Blank Florida Articles of Incorporation Document

When embarking on the journey of establishing a business in Florida, one of the first crucial steps involves completing the Articles of Incorporation form. This document serves as the foundation for your corporation, laying out essential information that defines its existence. Key elements include the corporation's name, which must be unique and compliant with state regulations, as well as its purpose, which outlines the nature of the business activities. Additionally, the form requires details about the registered agent—an individual or entity designated to receive legal documents on behalf of the corporation. Furthermore, the Articles must specify the number of shares the corporation is authorized to issue, which can significantly impact ownership structure and investment opportunities. Lastly, the form calls for the names and addresses of the incorporators, those individuals responsible for filing the document and initiating the corporation's formation. By carefully addressing these components, entrepreneurs can set a solid groundwork for their business venture in the Sunshine State.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Florida Articles of Incorporation form is used to officially create a corporation in the state of Florida. |

| Governing Law | The form is governed by the Florida Business Corporation Act, specifically Chapter 607 of the Florida Statutes. |

| Filing Requirement | To incorporate, the form must be filed with the Florida Department of State, Division of Corporations. |

| Information Needed | Key details required include the corporation's name, principal office address, and the names and addresses of the initial directors. |

| Registered Agent | A registered agent must be designated, who will receive legal documents on behalf of the corporation. |

| Filing Fee | The standard filing fee for the Articles of Incorporation is $70, but additional fees may apply for expedited processing. |

| Effective Date | The corporation can specify an effective date for its incorporation, which can be the filing date or a future date. |

| Duration | The corporation can be formed with a perpetual duration unless a limited duration is specified in the Articles. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment form with the Florida Department of State. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record and can be accessed by anyone. |

Similar forms

The Articles of Incorporation form is an essential document for establishing a corporation. However, it shares similarities with several other important documents in the business formation process. Here’s a list of nine documents that are similar to the Articles of Incorporation, highlighting how they relate to one another:

- Bylaws: Bylaws outline the internal rules and procedures for a corporation. While the Articles of Incorporation establish the existence of the corporation, the bylaws govern how it operates.

- Operating Agreement: This document is primarily used for LLCs and details the management structure and operational procedures. Like the Articles of Incorporation, it serves to formalize the entity’s structure.

-

Tax Compliance: Ensuring proper tax compliance is crucial for any individual or business. For Ohio residents, utilizing the It 1040X Ohio form allows taxpayers to amend previous income tax returns and accurately report any changes to avoid potential penalties.

- Certificate of Incorporation: Often used interchangeably with the Articles of Incorporation, this document is filed with the state to officially create the corporation. Both documents serve the purpose of establishing legal recognition.

- Business License: A business license grants permission to operate legally within a specific jurisdiction. While the Articles of Incorporation create the entity, the business license allows it to function in compliance with local regulations.

- Partnership Agreement: This document outlines the terms of a partnership, detailing each partner's rights and responsibilities. Similar to the Articles of Incorporation, it formalizes the relationship between parties involved in a business venture.

- Tax Identification Number (TIN): A TIN is required for tax purposes and is often obtained after filing the Articles of Incorporation. Both documents are crucial for the corporation’s legal and financial identity.

- Annual Report: Corporations must file annual reports to maintain good standing with the state. This document provides updates on the corporation’s status, similar to how the Articles of Incorporation initially establish that status.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders. Like the Articles of Incorporation, it helps clarify the governance of the corporation and the relationship among its owners.

- Business Plan: While not a legal document, a business plan outlines the strategy and goals for the business. It complements the Articles of Incorporation by providing a roadmap for how the corporation intends to operate and grow.

Each of these documents plays a vital role in the formation and operation of a business entity, much like the Articles of Incorporation. They work together to create a comprehensive legal framework that supports the business’s success.

Florida Articles of Incorporation Example

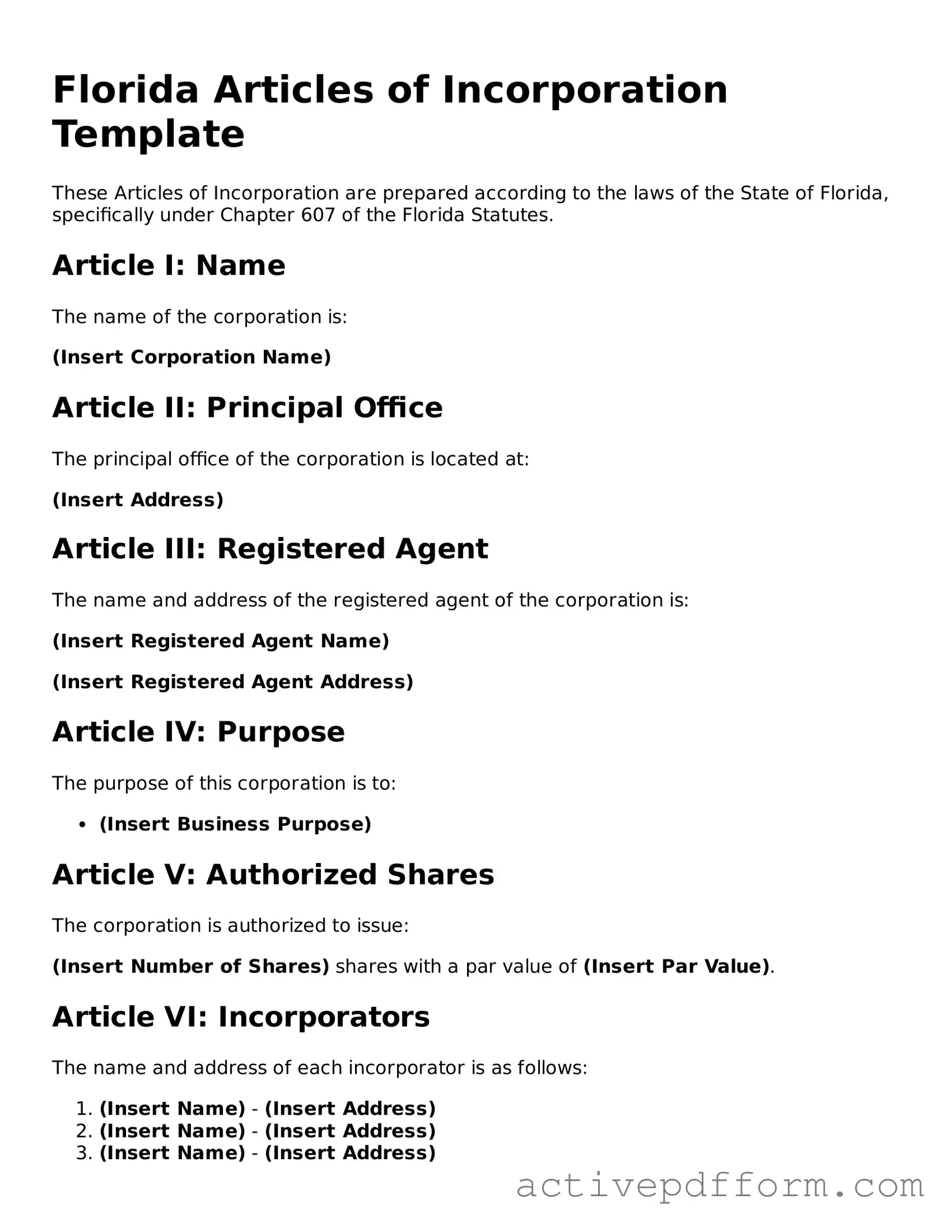

Florida Articles of Incorporation Template

These Articles of Incorporation are prepared according to the laws of the State of Florida, specifically under Chapter 607 of the Florida Statutes.

Article I: Name

The name of the corporation is:

(Insert Corporation Name)

Article II: Principal Office

The principal office of the corporation is located at:

(Insert Address)

Article III: Registered Agent

The name and address of the registered agent of the corporation is:

(Insert Registered Agent Name)

(Insert Registered Agent Address)

Article IV: Purpose

The purpose of this corporation is to:

- (Insert Business Purpose)

Article V: Authorized Shares

The corporation is authorized to issue:

(Insert Number of Shares) shares with a par value of (Insert Par Value).

Article VI: Incorporators

The name and address of each incorporator is as follows:

- (Insert Name) - (Insert Address)

- (Insert Name) - (Insert Address)

- (Insert Name) - (Insert Address)

Article VII: Duration

The duration of the corporation is perpetual unless dissolved as per Florida law.

Article VIII: Additional Provisions

Any additional provisions for the regulation of the internal affairs of the corporation include:

- (Insert Additional Provisions)

Article IX: Signature

We, the undersigned incorporators, hereby consent to the above Articles of Incorporation and certify that the information herein is true and correct.

Incorporator Signature: __________________________

Date: __________________________

Understanding Florida Articles of Incorporation

What is the purpose of the Florida Articles of Incorporation?

The Florida Articles of Incorporation serve as the foundational document for creating a corporation in the state of Florida. This document outlines essential details about the corporation, including its name, purpose, registered agent, and the number of shares authorized. Filing the Articles of Incorporation with the Florida Division of Corporations officially establishes the corporation as a legal entity, allowing it to operate and conduct business in Florida.

What information is required to complete the Articles of Incorporation?

To complete the Florida Articles of Incorporation, you need to provide several key pieces of information. First, you must choose a unique name for your corporation that complies with Florida naming requirements. Next, you need to specify the principal office address and the name and address of the registered agent. Additionally, you must indicate the number of shares the corporation is authorized to issue and describe the purpose of the corporation. Some corporations may also need to include information about the initial directors.

How do I file the Articles of Incorporation in Florida?

You can file the Articles of Incorporation online or by mail. For online filing, visit the Florida Division of Corporations' website, where you can complete the form and pay the required filing fee using a credit card. If you prefer to file by mail, print the completed form, sign it, and send it along with a check or money order for the filing fee to the appropriate address. Ensure that all information is accurate to avoid delays in processing.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Florida Articles of Incorporation varies depending on the type of corporation you are forming. As of October 2023, the standard fee for filing Articles of Incorporation for a for-profit corporation is $70. Non-profit corporations may have a different fee structure. It is essential to check the Florida Division of Corporations' website for the most current fees and any additional costs that may apply, such as expedited processing fees.

What happens after I file the Articles of Incorporation?

Once you file the Articles of Incorporation and the state processes your application, you will receive a confirmation of incorporation. This document serves as proof that your corporation is officially recognized by the state of Florida. After incorporation, you must comply with ongoing requirements, such as holding annual meetings, maintaining corporate records, and filing annual reports to keep your corporation in good standing.

Dos and Don'ts

When filling out the Florida Articles of Incorporation form, it's important to follow certain guidelines to ensure your application is processed smoothly. Here’s a list of things you should and shouldn't do:

- Do provide accurate information for all required fields.

- Do check for spelling and grammatical errors before submitting.

- Do include the correct filing fee with your application.

- Do ensure that the names of your directors and officers are clearly stated.

- Don't leave any required fields blank; this can delay processing.

- Don't use abbreviations or acronyms that are not widely recognized.

Following these simple guidelines can help you avoid common pitfalls and make the incorporation process easier.

Browse Other Popular Articles of Incorporation Templates for Specific States

How Much Does a Llc Cost in Texas - This filing is a critical step in launching a new business as a corporation.

To ensure that your limited liability company remains compliant with state regulations, it is important to understand the requirements surrounding the filing of the California LLC 12 Form. For further assistance in completing this essential document, you can visit California PDF Forms to access the necessary resources.