Blank Florida Deed Document

In Florida, the deed form plays a crucial role in the transfer of property ownership, encapsulating essential information that facilitates a clear and legally binding transaction. This document typically includes the names of the parties involved, a detailed description of the property, and the terms of the transfer. It serves as a public record, ensuring that ownership rights are transparent and accessible. Various types of deeds exist, such as warranty deeds, quitclaim deeds, and special purpose deeds, each serving specific purposes and offering different levels of protection to the buyer. The execution of the deed must adhere to specific legal requirements, including proper notarization and, in some cases, witnesses. Understanding the nuances of the Florida deed form is vital for both buyers and sellers, as it not only impacts the legal standing of property ownership but also influences future transactions and property rights. Clarity and accuracy in completing this form can prevent disputes and ensure a smooth transfer process.

Document Attributes

| Fact Name | Details |

|---|---|

| Definition | A Florida Deed is a legal document that transfers ownership of real property from one party to another. |

| Governing Law | The Florida Deed form is governed by Florida Statutes, particularly Chapter 689. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. |

| Signature Requirement | The deed must be signed by the grantor (the seller) and notarized for it to be valid. |

| Recording | To protect the buyer's interest, the deed should be recorded in the county where the property is located. |

| Consideration | The deed must state the consideration, which is the price or value exchanged for the property. |

| Legal Description | A precise legal description of the property must be included to clearly identify the real estate being transferred. |

Similar forms

The Deed form is a crucial document in property transactions, but it shares similarities with several other legal documents. Understanding these similarities can help clarify their functions and importance. Below are four documents that are similar to the Deed form:

- Title Insurance Policy: Like a Deed, a Title Insurance Policy serves to protect the interests of the property owner. It ensures that the title to the property is clear and free from any claims or liens, similar to how a Deed conveys ownership rights.

- Bill of Sale: A Bill of Sale is akin to a Deed in that it transfers ownership of personal property from one party to another. Both documents serve as proof of ownership and are essential for establishing legal rights over the property or asset involved.

- Lease Agreement: A Lease Agreement, while primarily used for rental situations, also shares similarities with a Deed. It outlines the rights and responsibilities of both the landlord and tenant, much like a Deed specifies the rights of the property owner. Both documents create legal obligations between parties.

- RV Bill of Sale: This legal document is essential for transferring ownership of a recreational vehicle in Arizona. It encapsulates vital information about both the buyer and the seller, ensuring clarity in the transaction. For those looking to complete their sale, visit Arizona PDF Forms to access the necessary template.

- Trust Agreement: A Trust Agreement can be compared to a Deed in that it establishes a legal framework for managing property. Both documents define how property is held and who has rights to it, ensuring that the intentions of the property owner are respected and enforced.

Florida Deed Example

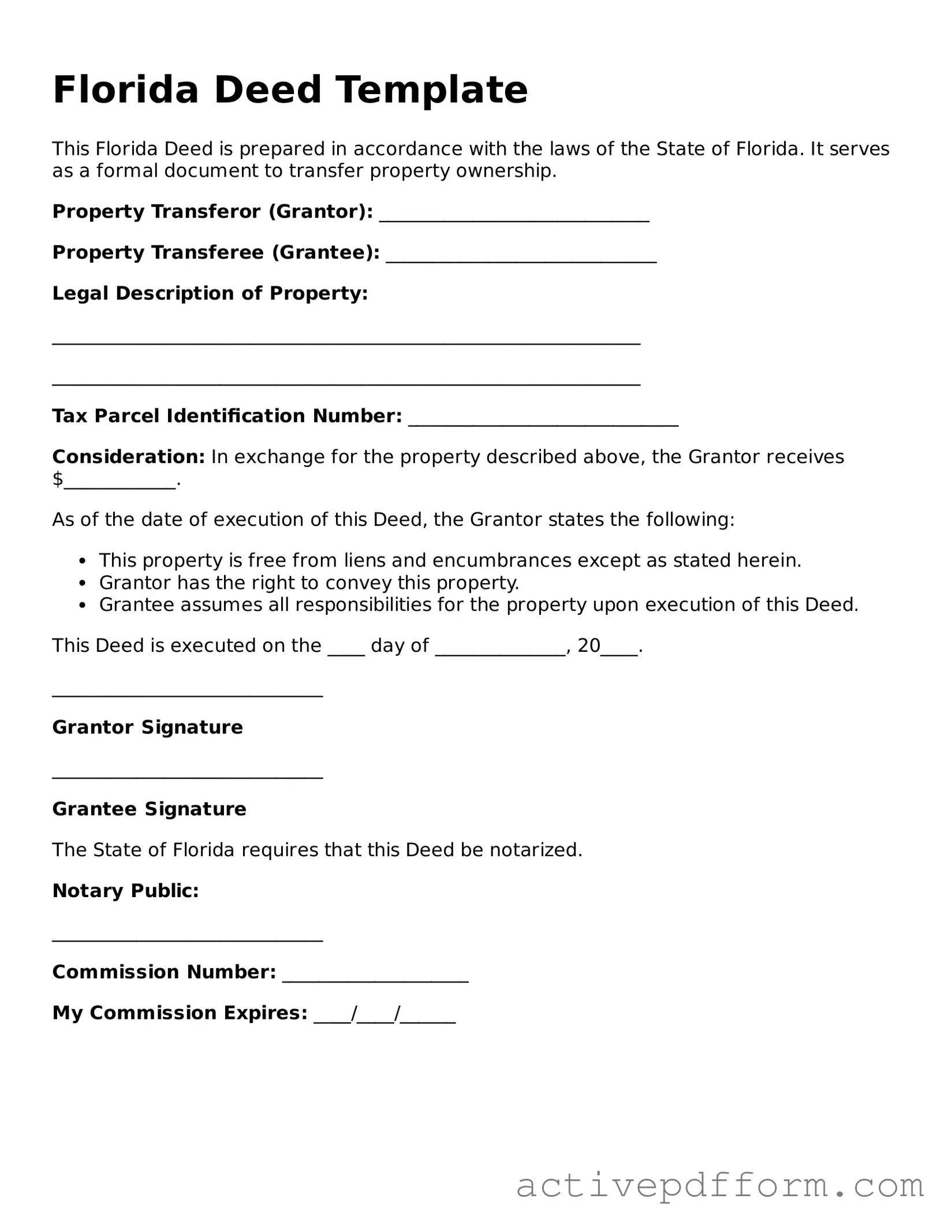

Florida Deed Template

This Florida Deed is prepared in accordance with the laws of the State of Florida. It serves as a formal document to transfer property ownership.

Property Transferor (Grantor): _____________________________

Property Transferee (Grantee): _____________________________

Legal Description of Property:

_______________________________________________________________

_______________________________________________________________

Tax Parcel Identification Number: _____________________________

Consideration: In exchange for the property described above, the Grantor receives $____________.

As of the date of execution of this Deed, the Grantor states the following:

- This property is free from liens and encumbrances except as stated herein.

- Grantor has the right to convey this property.

- Grantee assumes all responsibilities for the property upon execution of this Deed.

This Deed is executed on the ____ day of ______________, 20____.

_____________________________

Grantor Signature

_____________________________

Grantee Signature

The State of Florida requires that this Deed be notarized.

Notary Public:

_____________________________

Commission Number: ____________________

My Commission Expires: ____/____/______

Understanding Florida Deed

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real property from one party to another in the state of Florida. It outlines the details of the transaction, including the parties involved, a description of the property, and any relevant terms or conditions. The deed must be properly executed and recorded to be effective.

What types of deeds are available in Florida?

Florida offers several types of deeds, including Warranty Deeds, Quitclaim Deeds, and Special Purpose Deeds. A Warranty Deed provides a guarantee that the grantor holds clear title to the property. A Quitclaim Deed transfers whatever interest the grantor has without any warranties. Special Purpose Deeds, such as Personal Representative Deeds or Trustee Deeds, serve specific legal functions.

Do I need a lawyer to prepare a Florida Deed?

While it is not legally required to have a lawyer prepare a Florida Deed, it is highly recommended. A lawyer can ensure that the deed complies with state laws and accurately reflects the intentions of the parties. They can also help avoid potential legal issues that may arise from improperly drafted documents.

How do I fill out a Florida Deed form?

To fill out a Florida Deed form, you will need to include the names of the grantor (seller) and grantee (buyer), a legal description of the property, and any relevant terms. It's important to ensure that all information is accurate and complete. The form must then be signed by the grantor in the presence of a notary public.

Is it necessary to record a Florida Deed?

Yes, recording a Florida Deed is necessary to provide public notice of the property transfer. Once recorded, the deed becomes part of the public record, which helps protect the rights of the grantee and establishes their ownership. Failure to record a deed may lead to disputes over property ownership.

What is the cost to record a Florida Deed?

The cost to record a Florida Deed varies by county. Typically, there is a recording fee based on the number of pages in the document. Additionally, there may be documentary stamp taxes that apply to the transfer of property. It’s advisable to check with the local county clerk's office for specific fee schedules.

Can a Florida Deed be revoked or changed after it is signed?

Once a Florida Deed is signed and recorded, it generally cannot be revoked or changed unilaterally. However, the parties involved may create a new deed to transfer ownership back or make changes, provided all parties agree. Legal advice is recommended for any modifications to ensure compliance with state laws.

What happens if a Florida Deed is lost or damaged?

If a Florida Deed is lost or damaged, it can be replaced by obtaining a certified copy from the county clerk’s office where it was recorded. It is advisable to keep a copy of the original deed in a safe place to avoid complications in the future.

Are there any tax implications when transferring property with a Florida Deed?

Yes, transferring property with a Florida Deed may have tax implications. The seller may be subject to capital gains tax if the property has appreciated in value. Additionally, documentary stamp taxes may apply to the transaction. Consulting a tax professional is recommended to understand the specific tax consequences.

What should I do if I have questions about my Florida Deed?

If you have questions about your Florida Deed, it is best to consult with a qualified attorney or a real estate professional. They can provide guidance specific to your situation and help clarify any uncertainties regarding the deed or the property transfer process.

Dos and Don'ts

When filling out the Florida Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do double-check the names of all parties involved. Ensure that they are spelled correctly and match the identification documents.

- Don't leave any sections blank. If a section does not apply, write "N/A" to indicate that it was intentionally left out.

- Do provide a clear and complete legal description of the property. This helps avoid any confusion regarding the property being transferred.

- Don't use abbreviations or shorthand in the legal description. Always write it out in full to prevent misunderstandings.

- Do ensure that the form is signed by all necessary parties. Without the proper signatures, the deed will not be valid.

- Don't forget to have the signatures notarized. A notary public must witness the signing to authenticate the document.

- Do include the date of the transaction. This is important for record-keeping and legal purposes.

- Don't submit the form without reviewing it for errors. Take the time to proofread and confirm that all information is accurate.

By following these guidelines, you can help ensure that your Florida Deed form is completed correctly and efficiently.

Browse Other Popular Deed Templates for Specific States

How to Get a Copy of My House Deed - Maintaining a copy of the Deed is essential for future reference and for protecting ownership rights.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping specific details confidential, ensuring that proprietary information remains secure. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets. For further information and to access a template, you can visit https://nytemplates.com/blank-non-disclosure-agreement-template.