Blank Florida Deed in Lieu of Foreclosure Document

In the state of Florida, homeowners facing the distressing prospect of foreclosure may find a potential lifeline in the Deed in Lieu of Foreclosure form. This legal document serves as an alternative solution, allowing property owners to voluntarily transfer their property back to the lender in exchange for the cancellation of their mortgage debt. By opting for this route, individuals can avoid the lengthy and often costly foreclosure process, which can have lasting impacts on their credit score and financial future. The Deed in Lieu of Foreclosure form typically outlines the terms of the transfer, including the condition of the property and any potential liabilities that may remain. It's crucial for homeowners to understand that this option is not just a simple handover of keys; it involves negotiations with the lender and careful consideration of the implications for their financial situation. As such, this form can provide a pathway to a fresh start, but it requires thorough understanding and careful planning to navigate effectively.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid the foreclosure process. |

| Governing Law | This form is governed by Florida Statutes, specifically under Chapter 701, which outlines the requirements for deeds and conveyances. |

| Eligibility | Homeowners must be in default on their mortgage payments and willing to surrender their property to the lender. |

| Benefits | This option can help homeowners avoid the lengthy and stressful foreclosure process, potentially protecting their credit score more effectively. |

Similar forms

-

Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on their mortgage. Like a Deed in Lieu of Foreclosure, it aims to avoid foreclosure and minimize the negative impact on the homeowner's credit. Both processes require lender approval and can provide a smoother transition for the homeowner.

-

Loan Modification Agreement: This agreement alters the terms of an existing mortgage to make it more manageable for the borrower. Similar to a Deed in Lieu of Foreclosure, it seeks to prevent foreclosure by allowing the homeowner to keep their property while adjusting their payment terms. Both options involve negotiation with the lender to find a solution that works for both parties.

- Notice to Quit: This form is essential for landlords seeking to evict tenants, providing a clear and legal way to request property vacating. For more information, visit Arizona PDF Forms.

-

Forbearance Agreement: This document allows a borrower to temporarily reduce or suspend mortgage payments. Like a Deed in Lieu of Foreclosure, it offers a way for homeowners to avoid foreclosure while they regain their financial footing. Both agreements require cooperation and communication with the lender to ensure the homeowner can meet future obligations.

-

Bankruptcy Filing: Filing for bankruptcy can provide relief from debt and may stop foreclosure proceedings. While a Deed in Lieu of Foreclosure involves voluntarily handing over the property, bankruptcy can offer a legal framework to restructure debts. Both options aim to provide a fresh start, but they differ significantly in their processes and long-term implications.

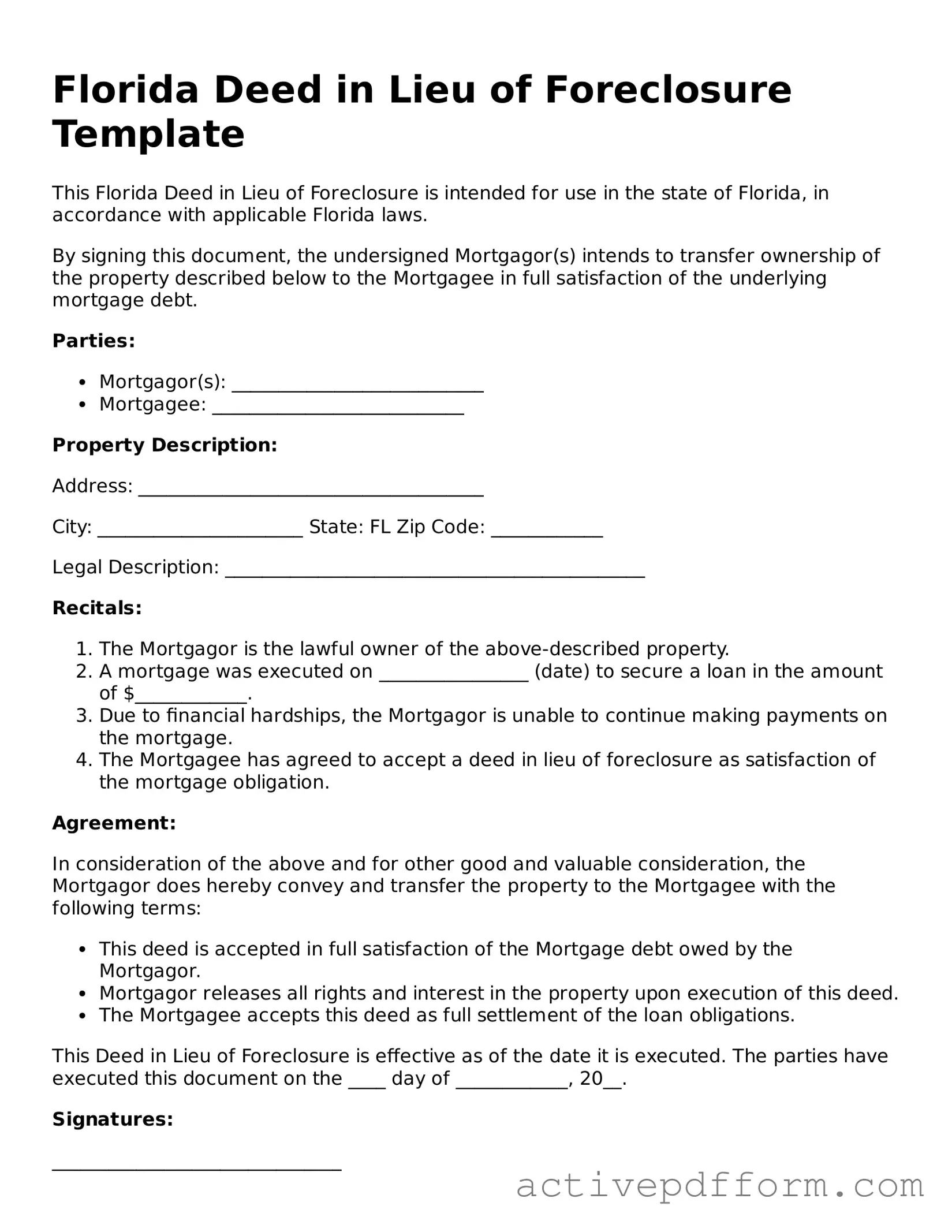

Florida Deed in Lieu of Foreclosure Example

Florida Deed in Lieu of Foreclosure Template

This Florida Deed in Lieu of Foreclosure is intended for use in the state of Florida, in accordance with applicable Florida laws.

By signing this document, the undersigned Mortgagor(s) intends to transfer ownership of the property described below to the Mortgagee in full satisfaction of the underlying mortgage debt.

Parties:

- Mortgagor(s): ___________________________

- Mortgagee: ___________________________

Property Description:

Address: _____________________________________

City: ______________________ State: FL Zip Code: ____________

Legal Description: _____________________________________________

Recitals:

- The Mortgagor is the lawful owner of the above-described property.

- A mortgage was executed on ________________ (date) to secure a loan in the amount of $____________.

- Due to financial hardships, the Mortgagor is unable to continue making payments on the mortgage.

- The Mortgagee has agreed to accept a deed in lieu of foreclosure as satisfaction of the mortgage obligation.

Agreement:

In consideration of the above and for other good and valuable consideration, the Mortgagor does hereby convey and transfer the property to the Mortgagee with the following terms:

- This deed is accepted in full satisfaction of the Mortgage debt owed by the Mortgagor.

- Mortgagor releases all rights and interest in the property upon execution of this deed.

- The Mortgagee accepts this deed as full settlement of the loan obligations.

This Deed in Lieu of Foreclosure is effective as of the date it is executed. The parties have executed this document on the ____ day of ____________, 20__.

Signatures:

_______________________________

Mortgagor(s)

_______________________________

Mortgagee

Witnesses:

_______________________________

Witness

_______________________________

Witness

This document should be notarized to ensure its validity and enforceability. Please consult with a qualified attorney or professional for additional guidance tailored to your specific situation.

Understanding Florida Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers their property title to the lender to avoid foreclosure. This process can help both the homeowner and the lender by simplifying the resolution of a mortgage default. It allows the homeowner to walk away from the property without the lengthy process of foreclosure.

What are the benefits of a Deed in Lieu of Foreclosure?

One major benefit is that it can help you avoid the negative impact of a foreclosure on your credit score. It may also allow you to settle your mortgage debt more quickly. Additionally, the lender may agree to forgive any remaining balance on the mortgage, relieving you of further financial obligations.

Are there any drawbacks to consider?

Yes, there are potential drawbacks. Not all lenders accept a Deed in Lieu of Foreclosure, so it’s important to check with yours first. Additionally, you may still face tax implications if the lender forgives a portion of your debt. It’s wise to consult a tax professional to understand the possible consequences.

How do I initiate a Deed in Lieu of Foreclosure?

To start the process, contact your lender and express your interest in a Deed in Lieu of Foreclosure. They will provide you with the necessary forms and information. You will need to gather documentation about your financial situation and the property. Be prepared for an evaluation process by the lender.

What happens after I submit the Deed in Lieu of Foreclosure?

Once you submit the Deed, the lender will review your request. If approved, they will prepare the necessary paperwork to finalize the transfer of the property. You will then need to sign the deed and any other documents. After that, the lender will record the deed with the county, officially transferring ownership.

Can I still live in my home after initiating this process?

Generally, once you submit the Deed in Lieu of Foreclosure, you will need to vacate the property. The lender will typically require you to move out, as they will take possession of the home. It’s important to discuss this with your lender to understand their specific requirements.

Is legal assistance necessary for a Deed in Lieu of Foreclosure?

While it’s not strictly necessary, seeking legal assistance can be very beneficial. An attorney can help you understand the process, ensure all documents are correctly prepared, and protect your interests throughout the transaction. This can be especially important if there are complications or if you have questions about your rights.

How does a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure will impact your credit score, but usually less severely than a foreclosure. While it will still be noted on your credit report, it may be viewed more favorably by future lenders. The exact impact can vary based on your overall credit history and the specifics of your situation.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it's crucial to approach the process with care. Here’s a list of essential dos and don'ts to guide you:

- Do ensure all information is accurate and complete. Double-check names, addresses, and property details.

- Don't rush through the form. Take your time to understand each section before filling it out.

- Do consult with a real estate attorney if you have any doubts or questions about the process.

- Don't leave any sections blank. If a section does not apply, indicate that clearly.

- Do keep copies of the completed form for your records. Documentation is essential.

- Don't forget to sign and date the form where required. An unsigned form may be considered invalid.

- Do notify your lender of your intention to submit the deed in lieu. Communication is key.

- Don't ignore deadlines. Ensure you submit the form within any specified time frames to avoid complications.

Browse Other Popular Deed in Lieu of Foreclosure Templates for Specific States

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - The decision to pursue this option should be carefully weighed against other foreclosure alternatives.

For businesses seeking the advantages associated with the Qualified Empire Zone Enterprise (QEZE) Sales Tax Certification, understanding the application process for the New York DTF-84 form is vital. This form, which facilitates access to significant sales tax benefits, must be meticulously completed and submitted alongside the required documentation. To further assist you in navigating this process, you can find more information at nytemplates.com/blank-new-york-dtf-84-template.