for those seeking public housing and can be completed using the template available at https://nytemplates.com/blank-nyc-housing-application-template/, ensuring that applicants express their interest accurately to meet eligibility criteria.

- Life Estate Deed: A Life Estate Deed grants someone the right to live in or use the property during their lifetime, similar to how a Lady Bird Deed allows the original owner to retain control. Upon the owner's death, the property automatically transfers to the designated beneficiaries.

- Revocable Living Trust: This document allows for the management and distribution of assets during and after the owner's lifetime. Like the Lady Bird Deed, it helps avoid probate and can provide flexibility in how assets are handled.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together, ensuring that when one owner passes away, their share automatically transfers to the surviving owner(s). This is similar to the automatic transfer feature of a Lady Bird Deed.

Each of these documents serves a purpose in estate planning, and understanding their similarities to the Lady Bird Deed can empower you to make the best choices for your situation.

Florida Lady Bird Deed Example

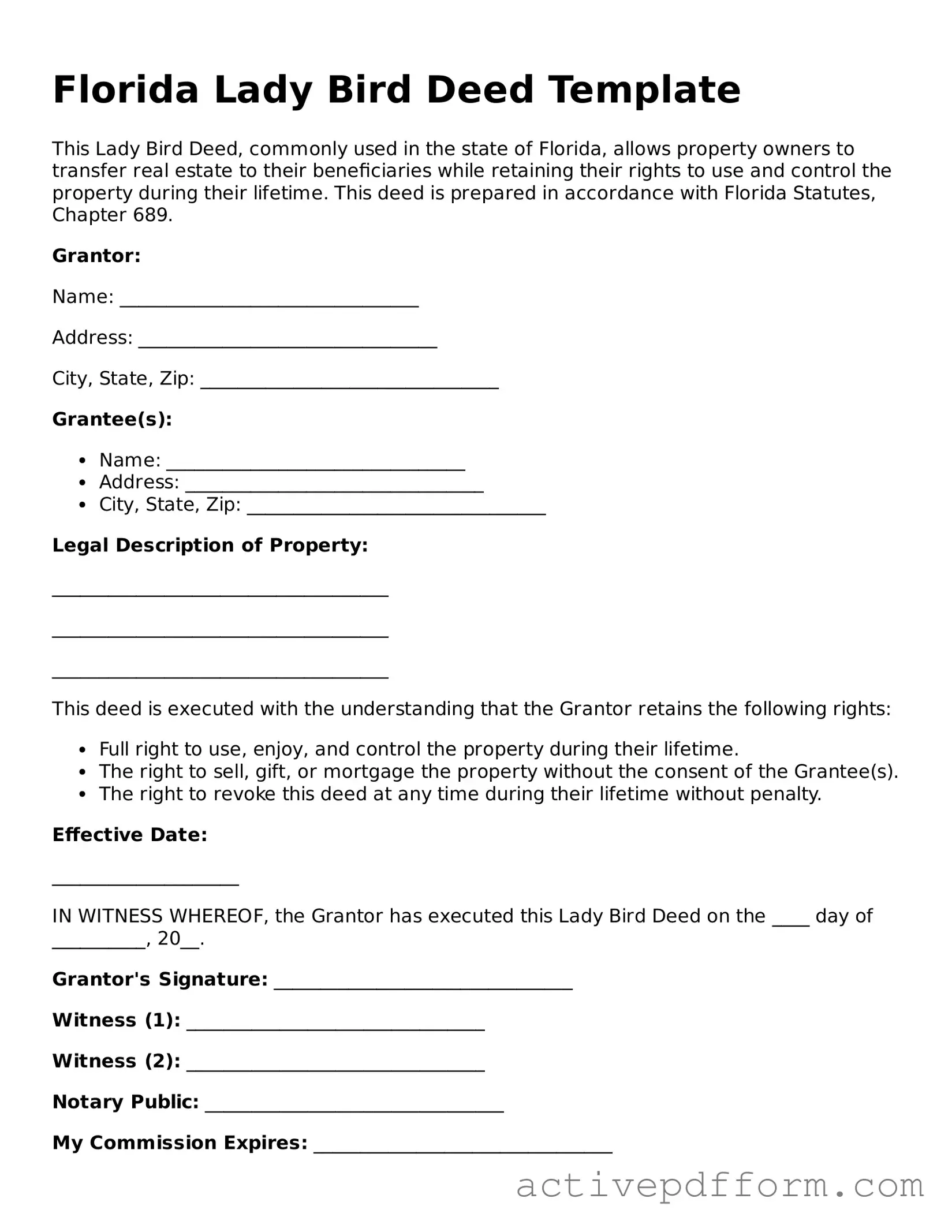

Florida Lady Bird Deed Template

This Lady Bird Deed, commonly used in the state of Florida, allows property owners to transfer real estate to their beneficiaries while retaining their rights to use and control the property during their lifetime. This deed is prepared in accordance with Florida Statutes, Chapter 689.

Grantor:

Name: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

Grantee(s):

- Name: ________________________________

- Address: ________________________________

- City, State, Zip: ________________________________

Legal Description of Property:

____________________________________

____________________________________

____________________________________

This deed is executed with the understanding that the Grantor retains the following rights:

- Full right to use, enjoy, and control the property during their lifetime.

- The right to sell, gift, or mortgage the property without the consent of the Grantee(s).

- The right to revoke this deed at any time during their lifetime without penalty.

Effective Date:

____________________

IN WITNESS WHEREOF, the Grantor has executed this Lady Bird Deed on the ____ day of __________, 20__.

Grantor's Signature: ________________________________

Witness (1): ________________________________

Witness (2): ________________________________

Notary Public: ________________________________

My Commission Expires: ________________________________

This document is intended for informational purposes only and is not a substitute for legal advice. Consult an attorney for specific legal assistance regarding your situation.

Understanding Florida Lady Bird Deed

What is a Lady Bird Deed in Florida?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their real estate to beneficiaries while retaining the right to live on and control the property during their lifetime. This type of deed simplifies the transfer process upon the owner's death, avoiding probate and allowing for a seamless transition of ownership to the designated beneficiaries.

Who can benefit from using a Lady Bird Deed?

Individuals looking to pass on their property to heirs without the complications of probate can greatly benefit from a Lady Bird Deed. It is particularly useful for those who want to maintain control over their property while ensuring that their wishes are honored after their passing. This deed is often favored by seniors who wish to protect their home while still providing for their loved ones.

What are the main advantages of a Lady Bird Deed?

One of the primary advantages is the avoidance of probate, which can be a lengthy and costly process. Additionally, the property remains in the owner's control during their lifetime, allowing them to sell or modify the property as needed. Moreover, a Lady Bird Deed can also protect the property from creditors after the owner's death, providing peace of mind to the family.

Are there any disadvantages to using a Lady Bird Deed?

While the benefits are significant, there are some potential downsides to consider. For instance, if the property owner needs to qualify for Medicaid, the property may still be considered an asset, affecting eligibility. Furthermore, if the property owner decides to sell the property before passing, the deed will become void, requiring a new estate plan to be established.

How is a Lady Bird Deed executed in Florida?

To execute a Lady Bird Deed, the property owner must complete the deed form with the necessary information, including the names of the beneficiaries and a legal description of the property. The deed must then be signed in the presence of a notary public and recorded with the county clerk's office. It is advisable to consult with a legal professional to ensure that all requirements are met and that the deed is executed correctly.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time during the property owner's lifetime. The owner retains full control over the property, which means they can sell, mortgage, or change the beneficiaries as they see fit. To revoke the deed, the owner must execute a new deed that explicitly states the revocation.

Is a Lady Bird Deed recognized in other states?

While the Lady Bird Deed is a popular option in Florida, it is not universally recognized in all states. Some states have similar mechanisms, but the specific rules and benefits may vary. If you are considering a Lady Bird Deed outside of Florida, it is essential to consult a local attorney familiar with estate planning laws in that state.

What happens to the property if the beneficiary predeceases the owner?

If a beneficiary named in a Lady Bird Deed passes away before the property owner, the deed typically allows for the property to pass to the remaining beneficiaries, if any are named. If no alternate beneficiaries are designated, the property may become part of the owner's estate and go through probate. To prevent this, it is wise to periodically review and update the deed to reflect any changes in circumstances.

Can a Lady Bird Deed affect tax implications for beneficiaries?

Yes, a Lady Bird Deed can have tax implications for beneficiaries. When the property is transferred upon the owner's death, beneficiaries typically receive a "step-up" in basis, which can reduce capital gains taxes if they decide to sell the property. However, tax laws can be complex and subject to change, so consulting with a tax professional is recommended to understand the specific implications based on individual circumstances.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, keep these tips in mind to ensure a smooth process.

- Do double-check the property description to ensure accuracy.

- Do include the names of all parties involved clearly.

- Do consult with a legal professional if you're unsure about any part of the form.

- Don't rush through the form; take your time to avoid mistakes.

- Don't forget to sign and date the form where required.

- Don't overlook the need for notarization to make the deed valid.

Browse Other Popular Lady Bird Deed Templates for Specific States

Printable Lady Bird Deed Texas Form - The transfer of property via a Lady Bird Deed occurs automatically upon the owner's death without the need for court involvement.

For those seeking to prepare for future medical decisions, understanding the importance of a personalized Living Will document can be crucial. This legal form enables individuals to clearly communicate their preferences regarding healthcare should they become unable to do so themselves, ensuring their wishes are honored and respected.