Blank Florida Durable Power of Attorney Document

In the state of Florida, the Durable Power of Attorney form serves as a vital legal document that allows individuals to appoint a trusted person to manage their financial and legal affairs in the event they become incapacitated. This form is designed to remain effective even if the principal, the person granting the power, is no longer able to make decisions for themselves due to illness or disability. It encompasses a wide range of powers, which can include managing bank accounts, paying bills, handling real estate transactions, and making investment decisions. Importantly, the principal can specify the scope of authority granted to the agent, ensuring that their wishes are respected. Additionally, this form can be tailored to include specific instructions or limitations, providing peace of mind to both the principal and their loved ones. Understanding the implications and responsibilities associated with the Durable Power of Attorney is crucial, as it empowers individuals to maintain control over their affairs even in challenging circumstances.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Florida Durable Power of Attorney allows an individual to appoint someone else to manage their financial affairs if they become incapacitated. |

| Governing Law | This form is governed by Florida Statutes, Chapter 709, which outlines the rules for powers of attorney in the state. |

| Durability | The term "durable" means that the authority granted continues even if the principal becomes incapacitated. |

| Signing Requirements | The form must be signed by the principal and witnessed by two individuals or notarized to be valid. |

Similar forms

- General Power of Attorney: This document grants broad authority to an agent to act on behalf of the principal in various matters, similar to a Durable Power of Attorney. However, it typically becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This form specifically allows an agent to make medical decisions for the principal if they are unable to do so. Like the Durable Power of Attorney, it remains effective even if the principal becomes incapacitated.

- Notice to Quit: The Pennsylvania Notice to Quit form serves as an essential tool for landlords to inform tenants of lease violations. This legal document provides a clear process through which tenants can address issues like unpaid rent and must include a timeline to either rectify the breach or, as stated in the Notice to Vacate, leave the premises.

- Living Will: A Living Will outlines a person's wishes regarding medical treatment in situations where they cannot communicate. While it does not appoint an agent, it serves a similar purpose by ensuring that the principal's healthcare preferences are honored.

- Revocable Trust: A Revocable Trust allows a person to manage their assets during their lifetime and designate beneficiaries after death. It provides flexibility and control, akin to the Durable Power of Attorney, but focuses more on asset management.

- Advance Healthcare Directive: This document combines elements of a Living Will and a Healthcare Power of Attorney. It provides instructions for medical care and appoints an agent, similar to the Durable Power of Attorney's role in healthcare decisions.

- Financial Power of Attorney: This is a more specialized version of the General Power of Attorney, focusing solely on financial matters. Like the Durable Power of Attorney, it can remain effective during periods of incapacity.

- Will: A Will specifies how a person's assets should be distributed after their death. While it does not grant authority during life, it is an important legal document that complements the Durable Power of Attorney in estate planning.

- Guardian Designation: This document allows a parent to appoint a guardian for their minor children. It shares a similar purpose of ensuring that a trusted individual is in charge, much like how a Durable Power of Attorney designates an agent to make decisions.

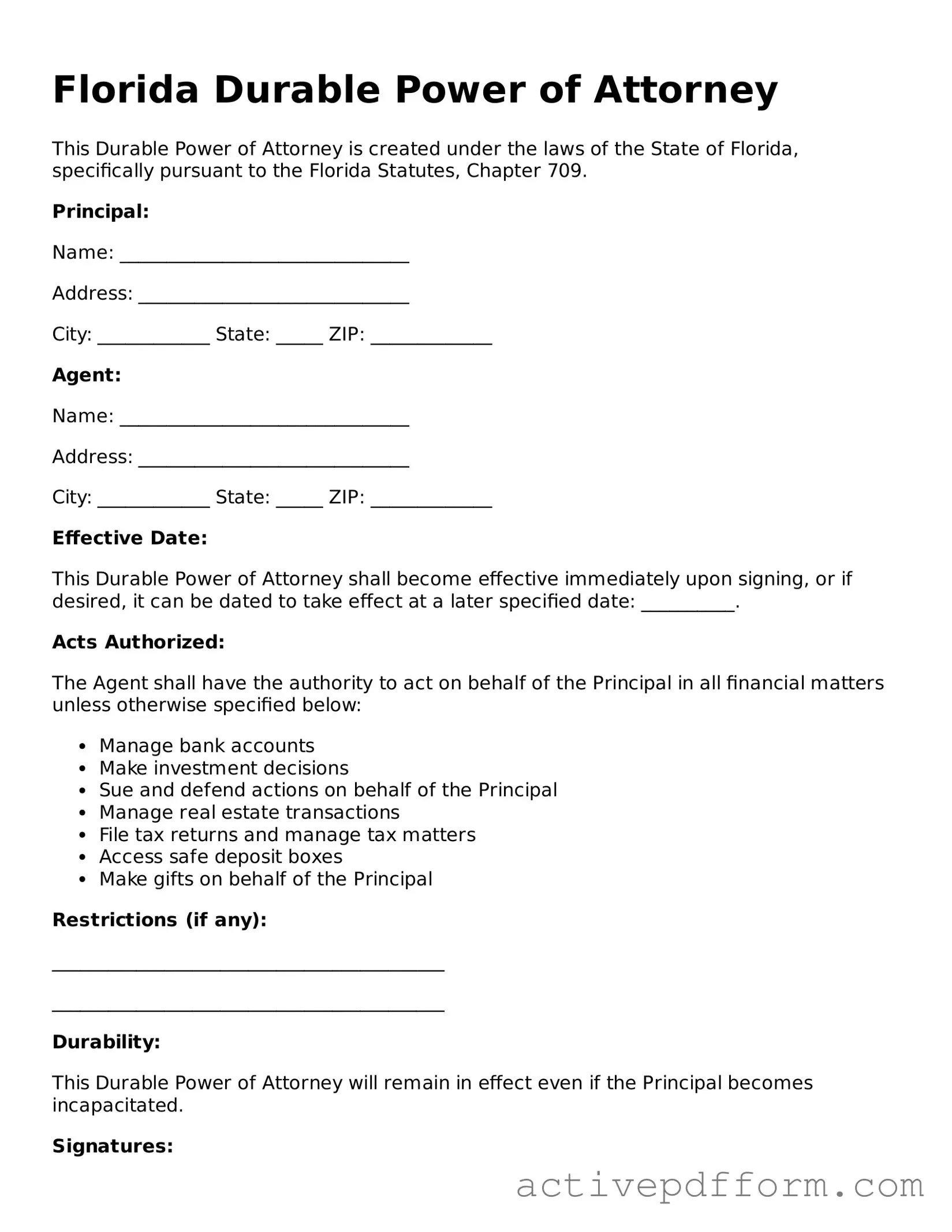

Florida Durable Power of Attorney Example

Florida Durable Power of Attorney

This Durable Power of Attorney is created under the laws of the State of Florida, specifically pursuant to the Florida Statutes, Chapter 709.

Principal:

Name: _______________________________

Address: _____________________________

City: ____________ State: _____ ZIP: _____________

Agent:

Name: _______________________________

Address: _____________________________

City: ____________ State: _____ ZIP: _____________

Effective Date:

This Durable Power of Attorney shall become effective immediately upon signing, or if desired, it can be dated to take effect at a later specified date: __________.

Acts Authorized:

The Agent shall have the authority to act on behalf of the Principal in all financial matters unless otherwise specified below:

- Manage bank accounts

- Make investment decisions

- Sue and defend actions on behalf of the Principal

- Manage real estate transactions

- File tax returns and manage tax matters

- Access safe deposit boxes

- Make gifts on behalf of the Principal

Restrictions (if any):

__________________________________________

__________________________________________

Durability:

This Durable Power of Attorney will remain in effect even if the Principal becomes incapacitated.

Signatures:

In witness whereof, I hereby sign this Durable Power of Attorney on this ____ day of ____________, 20___.

Principal’s Signature: ___________________________

Witness #1 Signature: _________________________

Witness #1 Printed Name: _____________________

Witness #2 Signature: _________________________

Witness #2 Printed Name: _____________________

Understanding Florida Durable Power of Attorney

What is a Durable Power of Attorney in Florida?

A Durable Power of Attorney (DPOA) is a legal document that allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to manage their financial affairs and make decisions on their behalf. The key feature of a DPOA is its durability; it remains effective even if the principal becomes incapacitated. This means that the agent can continue to act on behalf of the principal during times when they cannot make decisions for themselves, ensuring that their financial matters are handled seamlessly.

What are the key benefits of having a Durable Power of Attorney?

There are several significant advantages to having a Durable Power of Attorney. First, it provides peace of mind, knowing that someone you trust will manage your affairs if you become unable to do so. Second, it can help avoid the lengthy and often costly process of guardianship, which may be required if a person becomes incapacitated without a DPOA in place. Third, a DPOA can be tailored to meet specific needs, allowing the principal to grant broad or limited powers to the agent. Finally, having a DPOA can facilitate quicker decision-making, which is crucial in financial matters that require timely action.

How do I create a Durable Power of Attorney in Florida?

Creating a Durable Power of Attorney in Florida involves several steps. First, the principal must choose a trustworthy agent who will act in their best interests. Next, the principal should obtain a DPOA form, which can be found online or through legal resources. The form must be completed, specifying the powers granted to the agent. It is essential to ensure that the document is signed by the principal in the presence of a notary public and two witnesses, as required by Florida law. Once executed, the DPOA should be kept in a safe place, and copies should be provided to the agent and any relevant financial institutions.

Can I revoke a Durable Power of Attorney in Florida?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. To do so, the principal should create a written revocation document, which should clearly state the intent to revoke the DPOA. It is advisable to notify the agent and any institutions that were relying on the original DPOA of the revocation. Additionally, the principal may choose to destroy all copies of the original DPOA to prevent any confusion. By taking these steps, the principal can ensure that their wishes are respected and that their financial matters are managed according to their current preferences.

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it's essential to follow specific guidelines to ensure the document is valid and effective. Here are four important dos and don'ts to consider:

- Do clearly identify the principal and the agent in the form. Make sure their full names and addresses are included.

- Do specify the powers you are granting. Be clear about what decisions the agent can make on your behalf.

- Don't leave any sections blank. Incomplete forms can lead to confusion or invalidation of the document.

- Don't forget to sign and date the form in the presence of a notary public. This step is crucial for the form's legal validity.

Browse Other Popular Durable Power of Attorney Templates for Specific States

Poa Form California - The agent’s decisions should align with the principal's best interests.

The California Judicial Council form plays a crucial role in effectively managing legal documentation within the California court system, and for those looking to access these documents, it's important to utilize resources like California PDF Forms. By ensuring you have the right forms, you can navigate your legal matters more smoothly and with greater confidence.

Power of Attorney Form Texas Pdf - The principal can limit or expand the agent’s powers based on individual preferences.